Bitcoin (BTC) is at an unusual stage in its trading, as put options trade at a premium. Demand for put options has returned to levels not seen since the 2023 bear market.

Bitcoin (BTC) traders are trying to buy protection from the downside, raising the price of put options. Based on Glassnode data, put options are back to levels not seen since the 2023 bear market, when BTC moved at around $20,000. On Binance, put options also dominate, with 60.36% of volumes.

The recent premium for put options concentrated on contracts for a drop to $70,000. Current data shows that put options are still commanding a premium within the price range for potential BTC drawdowns. During this Friday’s expiration event, some of the options were seeking protection as low as $78,000 per BTC, as the market showed more bearish signals.

The drive for put options coincided with ongoing fearful trading, as the Crypto Fear and Greed index fell from 44 points to 28 points within days.

Despite the fearful trading, BTC held better compared to the stock market, only briefly dipping under $80,000. After that, within hours, BTC rallied above $84,000 again, with all other assets following with similar gains. BTC remained relatively volatile, later returning to $83,219.43.

The recent fearful trading and lack of bigger price dips also suggest BTC may be close to its local lows. However, a rally is still further in the future, as traders still bet on potential crashes or at least sideways trading. The current trading behaviors show one-sided fears, which are not reflected in the price action.

$2.5B in expiring options caused BTC instability

The weekly options expiry was one of the factors behind the price instability in the past day. After the large-scale quarterly options expiry, this Friday’s event retired a smaller number of contracts.

For BTC, 26,000 options expired, with a put/call ratio of 1.24, signaling a bearish outlook. Previous expiry events had ratios as low as 0.64, signaling bears are the dominant traders as the ratio climbed above the 1.2 threshold.

The recent rally to $84,000 coincided with the maximum pain point of $84,000 per BTC. The BTC options had a notional value of just $2.2B as overall crypto trading activity slowed down.

For ETH, the notional value of options was just $400M, again with a predominance of put calls and a ratio of 1.42. The options expired with a maximum pain point of $1,850.

Future trading positions are being set up

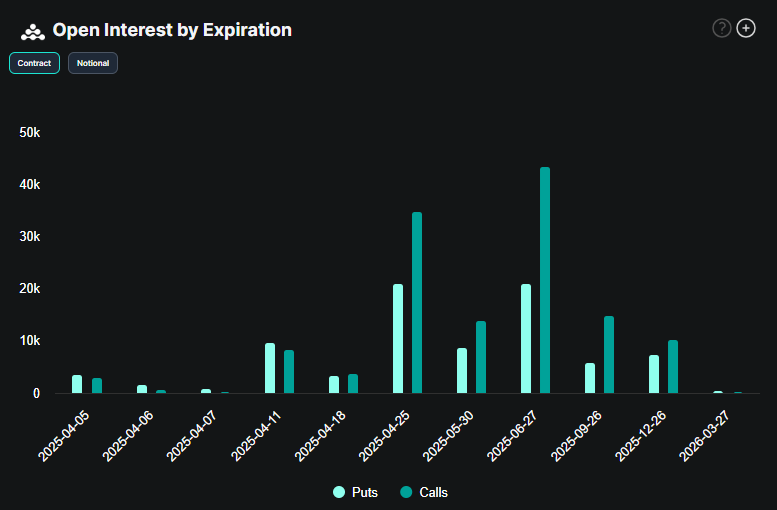

Whales bought more put options this week, with a trend for more put options for expiry rates further ahead in the coming months. The trend for put options is already building up a large position for the June quarterly expiry. Put options are growing both in terms of absolute positions and in trading volumes.

Call options are starting to dominate from the end of April onward, though the level of put options remains high. Based on Deribit data, the last few expiry events had a dominance of put options.

Crypto markets have slowed down their volumes to levels not seen since the last quarter of 2024. Despite the high supply of stablecoins, the inflow of funds has slowed down. Retail sentiment is even more bearish, and whales are prepared to take profits and avoid the downside. Options traders add extra protection from unexpected events, raising demand for put options at a lower BTC price range.

BTC is still mostly linked to the movements of the stock market and has decoupled from gold as a true safe haven. Despite this, BTC offers significant upside, and some traders have shifted to call options to lock in a potential rally in Q2.

Cryptopolitan Academy: Coming Soon - A New Way to Earn Passive Income with DeFi in 2025. Learn More

No comments yet