The White House announced: The era of tariffs has officially arrived

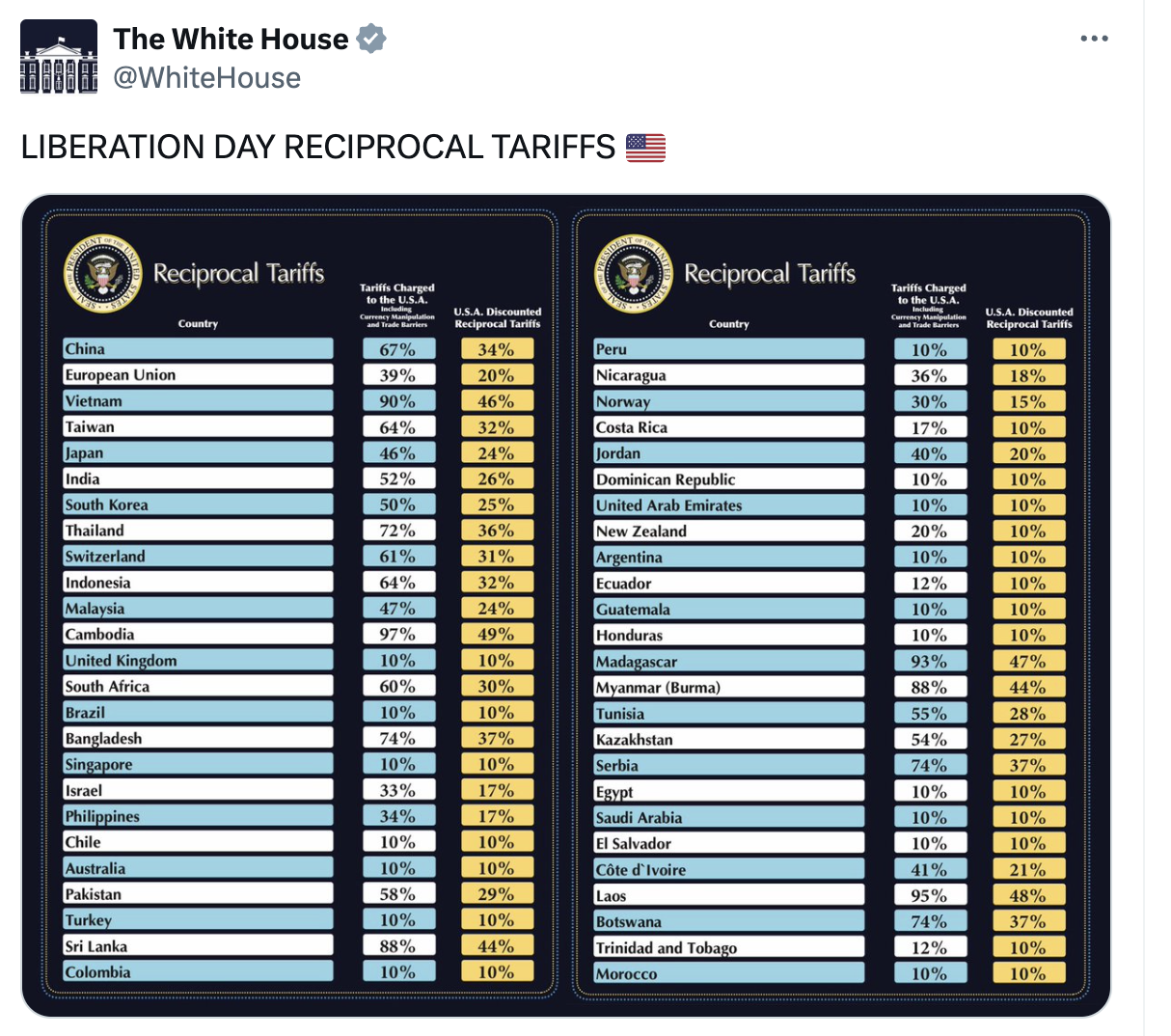

On April 2, US President Donald Trump announced in the Rose Garden of the White House that a 10% tariff would be imposed on almost all imported goods, and a higher "reciprocal tariff" would be imposed on about 60 countries that are considered to have the "worst trade deficit with the United States". This world-renowned trade policy conference not only caused a violent shock on Wall Street, but also quickly swept the cryptocurrency market.

In this tariff policy, the EU is 20% and Vietnam is 46%. In addition, all foreign-made cars will be uniformly taxed at a 25% rate, effective April 3.

In his speech, Trump called it "Liberation Day" and emphasized: "There is a price to pay for entering the world's largest market." He also vowed to "bring jobs back to the United States" and revitalize the core of the manufacturing industry through this policy.

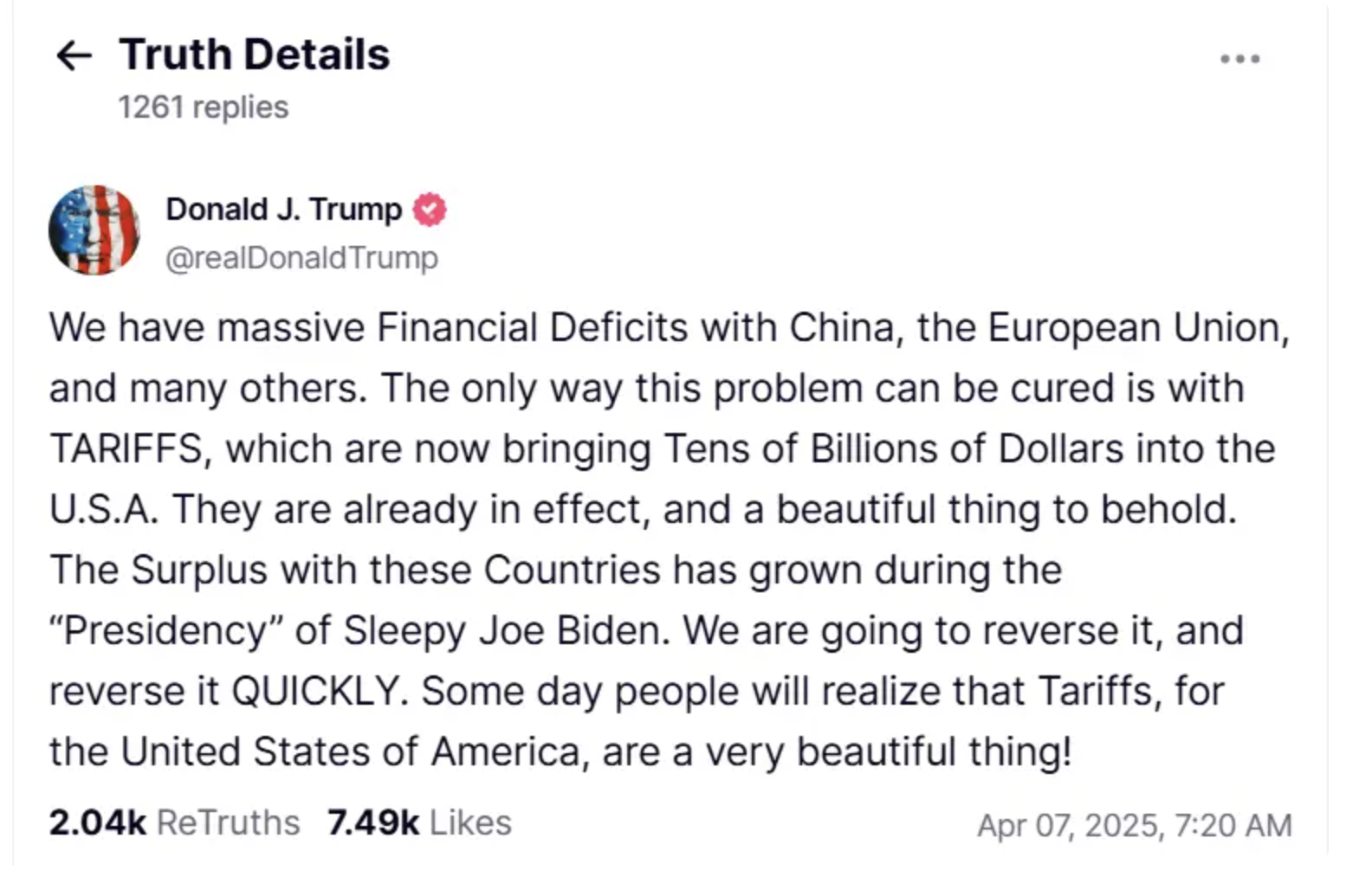

Trump posted on his social media platform that the United States has a huge fiscal deficit with the European Union and other countries, and the only solution is to impose tariffs, which have now brought tens of billions of dollars in revenue to the United States. He criticized the widening of the U.S. trade deficit with the above-mentioned countries during the Biden administration and promised to quickly reverse the situation, once again emphasizing that tariffs are "a very beautiful thing" for the United States.

Market shocks: Multiple impacts from traditional stock markets to crypto assets

After the tariff policy was released, the U.S. stock market reacted quickly. The Dow Jones, Nasdaq and S&P 500 indexes fell 2% to 4% in after-hours trading. Technology giants such as Apple, Amazon, and Nvidia also suffered heavy losses, with Apple falling 7%, Amazon falling 6%, and Nvidia falling 5%. This series of declines has caused global investors to worry about the prospects for U.S. economic growth.

While the traditional market was volatile, the crypto market was not immune. According to data, Bitcoin fell about 3% from a high of nearly $88,000 to around $82,600 after Trump announced the tariff measures; Ethereum fell rapidly from $1,930 to below $1,800, a drop of more than 6%; Solana fell 6.5% to about $118. Among the top 10 cryptocurrencies by market value, Dogecoin fell 6.2%, XRP fell 5.5%, BNB fell 3.7%, Cardano fell 5.8%, and Tron fell about 2%.

According to Coingecko data, the Crypto Fear and Greed Index quickly dropped to 25 points, entering the "extreme fear" zone, and market sentiment suffered a severe setback. Some investors believe that the uncertainty of tariffs has put short-term selling pressure on risky assets and may even trigger a deeper market adjustment.

The medium- and long-term impact of tariff policies on the crypto market

Although the tariff policy has caused significant fluctuations in the short term, some analysts believe that in the long run, the clarity of this policy may become a catalyst for the development of the crypto market. David Hernandez, a crypto investment expert at crypto asset management company 21Shares, said: "The market needs certainty. Although prices are currently volatile, institutional investors will have more confidence to re-enter the market as the policy scope and tax rates are clarified." At the same time, Rachael Lucas, a crypto analyst at BTC Markets, also said: "We have seen a surge in trading volume and a repositioning of market participants in the short term. Investors are waiting for a stable environment, and when the policy is clear, these factors will bring new buying opportunities for institutional funds." The high tariff policy announced by Trump not only has an impact on the US economy, but also forces major economies around the world to re-examine their trade relations with the United States. Some countries may take retaliatory tariff measures or reduce their dependence on the US market through policy adjustments. Analysts believe that this adjustment in the macro trade pattern will affect cross-border payments, supply chain finance and the global flow of digital assets to a certain extent.

In the short term, the crypto market still faces great uncertainty. Analysts generally believe that if Bitcoin can stabilize above $80,000, it is expected to gradually stabilize and restart the bull market after policy digestion; on the contrary, if tariffs lead to a deterioration of the macro economy and a sharp decline in US corporate profits, the market may enter a more sluggish adjustment period.

Some industry insiders pointed out that although the current market is full of fear, it is precisely because of this that long-term institutional investors may take advantage of the lows to further promote the reversal of digital asset prices. According to market data, some large accounts have recently entered the market to buy the bottom when Bitcoin fell to the critical range, which provides a certain support signal for the market. However, whether this bottom-fishing behavior can continue, it is necessary to observe the further evolution of the global trade and policy environment.

Signals that investors should pay attention to

Although the current crypto market reaction is violent, it is still difficult to characterize it as a "turning point".

From the on-chain data, some whale accounts quickly entered the market to buy the bottom when Bitcoin fell to around $82,000, which may mean that the support force below is still there. At the same time, the pledge data of platform chains such as Ethereum and Solana have not been significantly shaken, indicating that core users have not yet panicked and exited.

Investors need to pay attention to three major signals:

1. Whether Bitcoin can hold the $75,000 mark;

2. Whether the liquidity of mainstream L2 platforms has declined significantly;

3. Whether institutional wallets continue to increase their holdings steadily.

As long as there is no sign of large-scale "de-anchoring" in these three points, the crypto market may still be in a healthy shock wash stage.

Conclusion

Trump's global tariff policy is like a bombshell, which not only stirs up the traditional market, but also makes the crypto world feel the real impact of macroeconomic policies.

For crypto investors, it is an important time to remain cautious and focus on long-term layout. If the United States and major economies can cool down the trade war through coordination and compromise, and the process of clarifying market supervision continues to advance, digital assets, especially Bitcoin and stablecoins, may usher in a wave of rebound in the future, and re-prove their important position as global safe-haven assets and circulation tools.

No comments yet