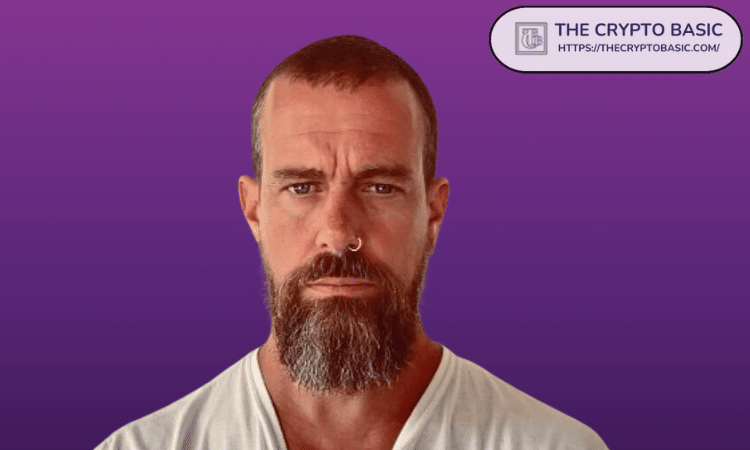

Jack Dorsey, CEO of Block and founder of Twitter, argues that Bitcoin risks becoming obsolete if its role remains limited to being a digital store of value.

Speaking during an appearance at the Presidio Bitcoin event, he emphasized that survival depends on Bitcoin evolving into a widely adopted medium of exchange.

According to Dorsey, if Bitcoin continues to serve primarily as a long-term investment tool, it may fail to sustain its relevance in the broader economy.

Caution on Over-Reliance on Store of Value Narrative

During his remarks, Dorsey noted that treating Bitcoin solely as a reserve asset may hinder its long-term potential. He argued that the tendency to “hodl,” or hold Bitcoin for value appreciation during economic uncertainty, limits the currency’s role in everyday life.

In his view, this narrow use case could eventually push Bitcoin to the margins of financial systems. To illustrate a different trajectory, Dorsey pointed to practical, grassroots-level usage emerging in regions often underserved by traditional finance.

In parts of Africa, Central America, and South America, communities are reportedly integrating Bitcoin into routine transactions. Individuals in these regions are using Bitcoin for everyday needs such as paying for meals, coffee, and services.

Dorsey noted that many of these users focus on Bitcoin’s functionality as money rather than its market value, signaling what he believes could be a critical use case.

Push for Broader Network Innovation

Dorsey also challenged the Bitcoin community to pursue innovation beyond existing second-layer solutions. Referring specifically to the Lightning Network, he argued that relying on a single method to scale transactions may limit growth.

Instead, he called for expanded experimentation with alternative solutions that could bolster speed and privacy while simplifying the payment experience.

He stated that the Bitcoin ecosystem has not yet realized the original vision of peer-to-peer electronic cash. According to him, achieving that goal would require building more accessible tools that can compete with conventional payment networks like Visa and Mastercard. He urged developers to create systems that prioritize real-world use, especially in commerce.

Derivatives Market Reacts to Sharp Bitcoin Price Drop

This news comes at a time when the market responded sharply to Bitcoin’s recent price downturn. Notably, Bitcoin has plummeted by 8.10% in the last 24 hours and 6.73% in the past 7 days. According to recent data, derivatives trading volume rose by 183.58%, reaching $183.10 billion.

Options trading activity also surged, with volume climbing 327.28% to $5.11 billion. This increased market volatility has triggered widespread liquidations, with total losses reaching $467.60 million over the past 24 hours.

No comments yet