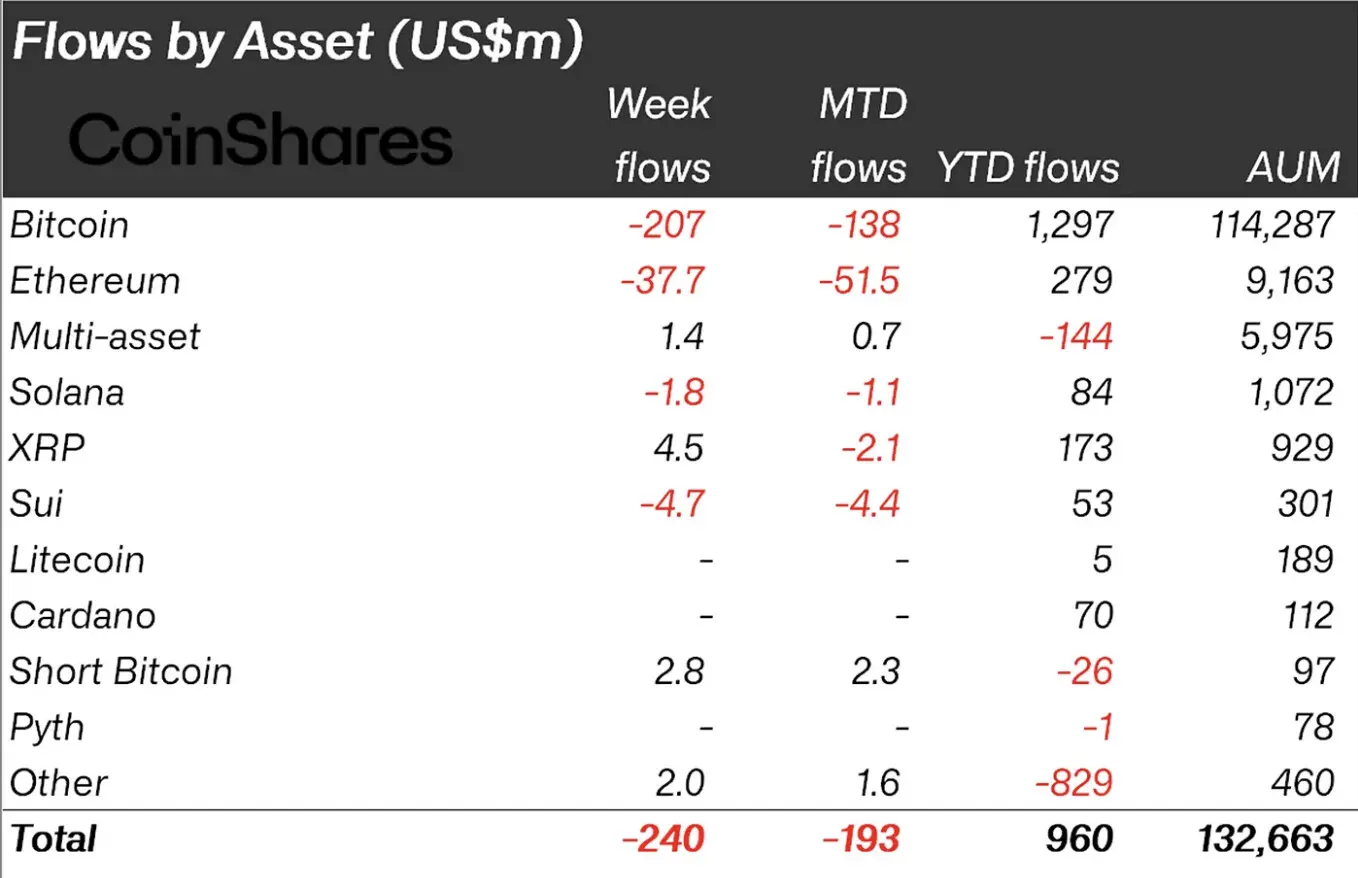

Crypto investment products recorded $240 million in outflows during the past week. According to the latest CoinShares report, the outflows came as investors responded to recent US trade tariff announcements that have raised concerns about economic growth prospects.

Bitcoin-focused products accounted for $207 million of the total outflows. Despite this weekly setback, Bitcoin investment products maintain a positive inflow of $1.3 billion year-to-date.

Grayscale saw the largest outflows

The figures show that even with the outflows, total assets under management in digital asset investment products were fairly steady at $132.6 billion. This is a 0.8% rise from the week.

This resiliency stands in stark contrast to legacy equities markets, as MSCI World equities fell 8.5% over the same timeframe. By provider outflow breakdown, it is evident that there were universal withdrawals from all of the largest crypto fund issuers. The largest outflows were at Grayscale Investments, which experienced $95 million worth of outflows for both weekly and month-to-date. iShares ETFs were next at $56 million weekly and $71 million month-to-date.

Other large providers reporting outflows were Bitwise Funds Trust ($31 million), ARK 21Shares ($20 million), and CoinShares XBT Provider AB ($6 million). Only two large providers defied the trend: Fidelity Wise Origin Bitcoin Fund increased by $10 million, and 21Shares AG received $7 million in new investment.

Geographically, negative sentiment showed up in the majority of the big markets. The United States had the biggest outflows at $210 million, then came Germany with $17.7 million and Switzerland with $8.3 million. Sweden also had significant outflows of $7.1 million. A few markets defied the trend, with Canada contributing $4.8 million. Brazil and Australia also had minor inflows of $1.4 million and $0.6 million respectively.

Bitcoin dominated with $207 million outflow

Bitcoin dominated the outflow picture with $207 million leaving BTC investment products last week. This has reduced its year-to-date inflows to $1.3 billion. Despite the weekly outflows, Bitcoin maintains the largest asset under management total at $114.3 billion.

Ethereum followed with $37.7 million in outflows, though it still maintains a positive $279 million in year-to-date inflows. ETH investment products currently manage $9.2 billion in assets.

Smaller altcoins showed mixed results. Solana and Sui recorded outflows of $1.8 million and $4.7 million respectively. XRP moved against the trend with $4.5 million in weekly inflows, though it remains negative for the month at -$2.1 million. Multi-asset products were one of the few categories to see positive flows. It has added $1.4 million during the week.

Interestingly, Short Bitcoin products, which bet against BTC’s price, saw $2.8 million in inflows. These products now manage $97 million in assets. Litecoin and Cardano products saw no notable activity during the week, though both maintain positive year-to-date inflows of $5 million and $70 million respectively.

Blockchain equities saw inflows for second straight week

Despite the outflows from crypto investment products, blockchain equities saw inflows for the second consecutive week, totaling $8 million. This suggests investors may be viewing recent price weakness as a buying opportunity in crypto-related stocks rather than direct digital asset exposure.

The contrast between outflows in crypto products and inflows to blockchain equities shows a change in how investors are approaching digital asset exposure during uncertain market conditions. Equity investments may offer more regulated exposure with familiar investment structures compared to direct cryptocurrency holdings.

The relative stability of assets under management despite the outflows points to underlying price appreciation offsetting some of the withdrawal pressure. This resilience is particularly notable when compared to traditional equities markets, which saw much steeper declines during the same period.

The report suggests that recent US trade tariff announcements were likely a key factor driving investor caution. These tariffs have raised concerns about potential impacts on global economic growth.

Cryptopolitan Academy: Want to grow your money in 2025? Learn how to do it with DeFi in our upcoming webclass. Save Your Spot

No comments yet