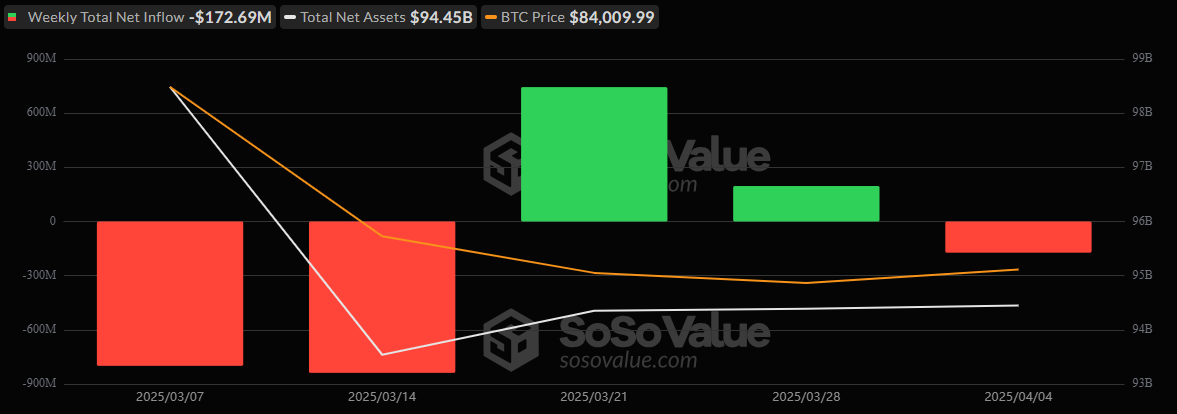

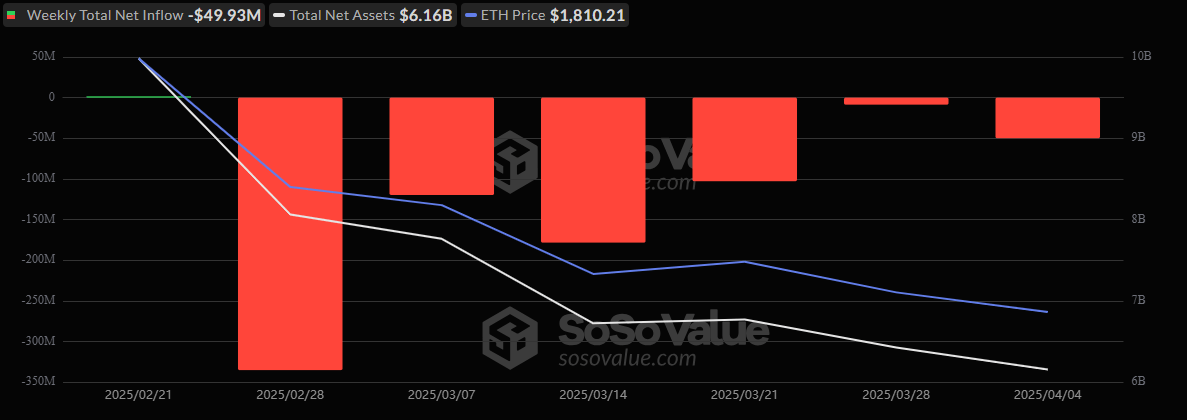

Bitcoin ETFs ended their two-week winning streak with a $173 million outflow. Ether ETFs remained under pressure, closing the week with nearly $50 million in net outflows, marking their sixth straight week in the red.

Bitcoin ETFs Flows Turn Negative Again With Ether ETFs Logging 6th Straight Week of Outflows

A wave of investor caution swept through crypto ETFs this past week, as bitcoin ETFs saw their two-week inflow streak snapped with a sharp $172.69 million net outflow. The brunt of the pullback came Tuesday, April 1, when fears around looming U.S. tariffs intensified, triggering a massive $157.64 million exit.

Wednesday offered a glimmer of optimism with a $220.76 million inflow, the only green day of the week, but it wasn’t enough to reverse the overall tide.

Grayscale’s GBTC led the weekly outflows with $95.48 million, followed by Wisdomtree’s BTCW ($44.53 million), Blackrock’s IBIT ($35.52 million), Bitwise’s BITB ($24 million), ARKB ($22.26 million), Valkyrie’s BRRR ($7.87 million), and Vaneck’s HODL ($4.85 million).

Only a few ETFs managed to stay afloat: Grayscale’s BTC recorded a $34.28 million inflow, Franklin’s EZBC added $17.40 million, and Fidelity’s FBTC brought in $10.16 million.

Meanwhile, ether ETFs extended their losing streak to a 6th week with $49.93 million in net outflows. Wednesday was again the heaviest day, with $51.24 million leaving the market. Grayscale’s ETHE topped the outflow chart at $31.08 million, followed by Blackrock’s ETHA ($20.17 million), Bitwise’s BITB ($6.19 million), and Grayscale’s ETH ($2.70 million).

Still, some ether ETFs fought back. Fidelity’s FETH saw a $6.42 million weekly inflow, Franklin’s EZET added $2.06 million, and 21Shares’ CETH chipped in $1.72 million.

The trading pattern for the past week on bitcoin and ether ETFs shows investors are actively recalibrating their exposure as geopolitical uncertainty and economic headwinds, particularly around trade policy, weigh on risk assets.

No comments yet