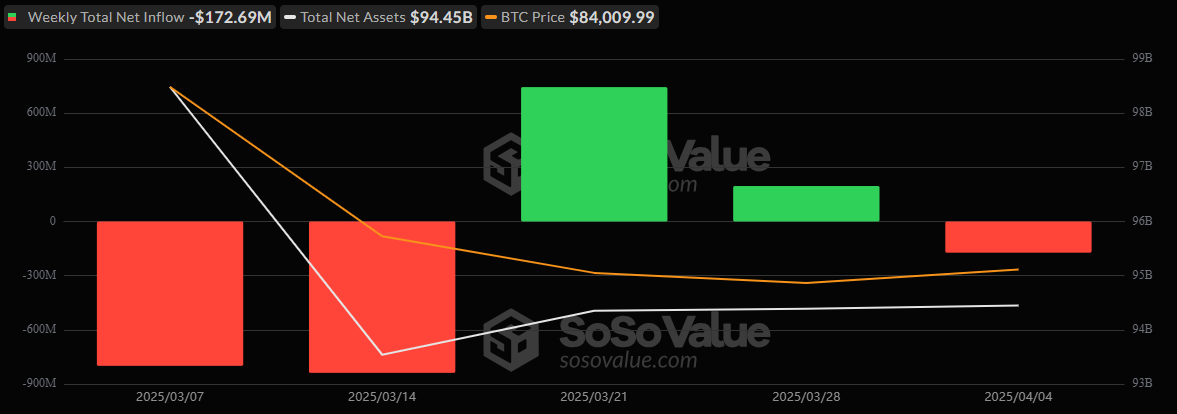

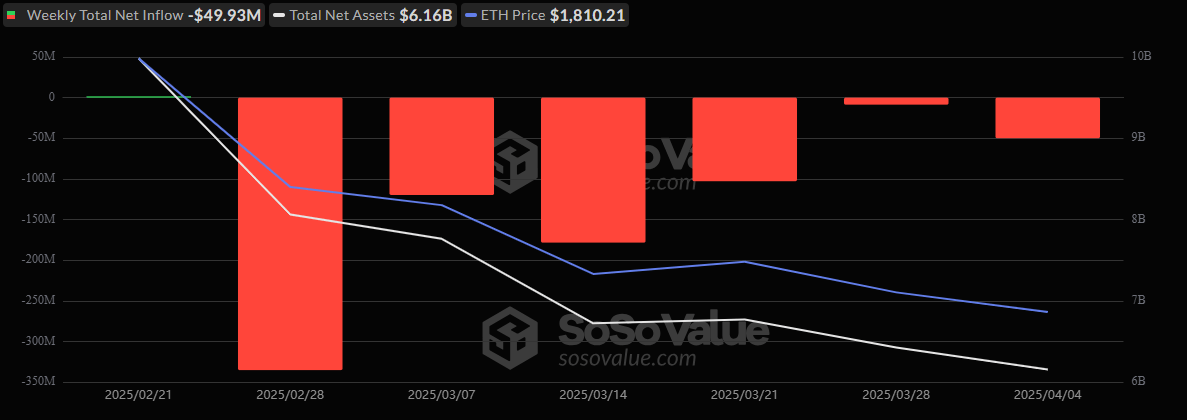

比特币ETF以1.73亿美元的流出结束了为期两周的连胜纪录。 Ether ETF仍处于压力下,本周终结了近5000万美元的净流出,这是他们连续第六周在红色的一周中。

比特币ETF流动再次变为负面,EthETF连续记录第6周流出

过去一周,一波投资者的警告席卷了Crypto ETFS,比特币ETF看到他们为期两周的流入纪录,净流出了1.7269亿美元。回调的首当其冲是在4月1日星期二的,当时担心迫在眉睫美国关税加剧,引发了大量1.5764亿美元的出口。

周三提供了一丝乐观的一线,并以22076万美元的流入为一周中的唯一绿色日,但不足以扭转整体潮流。

Grayscale GBTC以9,548万美元的价格领导了每周的流出,其次是Wisdomtree BTCW(4453万美元),Blackrock Ibit(3552万美元),位Bitb(2400万美元),ARKB(222.26亿美元)(222.2亿美元),Valkyrie Brrr(Valkyrie Brrr(787亿美元)和$ VANECK HOD)($ 4.55)。

只有少数ETF设法保持漂浮:灰度BTC记录了3428万美元的流入,富兰克林EZBC增加了1,740万美元,Fidelity FBTC带来了1016万美元。

同时,醚ETF以4993万美元的净流出将他们的失败连胜延长至第六周。周三再次是最重的一天,从市场上耗资5124万美元。 Grayscale Ethe以3108万美元的价格高位,其次是Blackrock Etha(2017万美元),位BitB(619万美元)和灰度。eth(270万美元)。

仍然,有些醚ETF进行了反击。富裕费斯(Fidelity Feth)每周一次有642万美元的流入,富兰克林Ezet增加了206万美元,而21 Shares的Ceth筹集了172万美元。

过去一周的交易方式bitcoinEther ETF显示,投资者正在积极重新校准自己的接触,因为地缘政治不确定性和经济逆风,尤其是围绕贸易政策,权衡风险资产。

No comments yet