Federal agencies are required to report their crypto holdings to Treasury Secretary Scott Bessent by the end of Monday. The mandate, issued under an executive order signed on March 6 by US President Donald Trump, directs every federal agency holding digital assets, specifically Bitcoin, acquired through criminal or civil forfeiture proceedings to disclose their inventories to the Treasury.

According to Fox Business journalist Eleanor Terrett, agencies must submit their crypto reports to Bessent, but the executive order does not mandate that the findings be made public. “Unclear as of now if and when the findings could be made public,” Terrett said in an April 6 X post.

Bessent collecting crypto holdings reports to set up reserve office

Per the executive order, the Treasury is mandated to create an administrative body collectively known as the Strategic Bitcoin Reserve responsible for custodial accounts. This reserve will be capitalized with all Bitcoin that is no longer subject to legal disputes and is not needed for obligations under the US Code or released through other government channels.

Agencies were given 30 days from the signing of the order to review if their holdings could be transferred into the reserve, and their final reports are due today. The coins deposited into the strategic reserve will be preserved as part of the United States’ government official holdings and will not be sold. Instead, it will be used to support governmental objectives under applicable laws.

Additionally, the Treasury and Commerce Departments have been instructed to find strategies for increasing the government’s Bitcoin reserves, provided such strategies are “budget neutral.” This means they must not incur additional costs for taxpayers.

“Any acquisition of digital assets beyond those forfeited through legal proceedings will require further executive or legislative approval,” the order read.

Within 60 days of the order’s issuance, Secretary Bessent must also submit an evaluation of how the reserve should be structured, including its legal basis, investment considerations, and if congressional legislation is needed to operationalize its management.

David Sacks, who serves as the White House’s de facto crypto and artificial intelligence Czar, had previously estimated that the US government holds approximately 200,000 Bitcoins. Though no full audit has ever been published, Arkham Intelligence records pegged the government’s holdings at 198,012 BTC, worth about $15.15 billion at current valuations.

A proposal for “₿ Bonds” to offset national debt

Outside the administration, the Bitcoin Policy Institute has floated a financial proposal to support government Bitcoin acquisition without burdening taxpayers. The group has proposed issuing $2 trillion in “₿ Bonds,” structured with a 1% interest rate.

90% of the funds would be allocated toward existing government obligations, while 10% would be earmarked for Bitcoin purchases.

The institute claims this approach could save the government $354 billion in interest costs compared to traditional 10-year US Treasuries, which currently yield around 4.5%.

If executed, the program could reduce the national debt by 2045, particularly if Bitcoin’s value appreciates. The institute predicted that over 132 million American households could participate, with an average contribution of $3,025 per household.

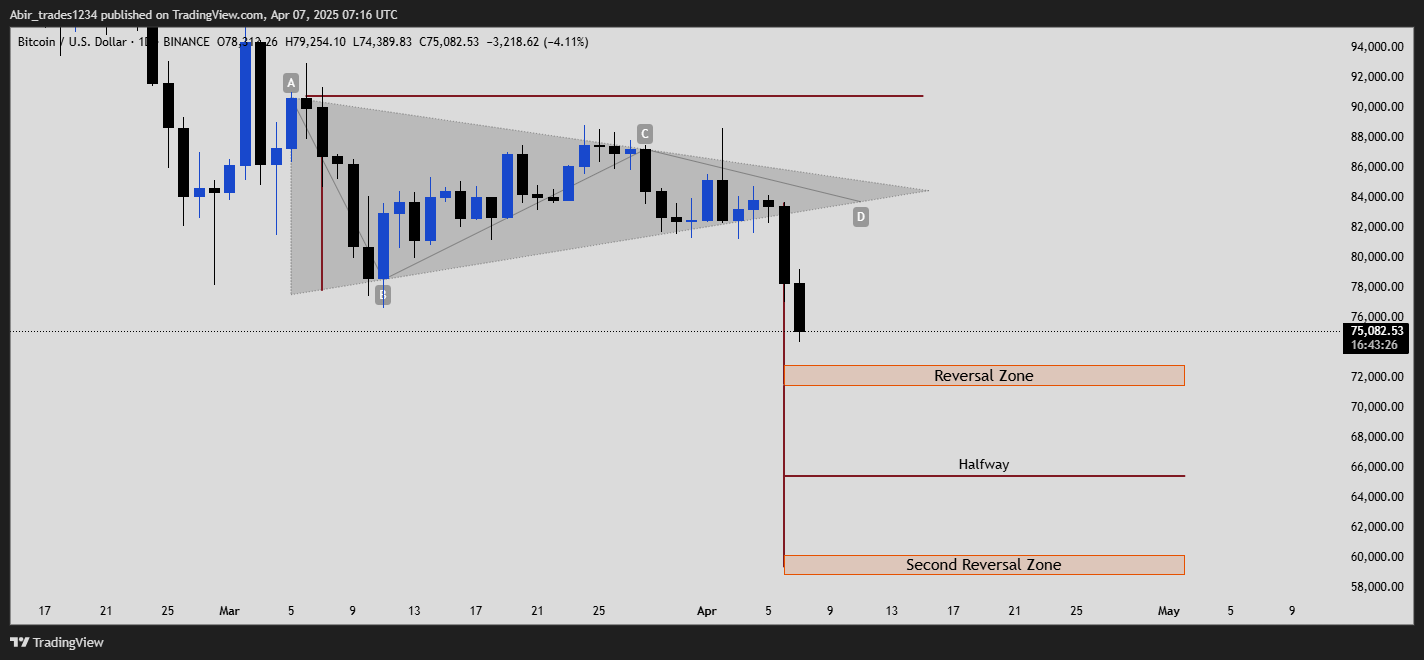

Market freefall continues as BTC plunges below $80K

Bitcoin’s price fell sharply in the past 24 hours, dropping more than 6.6% to trade around $77,206. For the first time in weeks, the leading crypto by market cap has dipped below the $80,000 threshold, contributing to a $300 billion loss in the total crypto market cap.

Technical analysts have noted the formation of a “death cross” on the charts, where the 50-day simple moving average crosses below the 200-day average, a bearish sign often interpreted as the beginning of a prolonged downturn.

Bitcoin is consolidating near a critical support level at $77,000, aligning with its yearly average. A psychological resistance zone lies near $88,000, corresponding to its 50-day moving average.

Still, price forecasts for the rest of 2025 remain largely optimistic. According to prediction markets Polymarket, there is about a 44% likelihood the crypto could go over its all-time-high level of $109,000 by the end of the year.

Firms like Fundstrat, Standard Chartered, and VanEck place Bitcoin’s year-end value between $180,000 and $250,000. Others like JPMorgan, Bloomberg Intelligence, and Polymarket expect a more conservative range of $120,000 to $150,000.

On the flipside, more bearish predictions from BitMEX and Glassnode see Bitcoin ending the year between $70,000 and $85,000.

Cryptopolitan Academy: Coming Soon - A New Way to Earn Passive Income with DeFi in 2025. Learn More

No comments yet