Crypto lending is the most researched sector based on Token Terminal data. DeFi lending still holds over $38B in various vaults, and has been key in tapping the value of Ethereum (ETH) and altcoins.

Crypto lending through DeFi protocols remains one of the most closely watched sectors. The sector saw inflows of smart money from whales, and is still closely watched for data signaling growth. DeFi lending as a whole increased its market capitalization by 3.7%, expanding to over $5.4B. Lending is a subset of general DeFi, which has remained relatively resilient during the recent market crash.

Total value locked in DeFi lending rose to $38.11B from lows of $37B in the past week. DeFi lending remains adaptable to changing market conditions, with funds flowing back on signs of market recovery. DeFi remains a proxy for the entire crypto market, as it depends on an overall bullish direction.

Aave (AAVE) is once again the leader, expanding its value locked by 5.22% overnight. The protocol is also among the biggest gas users, with over $231K in gas fees during highly active days. As a result, Aave has one of the biggest token incentives, especially on days with higher turnover. On April 3, Aave distributed $1.63M in token incentives. For that reason, Aave is one of the few protocols with days of negative earnings due to redistribution.

The protocol carries over $17B in value locked, easily returning to the levels of the 2021 bull market. AAVE recovered to $131.45 as buyers returned to the protocol in expectation of more growth and token buybacks. Aave was also relatively unscathed by the most recent round of DeFi liquidations, most of which affected Maker/Sky users with large Ethereum positions.

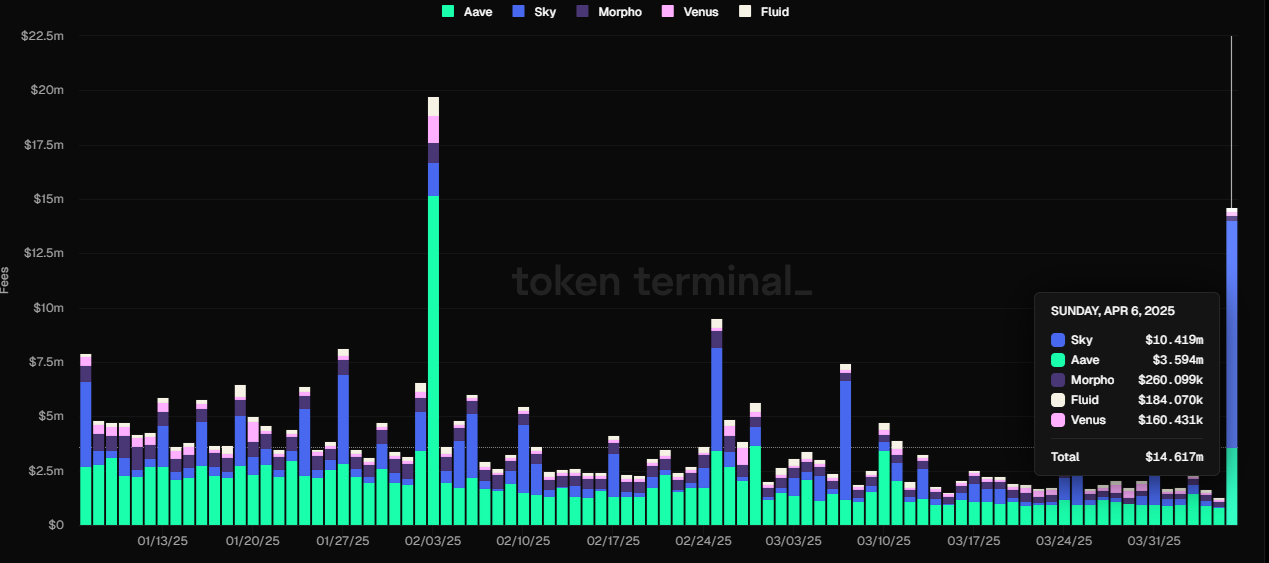

DeFi lending becomes top fee producer

DeFi lending is also among the top fee producers in crypto. The regular inflow of loans and stablecoins, as well as fees to lenders builds up on-chain economic activity.

Aave was in the top 10 of fee generators, with over $1.67M in daily gross revenue from borrowing and lending activity. In total, top DeFi lending protocols produced over $291M in fees for the last quarter, based on projects tracked by TokenTerminal. The top 3 projects in user interest and performance include Aave, Morpho Labs, and Spark Protocol, currently having the most active vaults.

For now, Ethereum-based lending remains a leading sector, but the model is also important in the Solana ecosystem. Kamino Lend locks in $1.54B and is capable of issuing loans against a collateral of meme tokens.

Not all DeFi lending protocols have the same profile. Some are serving as vault providers, as in the case of Aave. Others have a higher stablecoin turnover, with Sky Protocol and Curve Finance becoming the leaders.

DeFi lending faced $100M in liquidations

DeFi lending is closely watched for its ability to survive liquidations based on the value of ETH. As ETH recovered to $1,572.29, some of the liquidation pressure dissipated.

Currently, Aave holds $18.5M threatened by liquidation within 20% of current price levels. Sky Protocol, with its wider range of vaults, has over $849M in positions threatened by liquidation.

The recent price drop for ETH brought down the overall liquidation levels to a new range. Most of the new liquidity in lending pools has a liquidation price of $905.02 per ETH. In the past couple of days, the lending market liquidated over $100M from over-collateralized vaults. Currently, total loans that are liquidatable are down to $1B. The loan value was diminished by a mix of liquidations and repayments with added collateral.

Cryptopolitan Academy: Tired of market swings? Learn how DeFi can help you build steady passive income. Register Now

No comments yet