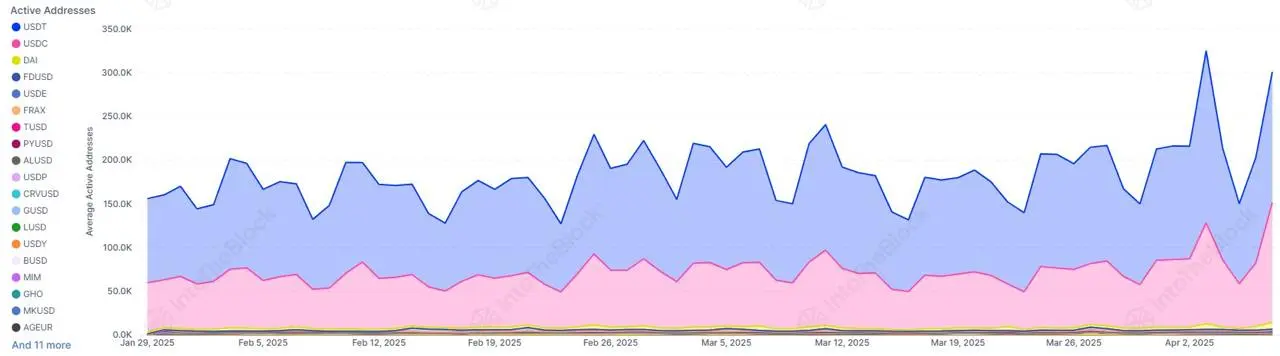

Stablecoin activity increased in the last 24 hours after the market rout caused by trade wars between the US and other countries. IntoTheBlock data shows daily active addresses hit 300,000, while on-chain stablecoin volume also hit $72 billion.

This is the highest level of stablecoin activity since February 2025 and highlights how investors flocked to stablecoins amidst the massive volatility in the crypto market. The move to stablecoins was unsurprising, given the plunge in crypto prices led by Bitcoin.

While crypto prices have been struggling for weeks due to economic uncertainties, Monday saw the biggest decline in a long time, with Bitcoin crashing from $81,000 to $74,000. Other digital assets followed with a double-digit percentage drop to compound a rough year for the crypto sector.

However, the market also experienced more volatility after fake news about the US pausing tariffs for 90 days caused it to surge briefly before dumping again after the White House debunked the report.

Unsurprisingly, the volatility affected long and short positions, leading to $200 million in liquidations in just one hour. Although there is more stability now, the market is still bleeding, with a 1.38% decline in the crypto market cap in the last 24 hours after BTC dropped to $77,000.

Market sentiment is also bearish as the trade war tensions look far from over, with other countries threatening retaliatory tariffs and import bans against the US. According to the CoinMarketCap Fear and Greed indicator, sentiment is currently at 19/100, which signifies extreme fear.

This is not surprising, given that several stakeholders in the traditional finance sectors have expressed concerns about market conditions. Billionaire investor Bill Ackman described the trade wars as ill-advised and bad for the US, while BlackRock CEO Larry Fink said the US might be in a recession already.

Stablecoin continues to grow despite crypto market struggles

Meanwhile, the global uncertainties that have crippled the crypto sector and resulted in a more than 24% decline in the cryptocurrency market cap in the last 90 days have no impact on stablecoins. The sub-sector has continued growing, with a total circulating supply of around $234 billion.

This represents a 13% growth year to date for the sector, mostly due to an increase in Circle USDC and Tether USDT supply within that period.

Unsurprisingly, the stablecoins market will likely grow more in the coming months, especially as new entrants venture into the space. One of the latest entrants is the Trump-backed DeFi project World Liberty Financial (WLFI), which is planning to launch its USD1 stablecoin and wants to distribute it via airdrop to WLFI token holders.

Regulators globally are also embracing the creation of legal frameworks for stablecoins, a move many believe will allow the sector to thrive. Kenya recently proposed a bill to regulate stablecoins and the crypto sector, giving the Central Bank of Kenya (CBK) and the Capital Markets Authority (CMA) authority to regulate the industry.

The US is also making its own efforts to regulate stablecoins, while the UK has stablecoin regulations on its roadmap for 2026. Many believe such regulations will improve stablecoin credibility, but they also affect offshore stablecoins such as USDT.

However, Tether CEO Paolo Ardoino believes that any regulation that affects USDT operation in the US will not be problematic, as the stablecoin issuer can create a stablecoin domiciled in the US to comply with US laws.

Cryptopolitan Academy: Coming Soon - A New Way to Earn Passive Income with DeFi in 2025. Learn More

No comments yet