HodlX Guest Post Submit Your Post

Many Decentralized Autonomous Organizations (DAOs) struggle with low voter turnout and engagement despite managing multi-million-dollar treasuries.

A promising solution has emerged – DAO incentive programs, where members receive financial or token-based rewards to participate in governance actively.

From Uniswap’s monthly stipends for delegates to GnosisDAO’s allocation of non-transferable voting power, DAOs aim to combat voter apathy and professionalize their governance structures.

But are these incentives making DAOs more democratic or merely turning governance into a gig economy?

Source: DeepDAO

The apathy problem – Low turnout and high stakes

Voter participation in many DAOs remains alarmingly low, often in the single digits.

Even significant protocols like Maker and Uniswap struggle to attract more than 10% voter participation for critical proposals.

This apathy undermines decentralization, as decisions become dominated by a few active whales rather than a genuinely decentralized community.

Enter the ‘governance mining’ concept – rewarding users explicitly for their participation in governance activities.

DAOs hope to turn passive token holders into active stakeholders by paying participants.

Let’s explore recent case studies and their impact.

Uniswap’s delegate rewards – $6,000 per month for active voting

A prime example is the Uniswap delegate reward initiative, which the DAO extended in March 2025 for an additional six months, committing $540,000 from its treasury.

Delegates can earn up to $6,000 monthly in UNI tokens if they meet stringent criteria, including at least 80% voting participation and active contribution to governance discussions.

The community has widely supported this program, with a striking 99% approval – over 47 million UNI in favor.

According to Uniswap governance forums, past cycles demonstrated increased engagement and turnout, suggesting incentives indeed drive participation.

One delegate summarized the rationale and said,

“This initiative will improve the quality of Uniswap governance by incentivizing informed voting.”

Early data indicates that more UNI holders are actively delegating their tokens to prominent delegates, improving overall governance quality and quorum consistency.

GnosisDAO – Voting power as a non-monetary incentive

GnosisDAO adopted a different but equally intriguing approach, allocating non-transferable voting power rather than direct payments.

In February 2025, the DAO selected 10 community delegates, each receiving 500 GNO of voting weight (around five percent of the supply), contingent on their active participation.

Delegates who fail to vote consistently lose their privileged positions.

This strategy addresses Gnosis’s historical problem of voter centralization, aiming to increase adequate voter turnout by 35-50%.

Unlike Uniswap’s financial incentives drawn from treasury funds, Gnosis essentially minted new ‘governance-only tokens’ to boost decentralization – a distinct yet complementary solution to voter apathy.

MakerDAO and others – Stipends and performance-based grants

MakerDAO, a pioneer in DeFi governance, has been compensating delegates for over a year.

Using a performance-based formula, Maker disbursed approximately 102,000 DAI to six top delegates in January 2025 alone.

This example underscores that even well-established DAOs see merit in financially rewarding governance participation.

Meanwhile, smaller or mid-sized DAOs have also explored KPI-driven reward mechanisms or platforms to tip and incentivize active governance participants, suggesting widespread industry acceptance of governance incentives.

Results and concerns – Does paying for governance improve outcomes

Early outcomes from incentive programs are promising.

Uniswap, for example, now regularly meets quorum with proposals receiving detailed rationales and robust discussions from incentivized delegates.

Likewise, Gnosis anticipates improved participation rates.

Yet, several critical concerns remain.

Moral hazard and mercenaries

Critics argue that financial incentives may attract short-term participants driven solely by monetary gain rather than long-term project alignment.

However, supporters note these rewards are relatively modest compared to the immense protocol value, positioning them more as fair compensation for effort than outright bribes.

Centralization risk

Continuously rewarding a select few delegates risks creating entrenched ‘DAO politicians,’ potentially limiting the diversity of voices in governance.

Over-reliance on familiar delegates could inadvertently centralize power and decision-making.

Cost and community sentiment

Although Uniswap’s community overwhelmingly supported the incentive program, minor dissenting voices raised concerns about long-term sustainability and the potential misuse of DAO funds.

However, the $540,000 expenditure remains relatively minor, with a treasury valued at billions.

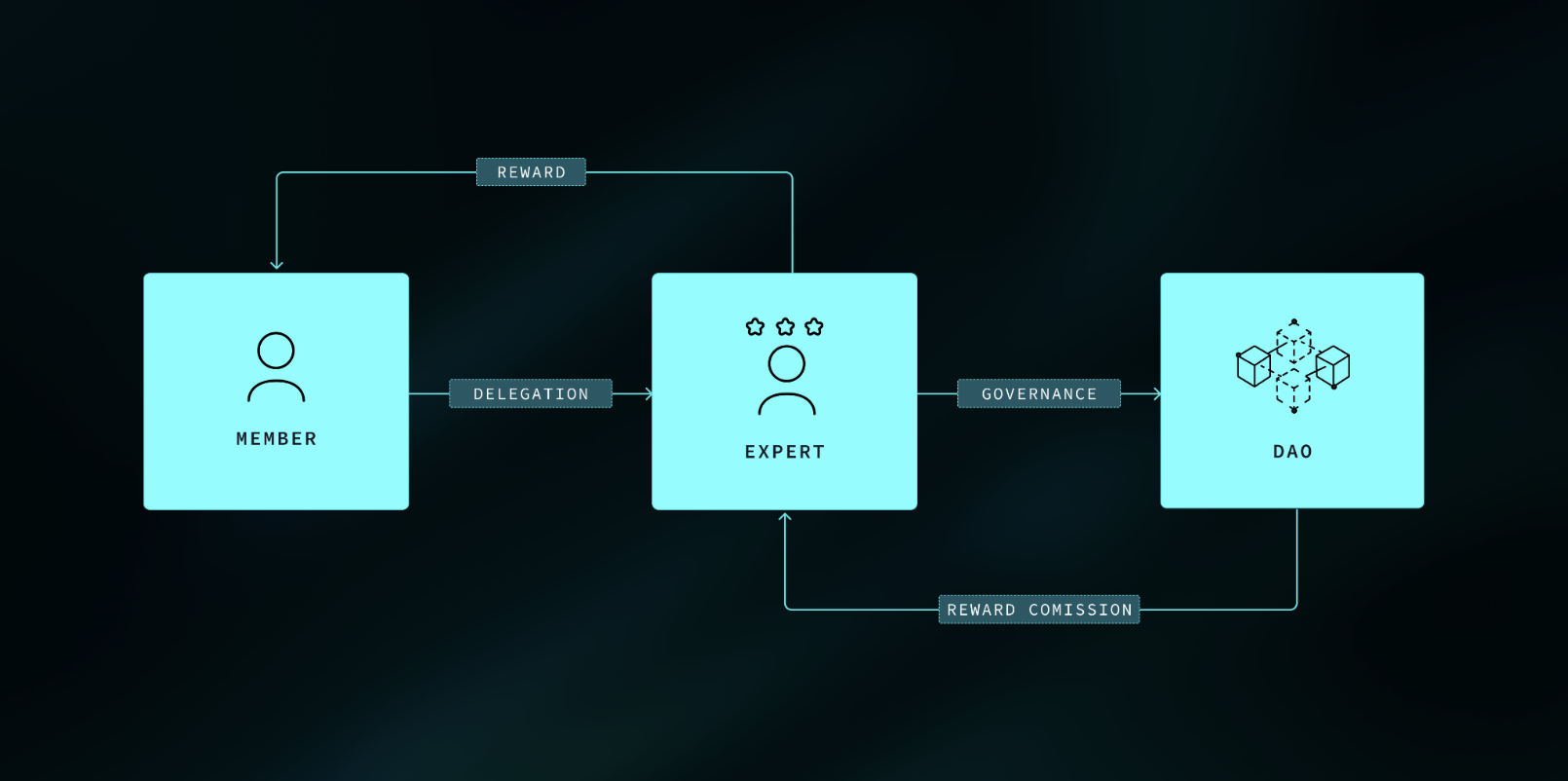

I believe that sustainable incentivization goes beyond simply paying participants – it lies in embedding incentives directly into the DAO’s economic design, forming what we call a ‘programmable economy.’

This approach includes an automatic reward system for actions like submitting proposals, voting and delegating while enabling members to assign their voting rights to trusted experts or specialized sub-DAOs focused on areas such as research or marketing.

Experts, in turn, receive rewards for their governance contributions.

This creates a self-reinforcing loop where community members, expert contributors and the DAO itself all benefit – helping transform participation from transactional to structural.

Conclusion – Professionalizing DAO governance or creating governance mercenaries

The trend of incentivizing governance participation through financial or token-based rewards has clearly gained traction among prominent DAOs.

Initial results suggest significant improvements in voter turnout, engagement quality and decentralization efforts.

However, these benefits have nuanced risks, including potential centralization and moral hazards.

The ultimate test remains: Can these incentives scale broadly across DAO communities without centralizing power or creating a class of paid governance mercenaries?

The upcoming governance cycles in Uniswap, Maker and Gnosis will offer crucial insights, determining whether incentivized governance can sustainably balance robust participation with genuine decentralization – an ongoing experiment with high stakes for the future of decentralized communities.

Roman Melnyk is the chief marketing officer at DeXe.

Generated Image: Midjourney

No comments yet