The cryptocurrency market continues its bearish trajectory. The market slightly recovered on Tuesday, Apr. 8. Bitcoin (BTC) got close to reclaiming the $80,000 mark. The rally was short-lived, and BTC has fallen back to the mid-$76,000 price point. TRON (TRX) and Chainlink (LINK) follow similar trajectories as well. Both assets experienced a slight recovery on Tuesday but are trading in the red zone on Wednesday.

Also Read: Pi Network Eyes $3 as Price Rebounds 28% Amid Token Unlock Buzz

TRON and Chainlink Continue To Slump

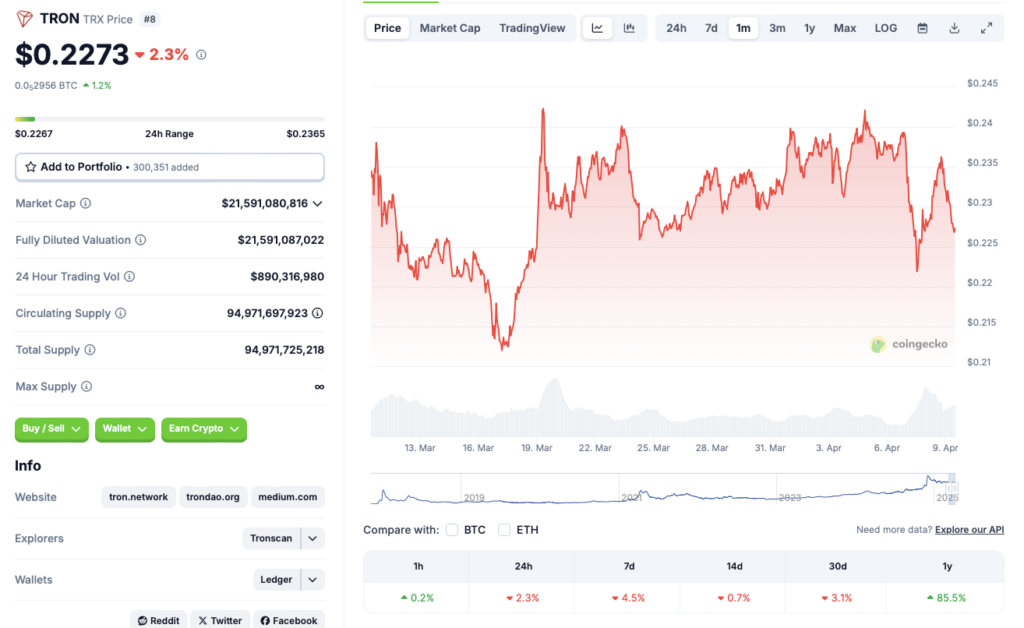

TRX has fallen 2.3% in the last 24 hours, 4.5% in the weekly charts, 0.7% in the 14-day charts, and 3.1% over the previous month. Despite the massive correction, the asset has rallied 85.5% since April 2024.

Also Read: Is Now the Time to Buy Shiba Inu? Here’s What $2,000 Could Turn Into by 2027

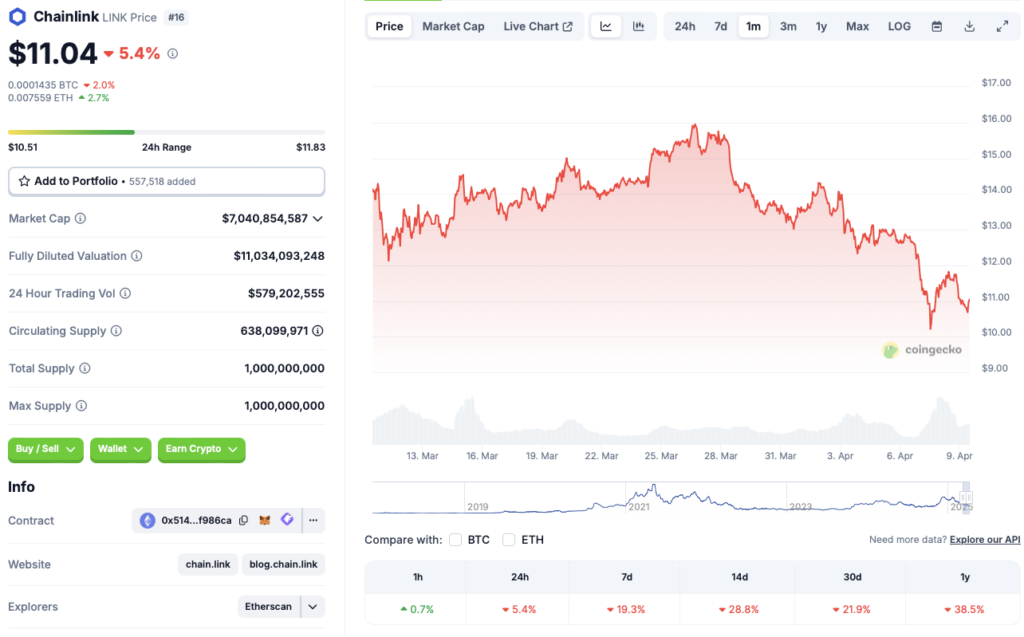

While TRX has maintained some gains in the yearly charts, Chainlink (LINK) is red across the board. The asset has fallen 5.4% in the daily charts, 19.3% in the weekly charts, 28.8% in the 14-day charts, 21.9% over the previous month, and 38.5% since April 2024.

The market crash comes amid good trade tensions. The US has slapped significant tariffs on many trade partners. The tariffs have led to a substantial dip in investor confidence.

Which Is A Better Buy For The Dip?

Both crypto projects are pretty solid. With that said, LINK has faced a steeper correction than TRX. This could mean that you could buy LINK for a far more discounted price. If LINK recovers, there will be more gains for you to make.

TRX, on the other hand, is one of the most robust networks. The blockchain has seen substantial growth over the last year. The real-world use cases for TRX make it an easy recommendation.

Also Read: Ripple: AI Predicts XRP Price If XRP ETFs Are Approved By April-May 2025

Both TRX and LINK could face an extended bearish leg. The crypto market will likely not rally until the tariff war is settled.

No comments yet