Original title: "Trump uses "tariff magic" and the global market is being tricked"

Original author: Mary Liu, BitpushNews

US President Trump suddenly announced on April 9 local time that he would suspend reciprocal tariffs on non-retaliatory countries. This "lightning change of face" not only caught Wall Street analysts off guard, but also caused a storm in the global capital market.

Global markets rebound retaliatedly

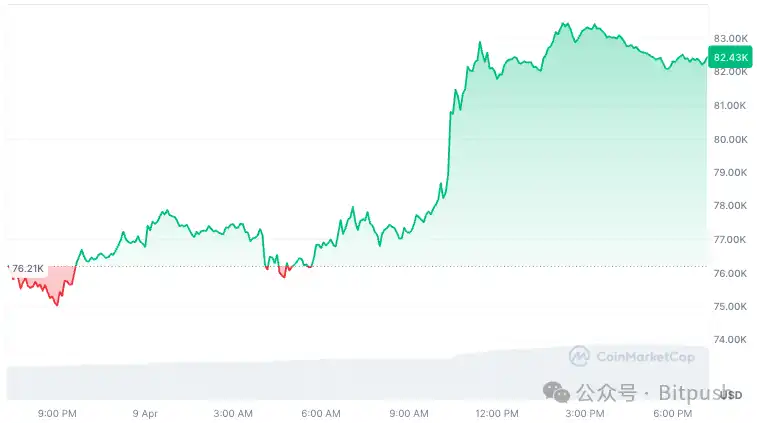

Policy shifts to stimulate a collective rebound in global risky assets. The cryptocurrency market responded the most rapidly, with Bitcoin price soaring 8% within an hour after the news was announced, breaking through the $83,000 mark at one point, and other mainstream currencies rebounded more vigorously, with XRP and Solana both rising by more than 11%.

The traditional financial market also ushered in a long-lost carnival. The S&P 500 soared 9.5% in a single day, the biggest single-day gain since the 2008 financial crisis. The Dow Jones Industrial Average and the Nasdaq Composite also rose 8.2% and 10.1% respectively. Cryptocurrency-related stocks performed particularly well, with Coinbase’s stock price soaring 17%, and MicroStrategies soaring 24%.

Trump has been insisting on a tough stance in the past two weeks, but he did not expect the transformation to become so fast, which shows that Trump's policy "resilience" far exceeds market expectations, and also reflects the extreme sensitivity of global capital to changes in Trump's trade policy.

Analysts change reports overnight

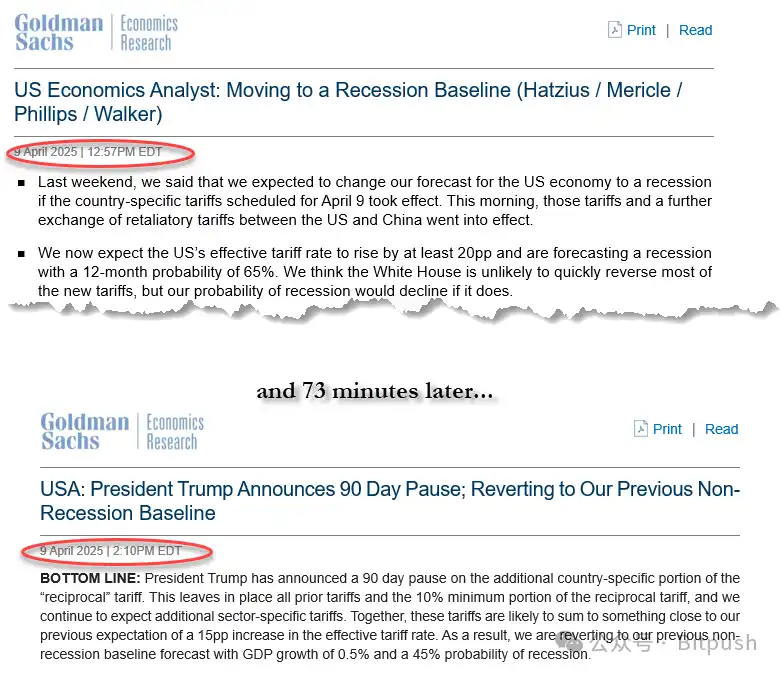

This dramatic change caught many Wall Street analysts off guard and had to revise their research reports overnight. Investment bank Goldman Sachs urgently adjusted its economic forecast in just one hour, lowering the probability of a recession in the U.S. in the next 12 months from 65% to 45%, setting the fastest correction record on Wall Street.

"We previously made a recession forecast based on the assumption of a full tariff increase, but the policy environment has changed now." However, the bank remains cautious and expects the U.S. GDP growth rate may slow to 0.5% in 2025.

Wall Street mixed reviews

Wall Street quickly formed two distinct camps in this regard. Bill Ackman, the head of Pershing Square Capital, made three pushes to praise the decision, calling it a "textbook case for contemporary trade negotiations." The ever-cautious hedge fund tycoon has rarely expressed optimism, and its funds have increased their holdings in US$1.2 billion in industrial stocks.

However, "old debt king" Bill Gross holds a completely opposite view, warning in his investment memorandum: "When market rises and falls become an accessory to presidential sentiment, we are essentially trading "Trump options." This is also directly reflected in market data: Goldman Sachs monitors hedge funds are buying volatility derivatives in a crazy way to hedge."

Ben Kurland, CEO of cryptocurrency research platform DYOR, analyzed: "Trump's 90-day tariff suspension is a strategic respite - he relieved short-term market pressure without giving up on chips, which clearly shows that his approach is trading rather than ideological. This move calms investors' tensions and gives businesses a temporary sense of stability, but not long enough to drive real supply chain shifts or investment decisions."

Market analysts have reminded investors to stay awake. "Short-term volatility is hard to conceal structural risks, and fundamental problems such as weak dollar, high inflation and supply chain reconstruction have not been resolved," said Zach Pandel, research director at Grayscale.

Morgan Stanley monitoring data shows that institutional investors are adjusting their holding structure and allocating more funds to safe-haven assets such as gold and US bonds. This defensive layout shows that professional investors are cautious about the future market.

No comments yet