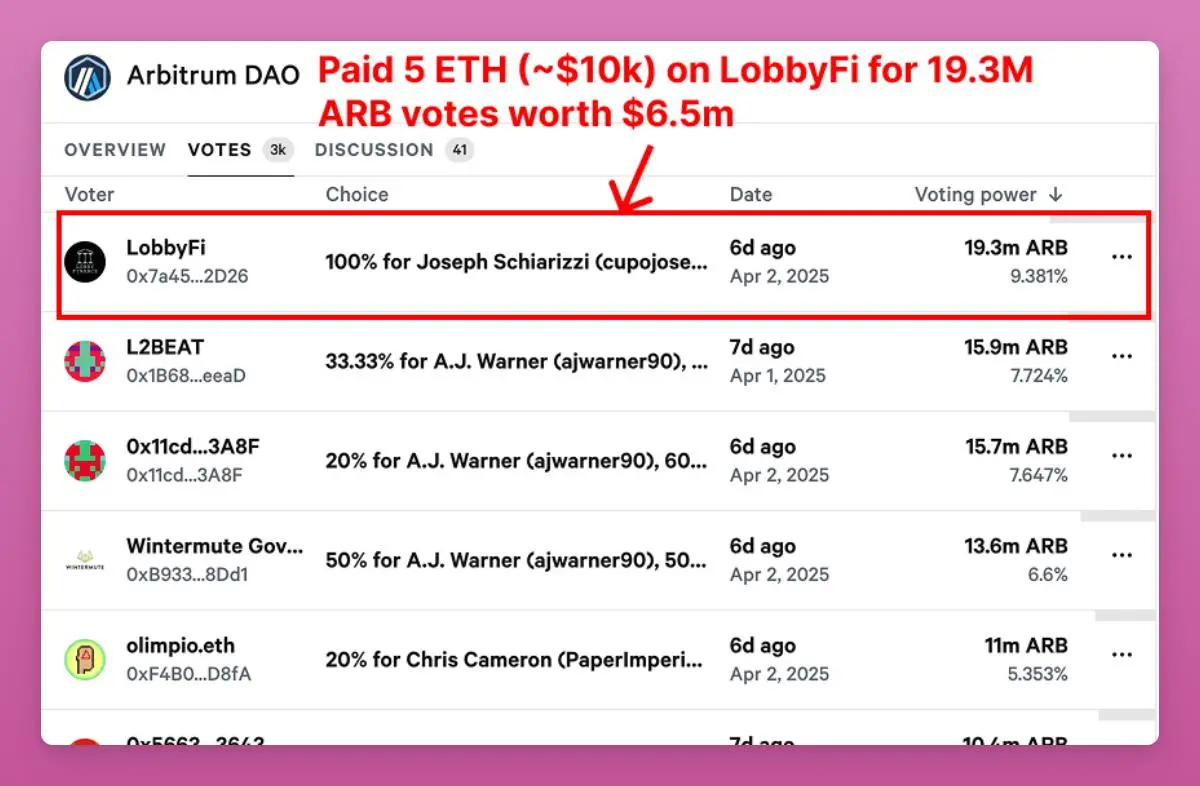

Arbitrum DAO is at the center of a voting manipulation controversy after one user spent 5 ETH worth around $10,000 to buy 19.5 million ARB ($6.5 million) votes. Crypto analyst Ignas shared the incident on X, noting that it could have massive consequences for decentralized governance.

According to Ignas, the user hitmonlee.eth bought the votes on Lobby Finance, a DeFi protocol that allows token holders to delegate their voting power in a decentralized autonomous organization (DAO) to others. Through the protocol, those who want to influence DAO decisions can buy voting power for a fixed price or auction while the people delegating their tokens earn yield.

The user got enough votes for just 5 ETH, putting them ahead of major DAO delegates such as L2Beat and Wintermute. Interestingly, they spent all the votes supporting crypto developer Joseph Schiarizzi to be a member of Arbitrum’s Oversight and Transparency committee.

The incident has raised concerns in the Arbitrum community, with many noting its major security risks. Attempts to manipulate DAO governance are not new, as there have been instances where some users have tried to acquire more tokens so they can influence decisions.

However, Ignas noted this is a major problem because attackers can exploit DAO governance at minimal costs compared to before. In the recent case, the attacker only spent 5 ETH, while Schiarizzi, the beneficiary, could earn around 66 ETH for one year as a committee member.

He said:

“But Lobby significantly (reduces) the costs of attacks.In Joseph’s case he will earn $7.5k for 12 months (47.1 ETH) as OAT member and potential bonus of 100k ARB (18.7 ETH). It’s 66 $ETH in total for paying 5 ETH in voting power.”

Interestingly, Schiarizzi said he did not ask for the votes and criticized the low cost, noting that the underpriced votes put DAO at risk of attacks.

Arbitrum community debates next steps as Lobby Finance defends its position

Meanwhile, Arbitrum DAO is debating what the community should do. The DAO is divided on whether to allow vote buying, ban and disqualify it or penalize people who buy votes. However, many stakeholders believe there is no simple solution as this problem goes to the root of the current DAO model.

According to Ignas, ARB tokenomics needs to change, or people will remain incentivized to delegate their tokens to other protocols for voting. He noted that as long as voting is the only use of ARB tokens, people have incentives to use protocols like Lobby.

However, Lobby Finance has defended its approach, noting that it is very transparent as it provides disclosures on available proposals, and the bidding process is open to everyone. It added that the protocol’s essence is to make DAO governance more interesting than the current system, in which few whales control all the decision-making.

Nevertheless, Lobby.fi said it would not modify its process to ensure that proposals that pose a great risk to DAOs are not listed or that the auction model reflects their significance.

It said:

“We would not refrain from NOT making a proposal available if we/the community thinks it may be a substantial danger + tweaked our auction model quite a bit to make it as secure as it may be, given the nature of things we do.”

Still, Ignas noted that Lobby’s mission to shake up the DAO governance model is a great idea, but similar platforms with less protection will likely emerge, and this can allow manipulation. As for Schiarizzi, he believes this could be a good development as it allows real contributors in DAOs with limited voting power to compete better against the whales while enabling those with governance tokens to earn yield.

Cryptopolitan Academy: Want to grow your money in 2025? Learn how to do it with DeFi in our upcoming webclass. Save Your Spot

No comments yet