Just yesterday, Binance announced that it will launch a new reward margin asset called LDUSDT. This is another "stablecoin" financial management product of Binance that can be used as margin for contract trading after the launch of BFUSD in November 2024. What is it and what is it different from BFUSD?

"Stablecoins" that are not stablecoins

LDUSDT is a "yield-based margin asset" specially designed for futures trading launched by Binance. The official notes that it is not a stablecoin. Users can convert their holdings of USDT simple income elastic product assets to LDUSDT.

LDUSDT has two functions, which can both trade margin and earn profits. Binance allows users to use LDUSDT as the margin for trading margin (U standard contract) of perpetual contracts, while users holding LDUSDT can continue to obtain real-time annualized returns from Binance's "guaranteed principal and earn currency" current products.

Simply put, like the BFUSD launched before, LDUSDT allows users' assets to have both "low-risk returns" and "liquidity". It is also beneficial for Binance. You can earn more lending interest and more contract capital fees while earning more. The founder of the old crypto community, the founder of the old crypto community, proposed that "if Binance chooses to use FDUSD to rebuild liquidity in lending and perpetual contracts, the underlying USD can also earn US debt." According to the reserve report displayed by First Digital Labs on February 28, 85% of the composition of the underlying USD of FDUSD is US Treasury bills. This is equivalent to a three-piece carving. In essence, LDUSDT is a product that Binance shares the above benefits with users.

How is it different from BFUSD?

After Binance launched BFUSD on November 27, 2024, similar products appeared on Dex Backpack and HUOBI exchanges, but their influence was less than BFUSD launched by Binance. However, after the launch of BFUSD, although the model was novel and participants generally believed that the model could improve liquidity, at the same time, some problems in the product were also emerging.

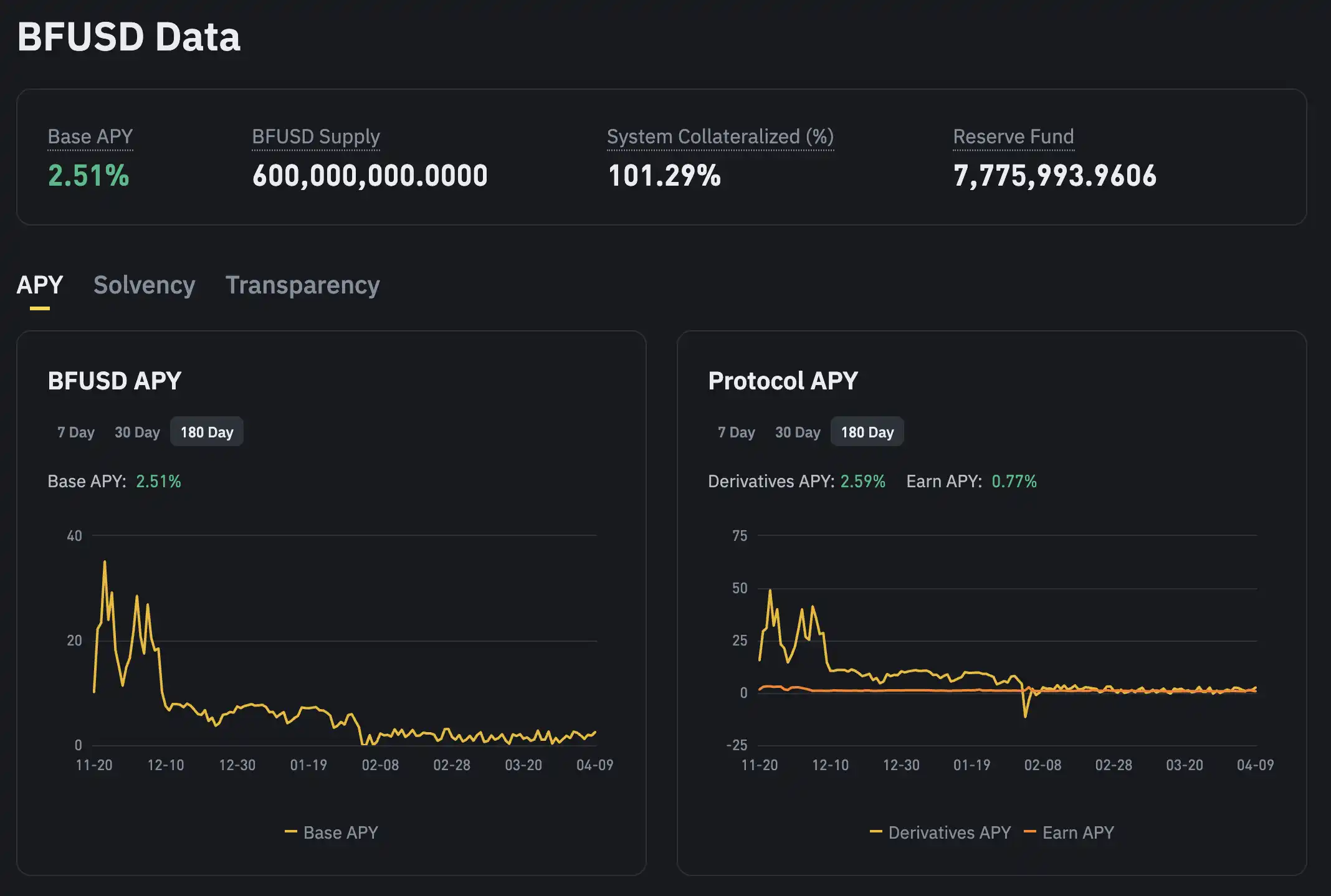

Returns are highly volatile, and the returns of BFUSD include two parts: the base interest rate and trading bonus, while the holding cap is linked to the VIP level. This model is highly dependent on market conditions and the user's own trading activities. Although it can reach an extremely high 38% APY at its peak, if the market unilateral market or trading volume is insufficient, the actual returns may be lower than expected, or even close to the lowest value of the base interest rate. It was able to maintain around 20-30% during the period when the market liquidity was quite high at the end of last year, but starting from February to March this year, APY was almost close to 0%.

The interest rates of retail investors and professional traders are different. The additional rewards of BFUSD are linked to the user's futures trading volume. High-frequency traders or large investors can significantly increase returns. However, if ordinary users have low trading volume, they may only obtain the basic interest rate, which is not cost-effective. This makes BFUSD's design more favorable to professional traders than ordinary retail investors.

Although LDUSDT is very similar to BFUSD's usage, its income structure is different. BFUSD is based on hedging strategies and staking implementation, while LDUSDT's revenue comes from Binance sharing the annualized income of "Simple Earn" with users, including some platform fees, lending income, or returns from some low-risk investments.

Due to the above two reasons, BFUSD is not popular in the current market. Unlike BFUSD, which fluctuates significantly due to fluctuations in capital rates, the advantage of LDUSDT is that it is relatively stable but the cost is that the yield will not be so high. These yields may be completely inconspicuous in the bull market, but at a time when liquidity is relatively exhausted, it is a very good choice for maintaining stable returns and liquidity at the same time. It is relatively simple to operate without relying on the user's own trading strategy, which can popularize more retail investors to participate.

What does Binance want to do with the launch of earnings stablecoins one after another?

In general, BFUSD is more like an investment tool, creating additional value for users through Binance's active behavior. It is a product that allows traders to frequently trade in "bull markets", while LDUSDT is a door that opens up the channels for Simple Earn and futures trading, and inspires conservative users to trade in "bear markets".

KOL "Loki_Zeng" sighed in response to this, "Binance is too crap. It was the inevitable end to think that the separation of interest and circulation of stablecoins will be a certain end, but it did not expect that the final revolution of Binance was Binance itself." Whether it is BFUSD or LDUSDT, what Binance wanted to do was to activate a large number of stablecoins idle on exchanges and put them in a leverage shell, and let them stay in the Binance ecosystem to continue to provide vitality for actual business.

No comments yet