author:Y UP IM

original:Bonds, Stock Market, and China: What Going On

Compiled by: TechFlow

False headlines and stock market fluctuations

Earlier this week, stocks rose sharply by a false headline that claimed President Trump could suspend new tariffs for 90 days. However, just a few hours later, when people discovered that the news was not true, the stock market fell rapidly. The fake news comes from a Twitter account called Walter Bloomberg (which has nothing to do with Bloomberg and shows signs of actually being an individual operation several times) that appears to have copied a title from somewhere (or perhaps intentionally manipulating the market, who knows).

The market’s response is important because it reveals the market’s strong desire to end tariffs. Investors are eager to believe any good news, so that even false information can trigger a market rebound.

However, so far, the government has not given any real good news. On Tuesday, the market was full of hope and overall was on an upward trend, but then after realizing that tariffs were coming, the market let out a helpless sigh and fell rapidly.

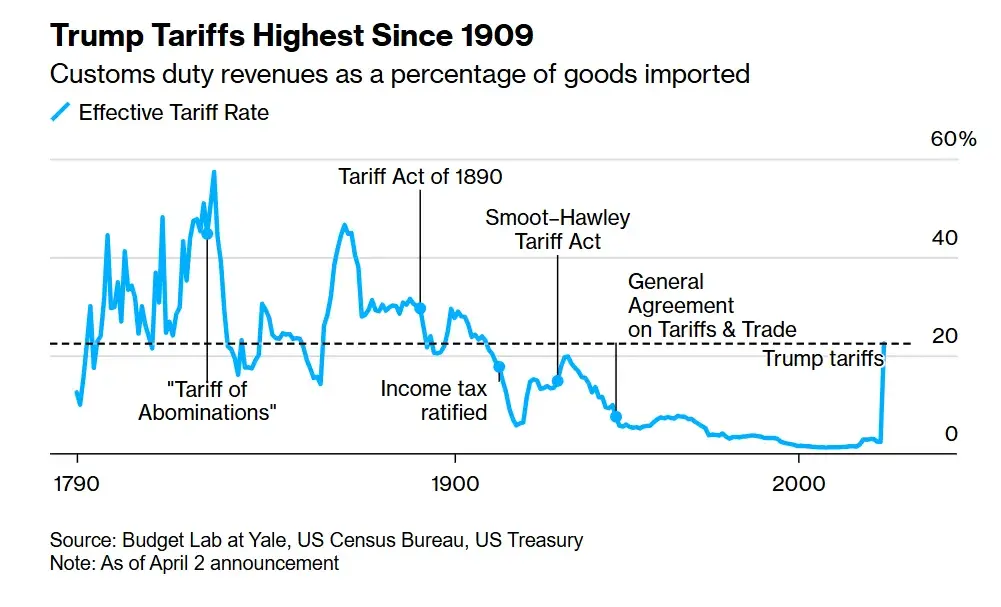

And these tariffs have indeed come - the largest tariff increase in U.S. history came into effect at 12:01 a.m. on April 9. In fact, these tariffs are so punitive that they instead start to reduce fiscal revenue, as Ernie Tedeschi wrote.

There are many questions here: Why did the fantasy of factory-made America in the 1950s obscure the reality of modern labor and technology? Has the bond market failed? What actions will Congress take? How is China's reaction? What should we do next?

BondsWhat's wrong with the market?

First, let’s look at the bond market.

The bond market is selling, and it's all happening in the middle of the stock market crash. At the moment, the United States is a risk to the world and temporarily puts markets in chaos. Here are some headlines that make us feel the level of turbulence in the coronavirus situation.

Stock markets fell because tariffs will affect the real economy. Normally, when the stock market falls, we see funds flowing to safe assets - when the market panics, people will think: "Well, US Treasury bonds look safe. The United States is a stable country, I will buy some Treasury bonds! Nothing goes wrong!" So people buy Treasury bonds, push up bond prices and lower yields.

But now, that's not the case. Yields are rising, which means people are selling bonds, which may herald a new era. Why is this happening? There are several reasons:

- China is selling:The bond sell-off may be due to the sale of U.S. Treasury bonds in retaliation or fear.

-

Forced to sell:As Matt Levine explained, market deleveraging may trigger the closing of underlying transactions, resulting in forced selling and even the explosion of hedge funds.

-

No longer has the risk aversion status:Perhaps everyone is beginning to worry that the "safe harbor" is no longer safe. If other countries think that the U.S. government may withdraw the Fed’s currency swap for political gain, or suspect that the White House may continue to impose tariffs until the economy collapses — they may decide, “Forget it, I won’t buy Treasury bonds, thank you.”

-

Market sentiment:This depends largely on people's opinions. Market sentiment is indeed important because it is a leading indicator of actual data and market positioning.

This raises a difficult question - when and how can this situation stop? At present, everything is falling - US dollar, oil, bond prices, stocks, and credit spreads are soaring. This is also bad news for the real estate market. Everything is moving in a direction that shouldn't have developed. So, who can do something?

Can the Federal Reserve or Congress intervene?

Maybe the Fed will intervene? But with inflationary pressures so high (due to tariffs), the Fed cannot easily cut interest rates and chooses to maintain the status quo, as San Francisco Fed Chairman Mary Daly said. Of course, the Fed can also adopt quantitative easing (QE) and buy some bonds, but this will further exacerbate inflationary pressure.

-

Congress can also intervene. This is their responsibility. Don't forget that all these policies are implemented in the name of emergency actions. They can stop these measures at any time. As the Washington Post wrote, “Seven Republican senators support a bipartisan bill that will lift new tariffs in 60 days unless Congress votes to approve them.” But they need at least two-thirds of senators (and 20 Republicans) to overturn Trump’s possible veto. They don't seem to want to do that.

-

So some senators — especially those from states dominated by manufacturing — may push for more targeted trade deals to mitigate the impact of tariffs on local businesses. Others, especially those where agriculture is a major employer, may lobby for exemptions or partial tariff relief to counter retaliation from other countries on U.S. agricultural products exports. If the situation worsens, it may provide farmers with a bailout plan like the previous tariff policies (although this will offset any income from the tariff).

-

-

At the state level, Governors may negotiate local business cooperation or FDI agreements. For example, a state can provide tax benefits or simplify the approval process, attracting businesses to build factories locally, thereby effectively creating small trade or investment zones. This may create tensions between state governments and White House policies, but state governments need to protect local jobs.

-

The real problem is in the federal government:The ideal situation is that the government cancels tariffs, but this doesn't happen when the policy becomes a show. As of the morning of April 9, Trump refused to reply to anyone in negotiations (although they "flattered him"), and now he is even talking about imposing tariffs on drugs.

The core of the yield issue is that the government wants to push it down so that it can refinance debt at lower rates, reduce interest payments, and then go away. But now, not only is the possibility of a recession imminent, but the yield has not declined – it is a perfect combination of stagflation: high inflation, low economic growth and high unemployment.

The transformation of the world order:

If you read my previous articles, you know I've been criticizing these tariff policies (even before the election, when I first interviewed Erica York at the Tax Foundation). The basic requirement of the current government is that other countries either pay new trade fees or don’t want to trade with us.

So, what does the United States mean to other countries in the world? Many people think that the United States is subsidizing the rest of the world, but in fact the opposite is true, as Ben Hunt wrote.

-

The United States is a major beneficiary of a global system based on stability and trust. In fact, the rest of the world has been subsidizing the American way of life. This stable system was once called "Pax Americana". In the past 80 years, the United States has provided security guarantees, open trade channels, stable US dollars, etc. to other countries in exchange for allowing the United States to exert a wide range of influence on global rules and institutions. Therefore, the United States enjoys unique privileges such as lower borrowing costs and ongoing trade deficits (which is not a bad thing), and other countries’ demand for US dollars and U.S. Treasury bonds actually subsidize the U.S. standard of living.

-

But now, the United States is turning to an additional fee that does not match any reasonable calculation (in fact, the mathematical model used is wrong, as pointed out by the American Enterprise Institute (AEI). So, countries began to question: "If the United States wants to be petty about every cargo ship and submarine, then we might as well establish a trade agreement on our own to avoid these troubles." As a result, we pushed them far away, and at the same time dismantled our own advantages - trust.

All this is changing, and perhaps the status of the reserve currency will change as well. In the past, we had only one big question: "Will China replace the US dollar?" But this question may be too simplistic. We may see the formation of a series of "monetary clubs", as the International Monetary Fund (IMF) has previously discussed, such as small groups or bilateral agreements, some based on digital clearing systems and some partially pegged, which are gradually reducing dependence on the United States.

Rather than saying that a single competing currency replaces the US dollar, we may see a spliced monetary system that together reduces the influence of the United States. The end result is the same: automatic demand for US Treasury bonds is reduced, the market is more fragmented, and the reflectivity of the "safe haven port" is weakened accordingly.

How does China respond?

Many people believe that the ultimate goal of this game is to weaken China's strength. U.S. Treasury Secretary Bessent said they could delist Chinese companies from the U.S. Stock Exchange because "all options are within the scope of discussion." At the same time, China also fought back and imposed a 50% tariff on U.S. imported goods. This marks that we have officially entered a trade war.

The RMB exchange rate fell, and China tried to make its exports more competitive by devaluing its currencies (a strategy that is extremely complex and has brought many effects), while also likely preparing for a capital war with the United States. China is a difficult opponent for the following reasons:

-

China's dependence on the United States is much worse than before:China has diversified its export market and exported more goods to Latin America, Africa and Southeast Asia. The U.S. share of China's total exports is no longer so important. Some might argue that “the United States has bankrupted all countries through these tariffs, thus making them unable to afford Chinese goods.” This statement sounds like fiddling with the board again in another dimension, but perhaps makes sense.

-

China can bear more pain than the United States:It was a complex argument, but in the final year of the Biden administration, the American public was furious about inflation. If tariffs push up inflation again (which is likely to happen because tariffs for Trump’s first term have already caused the price of imports to rise), this could seriously affect Trump’s public opinion support (maybe?), although the administration seems to think that this will consolidate its position among the general public. (To be honest, the "ordinary people" and "Wall Street" are almost the same thing now.)

-

China has excellent factories:China is not as afraid of automation as the United States. Their factories have been highly automated, even fully automated.

-

This does not include many high-end electronics, batteries, and almost all products on Amazon still rely on China's supply chains. If the United States really wants to isolate China, commodity prices will rise sharply. American consumers are accustomed to cheap goods, so it is conceivable what kind of reaction this price increase will trigger.

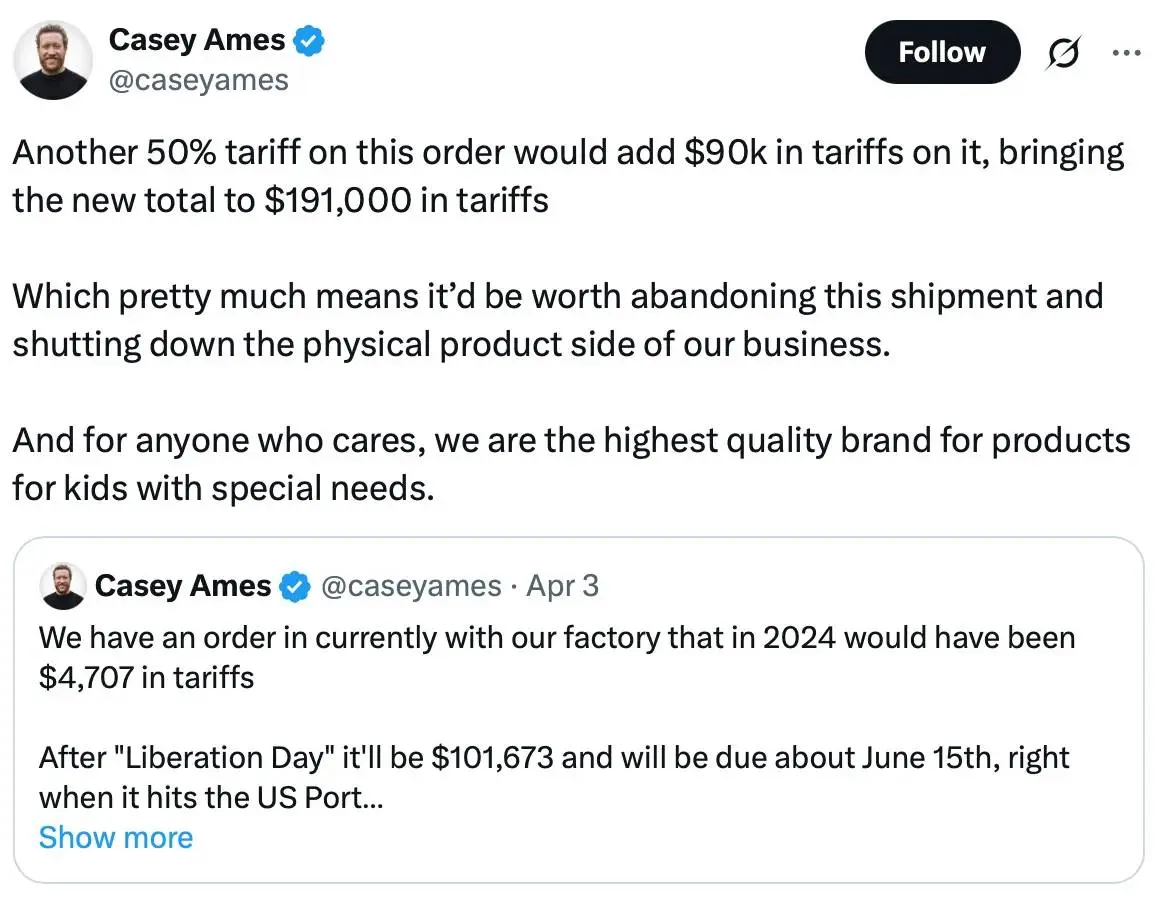

We often think that the decisions of large trading groups are led by the government. But don't forget that tariffs are paid by businesses that export goods to the United States, not by states. In more and more cases, multinational companies like Apple and Samsung may need to engage in some form of "corporate diplomacy" to ensure the continuity of supply chains. They may need to establish new shipping routes and manufacturing bases outside the United States to form a global network of quasi-private nature that may eventually be more important than the official agency dominated by Washington.

However, all of this is of course very complicated. As Scott Galloway mentioned, Trump has done a huge harm to the "American brand", and this is undoubtedly bad news for American companies.

Myths and reality of returning to manufacturing

Part of the government's official reason is that "we just need to make everything locally." This reflects their excessive persistence in reviving traditional manufacturing. However, reality is more complicated, and the following points are worth noting:

-

The manufacturing industry is actually growing:As Joe Weisenthal noted, U.S. manufacturing has actually flourished over the past four years, driven by the Inflation Cutdown Act (IRA) and the Chip Act, and this growth has not relied on broad tariff policies.

-

Nostalgia for the past:The government repeatedly mentioned scenes similar to those of workers assembled cell phone screws in the 1950s, and Trump even preferred to compare the United States to the "Golden Age" from 1870 to 1913 (because the United States had no income tax at that time). These nostalgic images do have some political appeal: the image of a steel plant or assembly workshop symbolizes the strength of the American economy, especially after the two world wars, when the United States was the only country with production capacity. But that era is gone forever.

-

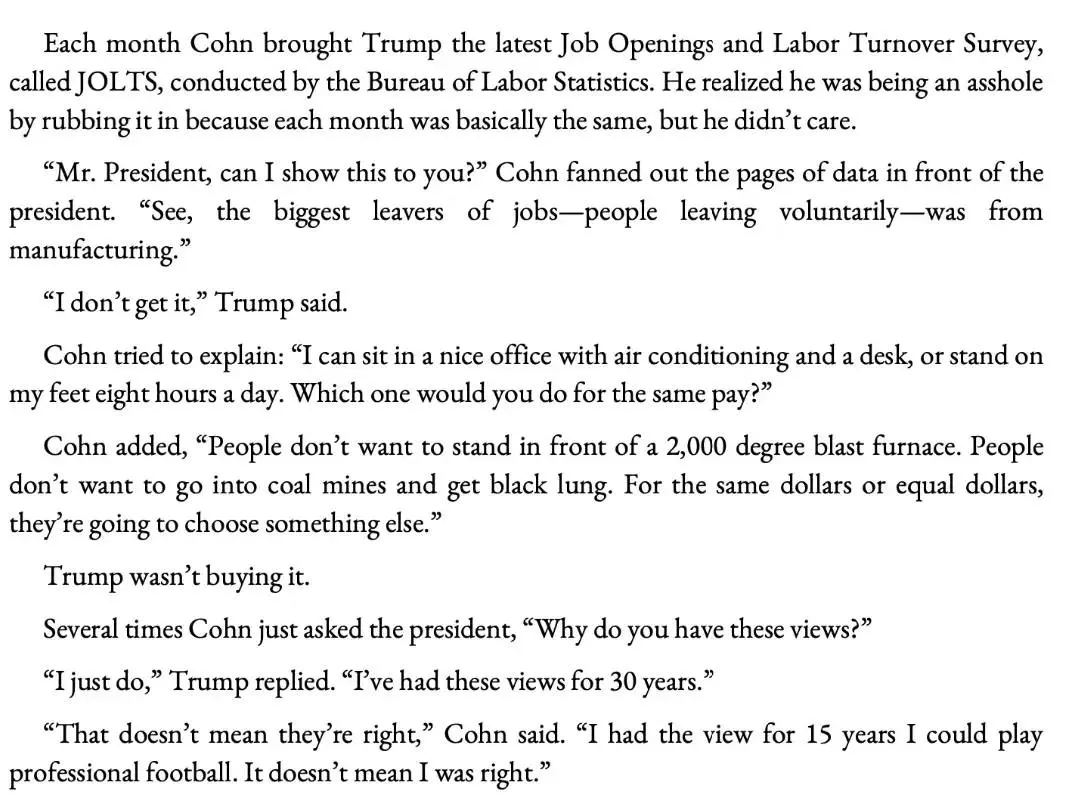

This cannot solve our social problems:Many people try to regard themselves as spokespersons for ordinary people, such as some commenters. They believe that returning to manufacturing is the key to solving the problem. However, in fact, once there is a chance, people leave manufacturing in large numbers. This is not to say that manufacturing is not important (it is really important!), but the problem is much more complicated than it seems.

-

Anecdote: Looking back at Trump's first term, Jordan Schneider shared what Gary Cohn said about Trump. People are leaving manufacturing, partly because the job is hard and monotonous. Although we have made great progress in using machines to improve the working environment, if people have a choice, they are certainly more willing to do work that doesn’t require screwing small screws into their phones. In contrast, people will be more inclined to choose to work in the aviation field or enter semiconductor factories (if the Chip Act was not cancelled, there might be more such opportunities!).

-

Not just Wall Street’s concerns:David Bahnsen has compiled a list of the impact of tariffs on the economic life of ordinary people, showing a lot of concerns and fears. The belief that the return of manufacturing can solve the "crisis of loneliness" or other social problems completely misunderstand the real root problems in our world. The problem lies in the popularity of smartphones and the housing crisis. When Trump took office, the United States was already in full employment.

-

This won't bring back too many jobs:The labor required for modern factories to operate has been greatly reduced, and the government acknowledges this. Today’s manufacturing jobs often require higher skills, such as programming CNC machines, which require labor training, faster approval processes, and other factors beyond taxation. As Alex Tabarrok elaborated on, tax benefits alone cannot solve these problems.

This leads to a situation of "loss-loss-loss-loss-loss".

-

If we promote onshoring but rely on robots to do our jobs, we will not get cheap foreign labor and create a large number of local jobs.

-

So you may see a decrease in foreign supply chains (which means the soft power of the United States is declining) and there will be no new wave of American jobs.

-

Manufacturers are actually reducing spending under uncertainty. Haas Automation, a company that makes CNC machine tools, has shown this trend, and Microsoft has decided not to build its $1 billion data center in Ohio, a decision that will result in the loss of 1,000 jobs and cost the local economy $150 million a year.

-

Trump is trying to cancel the Chips Act, which makes it all more uncertain. If you really want to promote the development of manufacturing, retaining such policies is the key!

Businesses have stopped providing guidance on the future, as Sam Ro wrote.

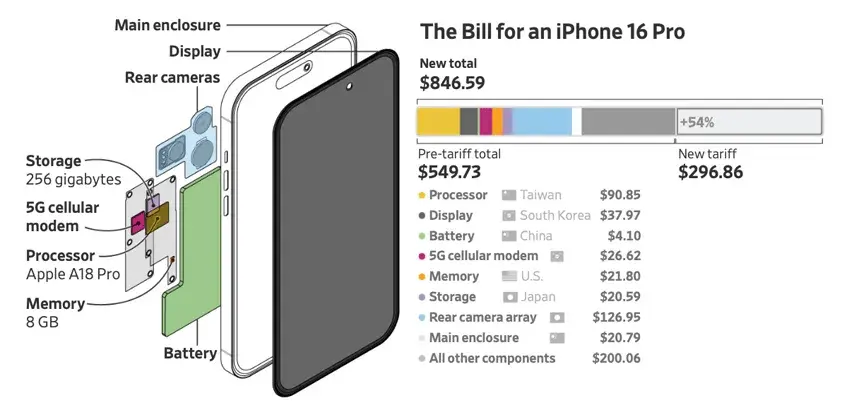

Even if we really promote localized production—such as Trump believes that the United States can make iPhone 4—the cost will be very high. The Wall Street Journal (WSJ) has a wonderful article that explores the situation of manufacturing an iPhone under tariff policies in detail. In addition to the huge effort and costs required to transfer production to the United States, the final mobile phone price will also become extremely expensive.

In the discussion about manufacturing, people often pay too much attention to commodity production and ignore the area that the United States is really good at - "financialization". As Matt Levine wrote:

Currently, many foreign countries sell goods to the United States. After obtaining US dollars, part of them is used to purchase American goods, and the rest is used to purchase American financial assets. And under Trump's system, these countries will have to use all the US dollar to purchase American goods rather than financial assets.

This means that other countries will no longer be able to buy U.S. stocks and bonds, but will have to try to buy U.S.-made goods. These commodities need to be cheap enough to be affordable in developing countries, which will:

Force the United States to significantly lower its living standards to produce cheap enough goods for export.

Indeed, the United States has a deficit in commodity trade, but it has a surplus in service trade - finance, software, media and other fields are our strengths. If other countries in the world develop parallel entertainment, payment systems or capital markets, we will lose this intangible advantage.

Furthermore, people completely ignore the fact that chocolate, bananas or other raw materials cannot be produced in the United States. Some people may say, "It's okay, I don't eat bananas", but this view is too narrow and ignores the way the global economy works. For example, although YouTuber Mr. Beast produces chocolate in the United States, the raw cocoa still needs to be imported from abroad because the United States does not produce cocoa. Again, while you may not need to eat bananas, what about small businesses (or even large creators) that rely on these raw materials?

For example, coffee. I drank two cups of coffee while editing this article this morning, and the coffee beans are from Colombia. These coffee beans cannot be grown in the United States because the climate is not suitable. So we have a trade deficit in coffee, but that's not a bad thing. Colombia has a comparative advantage in coffee production, we buy their coffee because Americans like to drink coffee, and they buy other goods with dollars. Both sides benefit.

It’s frustrating that we shouldn’t dream of making socks in the United States. The real focus of the United States should be advanced technologies, such as artificial intelligence, chips and biotechnology. If we decouple or punish foreign partners, it may accelerate their own R&D ecosystem. If they succeed, they will reduce their dependence on these key technologies in the United States. By then, what we will lose is not just the shoe factory, but the next wave of innovation. This is the deeper and more severe consequence.

Potential Next Policy:

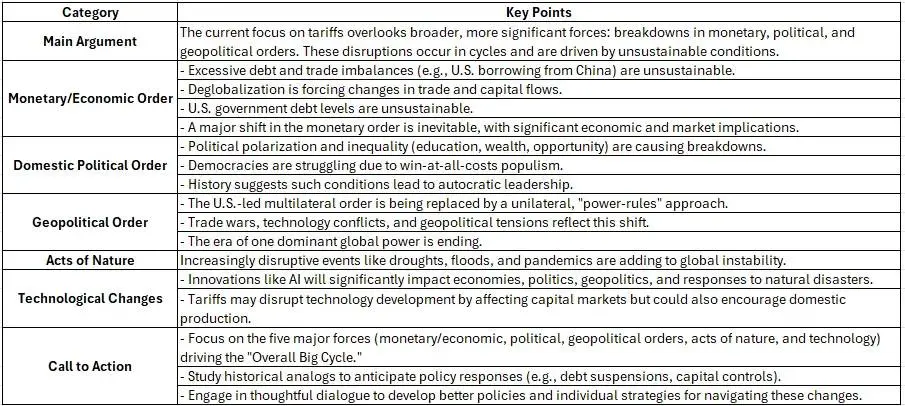

Ray Dalio once said: "Please note that this is not a tariff issue, but a debt issue, and we need to rebalance it in the end." This does make sense. He pointed out that we are in a turbulent world and need to find a solution.

Ray Dalio is right. We are talking about an ecosystem of trust that has been built over decades. Until recently, the world was willing to inject funds into U.S. Treasury bonds and let the U.S. dominate in many matters because they believed that the U.S. would be a relatively stable hegemonic country.

But if we continue to vent our emotions in unpredictable ways, or treat allies as subscription fees, this invisible trust gradually fades away, and along with it are the benefits we benefit from it—such as low borrowing costs, supply chain stability, and the dominant seat in every negotiation. What Dario calls the "Overall Big Cycle" has arrived, but solving the problem by triggering a global recession and weakening industries is obviously not the optimal solution.

Even if the White House announces next month, "Oh, forget it, no more tariffs!" Other countries in the world have seen the risk that the United States may take similar actions again. This alone is enough to prompt them to develop alternative plans—such as strengthening trade ties with each other, or finding alternative reserve currencies.

How should the United States respond?

1. Targeting real trade abuse:

Focus on verifiable intellectual property theft, forced technology transfer or unfair subsidies. Rather than imposing comprehensive tariffs on the entire industry, it is better to establish precise exemptions (such as for shrimp farmers) or impose punitive tariffs only on conclusive violations, thereby reducing collateral harm to U.S. businesses.

2. Invest in labor and technology:

Restoring the Chips Act! High-tech manufacturing incentives can encourage the construction of fabs in the United States without penalizing consumers through comprehensive tariffs. Funding vocational training, apprenticeship programs, and community college programs.

3. Formulate smart industry policies:

Modernize roads, ports and broadband facilities to reduce supply chain friction and enhance domestic competitiveness. Rather than relying on tariffs, it is better to attract high-value industries through incentives, especially those that are crucial to national security.

4. Revitalize the trade alliance:

Improve the US-Mexico-Canada Agreement (USMCA), or re-enter the improved Trans-Pacific Partnership Agreement (CPTPP) while protecting domestic interests.

5. Global Leadership:

Show consistency of policies, stop speaking out casually through social media, and show commitment to fulfilling negotiation terms.

Hope so. But what will happen next? We can imagine several scenarios

-

SlowFragmentation:The trade war will not trigger a violent collapse of the single, but will gradually reorganize the global system. Over time, the United States will become one of many important players, and no longer the focus of the world.

-

Partial concessions:The government realized that the recession was imminent and quietly lifted some tariffs. The market has calmed down slightly, but the damage has been caused and trust remains sluggish.

-

Comprehensive Crisis and Reconstruction:A collapse in a certain link—such as the massive sale of US Treasury bonds or the collapse of supply chains—forces parties to return to the negotiating table and develop a new "Bretton Woods." The United States may have to give up some privileges to restore stability.

In either case, it will not completely return to the previous "normality". Once the illusion of reliability or hegemony is broken, it cannot be simply re-established. We may be able to save a new balance, but this will be based on a completely new clause.

Meanwhile, nearshore outsourcing may skip the United States, allies may be indifferent to our threats, and the “automation-added tariffs” strategy may ultimately fail to create a large number of manufacturing jobs.

These tariff wars and bond market panics are not just short-term news, they may reshape capital flows, supply chain formation, and the way global cooperation is done on issues such as financial crises and wars. We may not see a single catastrophic moment, but a series of smaller collapses that ultimately form a world where the United States is no longer the core and other countries have already started.

Once we destroy this invisible trust structure, partial concessions cannot be fixed. If we don’t realize this early, we might get lost in a series of small crises and temporary alliances, and ironically, we will eventually find that despite the flaws in the old system, it is actually the best deal the United States can have.

What can you do?

The following content is not investment advice and is for reference only.

1. Check your portfolio:

Make sure you know how many stocks, bonds, and other assets you have in your portfolio. Consider diversified investment overseas. Understand the specific composition of the ETF (traded open-end index fund) or mutual funds you hold. By holding a combination of stocks, cash, bonds that mature at different times, and even other assets (such as real estate), it can help balance risks.

2. Establish cash reserves:

If the market is volatile, having a cash reserve for months of living expenses (or assets close to cash) is a good buffer. This avoids being forced to sell investments at inappropriate times.

3. High-yield Savings Account (HYSA):

If you have a low risk appetite, you can deposit funds into a high-yield savings account. This type of account not only generates profits, but also quickly withdraws when needed. I personally put about half of my portfolio in this kind of account.

4. Avoid panic selling:

Headlines can be a panic, but panic selling is usually not helpful. If you have a diversified long-term portfolio, short-term market volatility is often just "noise".

If you see worrying news, don't let fear dominate your decisions. This uncertainty won't go away in the near term, so stay calm, clarify your investment timeframe, and adjust the risk level of your portfolio to what you can accept. Thank you everyone!

1. Discussion on tariffs:

I've discussed tariffs in many previous newsletters and have interviewed Erica York of the Tax Foundation four times, and Stan Veuger of the American Enterprise Institute (AEI) and no one likes tariffs!

2. The impact of foreign investors:

Foreign investors hold 18% of the U.S. stock market, which could make market volatility even more intense.

3. Oil prices and bond markets collapsed at the same time:

The collapse of oil and bonds at the same time is unprecedented. Russia is obviously not very happy about this.

4. Complexity of manufacturing:

Consider various investments in the manufacturing process—processors, displays, camera modules, memory, batteries, glass, chips, housings, assembly, etc. This is a complex process and it will take a long time to establish such production capacity locally in the United States.

5. The importance of labor issues:

It is important to note about the labor force that we do outsource many external costs to other countries where workers tend to do very hard work but receive extremely low rewards. Part of this is the existence of the development ladder – while the work is hard and the reward is modest, factory wages may be better for emerging economies than other options. The problem won’t suddenly become perfect, and a comprehensive tariff will not solve this complexity. In fact, tariffs could make the problem worse if thousands of people lose their factory jobs and return to extreme poverty.

No comments yet