Bitcoin (BTC) hovers just above a key support level, threatening to break down its market structure. In a period of unpredictable markets, BTC has fallen to a lower range, putting pressure on both recent and older holders.

Bitcoin has re-tested and dipped under several key support levels, threatening to move to an overall lower market structure. For now, BTC is still retaining its overall bull market arc, but in the short term, price drops are putting pressure on both short-term retail buyers and older holders.

Bitcoin already lost the support levels at $93,000 and $87,000, recently re-testing its 365-day support level at $76,000. Only the lowest support level holds for now, with a bounce above $81,000 on positive market news. Another market breakdown may pressure BTC beyond short-term corrections, causing a re-evaluation of the 2025 trend.

BTC retained its recent gains at $81,892.01, with trading activity near a one-month high at over $73B in 24 hours. Bitcoin may still face price pressure in the short term, due to the accumulation of long positions in the $79,000 and $80,000 range.

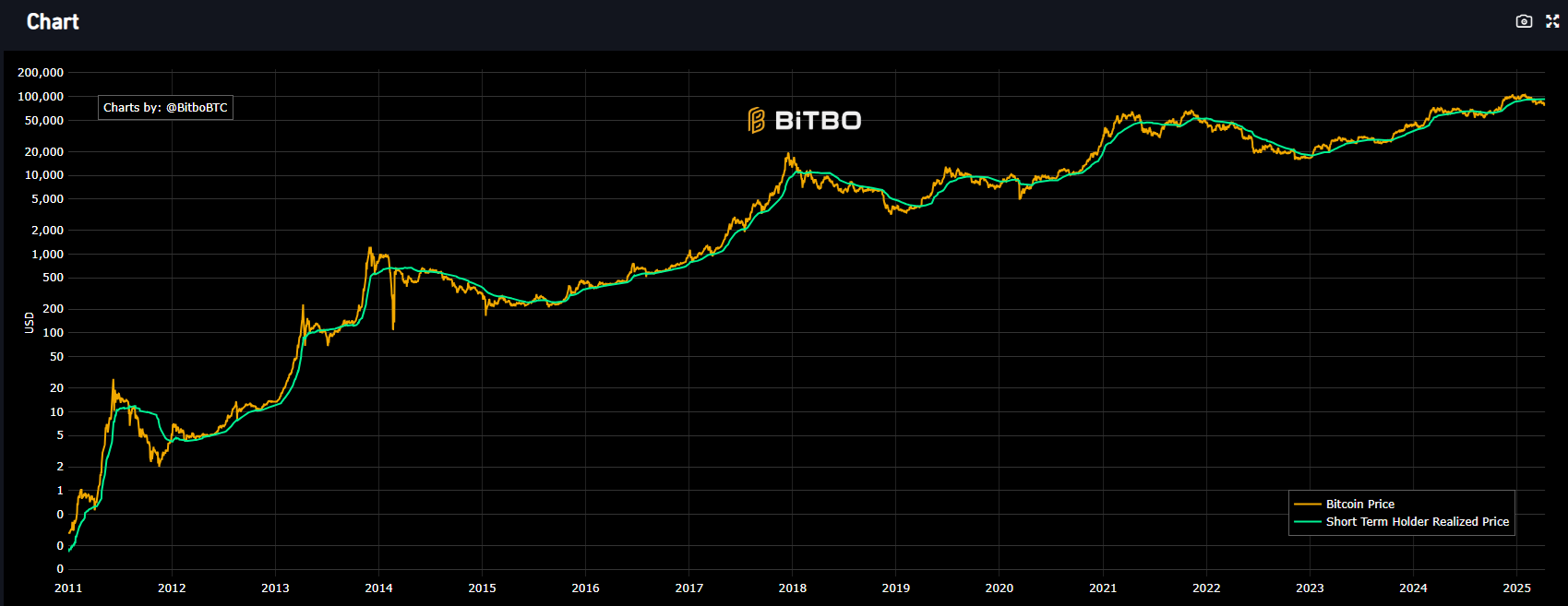

Short-term holders find support at $72,000

The latest cohort of buyers acquired Bitcoin in the $93,000 range down to $72,000. On the upside, short-term holders are still in the money after a recent series of capitulations. The $72,000 range is affecting slightly older holders, with unknown probability of capitulation.

Based on the ‘Hodl waves’ chart, wallets aged under 3 months decreased their holdings. All other wallets have expanded their share of BTC ownership. Additionally, corporate and public entities holding BTC have expanded their reserves to 3.15M coins, offsetting the retail and short-term panic.

Short-term holders with wallets under 3 months in age have also been actively trading, so not all are caught with unrealized losses. As of April 10, around 25% of BTC holders have unrealized losses, but so far, there are limited signs of spot selling. Additionally, there are signs that retail capitulation is easily absorbed by whales. Entities with over 10,000 in their BTC wallets have expanded their net position, reaccumulating coins after taking profits near the price record.

Based on Glassnode data, BTC has support at $71,000 based on the Active Realized Price. The True Market Mean at $65,000 offers a deeper level of support. Liquidity is available up to those levels, suggesting traders are ready for moves down to the lower range.

The recent retest of higher support levels coincides with fearful trading sentiment. The fear and greed index is back at 39 points, indicating cautious trading with quick reactions to negative news. The BTC trade is still tied to the tariffs narrative and is closely tracking the moves of the stock market.

Bitcoin inflows to Binance accelerate in April

The potential selling pressure from Bitcoin may come from additional inflows of coins into Binance. Over 22,000 BTC moved into the exchange since the end of March, with the potential for spot selling.

Since the end of March, 22,106 BTC flowed into the reserves of Binance. Exchanges overall hold a record low number of BTC, but Binance’s liquidity may affect the market.

Exchanges as a whole hold around 2.4M Bitcoins, with inflows of around 32,000 BTC in the past few weeks. However, the spot market puts only limited price pressure on the price, with most of the liquidity still used for the derivative market.

At the same time, up to 3B in stablecoins have left Binance in the past weeks, down from a peak of over 33B in dollar-denominated stablecoins. More cautious trading may continue the sideways trend for BTC.

Cryptopolitan Academy: Want to grow your money in 2025? Learn how to do it with DeFi in our upcoming webclass. Save Your Spot

No comments yet