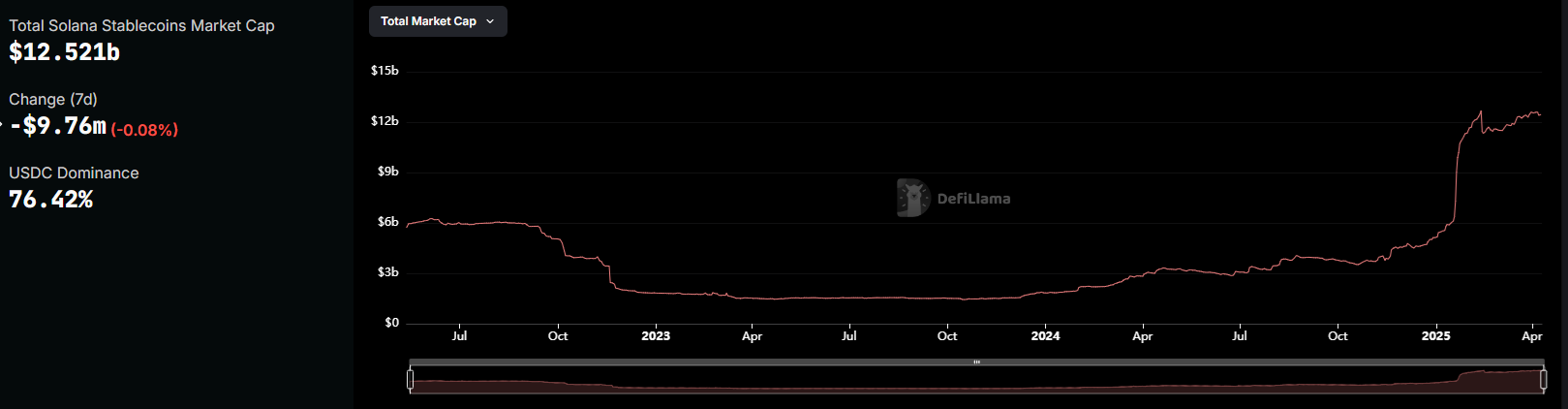

Solana (SOL) retained its expanded supply of stablecoins, even after the peak season for meme trading passed. The minting of new stablecoins turned out to be ‘sticky’, opening opportunities for more trading even as meme activity and DEX swaps fell from their peak.

Solana (SOL) retained most of the stablecoin supply, which was minted in Q1. The inflow of stablecoins facilitated both meme token swaps and the emerging DeFi sector on Solana. As a result, Solana still retains $6.15B in token-based value locked, but an additional $12.52B in stablecoin liquidity.

DeFi and DEX volume on Solana decreased after a spike on January 20, when the launch of Official Trump (TRUMP) created extraordinary market conditions. The presence of stablecoins at that moment boosted the trading levels. Even after that, on-chain users find new niches to deploy the stablecoins.

The most active period of stablecoin expansion came from Circle’s USDC, with rapid printing of up to 1B tokens daily at the beginning of 2025. In January, the inflow of USDC set up the stage for the rise of Orca and Meteora, which formed their meme token pairs against stablecoins.

The SOL stablecoin market started with a supply of only $1.5B in December, lagging significantly behind Ethereum, BNB Smart Chain, and even some L2 chains. The presence of stablecoins will bring the L1 chain more utility for payments, DeFi lending, and new trading pairs.

In the long term, there are hopes that Solana may replace other chains as the main hub for stablecoins. For now, most of the stablecoin supply is still used through Ethereum and TRON.

Solana grows DeFi-linked stablecoins

In the past month, the inflow of USDC slowed down, and the supply expanded by only around 3%. However, Solana already hosts seven stablecoins with a market cap above $100M. In total, Solana carries 34 stablecoins, with varying levels of liquidity and niche use cases.

Tether (USDT) added another 17.73% to its SOL bridged version, for a total of 2.31B tokens. The multi-chain token still lags behind USDC, as Circle aimed to expand the presence of the fully regulated stablecoin.

Most of the stablecoin growth came from DeFi-related tokens. Nick Ducoff, head of institutional growth at the Solana Foundation, pointed to the seven key stablecoins driving expansion.

7 stablecoins with over $100 million on Solana

1. $USDC: $9,483,570,133

2. $USDT: $2,330,095,748

3. $USDY: $175,960,682

4. $PYUSD: $130,801,475

5. $USDS: $117,717,101

6. $FDUSD: $103,727,549

7. $USDG: $103,572,268 https://t.co/ORMa8enslF— Nick Ducoff (@nickducoff) April 10, 2025

Some of the stablecoins also tokenize other currencies, such as the Australian dollar or the Euro.

The expanded availability of stablecoins led to the opening of new pairs on Raydium and Jupiter. The stablecoins also increase the activity of Kamino Lend. The protocol retains a relatively high level of activity at $1.54B.

The available stablecoins may build a yield generation DeFi sector on Solana, which may offset the slowdown in meme token trading.

Ondo and Ethena grow yield-bearing stablecoins on Solana

For the past month, the most active supply growth came from Ondo US Dollar Yield (USDY), growing its supply by 61.54%. USDY reached a total supply of 176.94M, becoming one of the major yield-bearing stablecoins on the L1 chain.

Ethena’s USDe grew its supply by 220%, for a total of 13.44M. For now, Ethena is cautious in expanding to new chains, as it navigates volatile market conditions.

Sky Dollar (USDS) retains its supply of around 104M tokens, expanding cautiously to the new chain. Sky Protocol aimed for large-scale expansion on Solana, which may be slowed down by the lowered yield.

Stablecoins on Solana are still relatively centralized, with some of the top addresses containing a significant share of the supply. Some of the stablecoins are held in vaults or smart contracts and have not yet found use cases in retail wallets.

Cryptopolitan Academy: Coming Soon - A New Way to Earn Passive Income with DeFi in 2025. Learn More

No comments yet