In the realm of digital assets, centralized exchanges (CEX) once dominated the market. However, as the crypto industry evolves, the risks of the traditional model have become increasingly apparent. From the dramatic collapse of FTX a few years ago to the regulatory turmoil surrounding Binance this year, crises at centralized exchanges have erupted one after another, sending chills down the spine.

Now, the arrival of the Web3 era has brought us a brand-new trading model—decentralized exchanges (DEX). This model not only ensures users’ autonomous control over their assets but also introduces unprecedented transparency and security to the financial world.

The Hidden Dangers of CEX: Is Your Money Really Safe?

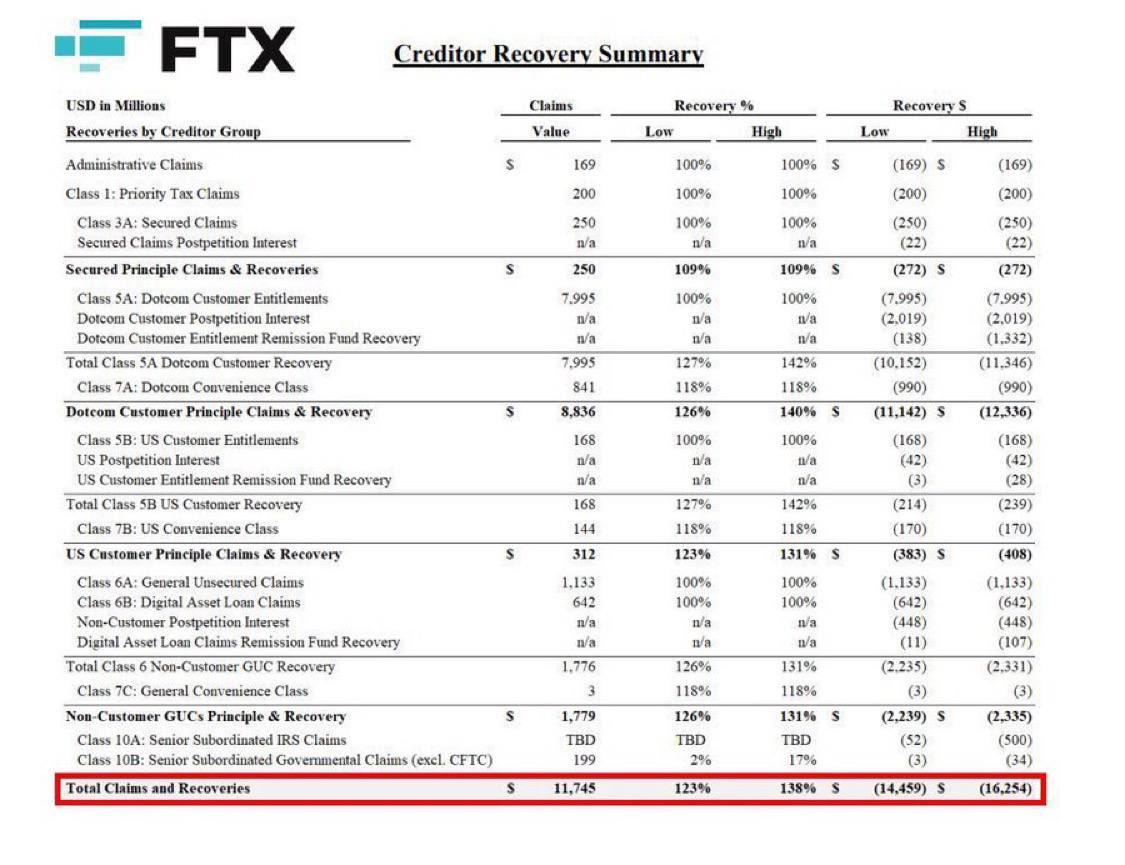

Imagine this: you’ve worked hard to save up your crypto assets and stored them on a CEX platform. Then, one day, the platform declares bankruptcy, or due to policy changes, withdrawals are banned—what would you do? This isn’t a hypothetical scenario; it has already happened. In 2022, FTX—once the world’s third-largest CEX—collapsed due to a broken capital chain and internal scandals, with user losses reaching tens of billions of dollars. What’s even more frustrating is that, as of October 2024, the repayment process has only just begun, and some users still haven’t recovered a single cent. Similar stories abound, like when Binance abruptly suspended services in 2023 due to policy changes in India, leaving user Ravi’s assets locked for months as he watched market opportunities slip away.

These incidents force us to ask: Can CEX really be trusted? The answer is likely no. The very nature of centralized exchanges reveals three unavoidable problems:

You’re Not the Owner of Your Assets

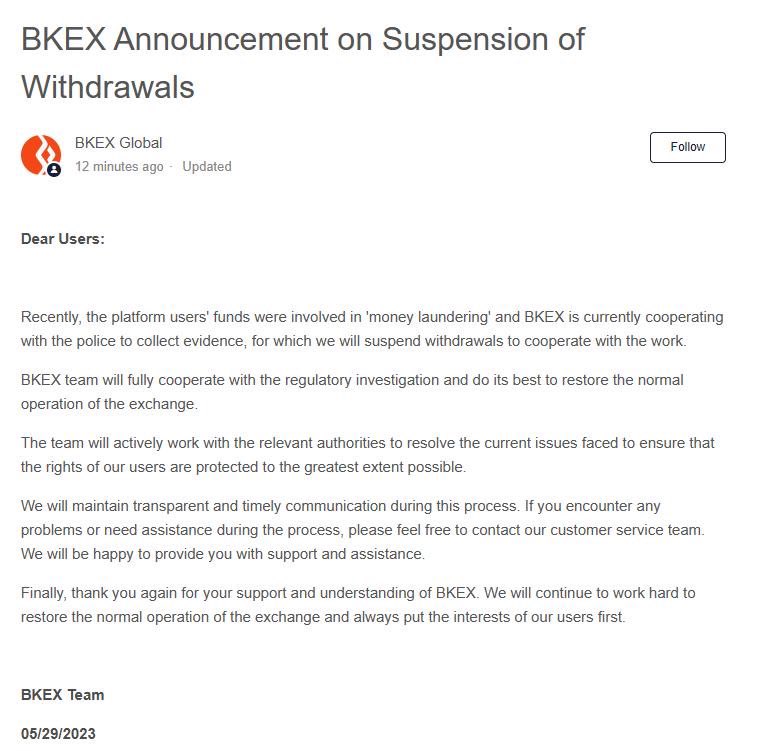

On a CEX, your funds are “custodied” by the platform, with the private keys in their hands. If the platform shuts down, gets hacked, or makes internal errors, your assets could vanish. The FTX debacle was painful enough, but in 2023, when Bkex froze withdrawals due to a money laundering investigation, millions of users were left helpless—a chilling reminder of the risks.

The Regulatory Straitjacket

CEXs must comply with government regulations worldwide, but policies can change rapidly, and platforms may be forced to shut down or restrict services at any time. In early 2025, Binance faced a judicial investigation in France, a massive claim in Nigeria, and even controversy over its collaboration with the Trump family. And the users? They can only passively accept the consequences, with their assets at risk of being frozen.

An Opaque Black Box

CEXs operate like a black box when it comes to trading and fund management—you can’t see how orders are matched or whether the platform truly has sufficient reserves. When FTX collapsed, it was revealed that its reserves were far from enough to cover user deposits. Such risks are invisible to users until it’s too late.

These issues show that the risks of CEXs are not accidental but structural. Are you really willing to entrust your asset security to someone else?

The Rise of DEX: Control in Your Hands

Unlike CEXs, DEXs rely on blockchain technology to create an entirely new asset trading ecosystem. DEXs don’t depend on centralized servers; instead, they operate through blockchains and smart contracts, with users always holding their private keys. In simple terms, DEXs make you the true owner of your assets, rather than leaving your fate in the hands of a platform.

The development of several DEXs demonstrates this trend:

in 2023, Uniswap’s daily trading volume surpassed $2 billion, PancakeSwap attracted massive users with its low costs, and even in a bear market, GMX remained vibrant. More strikingly, the total value locked (TVL) in DEXs skyrocketed from a few hundred million dollars in 2020 to tens of billions. This isn’t a flash in the pan—it’s a clear trend. DEXs are proving with real action that they are not just an alternative to CEXs but the future direction.

Absolute Sovereignty

In a DEX, trading doesn’t require entrusting your assets to a third party; users always hold their private keys, maintaining full control over their funds’ security. This design ensures every user is the true owner of their assets, eliminating the risk of losses due to platform errors or mismanagement.

Transparency and Verifiability

Decentralized exchanges leverage blockchain technology to record every transaction publicly and immutably on the chain. Users can verify transaction data at any time, ensuring all operations occur in a transparent environment, which significantly enhances the system’s trustworthiness.

Resistance to Regulation and Flexibility

Amid constantly changing global regulatory policies, DEXs, with their decentralized nature, can operate with less interference. Free from overly strict regulatory requirements, decentralized exchanges offer users a more liberated trading experience while creating conditions for innovation and cross-chain interoperability.

Improved User Experience Driven by Technological Innovation

Early DEXs faced issues like high fees, slow transaction speeds, and insufficient liquidity due to technical limitations. However, with the development of Layer 2, cross-chain technology, and smart routing, today’s decentralized exchanges have achieved a perfect balance of low costs, high efficiency, and excellent user experience. The new generation of DEXs continuously optimizes interface design and interaction processes, making them accessible even to users new to cryptocurrencies.

From Centralization to Decentralization: The Necessity of Transition

You might have heard this before: “DEX sounds great, but isn’t it too complicated to use? High fees, complex operations, and easy losses.” That might have been true a few years ago. Early DEXs, like Uniswap, ran on the Ethereum mainnet, where Gas fees often reached tens of dollars, the interface was cold and intimidating, and new users were left confused. Low liquidity also caused severe slippage, where even small trades could lead to significant losses.

But don’t worry—DEXs have transformed dramatically. Technological advancements have reinvented them:

Ultra-Low Fees: The widespread adoption of Layer 2 technologies like Arbitrum and Optimism has reduced Gas fees to mere cents. Platforms like Xbit DEX use smart routing to optimize trading paths, making costs even lower than CEXs.

Simplified Operations: Modern DEX interfaces are increasingly user-friendly. Xbit DEX even offers one-click trading. College student Miller, using a DEX for the first time, swapped $500 for USDT in just 3 seconds, exclaiming, “This is faster than signing up for a CEX!”

Slippage No Longer a Nightmare: Cross-chain bridges and liquidity optimization have made trading smoother, with Xbit DEX reducing slippage to nearly negligible levels.

What was once a “niche toy” has now become a “tool for everyone.” DEXs are no longer just for geeks—they’re an easy choice for the average person.

How to Choose the Right Decentralized Exchange for You

The market offers a variety of DEXs, each with its own strengths, so there’s always one that suits you:

Uniswap: A DeFi veteran with high trading volume and a rich ecosystem, but Ethereum’s high fees might deter small-scale users.

PancakeSwap: Runs on BSC with ultra-low fees, plus mining and lottery features, though it offers fewer token options.

Balancer: Supports multi-asset pools with high flexibility, ideal for experienced users, but newbies might find it complex.

Xbit DEX: Combines cross-chain functionality, low fees, and simple operations, loved by both new and seasoned users. Luke, a crypto veteran, tried Uniswap and PancakeSwap but ultimately found Xbit DEX the most hassle-free.

New users can start with Xbit DEX for its low entry barrier and great experience; experienced users can explore Balancer for more possibilities.

Looking to the Future: Take Control and Embrace the Decentralized Era

Imagine this: 10 years from now, your stocks, real estate, and even artwork can be freely traded on a DEX. No bank queues, no intermediary fees—just a wallet, and you’re in control of everything. Uniswap is already experimenting with on-chain derivatives, PancakeSwap is optimizing reward mechanisms, and Xbit DEX is making strides in cross-chain and governance. This isn’t science fiction—it’s the future unfolding right now.

Today, let’s step into the Web3 era together and experience the revolutionary changes brought by decentralized exchanges. From now on, your asset security will no longer be at the mercy of third-party oversight—it’s in your hands. The future is here, and the new era of digital finance awaits every visionary to join the journey.

No comments yet