In the world of digital currencies, bull and bear markets go hand in hand, with every price fluctuation tugging at the hearts of numerous investors. Bitcoin, the pioneer of cryptocurrencies, undoubtedly serves as a barometer for market trends. Recently, Ki Young Ju, the CEO of CryptoQuant, issued a warning declaring that the Bitcoin bull market has ended and the market is entering a different phase. So what insights lie behind this statement? What does it mean for the average investor? In this article, we will not only interpret Ki Young Ju's perspective but also explore the current state of the Bitcoin market and future trends, helping you better navigate this ever-changing landscape.

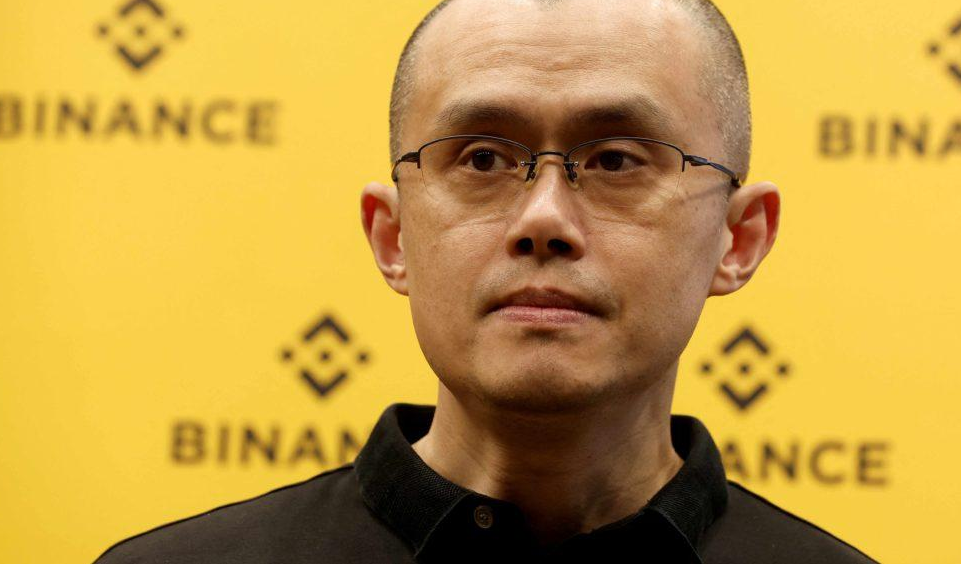

Ki Young Ju’s Perspective

Ki Young Ju is a well-known analyst and data expert in the crypto industry. He uses data analysis and market trends to provide insights for investors on social media. In a recent public statement, he expressed that after analyzing various market signals, he believes that the Bitcoin bull market has ended and the market will undergo a period of consolidation and adjustment.

The Power of Data Analysis

Ju's analysis is not merely a shot in the dark; he leverages on-chain market data focused on the CryptoQuant platform. According to historical data analysis, the end of a bull market is typically accompanied by shifts in market sentiment, trends of capital inflows and outflows, and changes in critical on-chain indicators. For example, the number of active addresses, trading volume, and miner behavior provide important context for market trends. Thus, Ju has good reason to believe that in the current Bitcoin market, buying pressure has weakened, and capital is starting to flow out.

Shifting Market Sentiment

The emergence of a bull market heavily depends on positive market sentiment and investor enthusiasm for buying. However, as prices dip, investor sentiment shifts accordingly. According to Ju's analysis, signs of fear and uncertainty are currently manifesting in the market. Diminished social media activity and reduced buying volumes indicate this trend. The decline in the optimistic sentiment that typically accompanies bull markets suggests that the market may be nearing its peak.

Timing the Market

In Ju's analysis, he emphasizes the crucial factor of "timing the market." While the end of the bull market may be looming in the short term, it does not mean that Bitcoin loses its investment prospects in the long run. Following a period of correction, the market could regain strength and embark on a new upward cycle. Investors need to remain calm, analyze market changes, and seek optimal entry points.

Real-World Challenges and Opportunities

Although Ju's warning signals that market adjustments are coming, this can also be seen as an opportunity for investors to identify opportunities within the market. During the market adjustment phase, new investment opportunities may arise, such as implementing a "buy-the-dip" strategy.

The Cycle of Bull and Bear Markets

In the cryptocurrency market, bull and bear phases are cyclical. Historical data shows that after multiple bull markets, Bitcoin typically experiences bear market corrections. While short-term pain and anxiety may ensue, history suggests that bull markets will often re-emerge at the right moment.

Finding New Opportunities

Market changes give investors a chance to reassess and reallocate their assets. In a bear market, comparatively low prices might present excellent investment opportunities, particularly for long-term investors. As the market declines, it could be wise to consider fundamentally strong projects, especially those with the potential to disrupt the current market landscape.

Future Development Trends

As Ki Young Ju's perspective gains traction, Bitcoin may soon face a more complex market environment. Investors need heightened sensitivity and insight, extracting useful information from the data to support their investment decisions.

Impact of Regulatory Policies

Globally, the ever-evolving regulatory landscape surrounding cryptocurrencies presents continuous challenges and opportunities for the market. In the coming months, any shifts in policy could affect investor confidence, making it crucial to keep a close eye on regulatory changes.

Technological Advances and Market Adaptation

In addition to external environmental shifts, the impact of technological advancement cannot be overlooked. As blockchain technology continues to evolve, the Bitcoin network may introduce new improvements and optimizations that enhance efficiency and security in transactions. Emerging technologies could become significant factors in mobilizing market recovery.

Conclusion

Ki Young Ju's assertion that the Bitcoin bull market has ended should not be perceived as an absolute negative signal but rather a warning of market adjustment. Investors must view short-term volatility with a rational mindset, prepare for future uncertainties, and seize emerging investment opportunities. As market uncertainties grow, data analysis and information acquisition become increasingly valuable. By staying vigilant and calm, we can anticipate more opportunities ahead. The journey of Bitcoin has only just begun; investors need to diligently monitor the pulse of the cryptocurrency market.

No comments yet