Original title: Networks in Crypto VC

Original author: @shloked_, @joel_john95

Original translation: TechFlow

Here is a brief version of the newsletter we posted on Decentralised.co. We examine how crypto venture capital firms (VCs) choose to invest together with their historical model of investment strategies.

As an asset class, venture capital follows the extreme power law. However, the specificity of this situation has not been studied in depth, as we are always catching up with the latest narrative. Over the past few weeks, we have created an internal tool to track the network of all crypto venture capital firms. But why do you do this?

The core logic is very simple. As a founder, knowing which VCs often co-invest in can save you time and optimize your financing strategy. Every transaction is a fingerprint. When we visualize them on a graph, we can reveal the story behind them.

In other words, we can track down nodes responsible for most of the capital raising in the crypto field. We are trying to find ports in modern trade networks, which is no different from merchants a thousand years ago.

We think this is an interesting experiment for two reasons.

1. The venture capital network we operate is a bit like Fighting Club. While no one is fighting (for now), we don’t talk about it often.

This venture capital network includes approximately 80 funds. Around 240 funds deployed over $500,000 in the seed phase throughout the crypto VC space. This means we are directly exposed to one-third of them, almost two-thirds of them read our content. This is an influence I had never expected, but it was.

However, it is often difficult to track who actually deploys the funds. Sending founder updates to each fund will turn into noise.

This tracker appears as a filtering tool that helps us understand which funds have deployed funds, in which areas, and with whom we invest.

2. For the founders, understanding where capital is deployed is only the first step. More valuable is understanding how these funds perform and who they usually invest with.

To do this, we calculate the historical probability that a fund's investment will receive subsequent investment, although this will become blurred in later stages (such as the B round), as companies usually issue tokens instead of raising traditional equity.

Helping founders identify which investors are active in crypto VC is the first step. Next is to understand which sources of capital perform better. Once we have this data, we can explore which funds jointly invest to get the best results.

This is certainly not Rocket Science.

No one can guarantee that someone will get a Series A financing because someone writes a check. Just like no one can guarantee that they can get married after their first date. But it is undoubtedly helpful to know what you are going to face, whether it’s dating or venture capital.

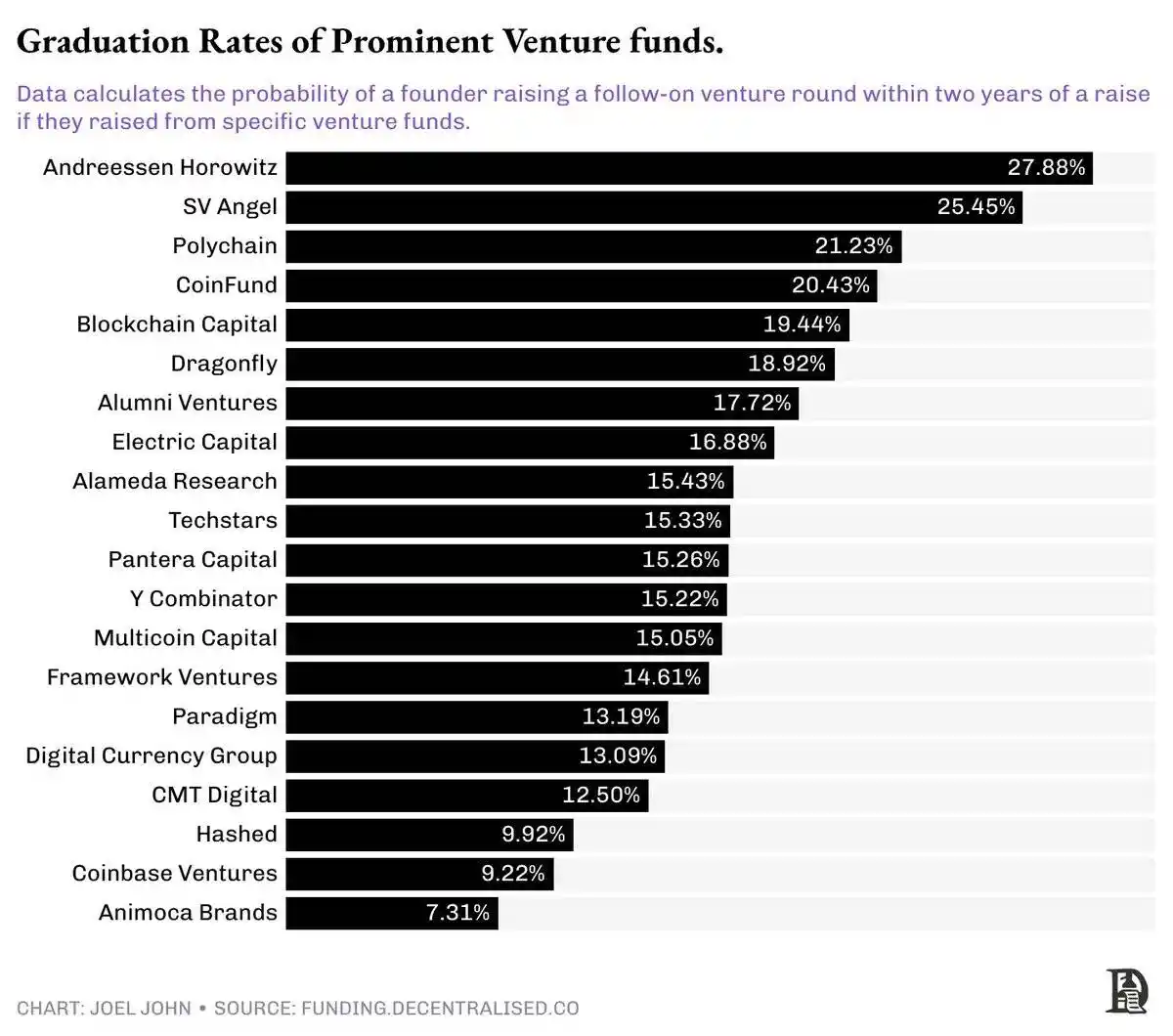

A successful architecture

We use some basic logic to identify funds that see the most subsequent rounds in their portfolio. If a fund sees multiple companies successfully raise funds after the seed round, it may have done something right. The investment value of VCs will rise when the company raises its capital at a higher valuation in the next round. Therefore, subsequent financing can be used as a good indicator to measure performance.

We selected the 20 funds with the highest subsequent rounds in the portfolio and then calculated the total number of companies they deployed in the seed phase. You can effectively calculate the probability of the founder obtaining subsequent financing. If a company has 100 seed stage checks, 30 of which received subsequent financing within two years, we calculate the probability of promotion to be 30%.

The thing to note here is that we limit the time to two years. Typically, startups may choose not to raise funds at all, or refinance after this period.

Even among the top 20 funds, the Power Law is still quite extreme.

For example, raising funds from A16z means you have a third chance of financing again within two years. That said, one out of every three startups supported by A16z will continue to do Series A financing.

Considering that the end of this list is only 1/16 chance, this is already a pretty high graduation rate.

Among the top 20 follow-up investment funds, the probability of refinancing of their investment companies is only 7%. These numbers may seem similar, but from the background, the probability of one-third is like rolling a number less than three when rolling a dice, while the probability of 1/14 is roughly equivalent to the probability of having twins. These are very different results, both literally and probabilistically.

Jokes are jokes, which shows the degree of aggregation within crypto venture capital funds. Some venture funds can design follow-up financing for their portfolio companies because they also have growth funds.

Therefore, they deploy seed phase and Series A financing in the same company. When a venture fund doubles down on more stakes in the same company, it usually sends a positive signal to investors in subsequent rounds.

In other words, the existence of growth phase funds within VC firms significantly affects the chances of success for the company in the next few years.

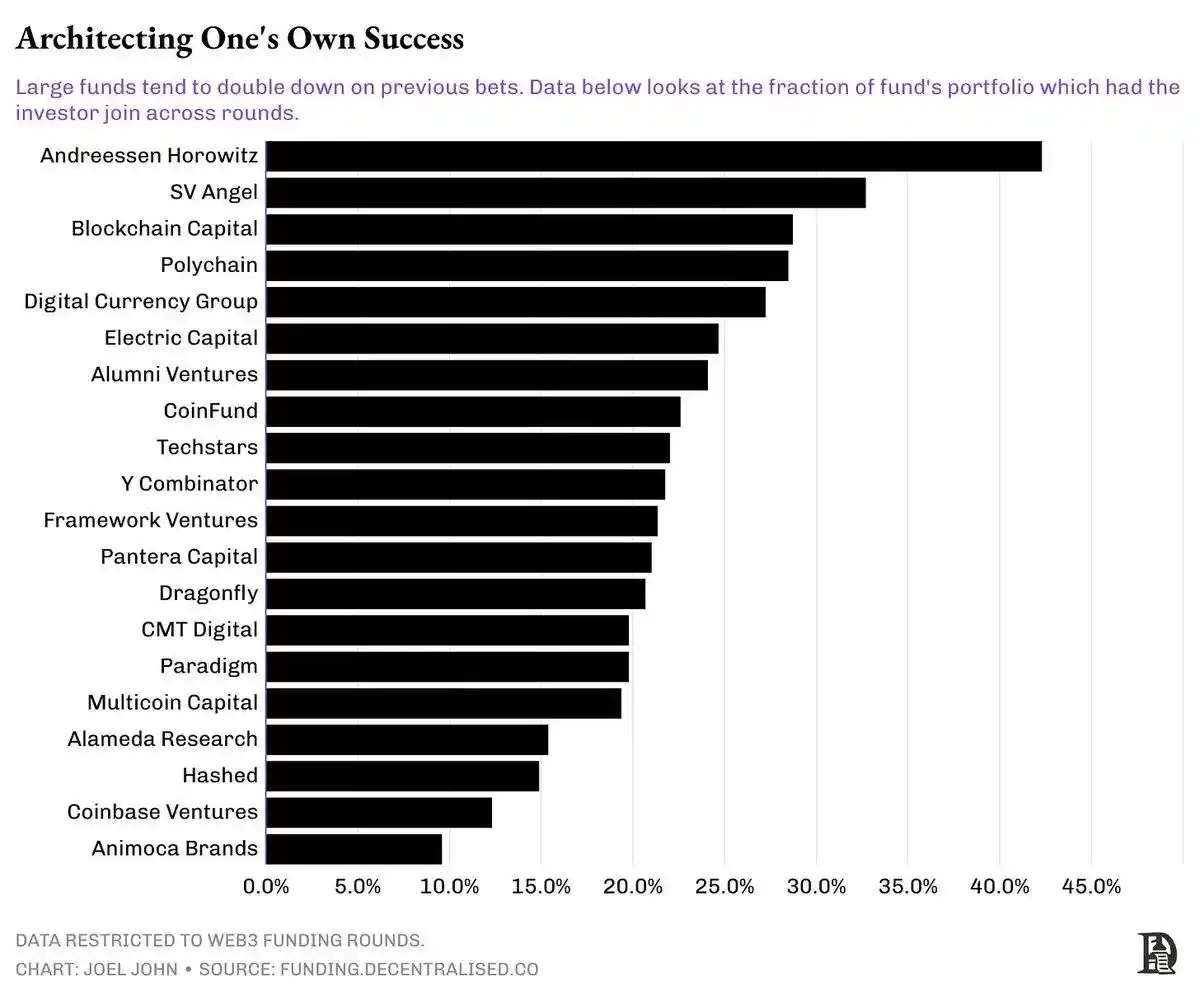

The long-tail effect of this trend is that crypto-risk funds are evolving to private equity investments in projects with considerable revenue. We have had theoretical arguments about this change. But what does the data really show? To study this, we considered the number of startups in our investor community that received subsequent financing. We then calculated the proportion of companies that the same venture fund participated again in subsequent rounds.

That is, if a company raises seed capital from A16z, what is the probability that A16z will invest again in its Series A?

This pattern appears quickly. Large funds managing over a billion dollars tend to make frequent follow-up investments. For example, 44% of startups in the A16z portfolio that continues to raise more capital saw A16z participate in subsequent rounds. Blockchain Capital, DCG and Polychain followed up in their quarter of their refinancing investments.

In other words, it is much more important than you think to who you raise money from at the seed or pre-seed stage, as these investors tend to support their own companies frequently.

Habitually vote together

These co-appointment models are summarized from hindsight. We don’t mean companies that raise funds from non-top VCs are doomed to fail. The goal of all economic activities is to grow or generate profits. Companies that can achieve either of these two will have their valuations rising over time. Of course, this helps improve the chances of success. If you can’t raise funds from this top 20 investor group, one way to increase your chances of success is through their network, or, in other words, to connect with these capital hubs.

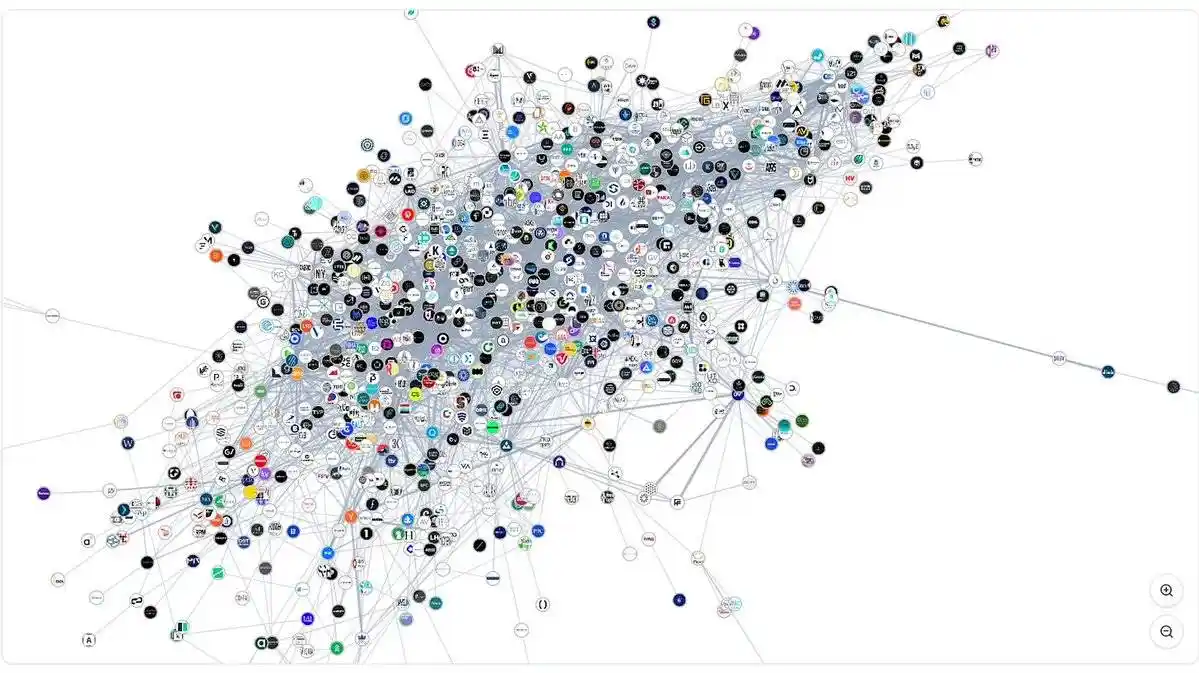

The following diagram shows the network of all venture capitalists in the crypto space over the past decade. There are 1,000 investors in total, and they share about 22,000 connections with each other. If one invests with another, a connection is formed. This may seem crowded and even seem to have too many choices. However, this also includes funds that have died, have never returned funds or are no longer deployed.

I know, this seems confusing.

However, the reality of market development becomes clearer in the figure below. If you are a founder who is looking for a Series A funding, there are about 50 fund pools investing more than $2 million in rounds. There are about 112 funds in the network of investors who have participated in such rounds. These funds are gradually concentrated, showing a stronger preference for co-investment with specific partners.

From seed turn to Series A financing process, you can raise funds from a wide range of investors. Over time, funds often form the habit of co-investment. That is, when a fund invests in an entity, it usually brings a peer fund, which may be due to the complementary skills of each other (such as technical support or marketing) or based on partnerships. To study how these relationships work, we began to explore the co-investment model among funds over the past year.

For example, in the past year:

· Polychain and Nomad Capital have 9 joint investments.

· Bankless has 9 joint investments with Robot Ventures.

· Binance and Polychain have 7 joint investments.

· Binance has just as much co-investment as HackVC.

· Similarly, OKX and Animoca have 7 joint investments.

Large funds are becoming increasingly picky about their choice of co-investment partners.

For example, in three of Paradigm’s 10 investments last year, Robot Ventures was involved in three of the rounds. DragonFly shared three rounds with Robot Ventures and Founders Fund in its 13 investments in total.

Similarly, Founders Fund co-invested with Dragonfly three of its nine investments.

In other words, we are gradually entering an era where a few funds make large investments and few co-investors. Many of these co-investors are often well-known funds that have been around for some time.

Enter the capital matrix

Another way to study data is to analyze the behavior of the most active investors. The matrix above considers the most invested funds since 2020 and their relationships. You will notice that accelerators (such as Y Combinator or Outlier Venture) have very little co-investment with exchanges (such as Coinbase Ventures).

On the other hand, you will also find that exchanges usually have their own preferences. For example, OKX Ventures has a high degree of co-investment with Animoca Brands. Coinbase Ventures has over 30 investments with Polychain and an additional 24 investments with Pantera.

There are three structural phenomena we see:

Despite the high frequency of investment, accelerators tend to have less co-investment with exchanges or large funds. This may be due to stage preference.

Large exchanges tend to prefer growth-stage risk funds. Currently, Pantera and Polychain dominate this.

Exchanges tend to work with local players. OKX Ventures and Coinbase show different preferences in the choice of co-investment partners, which highlights the global nature of capital allocation in Web3.

So, if the venture funds are gathering, where will the next marginal capital come from? One interesting model I noticed is that corporate capital has its own clusters. For example, Goldman Sachs shared 2 investments with PayPal Ventures and Kraken during its life cycle. Coinbase Ventures has made 37 co-invested with Polychain, 32 with Pantera and 24 with Electric Capital.

Unlike venture capital, corporate capital pools are usually targeted at growth-term companies with important product market fit (PMF). Therefore, it remains to be seen how this capital pool behaves in a period of early risk financing decline.

Evolutionary network

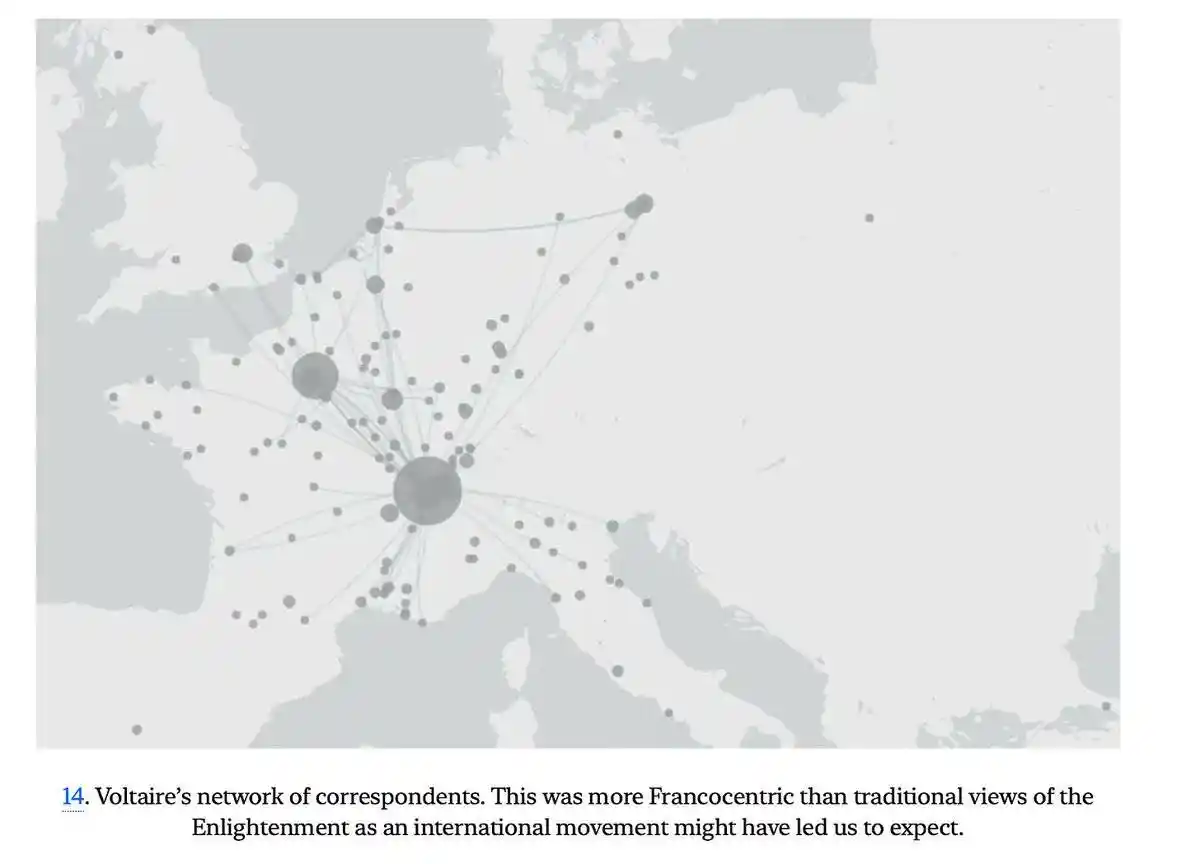

From "Platform and Tower"

After reading Niall Ferguson’s Squares and Towers a few years ago, I began to want to study networks of relationships within the field of encryption. The book reveals how the spread of ideas, products and even diseases is associated with the Internet. It wasn't until a few weeks ago that we built the funding dashboard that I realized that connecting networks between sources of capital in the visual encryption field were possible.

I think these data sets and the nature of these economic interactions between entities can be used to design (and execute) mergers and acquisitions and token acquisitions of private entities. These are the directions we are exploring internally. They can also be used in business development and partnership initiatives. We are still looking at how to get specific companies to access these datasets.

Back to the topic: Does the Internet really help the fund perform well?

The answer is a bit complicated. A fund selects the right team and provides a sufficient scale of capital capacity will be more important than its engagement with other funds. What really matters is the personal relationship between the general partner (GP) and other co-investors. Venture capital firms do not share transaction flow with logos, but with people. When a partner changes funds, the connection is transferred to their new fund.

I have some premonitions about this, but there are limited means of verifying this argument. Fortunately, there was a paper in 2024 that looked at how the top 100 venture capital firms performed over time. In fact, they studied 38,000 investment rounds involving 11,084 companies and even analyzed seasonal changes in the market. Their arguments are central to several facts:

Co-investment in the past does not necessarily translate into future cooperation. If previous investment fails, the fund may choose not to work with another fund.

During the fanatic times, co-investment tends to increase as funds want to deploy more actively. During the fanatic times, venture capital firms rely more on social signals and conduct less due diligence. During bear markets, funds deploy cautiously due to low valuations and usually act alone.

Funds select peers based on complementary skills. Therefore, the same crowded wheels that investors specialize in are often troublesome.

As I said before, ultimately, co-investment does not happen at the fund level, but at the partner level. In my own career, I have seen individuals transition between organizations. The goal is usually to work with the same person, no matter which fund they join. In an age where artificial intelligence takes over human work, it is helpful to understand human relationships as the basis for early venture capital.

There is still much work to be done on the formation of crypto-VC networks. For example, I would like to study the preferences of liquid hedge funds in capital allocation, or how late deployments in the crypto arena evolve with the market seasonal changes, or how M&A and private equity are involved. The answer is in the data we have today, but it takes time to ask the right questions.

Like many other things in life, this will be a constant inquiry and we will make sure to reveal it when the signal is discovered.

No comments yet