Real Vision’s chief crypto analyst, Jamie Coutts, is highlighting the outperformance of Bitcoin (BTC) amid a correction experienced by stocks and crypto assets.

Coutts says that even though Bitcoin has traditionally been more volatile than stocks, it has recently witnessed a relatively lower level of correction than would be expected based on its historical levels of price swings.

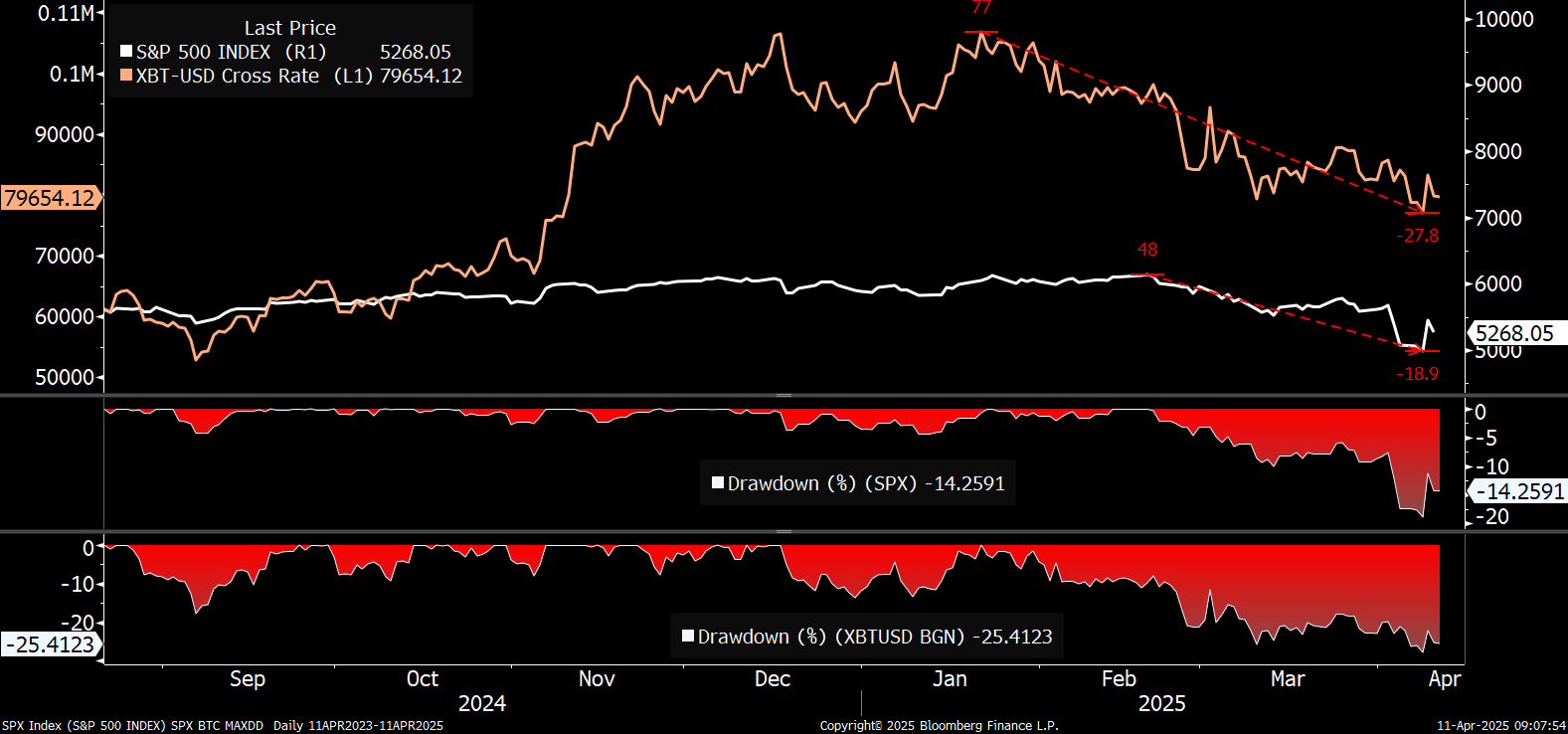

“Folks don’t understand what is happening with Bitcoin during this risk-asset panic. BTC with 2.5x the volatility of the S&P 500 experienced a drawdown of 28% vs. the S&P 500’s 19%. That is a massive OUTPERFORMANCE.

Perhaps it’s not just BTC’s strength, but a reflection of the increasing fragility of the fiat system and its asset markets – complex systems inherently trend toward entropy/chaos. Bitcoin is mirroring this unraveling.”

Going forward, Coutts says that Bitcoin will grow in importance as two of its use cases gain prominence across the globe.

“What is happening right now is epic. Things are breaking. The fiat fractional reserve credit-based system’s fragility is on full display, yet again. Look through the next couple of days and understand Bitcoin’s ascendancy as a global settlement layer and collateral asset is accelerating. Fast.

Before it was the plebs who understood this, this time it will be nation states.”

Bitcoin is trading at $83,227 at time of writing.

Follow us on X, Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Generated Image: Midjourney

No comments yet