An on-chain indicator suggests that top smart contract protocol Ethereum (ETH) could currently be undervalued, according to a popular crypto analyst.

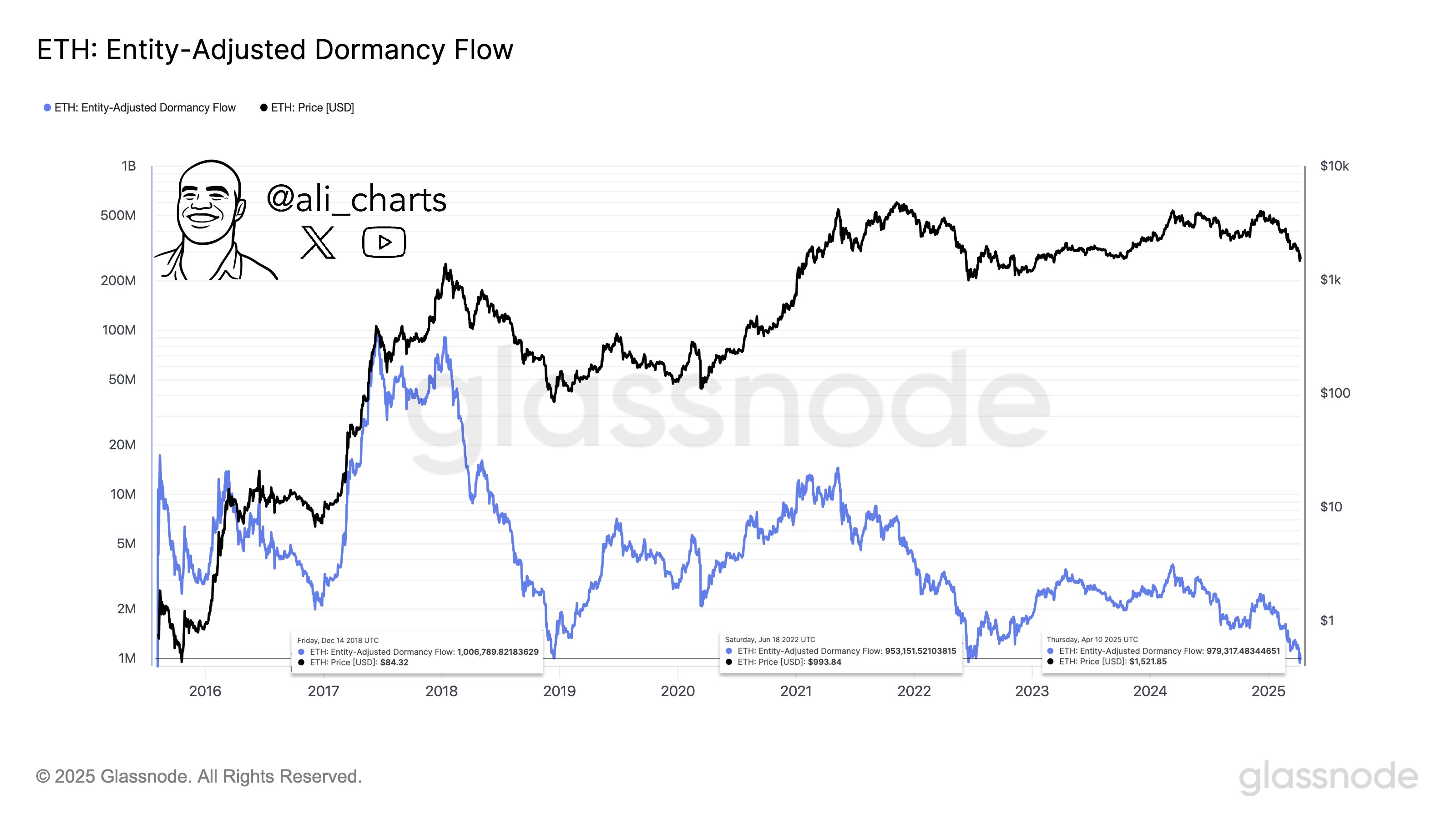

Trader Ali Martinez tells his 135,100 followers on the social media platform X that ETH’s Entity-Adjusted Dormancy Flow just dropped below one million, suggesting that Ethereum may be in the midst of carving a major cycle bottom.

“This historically indicates a macro bottom zone, meaning ETH might be undervalued and long-term holders are less inclined to sell. It also suggests:

• Sentiment is low

• Capitulation may have occurred

• Smart money might be accumulating”

Entity-Adjusted Dormancy Flow is used “to time market lows and assess whether the bull market remains in relatively normal conditions,” according to the crypto analytics firm Glassnode. The metric, which Glassnode says helps clarify whether an asset is in a bullish or bearish primary trend, measures the ratio of a coin’s market cap and its annualized dormancy value tracked in US dollars.

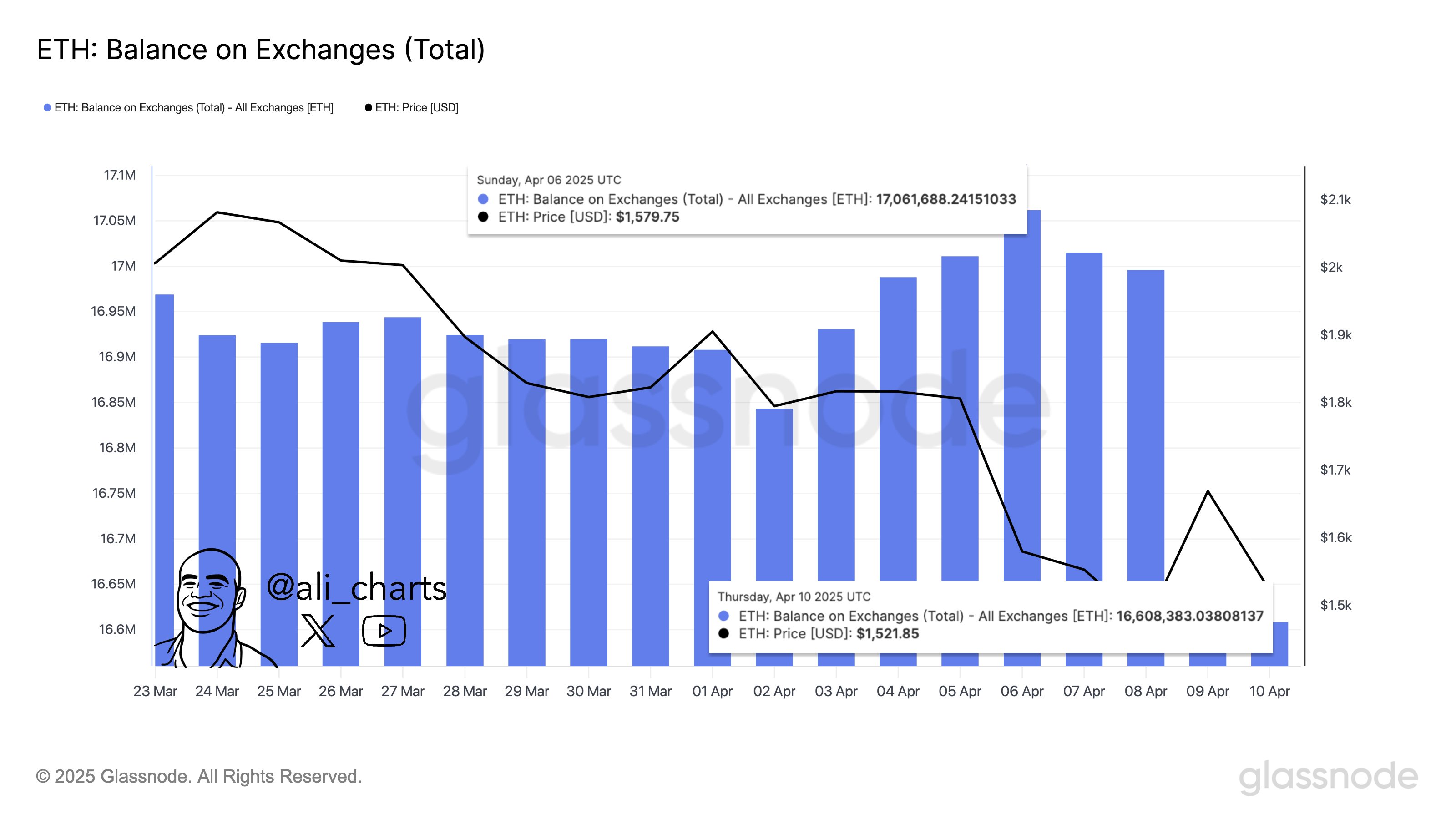

Martinez also notes that 453,000 Ethereum have been withdrawn from crypto exchanges in the past five days.

Large amounts of ETH flowing out from exchanges can serve as a bullish indicator as deep-pocketed investors accumulate the asset.

ETH is trading at $1,558 at time of writing, up over 2% in the last 24 hours.

Follow us on X, Facebook and Telegram

Don't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Generated Image: Midjourney

No comments yet