In the early morning, RWA sector project MANTRA (OM) fell 90% in a short period of time, plunging from $6 to $0.5 billion, and its market value evaporated by more than $5.5 billion. Three hours later, the MANTRA team (the issuer of OM tokens) issued a statement saying that the decline was caused by irrational liquidation and had nothing to do with the project itself, and said that it was not done by the team. Subsequently, OM rose from around $0.5 to $1.2, briefly losing ground. According to Coinglass data, the OM contract liquidation reached US$58 million in just four hours.

Before this plunge, OM has gone through several violent rises since November last year and was called "Strongzhuang Demon Coin" by the community. Related readings:"After evaporating 5.5 billion US dollars in 15 minutes, it soared 4 times. Why did the "monster coin" OM suddenly fall? 》. So, what is the truth about this plunge? Is it really caused by over-the-counter trading clearing?We will continue to pay attention and update in real time. The following is the event timeline compilation:

11:30: Binance responds to OM flash crash: mainly caused by cross-trading platform clearing, and will pay close attention to developments

At 11:30, Binance officially issued a statement saying that it noticed that the MANTRA token OM had severe price fluctuations. Preliminary investigations found that the fluctuations in the past day were mainly caused by cross-trading platform clearing. Since October last year, Binance has implemented several risk control measures on OM tokens, including reducing leverage levels. Binance will continue to monitor leverage levels and adjust to market conditions to strengthen risk control and help reduce volatility.

Since January this year, Binance has also enabled pop-up prompts for OM on the spot trading page to remind users that the token's token economic model has undergone major changes and the supply has increased. Binance will continue to monitor developments closely and take appropriate action to protect the interests of users and maintain the stability and impartiality of the platform.

9:06: 10 OM positions worth over one million US dollars have been liquidated in the past 12 hours

At 9:06, according to Coinglass data, 10 OM positions worth over one million US dollars have been liquidated in the past 12 hours.

On-chain monitoring: Before the OM flash crash, tokens accounting for 4.5% of the circulation were deposited into CEX, and strategic investor Laser Digital was suspected of participating.

At 8:40, according to The Data Nerd monitoring, the price of OM plummeted 90% from $6 to $0.40 million, and in the past 3 days, 24.4 million OMs (about $143.94 million at the time) were deposited into OKX from 5 wallets. Four of the wallets have the same operating mode: withdraw cash from Binance last month and then deposit it into OKX.

At 8:55, at least 17 wallets deposited 43.6 million OM (at the time $227 million) into CEX before the OM crash (since April 7), accounting for 4.5% of the circulating supply, according to Lookonchain monitoring. According to Arkham's tag, 2 of these addresses are associated with Laser Digital. Laser Digital is a strategic investor in MANTRA.

At 9:56, a large OM group transferred 14.27 million OMs (worth about $91 million at the time) to OKX just 3 days before the crash, according to Spot On Chain monitoring. Back in the end of March, they jointly extracted 84.15 million OMs from Binance, with a total price of about $564.7 million (average $6.711). Today, after a plunge of about 90%, their remaining 69.08 million OMs are worth just $62.2 million – an estimated total loss of up to $406.3 million. Spot On Chain said they may have hedged this part of the position elsewhere, which may be one of the reasons for the plunge.

At 8:28: OM contracts on the entire network were held at US$136 million, a 24-hour decline of 60.95%; the total liquidation amount in the entire network exceeded US$65 million, second only to Bitcoin

According to Coinglass data, the entire network OM contract holds US$136 million, with a holding of 134 million OMs, a 24-hour decline of 60.95%. Among them, the Binance platform has the highest market share, with OM contract holdings on the platform being US$33.0383 million, accounting for 24.33%. At the same time, the total liquidation amount of OM in the past 12 hours exceeded US$65 million, of which the long liquidation was US$47.3255 million. This currency has a second only to Bitcoin in its last 12 hours.

MANTRA Founder: OM's plunge is not caused by Binance, and it is caused by other CEX's improper forced closing of positions.

At 7:16, MANTRA founder JP Mullin posted a message on social media to respond to the OM plunge, saying that the market imbalance was not caused by the token sale of tokens by the team, MANTRA Chain Association, its core consultants or MANTRA investors, nor was it caused by Binance, and it was caused by improper forced closing of other CEXs.

JP Mullin said the market imbalance was not caused by the token sale of tokens by the team, the MANTRA Chain Association, its core consultants or MANTRA investors. The token remains locked and follows the announced unlocking period. In the next few hours, the team will hold a community link event on X platform to further discuss these events.

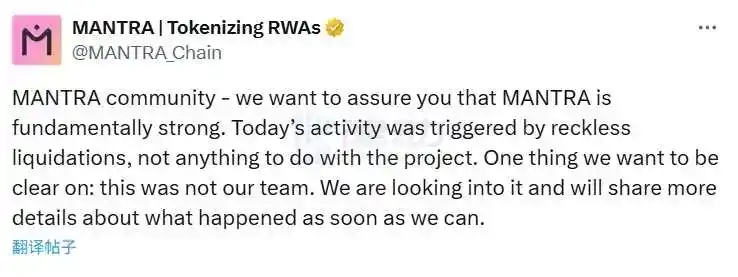

4:51 am: OM responds to the plunge in the early morning: volatility is caused by disorderly liquidation, not by the team

At 4:51, the MANTRA community issued a statement saying that today's abnormal fluctuations in OM were triggered by "disorderly liquidation" and had nothing to do with the project itself, and emphasized that the incident was not done by the team. The official said that the specific reasons are being investigated and more details will be announced as soon as possible.

The timing and depth of the crash indicate that the account positions were closed very suddenly and that sufficient warnings or notifications were not given, MANTRA said. This happens during the low liquidity period in the early hours of Asian time, which at least indicates that CEX has some degree of negligence or may be intentional market manipulation.

"CEX partners play an important role in providing liquidity for projects like us. We work closely with them, however, they still have great discretion. When such discretion is exercised without proper internal and external supervision, market misalignment may occur as recently as it has happened, thus damaging the interests of projects and investors. It should be clear that this market misalignment is not caused by the sell-off of tokens by the team, the MANTRA Chain Association, its core consultants or MANTRA investors. The token remains locked and bound by the published vesting period. The token economics of OM remain unchanged, as we stated in our latest token report last week. Our token wallet address is online and visible."

4 a.m.: A market maker algorithm abnormally pushes up BTCDOM perpetual contract 20%

At 4:01 a.m., according to Formula News, an unidentified market maker experienced an algorithm error after the OM (Mantra) flash crash, accidentally lifting the BTCDOM (Bitcoin Market Cap Index) perpetual contract on the Binance platform by 20%.

The BTCDOM index components include Binance and Binance Futures’ top 20 cryptocurrencies in market capitalization. Excluding BTC and stablecoins, the OM weight is only about 5%. This abnormal fluctuation is suspected to be caused by the market maker’s erroneous judgment that the sharp fluctuation of OM prices is a change in the market structure, which is a mistaken strategic buying operation.

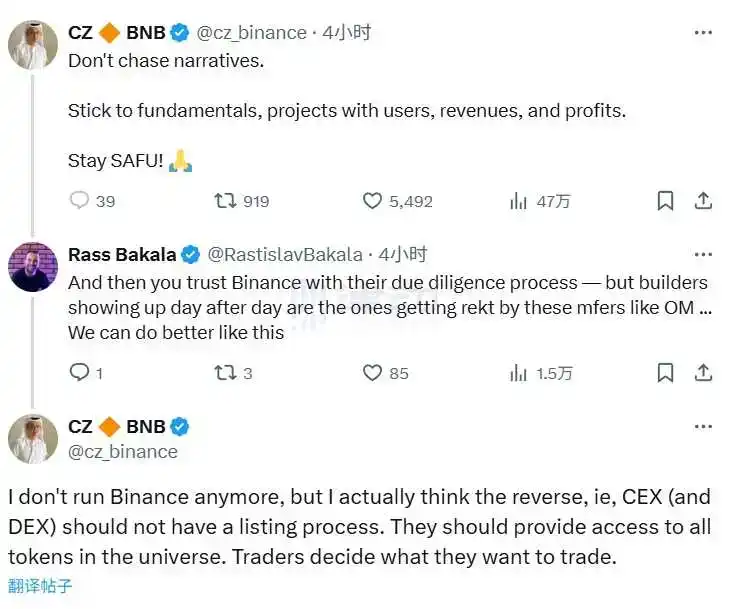

3 a.m.: CZ responds to OM flash crash: Don’t chase narratives, CEX should no longer have a currency listing process, investors should decide their own trading products

At around 3 a.m., CZ posted a post on X platform after OM fell, suggesting investors, "Don't chase narratives. Adhere to basic principles, users, income and profitable projects." In response to the community's doubts about "Whether the Binance platform does due diligence on OM flash crashes," CZ once again emphasized that CEX should no longer have a currency listing process, and investors decide on the trading products themselves.

No comments yet