Original title: Can Bitcoin Thrive Onchain?

Original author: Jean-Paul Faraj, Bankless

Original translation: BitpushNews

Despite being firmly at the top of the cryptocurrency market capitalization, Bitcoin has relatively low participation in the field of decentralized finance (DeFi), a phenomenon that is triggering a profound discussion of its future role.

Bitcoin has been the cornerstone of the crypto ecosystem for more than a decade – praised for its decentralization, censorship resistance and proven scarcity. However, despite the dominant market capitalization and re-seeking in recent days, it remains largely out of place with one of the most dynamic areas in the crypto space—DeFi—.

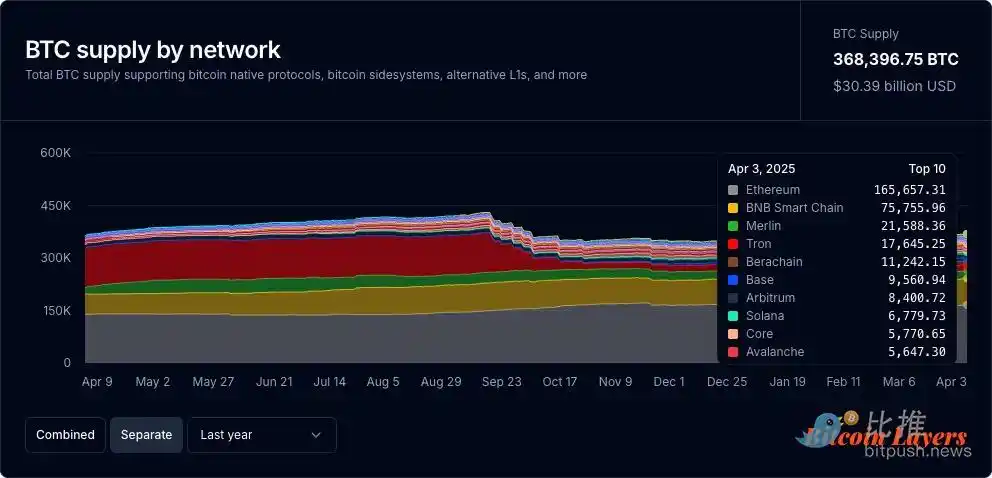

According to Bitcoin Layers, only about $30 billion of Bitcoin (only 1.875% of its total supply) is used for DeFi. By comparison, Ethereum locks in about $50 billion in ETH in DeFi, accounting for about 23% of its supply.

This gap highlights a central contradiction in today’s Bitcoin narrative: While BTC holds a huge value, relatively few BTC are actively exploited on-chain to provide earning opportunities. This gap is driving a wave of innovations around packaging, staking and other approaches to bringing Bitcoin into the DeFi economy, unlocking ways to make BTC a productive capital asset.

Bitcoin Layers: BTC supply by network, displaying all packaging BTC

Ethereum’s DeFi ecosystem has emerged tools for lending, staking and trading. By contrast, native Bitcoin is still difficult to use effectively, especially for new users. Transaction times are slow, the fees are variable and often high, and Bitcoin’s architecture lacks programmability to power Ethereum-based applications.

As the broader cryptocurrency sector matures, this raises an important question: Can Bitcoin participate meaningfully in the on-chain economy? If so, how can we get the average BTC holder to join without forcing them to go through a series of bridges, packed tokens and unfamiliar applications?

Question: Bitcoin’s design and the practicality of DeFi

Bitcoin’s underlying architecture is not optimized for the high programmability of today’s smart contracts. It prioritizes security and decentralization through the Proof of Work (PoW) mechanism rather than pursuing complex logical expressions - this design choice makes it a reliable value storage tool, but also limits its adaptability in smart contracts and complex DeFi applications. Because of this, native Bitcoin is difficult to integrate into the booming composable financial ecosystem on public chains such as Ethereum and Solana.

In the past we have seen some workarounds:

· Packaging Bitcoin:Users convert BTC to ERC-20 tokens to access Ethereum-based DeFi. This introduces custody risks, as token liquidity may be opaque and is not always BTC-backed by third-party custodians at a 1:1 ratio.

· Bridge protocol:Cross-chain platforms allow BTC to be transferred to other ecosystems. However, manual bridging increases friction, complexity, and risk – especially for non-technical users.

· Hosting platform:Centralized services like Coinbase provide BTC gains, but require users to give up custody and usually pay for returns in points, stablecoins, or proprietary tokens instead of BTC.

Each option comes with tradeoffs challenging Bitcoin’s core philosophy: security, simplicity, and user sovereignty.

Getting Started Barriers: Why User Experience Still Important

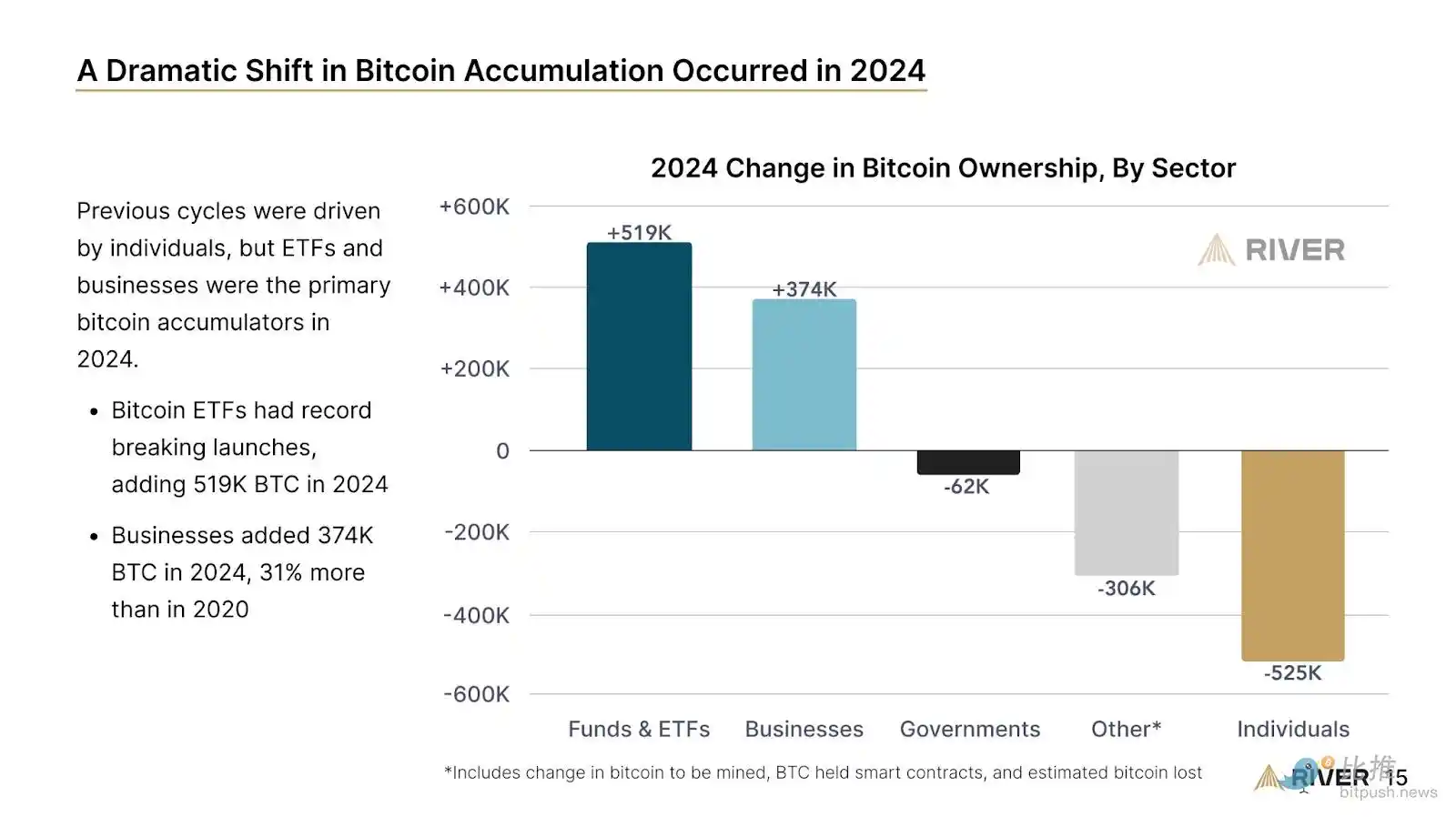

Accumulation of BTC in 2024, river.com

For Bitcoin holders who are curious about using their assets to do more (earning profits, participating in on-chain governance, or trying DeFi), the approach to the entry remains fragmented, unintuitive and often daunting. Although the infrastructure is mature, the user experience is still lagging behind, and competitors are not only other blockchains, but also TradFi.

This friction creates a major entry barrier. Most users don’t want to be power users of DeFi – they want to simply and safely increase their net worth and BTC holdings without having to shuttle through the maze of applications, bridges and protocols like Bitcoin buyers who have recently made large off-chain purchases through brokers, ETFs and products like Michael Saylor’s Strategy.

To transform the next wave of users from simple off-chain holders to on-chain users, the tool needs to remove this complexity without sacrificing control, self-hosting, or transparency. This is where emerging protocols and modern wallet experiences start to really come into play – providing user-friendly access to basic DeFi capabilities while keeping Bitcoin’s core philosophy unchanged.

A better user experience is not just the icing on the cake, it is the key infrastructure for Bitcoin to adopt the next stage.

New approach to on-chain BTC revenue and productivity

Many emerging solutions are designed to make Bitcoin easier to use in DeFi – each with different tradeoffs:

1. Pledge, re-pled and points-based earnings plans

Platforms like Babylon and Lombard now offer Bitcoin-related earnings plans through points or reward tokens, usually achieved through staking/re-staking, which can often be redeemed for benefits or future airdrops. These systems are attractive to early adopters and crypto-native users who chase airdrops and platform-specific token economics. These products usually include BTC standards that convert BTC to packaging, and then lock assets into various plans/products to earn variable returns. High returns are available for savvy on-chain traders, but this requires a deeper understanding of how to use cryptocurrencies, as well as manual bridging, packaging and depositing funds.

advantage:

· Wide range of profit opportunities

· Usually self-management

shortcoming:

· Rewards are not paid in BTC

Usually a lock-up period is required

· The long-term value of the reward is uncertain

2. Bitcoin Layer 2 and Meta-Protocol

Developments like Lightning Network, Rootstock (RSK), Alkanes and emerging Layer 2 like Botanix and Starknet are bringing new capabilities, programmability and speed to Bitcoin. These innovations enable use cases like fast payments, NFTs and similar smart contract behaviors. Therefore, users can now use their BTC to access a wide range of DeFi opportunities—such as by locking money to protect the network, participate in market making, borrow or convert assets to support packaging BTC standards on various protocols. As more and more teams build these networks, the ecosystem of Bitcoin-based earning opportunities will continue to expand.

advantage:

· Use cases for extending Bitcoin

·Align with Bitcoin's architecture

· Wide choice for earning income on-chain

shortcoming:

Still relatively early and scattered

· Need intermediate to advanced understanding to utilize

· A large amount of developer resources are required to build most of the practicality that already exists on other smart contract chains

3. Smart wallet integration and native BTC benefits

Wallets like Braavos offer features that allow users to earn native BTC earnings without manually wrapping their Bitcoin or giving up custody. Users can invest in BTC directly through their wallet without having to deal with the usual barriers to bridging or using external applications. Complex steps—such as deposits, packaging, and bridging—are seamlessly processed in the backend, with BTC deployed into specific DeFi policies. This user-friendly approach is designed to enable everyone to earn BTC benefits regardless of their technical background or cryptocurrency experience.

advantage:

· Earnings are paid in BTC (rather than points or proxy tokens)

No manual bridge or third-party hosting required

· Self-hosting by default

· Beginner friendly

shortcoming:

·BTC that depends on conversion to packaging

· It requires a certain amount of trust in the bridging mechanism and income protocol infrastructure

·Biger picture: Bitcoin’s ever-evolving role on the chain

Bitcoin’s narrative has long revolved around “store of value” – it reliably fulfills this role. But as the on-chain economy grows, it is increasingly stressed to integrate Bitcoin into this emerging financial stack and deliver on its promise as a reliable payment infrastructure.

To do this without sacrificing decentralization or user trust, new infrastructure must make these opportunities accessible without technical expertise or abandoning the core principles of Bitcoin.

This means:

· Earnings should be paid in BTC first, rather than derivative assets

Hosting must be retained for users

Complexity must be abstracted, not transferred to the user

Like Braavos, Lombard, Babylon and other products mentioned in this article are examples of how these ideas are implemented. Whether it’s giving users a profit through staking or by embedding Bitcoin support directly into self-custody options and automating the complexity behind it, they make DeFi more accessible to Bitcoin holders without them leaving the Bitcoin ecosystem altogether.

Closing the gap carefully

The transition from Bitcoin to an on-chain economy won’t happen overnight—and it shouldn’t be. Prudence, simplicity and self-sovereignty are the foundations of Bitcoin’s core philosophy. But as more tools to respect these values and provide new features emerge, BTC’s role in the wider cryptocurrency economy is evolving.

The challenge now is to build open, secure and most importantly, accessible systems. If the next billion users will join through Bitcoin, they will need to meet their existing needs and be accepted by the wider user base.

No comments yet