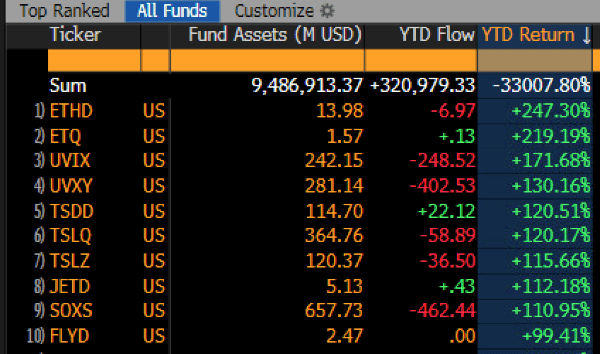

在美国,两家表现最佳的交易所交易基金(ETF)都对以太进行了杠杆押注,因此获得了令人振奋的回报。

一年eth简短:看跌投资者如何赚取ETF利润

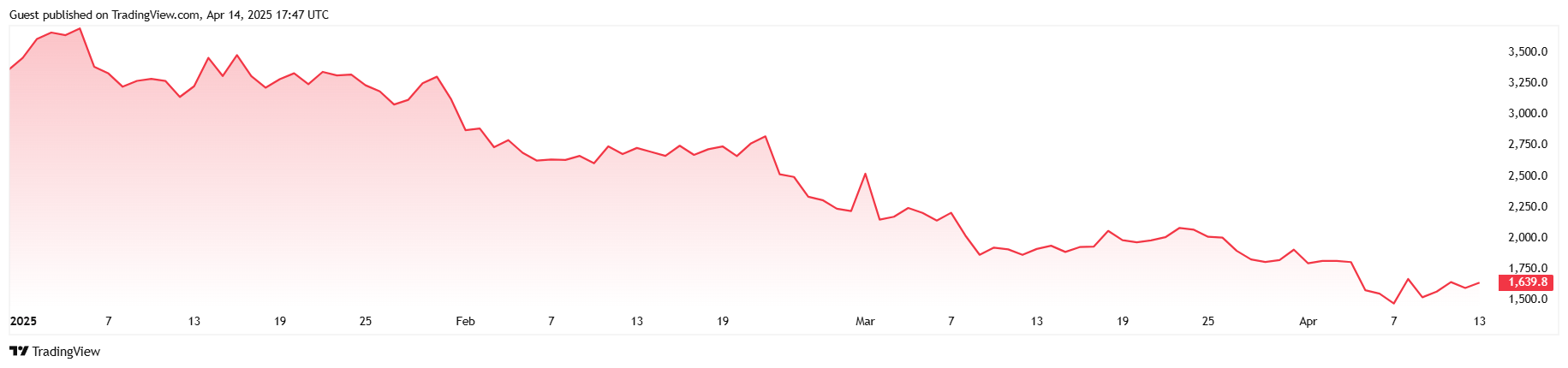

以太坊以太(eth自1月份以来,一年艰难的一年,近51%。精明的投资者利用了加密货币的消亡,投资了ProShares Ultrashort Ether ETF(Ethd)并获得近250%的年度恢复(YTD)的收益,根据致彭博ETF分析师Eric Balchunas。

该基金属于一类高风险投资工具,这些工具将杠杆化的赌注按基础资产的价格进行。 Proshares Ethd旨在每天返回彭博以太坊指数的反向性能的两倍。今年,该策略意味着作为以太罐,ETHD的上升速度是加密货币折旧率的两倍。

为了增加受伤的侮辱,另一个杠杆ETF,T-Rex 2倍逆以太币每日股票ETF的雷克斯股票以与ETH类似的方式运行,除了它在现场相似,而不是彭博指数,它也以大约220%的范围内的是220%,这是美国第二次最佳表现的ETF。换句话说,短路ETH至少目前,一直是美国ETF的胜利策略。

“今年表现最好的ETF是-2x Ether ETF ETHD,增长了247%,” Balchunas在X上的一篇星期五帖子中解释说:“第二位是另一个-2x Ether ETF,”他补充说。 “野蛮。”

No comments yet