Original title: "RFC token surges 2000% Behind: Giant Whale Trader and Musk's Crypto Capital Game"

Original author: Alvis, Mars Finance

1. Phenomenon surge: From the edge Meme to the hundred times myth

Late at night on April 13, 2025, Solana's on-chain surveillance alarm suddenly sounded - the price of a Meme token called RFC (Retard Finder Coin) soared 200% in 15 minutes, with a market value exceeding $100 million, and the highest price pin to $0.199. The climax of this carnival was ignited by a huge purchase order worth $1.2 million. While the market is still guessing whether this is a collective madness of retail investors, the on-chain data reveals a more complex capital game: at least 3 related address groups, 5 market makers and a precision network woven by $180 million hot money is pushing this "community carnival" into an unpredictable abyss.

1.1 Capital riot: Complete a hundred-fold leap within two weeks

Since Musk first liked the "Retard Finder" social account on March 29, RFC has started a crazy upward trend. From the historical high of US$0.003 on April 1 to the historical high of US$0.2 on April 13, its price curve shows a typical "step-by-step control" feature: every time the integer threshold is broken, there must be a huge amount of buy orders to press the array, and the callback amplitude is always controlled within 15%. This abnormal stability is rare in Meme coins, which have always been known for their high fluctuations.

1.2 The appearance of giant whale: The secret of US$120 million liquidity

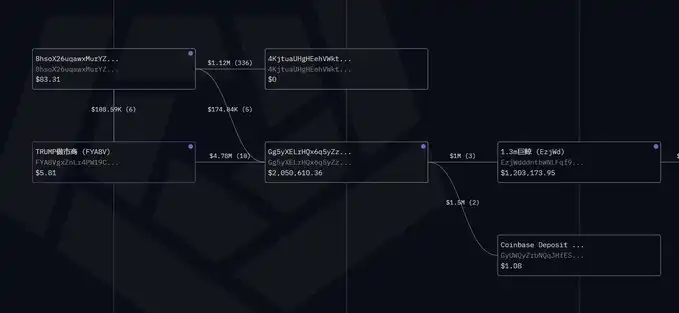

In the early morning of April 14, on-chain detective @CaNoe disclosed key evidence: 0x3d... The giant whale address at the beginning bought a US$1.2 million RFC through four transactions, pushing its market value to exceed US$100 million.

But this is just the tip of the iceberg - the address completed the fund split through 14 related wallets in 3 days, with an actual purchase of more than $8 million, accounting for 23% of the total transaction volume.

What is even more shocking is the path of capital flow:

1. Upstream fund pool: US$100 million USDC comes from a TRUMP market maker address, transit through Gg5yX...

2. Relay network: 8hsoX... The address group completes 10 cross-chain conversions, involving three public chains: ETH, SOL, and BASE

3. Terminal operation: Finally, RFC scanning is completed through 5 newly created addresses on the SOL chain.

This triple-step capital flow reveals the trader's skillful skills in evading supervision. As crypto analyst Yu Chen said, “This is not a temporary speculation, but a premeditated capital layout for months.”

2. Dissecting the giant whale: the capital map of cross-ecological traders

2.1 TRUMP market makers reinstalled

By tracing the historical behavior of the 0x3d address, we find that it is deeply bound to TRUMP, the 2024 general election concept coin.

This address has only interacted on three coins, namely $TRUMP $VIRTUAL $LIBRA. Especially on $TRUMP, there were nearly 50 frequent interactions in total, with a total purchase of $7.3m/a total selling of $11.2m. This interaction mode can basically be determined as the address of the market maker.

At the same time, we have also conducted activities on $LIBRA and $VIRTUAL, which are also recognized as super strong currencies, not to mention that $LIBRA is deeply involved in the manipulation scandal behind the entire foundation (although not many people have re-mentioned it now).

This typical market maker behavior pattern is perfectly replicated in the RFC campaign. It is worth noting that the address group suddenly cleared all TRUMP positions on March 15, which happened to form a time coupling with the RFC start-up rise.

2.2 Undercurrents and related networks

By further digging deeper into the flow of funds, we have drawn a larger correlation map:

(Data source: On-chain analysis platform)

These projects jointly outline the trader's strategic preferences: choose tokens with strong narrative, low circulation, and celebrity endorsement, and create liquidity illusions through high-frequency trading. RFC just meets all the conditions - Musk Interactive, Solana ecological support, fixed supply and other characteristics, making it an ideal trading target.

3. Musk effect: the fatal temptation of decentralized narrative

3.1 From Twitter Interaction to Code Mystery

The outbreak of the RFC is by no means accidental. On March 7, when Musk responded to the remarks of the "Retard Finder" account on Twitter about "cryptocurrencies need more rebellious spirit", keen capital had already smelled the opportunity. On-chain data display:

· March 8-10: 6 new addresses buy at $800,000 RFC

March 15: The project official website updates the code base and the "XCorp" key appears (a company under Musk)

April 1: Eric Trump forwarded RFC-related tweets, sparking a frenzy in the right-wing community

This three-part marketing of "celebrity interaction-code hint-community communication" accurately hits the narrative hunger of the crypto market. Even though Musk never publicly acknowledged his relationship with the RFC, enough "coincidence" has put speculators in collective madness.

3.2 The sword of Damocles with a concentrated chip

M7 Research’s on-chain report reveals a more dangerous reality: the top 500 addresses control 36.46% of RFC supply, with green clusters accounting for 29.61% of the single address group.

This concentration even exceeds SHIB in 2021 (27% of the first 10 addresses at that time), giving Giant Whale absolute market control.

We simulated the price shocks in different selling situations:

(The data model is built based on historical Meme currency liquidity data)

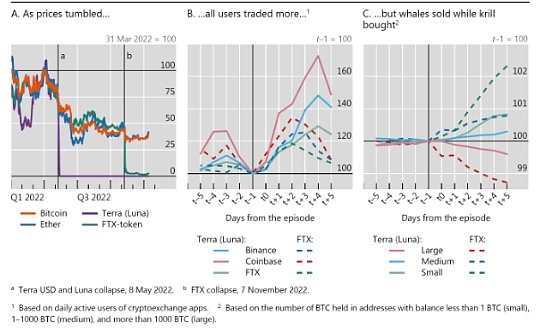

This means that at least $40 million of the current $120 million daily trading volume is "false liquidity" - once the giant whale starts selling, the price collapse may be calculated in hours.

4. Ecological resonance: Solana's wealth-making machine and risk hotbed

4.1 The mysterious promoter of the foundation

The deep intervention of Solana ecosystem injects additional impetus into the surge in RFC. On-chain data display:

· March 25: SOL Foundation address transfers 5000 SOL to the RFC development team

· April 5: RFC/SOL liquidity pool appears on Serum DEX with initial injection value of $2 million

· April 12: Solana Ventures affiliated address participates in RFC Community Governance Proposal 7

This kind of support from the interweaving of light and dark makes RFC surpass the scope of ordinary Meme coins and become a "model project" to demonstrate Solana's ecological capabilities. But the question is - when the project party is deeply bound to the interests of ecological builders, has the so-called "decentralization" become a marketing tactic?

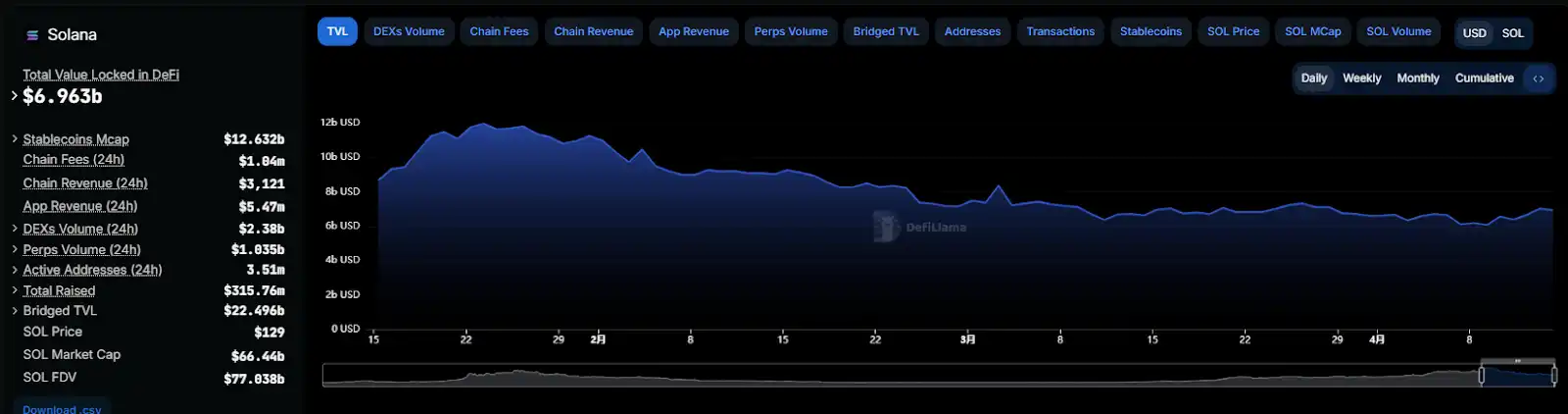

4.2 Liquid siphon effect

Since April, SOL on-chain TVL has grown by 16%, but 63% of it comes from Meme coin-related protocols. The price of Sol tokens has a bottom of $95 to rise to the current $130, an increase of more than 35%. The rise of RFC coincides with a critical period of Solana's ecological recovery.

Future Deduction: Direction Choice of Capital Games

Based on historical data modeling, we predict that RFC may face two paths:

· Optimistic scenario:Market makers continue to keep prices fluctuating in the range of USD 0.08-0.12, making profits through hedging of derivatives markets, and extending their life cycle to 6-8 weeks

· Pessimistic scenario:New hot spots in the Solana ecosystem have led to liquidity transfer, and the giant whale initiates distribution above US$0.15, triggering more than 60% callbacks

The current market may be more inclined toward the second possibility - the flash crash of OM coins on April 14 (90% decline in a single day) has triggered chain panic, and investors' risk appetite has contracted rapidly.

No comments yet