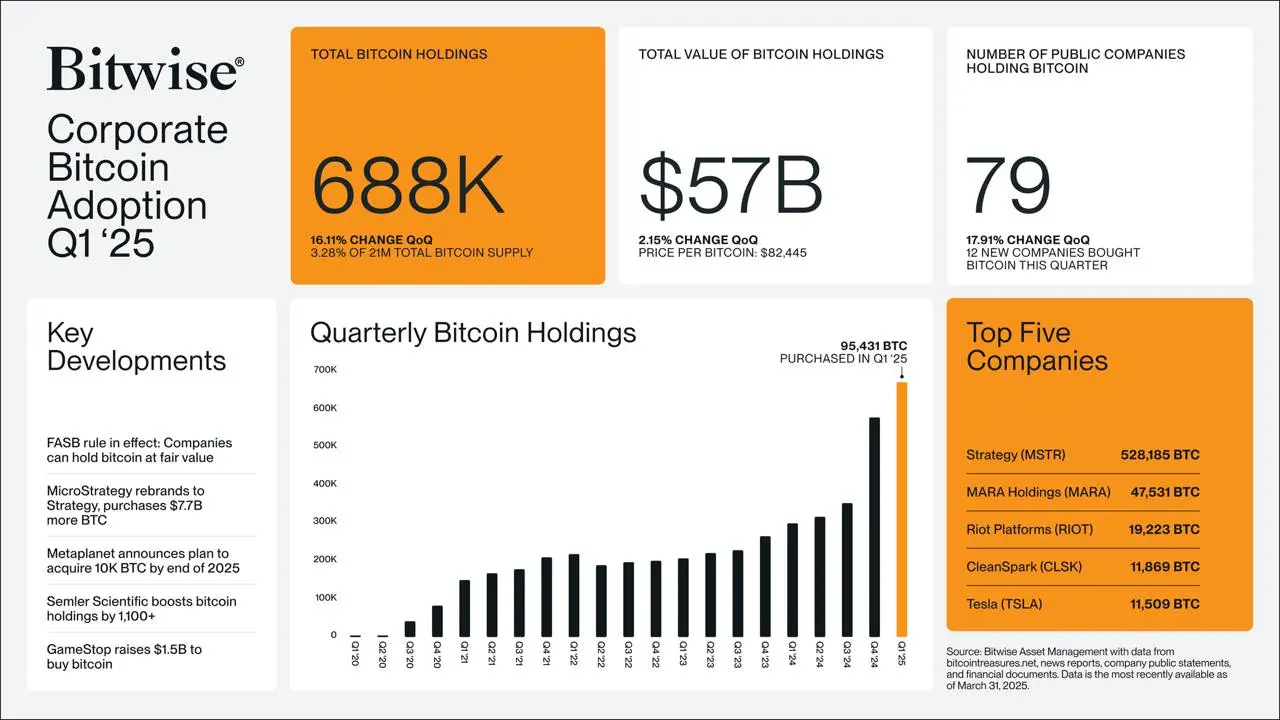

Digital assets firm Bitwise has reported a 16.11% increase in the Bitcoin held by publicly listed companies during 2025 Q1. In a post on X, the firm said publicly traded companies added 95,431 BTC to their portfolio in the first quarter.

According to the report, this brings the Bitcoin holdings of publicly listed companies to 688,000, which account for 3.28% of BTC’s total supply of 21 million coins.

Interestingly, it was not only the Bitcoin stash that increased. The number of public companies holding BTC also rose by 17.91% in the first quarter, as 12 new companies acquired BTC for the first time. 79 public companies now hold Bitcoin.

Bitcoin acquisition spreads beyond the US

The biggest first-time purchaser was Hong Kong construction company Ming Shing, a subsidiary of Lead Benefit. The Nasdaq-listed company bought 833 BTC in two installments between January and February 2025.

Canadian video-sharing platform Rumble also bought 188 BTC in March, while Hong Kong investment firm HK Asia Holdings bought just one BTC. Another company that adopted the Bitcoin standard in Q1 is Matador Technologies, with 29 BTC.

Unsurprisingly, the adoption of the Bitcoin standard affected the performance of most of these companies, at least for a brief period. HK Asia’s stock doubled in value after it announced its single BTC purchase, while Rumble saw a slight jump in its value when it bought BTC.

Despite the sizable increase in companies’ Bitcoin holdings, the dollar value of the holdings only increased 2.15% to $57 billion. This is due to the decrease in BTC value over the quarter, starting at $93,000 and finishing at $82,445.

Strategy leads acquisition

Unsurprisingly, Strategy was the biggest purchaser of the quarter, buying 81,785 BTC for $7.7 billion within the first three months of the year. The company, which rebranded from MicroStrategy, has continued to acquire more BTC despite the volatile market.

According to data from its website, it bought BTC nine times in 2025 Q1, starting on January 6 and ending on March 31. Within that period, the company bought at various price ranges, as high as $105,596 on January 27 and as low as $82,981 on March 17.

The massive acquisition by Strategy meant the company alone accounted for around 77% of all corporate Bitcoin holdings as of the end of Q1 with 528,185 BTC. However, other major holders include Marathon Digital, which had 47,531 BTC as of the end of Q1. Riot Platforms, CleanSpark, and Tesla make up the top five.

Strategy has continued with its Bitcoin acquisition moves into Q2, with the company already purchasing 3,459 BTC, which it bought for $286 million by selling some of its common stock during a volatile week for crypto and the stock market. It now holds 531,644 BTC.

While the Michael Saylor-founded company remains the monster in the sector, other companies are also doubling down on accumulation, with Metaplanet and Semlar Scientific buying more BTC this year.

However, more companies could soon adopt the Bitcoin standard. Gamestop recently announced plans to raise $1.5 billion to acquire Bitcoin. Other publicly traded firms such as Acurx Pharmaceuticals, Hoth Therapeutics, LQR House, Sunation Energy, SOS Limited, and reAlpha Tech Corp have all announced plans to allocate a part of their treasury to BTC.

Cryptopolitan Academy: Want to grow your money in 2025? Learn how to do it with DeFi in our upcoming webclass. Save Your Spot

No comments yet