Guest:JP Mullin, Co-founder of Mantra

Original translation: zhouzhou,

Editor's note:The podcast discusses Mantra co-founder JP Mullin’s explanation of the OM token crash. He expressed his sense of responsibility for investors and the losses of the community, despite the lack of malicious behavior. JP promises to provide comprehensive and transparent information and launch repurchase and destruction programs to support investors. He stressed the importance of transparency and continuous communication, and said that he would make every effort to repair the current situation and restore the health of the project. He thanks supporters and promises to strengthen interaction and commitment with the community in the future to ensure better development and response to investor needs.

The following is the original content (to facilitate reading comprehension, the original content has been compiled):

JP Mullin:Putting aside the market value, I can't be happy about this matter at all. This is an unprecedented event, and many people have lost money and been hurt. I am also very injured. I feel that our community is injured, the coin holders are injured, and the investors are injured. Even if I did nothing wrong, I did not have any negligence or malicious behavior, I still feel responsible.

host:I'm a little curious, you said the investors were injured, but if the current trading price was 70 cents, I was wondering if they were really losing money?

JP Mullin:I think they haven't lost yet. And because of this, investors who own circulating tokens have not sold them yet.

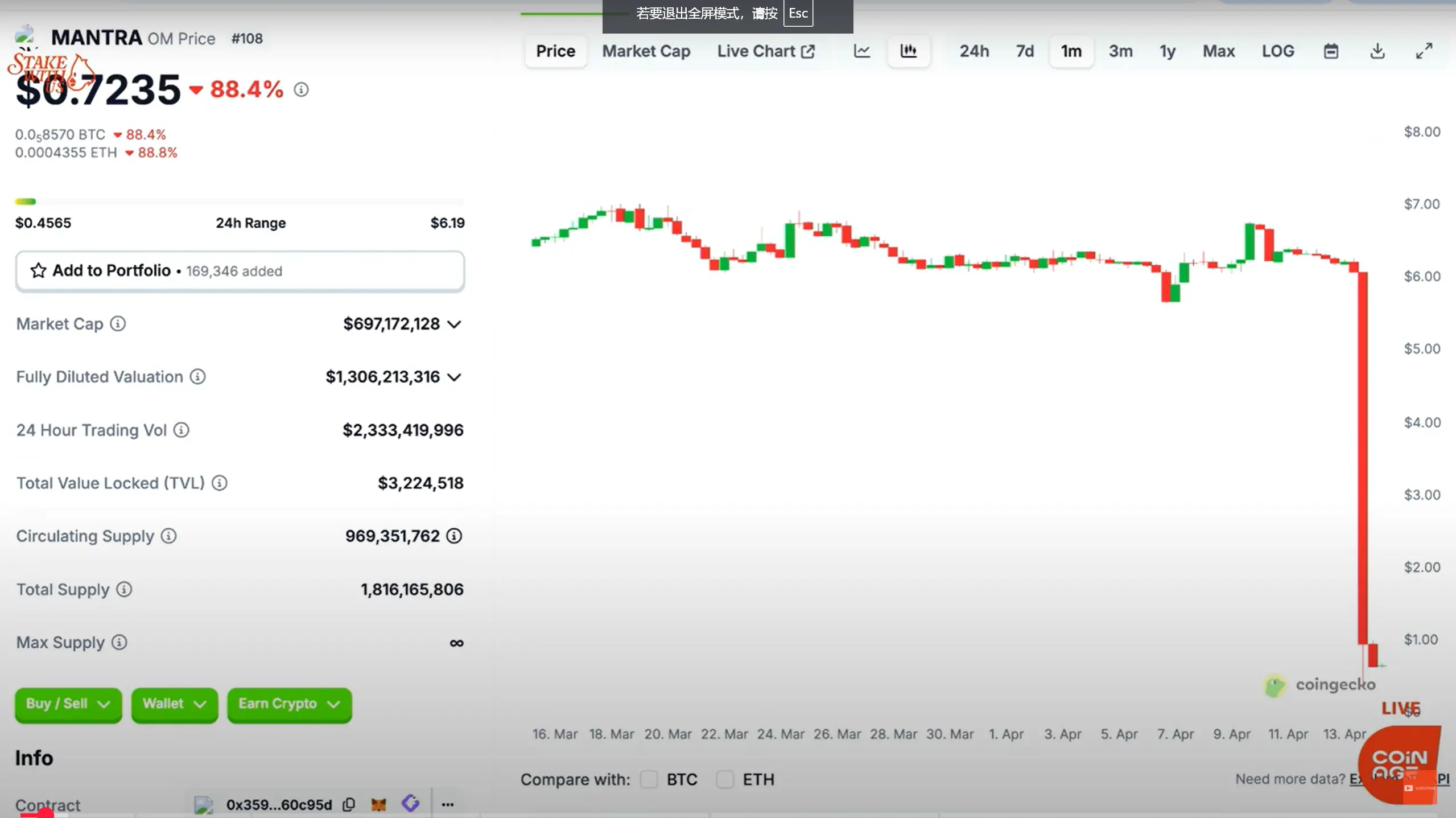

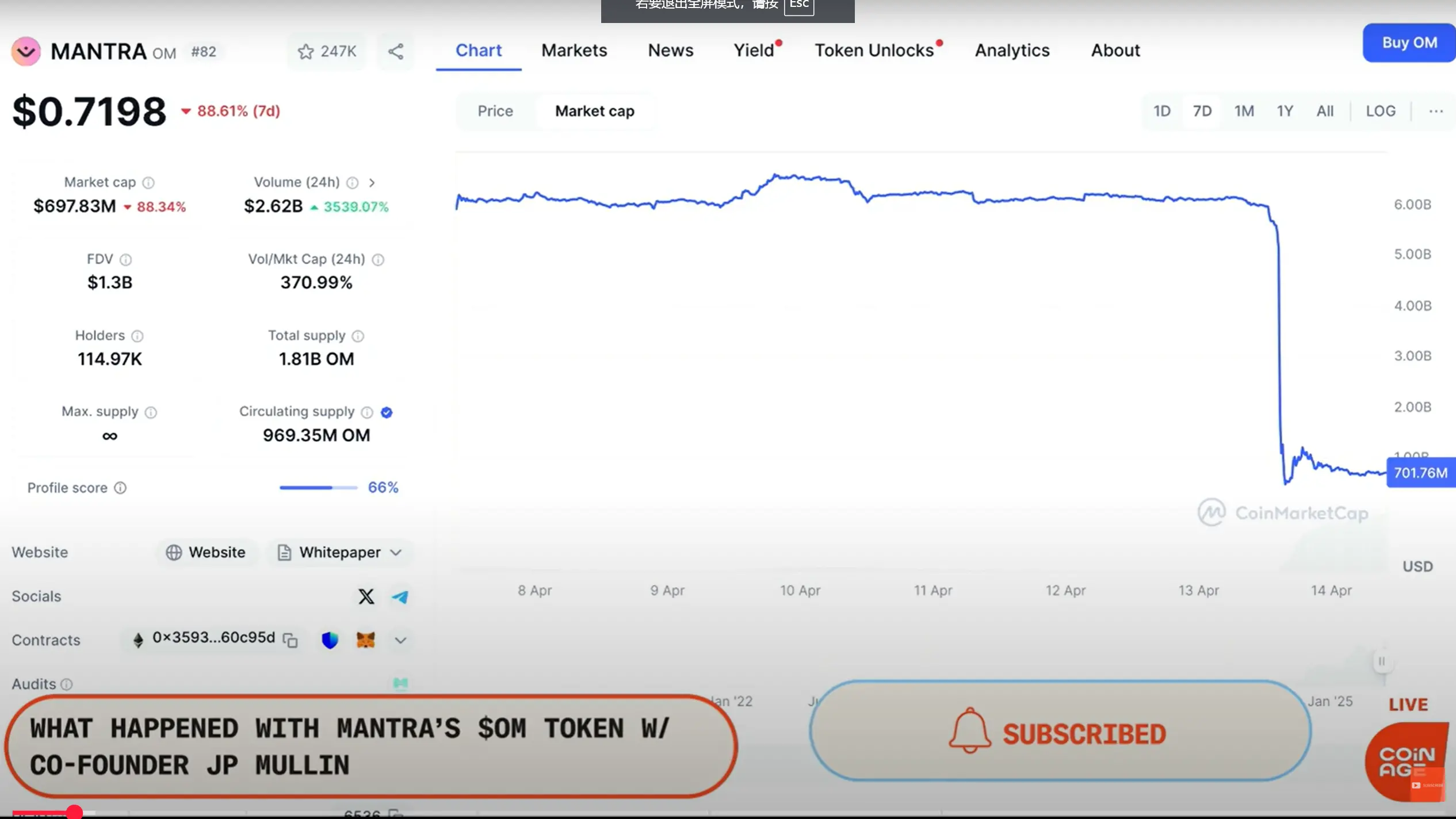

host:I am the host Akuzhman. A lot of things have happened in the crypto circle recently, and this weekend, the entire circle is paying attention to the tokens of a realistic asset blockchain project plummeted.

The chart we are now seeing shows that OM tokens plummeted by more than 80% in one day, with market cap evaporating about $5 billion (at least on the books).

Many people are asking what happened, and hopefully we can find some answers today. We also want to thank the co-founders of Mantra for answering these questions and welcome John Patrick Mullin, JP for short.

JP Mullin: I am also grateful to you for giving me this opportunity to talk about this incident and how we plan to deal with it next.

Host: What happened in the past 24 hours since you noticed this? How is this time going on for you?

JP Mullin reacts to OM crash

JP Mullin:This day was very difficult for me, the team, and the community, and most importantly, it was particularly uncomfortable for the community. Maybe I can talk about how the whole thing happened from beginning to end, and slightly disassemble the whole story and our current situation.

I attended the Paris Blockchain Week last week in Paris. On Saturday, Paris time, I boarded a flight to Seoul, South Korea, and now I am in a hotel in Seoul. We held a summit mainly on artists here today, and I also attended it, so I can talk about this later. Basically, I went to bed around 12 a.m. local time. I posted a tweet at the time saying I was on the plane and there was no WiFi on the plane, so everyone thought I was on the way.

But in fact, I just fell asleep because it was already late at night. Later, at about 5 a.m., I was woken up by the hotel phone. Our team couldn't contact me, so we called the hotel reception. Then as soon as I woke up, I was directly smashed by a bunch of news: the tokens plummeted, something happened, etc. We immediately start checking to make sure it is not an attack on the chain, not a token stolen or other similar issues.

Liquidation triggers a token crash?

Afterwards, we communicated with some key partners, investors and exchanges, and soon found that the problem lies with the centralized exchange - there are large-scale clearing operations. The reason is that some people use Om tokens as collateral for leveraged positions, and there are also many positions that use Om to be long directly. These positions were forced to close in a short period of time, and it happened to be Sunday night in Asian time, with very poor liquidity.

I was still sleeping at the time, but these positions were quickly liquidated, triggering a price plunge, and triggering more liquidation and selling, which eventually led to this large-scale decline.

So I woke up in this state and we immediately issued a statement saying we were investigating the matter and promised to maintain communication and transparency. We have contacted all investors, partners, exchanges and community members to clearly explain what exactly is going on, what measures we will take, and answer any questions you may have, because the situation is indeed very complicated at the moment.

host:Let everyone know - we didn't actually communicate much before the show, we just made a brief arrangement. So I, like everyone else, just started to understand what was going on.

But I was a little surprised that you and your project Mantra have been around for a long time. So can we start talking about this plunge? Because many people may not know what you are doing. You are working on a Layer 1 agreement linked to real-world assets. The project base should be in Dubai, where you spend most of your time, in the UAE.

The core of your project is to tokenize real-world assets, but in fact, the OM token has existed for several years before you went online last year. It was an ERC-20 token on Ethereum at that time, right? So can we start from the beginning and see how this project has developed to the present? Because I think your tokens are actually circulated on several chains. I'm also quite curious who is selling the exchange you mentioned just now? If it weren't for your investor and the tokens were not sold by you, who caused this wave of market crash? Do you have any further understanding?

The founding of Mantra, token design and bridge

JP Mullin:I started with the founding of Mantra, so that you can understand the relationship between these two tokens more clearly: one is the early ERC-20 version, and the other is the later mainnet coin.

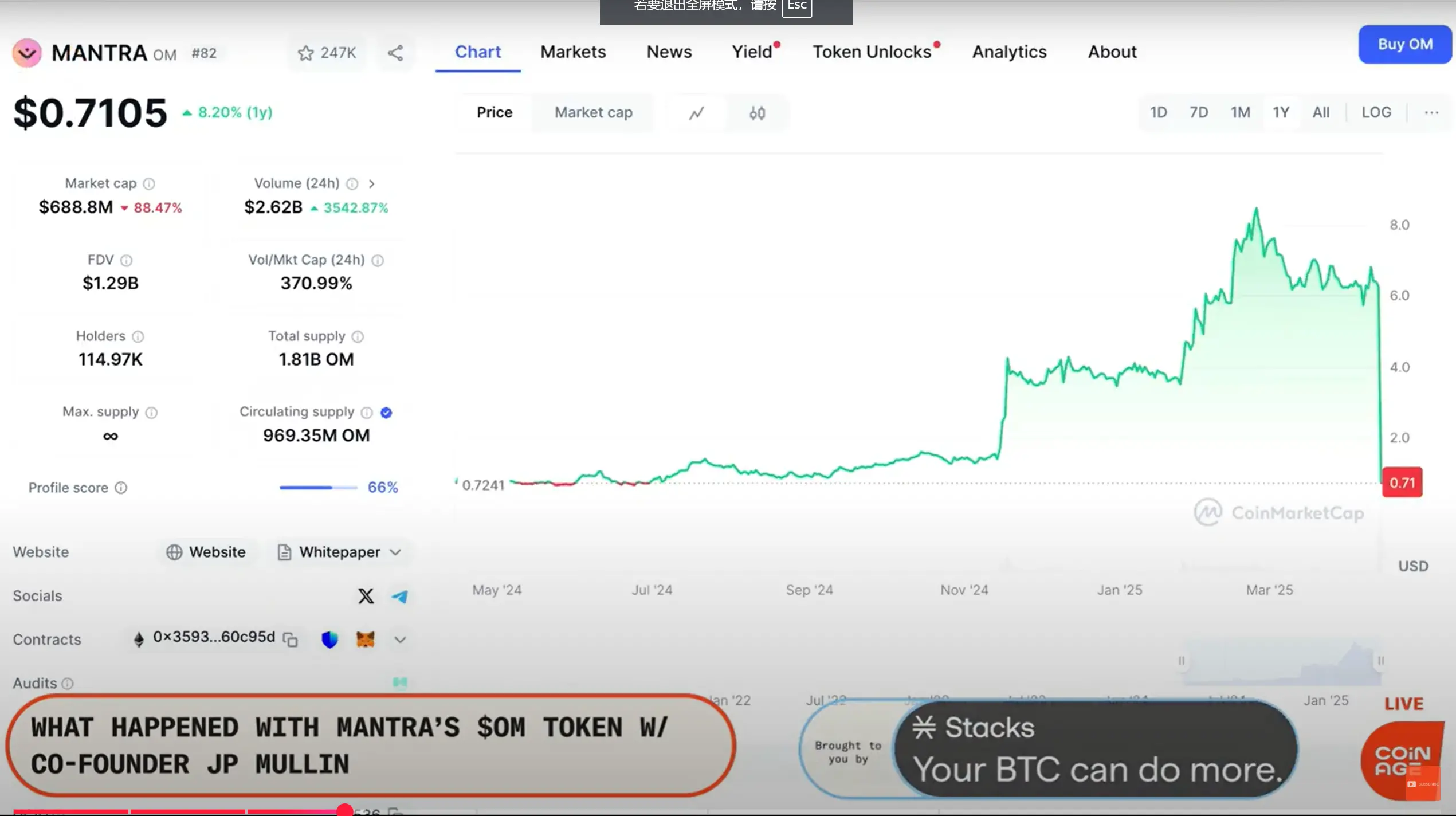

Mantra was founded in early 2020, during the pandemic, and we launched the ERC version of Om on August 18, 2020. So by now, the entire project has been around for almost five years. In March 2021, we went online on Bybit. At that time, we started as a DeFi protocol and also made some products in the early stage. We seized the opportunity of the first wave of DeFi Summer, which rose well at the beginning, but later, like the entire market, fell all the way.

By 2023, our situation was actually very difficult. For example, in October 2023, our currency price once fell to US$0.017. Then from the end of 2023 to the beginning of 2024, I began meeting with some of the core partners now, including Shorooq, a fund headquartered in the UAE, and Laser Digital, the crypto division of Nomura Securities. They have helped us introduce some institutional funds and have also promoted us to further build the concept of "regulated DeFi protocols".

We were still following the license process with Dubai regulator VARA. At the beginning of this year, we really obtained the world's first official license for the DeFi agreement. Our new Layer 1 chain is designed for the tokenization of real assets, with built-in functions such as compliance framework, permission management, and identity layer.

At about that time (end of 2023 to early 2024), we began to think about how to integrate the token model. Initially, we planned to make these two token systems run independently: one is the Mantra ERC token based on Ethereum, and the other is the AUM token on the new chain Omega that we originally planned to launch.

But later we took this matter to the community to vote, and the community wanted us to concentrate resources to support one token instead of two. So we merged these two routes based on the voting results, and since then we began to focus on how to develop an institutional-level real-world asset tokenization business in the UAE.

In the past month, we have actually released many major cooperations, such as cooperation with Mag and Damac Group in the real estate direction. At the same time, we have officially obtained VARA's compliance license and officially launched our own chain at the end of last year.

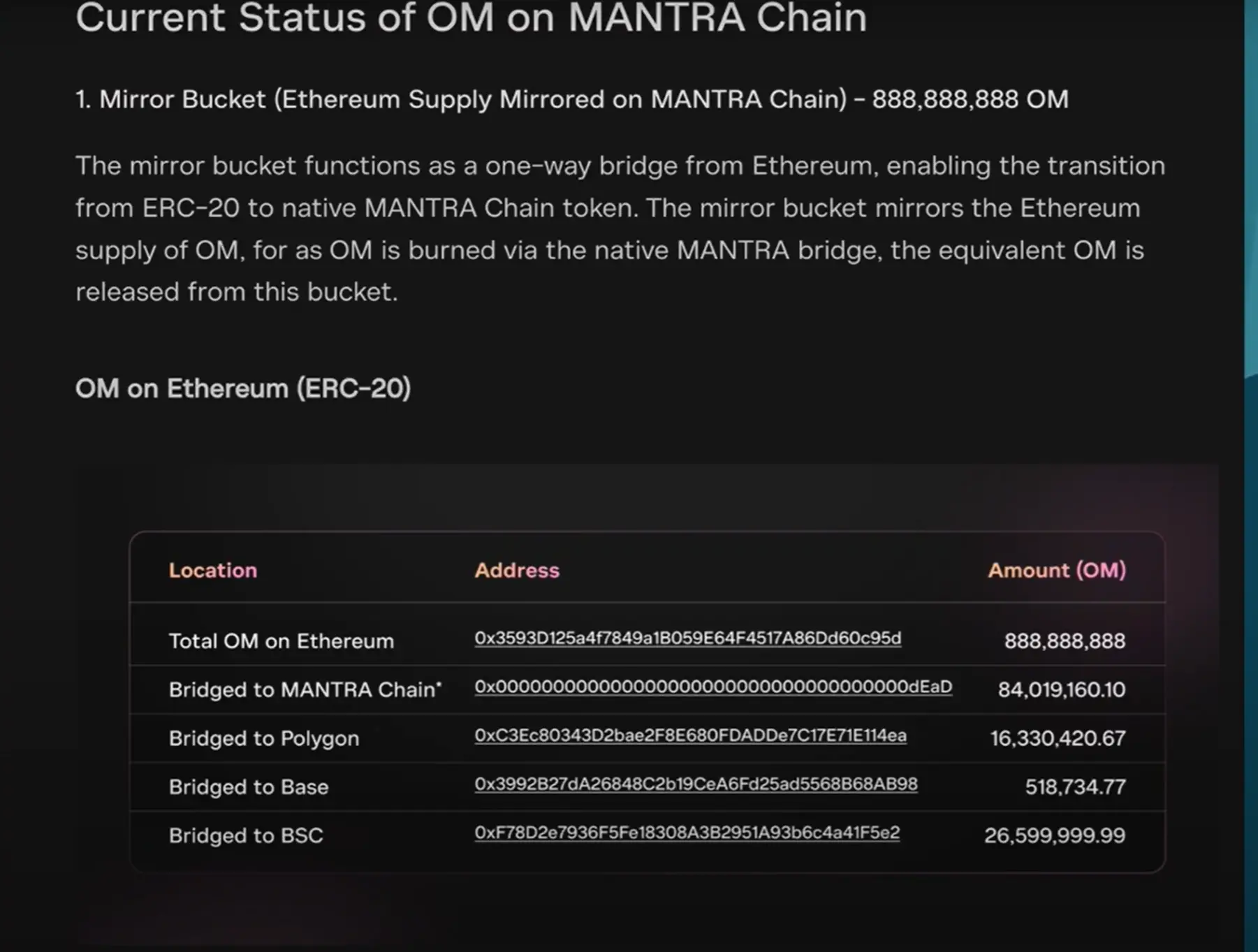

While launching the chain, we also started the cross-chain bridge process. Now, when the ERC version of tokens was launched, about 95% to 96% were in circulation, and now it is almost 98%. This ERC token is hard-top, with a total of 8 million. All of this can be verified on Etherscan. The wallet address and distribution are very clear. Many are in exchange wallets, and some are marked wallets.

Most of the token parts on the main network are still locked and entrusted in third-party institutions, such as compliant custodians like Anchorage, and there is also a mandatory attribution mechanism.

We actually just released a transparency report last week to respond to everyone's concern about the details of tokens. We will continue to provide more transparent information about wallets and distribution later.

Now ERC's tokens have actually been bridged to multiple chains, such as Polygon (through Polygon POS Bridge), Binance Smart Chain (OM version on BSC), and even the version on Base.

However, all of these are still within the original ERC total of 8 million. There is no new supply, just circulating on other chains through bridging.

host:I think this part is quite interesting. You "mirrored" the tokens on the old chain to the new chain, which means that if someone wants to transfer the tokens on the old chain to the new chain, they must first destroy (burn) the old one and then exchange it for the new one, right?

These designs are one of the important decisions that long-established projects need to be made during the evolution process. Now everyone has learned about the development background of Mantra and the situation where its tokens are now distributed on multiple chains.

Then let's go back to the core of this incident. You mentioned yesterday that someone might have built a large leverage position with OM in a certain exchange, and it was later forced to level it. In this process, a large number of tokens are sold by the market, and the market crash occurs.

So I would like to ask a few questions: First, have you further understood who operated this way? Second, which exchange happened? Third, have you received a notice before the liquidation occurs?

JP Mullin:In fact, we have been communicating with some exchanges before, such as asking them: "When were these tokens listed?", "Do you know who the owner of these wallets are?", "Are these team members? Are they market makers?", etc.

As for this incident, we have been communicating with some exchanges in the past few months, and we didn’t start asking them in the past 24 hours. We will focus on which tokens have flowed into the exchange and whether they have come in as collateral. But these tokens come in from some clean wallets - clean wallets are those that have been transferred from other exchanges, have no historical behavior, and are not connected to the wallets we are familiar with.

I myself would tag all my wallets I know on Etherscan so I can track them anytime. But the wallets involved this time are all clean, unmarked, brand new wallets. That is, they are not directly associated with the team or entities we are familiar with.

We do know that some exchanges played a role in this incident, but it is not convenient for me to name it at the moment. We are now working with institutional investors and partners to evaluate whether there are legal means to use to protect our communities and investors because we believe they have indeed suffered harm and injustice in this incident.

It is obvious that this time, a large-scale forced liquidation occurred late on Sunday night in a low liquidity environment. We have not yet contacted investors who have been liquidated, but we have been in communication with some institutional partners, such as Cheroke and Laser.

host:It should be noted that Cheroke and Laser have both publicly stated that they are not the main force in this sell-off. So you mentioned earlier that this incident occurred at a time when there is low liquidity, that is, the "inactive period" of the weekend, but in fact this is one of the reasons why the project parties generally cooperate with market makers - in this case, the market is stabilized. Can you reveal what market makers you work for? And, how did they deal with this incident? After all, this is theoretically the time when market makers should take action.

JP Mullin:We do have multiple market makers, and they themselves are our investors. We cooperate with some large trading institutions. On the one hand, they are investors, and on the other hand, they also hold OMs and have loan agreements with us.

But to be honest, I don't think their positions are enough to deal with this extreme situation. Based on our current understanding, this forced sell-off may be as high as hundreds of millions of dollars, but we do not have the exact number, which is also part of what we are currently investigating further. Once we obtain more information, it will be disclosed to the public as soon as possible.

host:The position you just mentioned is about $100 million. Is it this magnitude?

JP Mullin:We think it is probably that range, which is indeed a very large position. OM is a multi-billion dollar token, with many long-term large investors who use these tokens to support other collateral positions and are also used as part of leverage operations.

And it all happened very quickly - I remember falling asleep at midnight and waking up at five in the morning, and it had been an hour or two. We responded passively without knowing it.

This is why we have always emphasized that this is an unprecedented, sudden and rapid event. We are also working hard to figure out more details and share them with everyone as openly and transparently as possible.

host:I agree that this is indeed a very rare situation, especially during the low liquidity period on weekends. It's also clear from the price chart. What I am more curious about is that when the community is discussing on-chain transparency, everyone will ask, if it is not your core investor, who can establish a position of $100 million? This large-scale clearing event is obviously unlikely to happen completely within the transparent range of the chain, and many things may involve off-chain operations.

As a project founder, I know that these choices are complicated and you have to make decisions between many trade-offs. If you want to find a way to put the tokens on a centralized exchange and cooperate with market makers, you have to worry that they will not "back-punch" you at critical moments.

So we might as well start talking in 2024: What decisions have you made in the process of promoting the project online? For example, is there an OTC protocol? What is the structure of these protocols? How did you get to this situation step by step? Because we all know that before the project party officially went online, many tokens were already circulating in the market. Has all this laid the groundwork for today's things?

What happened before the project party officially went online?

JP Mullin:We actually conducted two rounds of financing for main network tokens, and these situations have also been explained in the transparency report we mentioned earlier. These tokens are still entrusted on the Anchorage platform and are locked.

The first round started in October last year, with a 12-month and 24-month lock-up period, and the release time of the other round was almost here, and the lock-up period of that round was 12 months.

In addition, some of our investors have purchased ERC versions of tokens through OTC, and these investors are old investors like Shorooq and Laser. Their wallet address is public and everyone can verify that they have not sold any tokens so far. The tokens were designed for an 18-month vesting period at the time and are still in progress.

Our first financing was completed in February or March last year, and these tokens have been in circulation for a long time. But as we can see from the chain, no one is selling it. We have a group of investors with very long-term and consistent values. I am really grateful that they always support us in this incident and we will continue to support them.

So we completely deny the accusation that "someone is secretly selling coins" from the outside world.

host:Regarding the "accusation" you mentioned just now, I want to clarify what exactly we are talking about. Because I haven't seen anyone really publicly accuse you, I must be very rigorous as a reporter.

I don't think everything that happens in the crypto circle can be simply defined as "running away", just like Terra's incident, I don't think it's running away. Many times the problems that occur are not malicious fraud, and we are not discussing those meme coin projects now.

What we are now discussing is that your team is building a Layer 1 blockchain related to real assets, and it is also working with many large institutions, such as the docking of other projects in Dubai before.

So I think it is necessary to talk about it. Where do you think the whole incident is going wrong? If you want to do a real and useful project seriously, what do you think is wrong? Judging from what you meant just now, it seems to be implying that there are any problems with a certain transaction.

In addition, in terms of numbers, the $100 million position you mentioned is basically equivalent to the trading volume throughout the day in the daily trading volume over many days. To be honest, the liquidation of this scale is very intense.

Where is the problem?

JP Mullin:I'm not suggesting that this is just someone operating. To be honest, we think it is the result of a group and multiple people acting together. We do think the core of the event takes place on a particular exchange, but we are currently working with all exchanges to investigate, hoping to find as much information as possible.

This is indeed an unprecedented event and is very sad for our community and we will do our best to solve this problem. I have also participated in many AMAs and Spaces these days, just hoping that everyone knows that we have not evaded responsibility.

Next, we will take some measures. The most important thing at present is to deal with the communication issues between public opinion and the community first. We also attended an RWA-based summit in South Korea this morning, and I was there in person because I wanted to tell everyone that we didn’t run away or hide.

Our project has been in operation for five years, and we will continue to move forward, not only for five years, but may be even longer.

Repurchase and destruction plan preview

What we need to do next is how to repair the confidence of our community and coin holders. We are now actively considering launching a repo program. At the same time, we are also considering whether to destroy some future releases token supply. If these two measures can be implemented in combination, we hope to announce a plan to the public as soon as possible.

In addition to this repo support program, we also hope to provide as much detailed information and transparent on-chain data as possible, and use facts and evidence to prove that what we are saying is true, so that the community can verify our statements on its own and see that we are indeed dealing with this matter responsibly.

host:There is a very realistic problem. Now the number of token holders in your token has actually increased after the incident - that is to say, many people only buy after the decline. Now you want to promote repurchase, and everyone will also care about: How much money do you have to implement this plan? Can you tell me about your current financial situation?

JP Mullin:I would like to emphasize a few things: our current operation is completely healthy, with sufficient funds, and our business is fully solvency. In addition to existing investors, we have also received support from many new investors, including providing funds, participating in repurchase plans, and conducting long-term OTC transactions.

We are actively evaluating these options and will introduce a complete solution as soon as possible. During this period, the business will be promoted normally and we will maintain communication and updates. So from a financial perspective, we have no problems at the moment and will continue to move forward.

Transparency, investors and market makers

host:You just mentioned "long-term OTC trading", and I think this is also worth paying attention to. Because in the token trading structure, OTC is actually a relatively common but not very transparent way.

You mentioned earlier that investors like Laser Digital and Shrooks have locked their tokens, and they also publicly stated that they did not sell them, but the OTC transaction involves the project party selling the tokens to others privately, which may be below the market price.

This type of token later flows into the market and may also be regarded as "the project party is smashing the market." So I would like to ask, have you done a lot of OTC transactions before this project? Is the number large?

JP Mullin:We do have OTC transactions with some institutional investors, high net worth individuals, family offices. But these are all long-term lockouts, and in fact, no transaction has been unlocked yet.

We have set a number of restrictions in these agreements, such as prohibiting resale or transfer in the secondary market. We have also been working hard to ensure that investors are in line with our direction. For example, they will not hedge, they will not be short-term operations, but "long" holders who are optimistic about the project in the long term. We do not want any unnecessary selling pressure to appear in spot or perpetual markets.

In addition, we also attach great importance to the health of the entire secondary market, so we will handle all such transactions through our official approval methods. We do work with some brokers, and sometimes they will tell us that there are institutions that want to buy or sell, and we will coordinate to ensure that these transactions are conducted with our knowledge and supervision, and to ensure that the market operates healthily.

host:I understand that you have a control mechanism, but back to the question just now: This matter has fermented in the market now. And I have read your token allocation table. There are actually quite a few tokens in the early ERC-20 versions, which can be mapped to your main network new coins. So in this case, is it actually difficult to control the number of circulating tokens? No wonder someone can build a large position on the chain that seems valuable but actually has poor liquidity, right?

JP Mullin:It's not as difficult as you think. Judging from the data I looked at earlier today, more than 100 million OMs have been bridged from Ethereum to the main network. That is to say, yes, there are indeed a large number of tokens entering the market.

But we need to be clear: we do not sell these "highly liquid" tokens on the market. What we sell are those parts that are locked up for a long time and cannot be circulated casually.

host:I understand that you do not sell these circulating coins, but these existing coins in the market can be used by some people to build positions. So when the exchange sees someone on the chain using these tokens as collateral and making a large position, it may be worried: "These coins seem to be of high value on the books, but in fact, not many people are willing to take over or have poor liquidity." So it is forced to settle. Is this the core issue of this incident?

JP Mullin:Why do these tokens seem valuable on the books, but are not actually worth so much? Is it because of liquidity? What we are talking about here is not locked tokens as collateral, but that tokens that can be circulated freely are taken to the exchange.

I think major exchanges have their own risk control mechanisms. Of course, we do communicate with some exchanges, but this type of liquidation should be a matter between the exchange and investors.

Usually this kind of thing does not happen overnight, but will have a continuous communication process. I did not participate in this specific conversation and it was difficult to comment on the details, but from what we saw, the liquidation action was very radical and rapid, so we were very concerned about this matter and were considering all possible legal means.

We are also working with investors to evaluate all possible options.

host:I also want to talk about the token plan you announced before, because this incident actually happened shortly after your airdrop round ended, and you were still preventing "Sybil attack" at that time - that is, someone created a large number of fake wallets to multi-space airdrops.

As the founder, how do you view the relationship between this matter and the time point of liquidation? Has this exposed some risk signals in advance, such as some tokens may be mis-distributed to people who should not be taken?

JP Mullin:To be honest, I think it's just an unfortunate coincidence. We did the first round of 10% airdrop about a few weeks ago, and this round was actually postponed before.

Let me briefly introduce our overall token economic model: We announced our first airdrop plan in February 2024, when 50 million tokens were issued, with a total value of approximately US$5 million to $10 million. Later this number rose to a market value of 400 million or even 500 million US dollars.

This also means that some of them are zero-cost airdrop tokens, which is definitely a concern for old users who spend money to buy them. So we have adjusted the locking rules and tried our best to balance the interests of both sides. Despite this, we still did the first round of airdrops.

At the same time, we also filtered the airdrop address, and this proportion is very large. We found that there were indeed a lot of malicious operations, such as hundreds of thousands of addresses trying to swipe airdrops, which is obviously not what we hope to see. We want to protect community members who really spend money and support the project.

We made the filtering decision in March, and this time the airdrop was 10% of the first round distribution that was completed about one to two weeks ago.

host:So I would like to add, why do you need to protect the cost price of those users who really invest in tokens? Logically, it is to prevent people who get tokens without spending money from causing an impact on them, right?

JP Mullin:Yes, I think this is very important - if someone is willing to use their hard-earned money to support your project and your tokens, I really think it is my responsibility.

As a founder, this is not only my fiduciary duty, but also a responsibility I want to take from the bottom of my heart.

When we find that some people use loopholes to brush airdrops, seize resources, and then throw these tokens directly to the real holders who have been with us, this is a harm to our project itself. I can't allow this to happen.

Of course, this does not mean that we do not welcome everyone to participate in the airdrop. In fact, after our airdrop, more than 200,000 wallet addresses participated in the event on the main network.

These people are real users, and have passed our anti-witch attack mechanism and have not used false identities. They have made transfer operations and are still holding coins - we must protect these people.

Moreover, we not only protect these addresses on the main network, we also have more than 100,000 original coin holders on Ethereum, and this number is not included in the wallet address on the exchange. So overall, this involves a lot of users, and I take this matter very seriously.

host:Since you say you take this responsibility seriously, as the founder, there are actually two key tasks: the first is to ensure that the locking mechanism is clear and implemented. Because some projects do not do chain warehouses.

The second is the rise in the token price you mentioned earlier. In fact, we have also seen this situation in the past when the market liquidity is relatively poor, and some market makers use extremely low funds to continuously pull up the market and push the price up.

Your project is quite special. On the one hand, there is an existing token, and on the other hand, you have launched a new L1 main network, which also allows users to swap between the two tokens.

So as the founder, are you nervous when you see these things? You have also said that you don’t want someone to take over at a high level. If there is actually not enough real trading volume or activity in the market to support the price increase, it is easy to form an inflated price.

From the perspective of the entire crypto circle, many founders and market makers are actually betting that your team can push up the demand for tokens in the future, exceeding the existing and future unlocked supply. Especially for projects like yours that have an original design with airdrop + unlocking mechanism.

So how do you think of this kind of game? As for this incident, how much responsibility do you think the founder should bear?

JP Mullin:I can explain a little bit about some of the adjustments we made in the token economic model this time, so that you can also be more clear about the entire background.

When we modified the release mechanism (vesting) for this airdrop, we actually adjusted the team's token release arrangements. The team's tokens are still locked in Anchorage, and the wallet address has been published, and it has been written in the transparent report we released.

At the same time, as part of the new airdrop rules, we have extended the token lock-up period of our team and consultants to one of the longest in the industry—specifically, 30-month cliff (no release at all during the lock-up period) + 30-month linear release.

You should know that I have actually received the original ERC version of the original tokens, but I returned all of these tokens and reset the unlocking period. So my current tokens will have to be locked for another six years, plus I have spent four and a half years building a Mantra project before. We are here for the long term.

I will accompany this project through the climax and trough. This is not the first time we have experienced a storm. Of course I have to take responsibility for this incident. This time, we have never encountered any situation. I think there is indeed some malicious behavior in it, and we are also investigating what is going on.

The reason why I am willing to sit here for interviews with you, and why I went to Korea to attend the summit, and I have been communicating as openly and transparently as possible is because - this project is really important to me, and the community is everything to me.

We will continue to do what we should do and support the community to move forward. Whether it is good or bad, I have to bear it. Now is indeed one of our toughest times, but we will continue to move forward and continue to walk with our strong partners on the solid foundation we already have.

host:I would like to ask again, what you said is new information to me, can you explain it? Because it sounds more like someone holding a large number of tokens and being liquidated, in my opinion, this may be just a market behavior and does not necessarily constitute "malice", right?

JP Mullin:I would say that the timing of this incident was very suspicious, and the whole process was too "unified" and did not seem to happen randomly. It is unlikely that you will see such a big "waterfall-style liquidation" suddenly breaking out overnight. That's why we must investigate carefully and find out what's going on behind it.

Generally speaking, this situation cannot be "instantly". You know, if you have experience of being given margin or loan liquidation, you will understand that if you have been in communication with the exchange or lender, actively contacting, providing additional collateral or seeking solutions, the other party will not clear you all directly, especially it is impossible to liquidate hundreds of millions of dollars in positions at once.

That is a very large position and must be managed very carefully. Our feeling now is that this matter has not been handled properly, so we are investigating what happened, because this time it has indeed hurt many people.

host:I agree with you, but this is exactly what everyone is concerned about, especially the relationship between market makers and the communication issues between you. From the perspective of our external observers, we can only rely on guessing. As the project leader, you are the person who is most likely to know the truth. So the core question is: How did such a thing happen?

Many people say that this logic is not difficult to understand - for example, the liquidation example you gave: If the price of a token is not formed by natural supply and demand, but is artificially pushed up by some participants, then when the price pulls back, the exchange may feel that this price is not real, the market does not have real buying, and once no one takes over, it will collapse quickly.

From this perspective, the trigger of liquidation is actually "reasonable". As the founder of the project, I guess you should be involved in these conversations about tokens, circulation, which exchanges to be posted on, trading volume distribution, etc. At least you should understand the operation of these relationships, right?

JP Mullin:To some extent, yes. We do have some exchanges that come involuntarily contact us and ask us, "What's going on with these tokens? Where do they come from? Why are these tokens used as collateral?"

They would send me a wallet address, which was transferred from a newly created wallet on another exchange, and it looked like a completely unfamiliar new address.

I can't make a decision and have no exact information to determine where these tokens come from, especially if they come from a centralized exchange. Obviously, we have partnerships with multiple market makers, who are also our investors, and I’m very willing to tell you who they are: including Laser, Amber and Manifold Trading. These are our investment partners.

I can say clearly that we have never worked with market makers for any form of "pull-up" or token price manipulation. We simply don’t have that much capital to do this, and Mantra has raised limited funds in the past 12 to 16 months, which is not something we will do, and I’m willing to make this public statement.

You can comment on the value of tokens as you like. Whether it is fair is determined by the market. I hope to finally achieve a fair market value, and the same goes for the projects we are building.

We have really received a lot of attention over the last 12 to 15 months and the execution is strong. We have issued many major announcements and received a lot of support. Including support from institutional investors, real estate developers, and web2 partners like Google.

So from the due diligence perspective, we passed all the reviews. We are a regulated project and we have demonstrated all our compliance to regulators and partners, and have been transparent and communicated with regulators.

host:If this is a project approved by Vera, I'm curious if you have any discussions with them about what happened?

JP Mullin:Of course we contacted them the first time. So, we keep in touch with them all the time. Overall, everyone wants to figure out what is going on. We promise to remain transparent and to show every fact and information as much as possible.

In addition to the recovery plan, the next step is to present detailed post-event analysis and disclose all facts and information as much as possible, including public wallets and more. We will make everything we know public in order to regain the trust of the community and be able to clearly show our views on the chain.

Shrug has announced their wallet, Laser has also announced the wallet, and we have also published our wallet address. We will continue to release more information and be as transparent as possible. We are not avoiding this, we are here.

How will Om tokens develop?

host:I want to continue talking about transparency, as I said before, Sheriff released their report and said that these tokens that were sold are not theirs. Speaking of transparency, where should we go next? Where should Mantra go? How will Om tokens develop? Because, as you said, there are many questions around these issues now.

Before this happened, I saw a discussion on Twitter while preparing for this conversation, one person mentioned the issue of transparency, and you responded that in terms of supply we have discussed the vicious cycle of this airdrop.

You basically responded at the time, "I'm not doing any kind of pull-up, I'm not saying it's a bad investment, nor is it a good investment. We've been transparent from the beginning and recently released another report to the community." I kind of want to figure out which report you're referring to?

I'm not sure if you're referring to that part about the vicious cycle, but the main question is whether it's about transparency about the supply dynamics. I even saw Binance recently mentioned warnings about the listing of OM tokens due to concerns about the increase in supply. I'm curious if you're referring to this question.

I mean the transparency report you've shown before, and that report lists different categories and I'm happy to provide links, which was released about a week ago.

As you mentioned, throughout Mantra’s history, we have been releasing updates about the issuance and provision of OM tokens. These are all from last year, when we merged the ERC token and the new chain token, the entire process was verified after the governance vote and the ERC20Mantra community approval. We have also been releasing updates over the past few months and although there are no links now, I'd be happy to provide them.

You can see the process of these changes. We work very closely with Binance and other exchanges and we communicate with them immediately whenever there is a change in modern currency economics. If there is any economic change, we will publish it publicly through publicly verified governance proposals, or through media articles, etc., and we will share this information directly with Binance and other exchanges.

I know Binance must know about this change, and because of this, many exchanges have decided to support this change, and Binance is one of them. We have contacted them about this change, they are informed about the change in the token supply, which is not new, and has happened as early as October.

This incident really makes me feel a little strange, especially the idea of "mirror destruction in one-to-one ratio". Has it been discussed that if the existing token supply is too large, should some of these tokens be considered? As we discussed earlier, the supply of OM tokens is already very large.

I'm looking at the proposal now and a lot of people mention that this proposal might be that type of proposal, and I remember you mentioned that it had 91 votes. I remember you said that when we were doing this, many people said we were done. As a leader of Mantra, can you talk about the process of making this decision? And will you go back and make a different decision?

JP Mullin:I won't change my decision. In fact, if this proposal had not been passed at that time, we wouldn't have even had Mantra's Layer 1 chain.

At the beginning, we planned to use Mantra’s ERC tokens, and we planned to build a completely independent L1 chain that will perform some form of airdrop and give back to OM, the new token is called Omega AUM.

We had discussions with investors and core team members at the time, which happened in late 2023 and early 2024, when few people had heard of Mantra.

In fact, our tokens fell by 95%, and many people think we are done, right? Then we had this nearly impossible recovery, which was also supported by OM token repricing, and Mantra’s chain was launched with the goal of supporting RWAs. These different narratives combined with the efforts we have made, and finally we have achieved what we are today.

Regarding this "mere bucket", in fact, when we create this new supply for the chain, everything is public. Everyone who supports this project knows the situation completely. We have been conveying this information since the proposal was released.

The mirror bucket is actually a bridge between ERC tokens and mainnet tokens, and we effectively replicate the supply of existing ERC tokens, which can also be verified on-chain. When people send ERC tokens over, these tokens are sent to the destruction address, and about 100 million tokens have been destroyed.

The whole process is exchanged in a one-to-one proportion of alternative tokens. You can even see on Bybit that they have both ERC version of OM and Mantra chain version of OM. You can deposit ERC version of OM and extract Mantra chain version of OM, and vice versa.

We set a threshold of 30,000 tokens, and when you send tokens through a bridge, this amount will automatically fill in a few minutes, and after verification is sent to the destroyed address, new tokens will be released. If the number exceeds 30,000 tokens, we need a manual process, approve and send the tokens through a multi-sign wallet, which can last 24 hours, ensuring everything is safe because it involves huge flow of funds.

Even when we started, I forgot what the price of OM was then, it was still tens of billions of dollars or even more of the tokens stored in this bridge wallet. We want to make sure that this is not a target for the attack. We also want to make sure people can correctly bridge their tokens to mainnet tokens, which is where all new activities begin and the direction we will develop in the future.

host:You look back at this 90% drop, considering those who might enter the market when prices are much higher, the prices are now well below their investment price at the time. If so, as you said, they may have lost the money they have worked hard to earn. Do you think you and your team have done enough in terms of transparency? Have you told you that these things may happen?

JP Mullin:I do feel like we've always tried to stay transparent. I don't think the problem lies in transparency. I do want to continue to be as transparent as possible so that everyone can see that in fact we have not sold any tokens and neither have investors.

host:I don't think people are necessarily upset about your tokens selling, and strangely, I know you're not in the US, but the SEC recently released their position on transparency. Specifically, they pointed out that if you are involved in cryptocurrency trading, it is essential that you disclose which market makers are, the agreements you have signed, which people may hold tokens, and how the supply changes, which is basically what they require.

So if we start over now, considering that OM is trading at 70 cents now, and it has dropped to one thousandth of the original, considering that it was trading at nearly $7 before? If you want to talk about the transparency of these protocols, especially given the cost base of these large market makers or investors, this can put a lot of pressure on supply. So, what would you disclose if you communicate with new people?

JP Mullin:I think the best thing we can do now is publish as much on-chain information as possible, display where the token is and what exactly happened.

host:This is about off-chain content, like those protocols and over-the-counter trading, and my question means that.

JP Mullin:I think the part off the chain is relatively open, including our vesting plan that has been made public from the beginning.

So, obviously, we are willing to provide as much information as possible in relation to any agreement involving monetary associations. We are fully committed to doing so. You know, I'll support this, we'll post it, but can't do everything.

I think now, investors will want to know what exactly happened. I'm glad you raised two questions about both on-chain and off-chain. We are fully committed to providing as much information as possible and I make this commitment.

Mantra Future Route

host:What to do next is undoubtedly a big problem, and it is obviously the reason why many people are paying attention to our conversation now.

I want to give you a chance to talk about your plans and the route you plan to take, because frankly, I haven’t heard of Mantra before that, maybe because you’re there, we’re here, there, there’s really a difference between New York and global crypto users. At least I haven't heard much about you.

But now, considering the real-world assets on this chain, you said that you don’t have much money. Well, when you mention the repo program and plan to recover, I want to say that even you might agree that it is almost impossible to go back to those levels before now. But how do you think about the plan to go back to that level and the assets you can operate now?

JP Mullin:Of course, you know, this has happened before. We once fell by more than 95%, and when it was launched, everyone thought we were done, but we successfully came back. We know we will do this kind of recovery again.

From a founder’s perspective, I’m willing to do whatever I need to do to ensure the community is well cared for. This is more important to me than anything, and we need to act in this difficult time, return to normal and support our community.

We do have strong long-term institutional partners, and I mentioned that our company is financially backed, the business remains healthy, and we will continue to move forward and execute our plans. Afterwards, the institutions we saw were very interested in, and it was really nice to see these.

We promise to do our best to execute the repo program, and I have relocked my position starting with my personal founder token. At this stage, I did not value financial interests. To be honest, it was not for financial purposes at the beginning. So, I want to make sure we can restart this project and keep moving forward.

We will work with our partners such as Subaru, Laser, etc. to develop a reasonable repurchase plan, and create a destruction mechanism to let everyone see what is happening and destroy any unnecessary supply. I have communicated with our investors and they have also promised to help and support this program.

host:The points you mentioned want to confirm the normal situation of these processes and the liquidation issues you talked about. If there is an investor interest or institutional demand, you may intervene at this time. Are you saying that these conversations have not happened, right?

I meant until now, about demand, the institutional support and investor support you talked about, is now in the situation after a 90% drop, right?

JP Mullin:This did happen very quickly and it broke out almost one night. It was on a Sunday night and it was abrupt and we didn't have much time to react. I was sleeping too.

So we have obviously worked with partners who hold tokens and they will continue to support the project and have financial support. But we have also attracted a lot of new investors who have become interested in the project and will continue to support it, showing that they are willing to continue to participate.

So, seeing these new investors joining makes me feel very good. Everyone understands that we have done a lot of work, and this is not the first time we have encountered such a challenge. We are ready to stand up again.

host:Speaking of the personal impact of this on you, I would like to ask, you mentioned that you have been working on this project for a while, and I have also seen your past interviews, from talking about Home to before the mainnet was released last year.

For you personally, after all this, how do you view this process? I’ve interviewed a lot of founders before, including Do Kwan after Terra’s crash and SBF after FTX’s collapse, and I’ve interviewed a lot of founders of other projects.

For you, after experiencing these fluctuations, will you feel a sense of release? Of course, I know today that you didn't sound relieved. But judging from the token fluctuations, the price may be at a low level now. As you said, you have experienced a similar collapse. Isn’t it a bit like “maybe we should be at this point”?

JP Mullin:I don't think so. You know, it's not something I'd feel relieved if the market value is aside. An unprecedented event happened, and many people lost money and were hurt, and I was not at all relieved about it.

I was very upset and today was very difficult for me. I feel sorry for our community, I feel sorry for those who lose money, I feel sorry for our team, some foreign investors, it’s really bad. To be honest, I feel very sad.

So, this is not anything I would feel relieved. I think it's awful, but I promise to do my best to spend every minute fixing it and doing the right thing, and I stand behind these words. I believe that those who have seen us over the past five years will support me. You know, I will keep my promise and do what I can to support this project, take responsibility, and not escape.

host:You said you felt bad, but I actually wanted to figure out which part made you feel bad. Obviously, the price drop is one thing, but it sounds like you say it's not your fault. So, if there is a certain part that makes you feel bad, in addition to the price, which part is it?

Because it sounds like you say you're not selling, nor are your investors. So, from the outside, especially those who are not in the Mantra ecosystem, what do you feel you are doing wrong?

JP Mullin:What I feel sad is that those who believe in this project and this token lost money as a result, and they did not participate in this incident. As soon as they woke up, the token fell by 80%, 90%. It's really bad, and I feel sorry for those who support us.

host:Part of the responsibility lies with you, right? I think if I can make it clear in the end, where exactly do you feel sad? Is it about what you did?

JP Mullin:They believe me, they believe in the project, and they end up losing money in it. Like I said, it makes me feel like I have a responsibility to take care of token holders and our supporters as a responsible founder. I can't avoid it, I just feel sad for them, and to be honest, I don't know what else to say.

I feel very sad. I feel like our community is hurt, our token holders are hurt, and our foundation is hurt. I feel responsible, even if I haven't done anything negligent or malicious, I feel heavy.

host:Curiously, if your investors are injured, I wonder if they are actually losing money, even if the token is trading at $0.7 now.

JP Mullin:I don't think they are losing money, which is why investors who hold liquid tokens have not sold any liquid tokens so far.

host:So maybe they weren't affected too much, but those who came in later were affected even more. As you said, that's why we had these conversations and why we're talking to you. Maybe if we had talked about it earlier, maybe more people would have learned about the real situation of the project. Again, I'm only now starting to understand what you're doing and how it relates to real-world assets, which is obviously a very popular area.

It sounds like you've been working on what's going on for a long time, too. Then the last sentence, what do you want to say to those who hold this token?

JP Mullin:First of all, I want to thank you for giving us the opportunity to come out and share our position. Again, we will develop a plan to ensure full transparency, to disclose what happened and where something went wrong.

So, you can follow my personal Twitter and our company’s Twitter account, and all this information will be posted. We will also launch our buyback and destruction programs in the next few days to ensure we do everything we can to support investors. We will maintain continuous communication with the community. Again, friends in the community, we will do everything possible to correct this situation.

Thank you to those who support us and are actively connected, thank you very much. This means a lot to us. For those who doubt us at this moment, we will continue to do our best and become stronger than ever.

host:I am very grateful. I think sometimes people are reluctant to keep information transparent and don’t want to keep everyone up to date. This time the situation is relatively unique, especially the events that happened over the weekend. So I think letting people know everything you know is exactly the transparency that this field expects.

No comments yet