Solana (SOL) bridging in the past week shows renewed interest in the chain. The biggest inflows came from Ethereum and Arbitrum, signaling an attractive narrative or token sector on the network.

Solana (SOL) is once again attracting inflows from bridging, signaling a renewed interest in the ecosystem. Based on Artemis data, Solana has led in terms of net bridged value for the past 24 hours.

The chain attracted $11.3M in inflows for the past day, with $7.1M in outflows. Historically, inflows are linked to heightened on-chain activity and more risk-takers using the chain as a meme token casino. The biggest previous inflows came in January, as traders competed for Official Trump (TRUMP) and other celebrity tokens.

For the past week, bridging served as a signal for increased DEX and aggregator activity, with a boost from both bridged tokens and stablecoins. Based on Artemis and DeBridge data, the chain drew in over $120M in new inflows, reversing the recent trend of outflows.

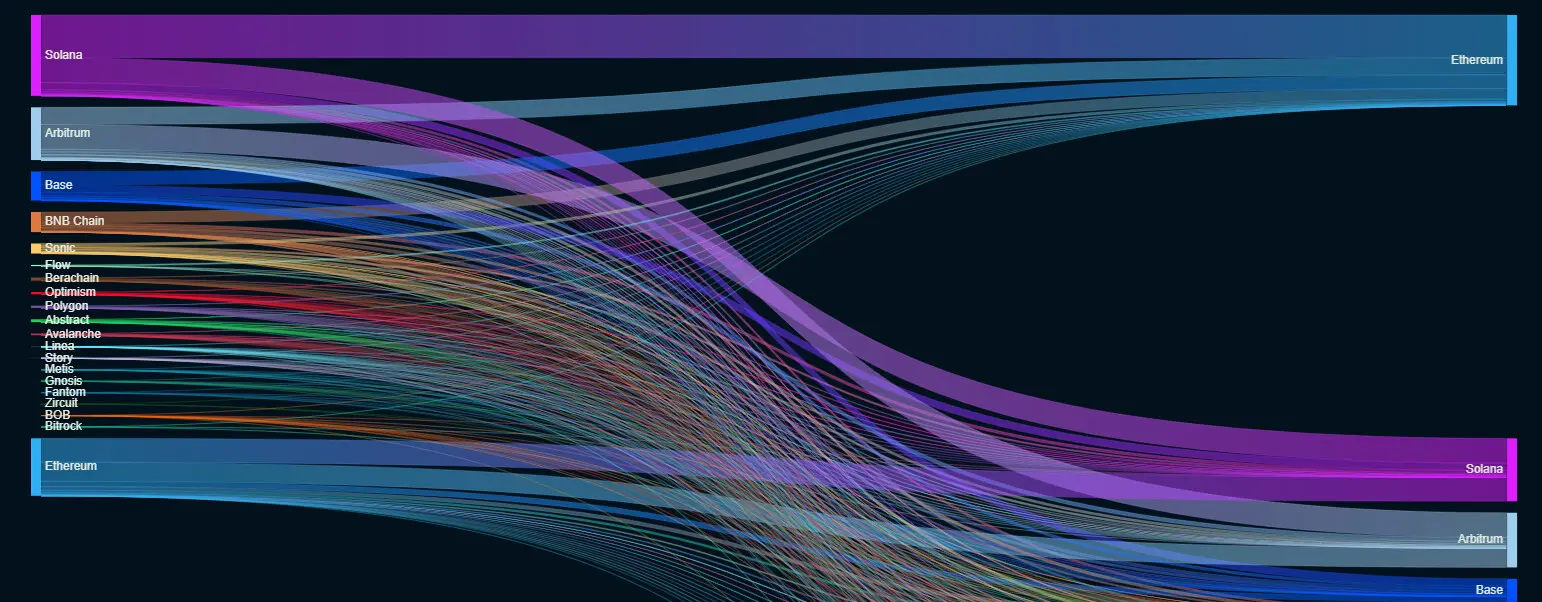

Detailed DeBridge breakdown shows Solana mostly interacts with Ethereum, with significant inflows from Base, Arbitrum, and BNB Smart Chain.

Over $10M flowed into Solana from the Ethereum ecosystem, potentially boosting the supply of stablecoins. The chain carries over $6.93B in value locked, with over $12.63B for native and bridged stablecoins.

Solana apps get a boost on weekly volumes

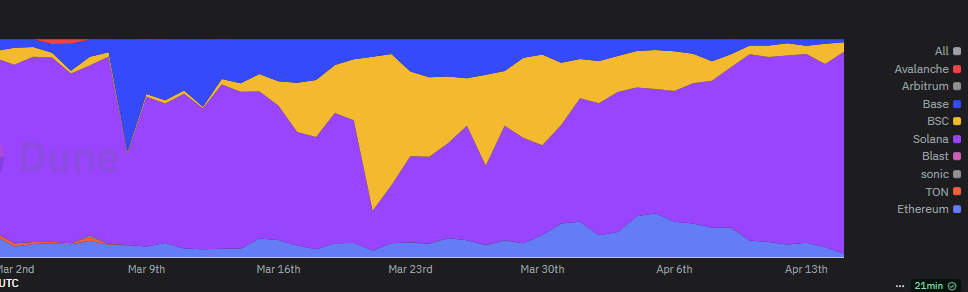

Solana DEX activity has been recovering from the lows in March. At one point, DEX volumes reached a local low of $12B in 24 hours for all decentralized markets.

In the past week, DEX activity returned to over $19B in 24 hours, almost recovering to the levels from Q4, 2024. So far, the L1 chain has not repeated the trend-bucking spike from January, when Orca and Meteora activity took over, but the past week has shown a return of users to baseline levels.

The SOL ecosystem saw marked trading lows around March 24, when bot activity reached just 18.4% of all DEX volumes. The Solana chain still carries more than 86% of all trading bot volume, with some increase for the BNB Smart Chain.

In the past two weeks, however, Solana erased the temporary advantage of BNB Smart Chain. Recent user activity signaled BNB Smart Chain may become the next meme token casino. However, meme tokens and perpetual futures showed their appeal, regaining their share of DEX activity.

The hot DEX trading on Solana follows the recent recovery of meme tokens. Whales continue their high-frequency trading, switching between trending memes. In the past weeks, activity increased for FARTCOIN, with additional flows into BONK, WIF, and other Solana staples. The Official Trump (TRUMP) token unlock also increased trading volumes.

Daily active users increased from a low of 2.77M daily as of March 17 to 3.99M in April. Pump.fun is also driving the increased traffic while doubling its daily fees to around $2.73M. Jupiter, the main SOL DEX aggregator, also produced over $2.45M in daily fees, becoming one of the chain’s top apps and signaling a return to DEX activity.

After the traffic and fee growth, SOL is still stuck at around $131.90, awaiting a more decisive price move. SOL open interest moved up from a low of $1.81B over the weekend to over $2.4B in the past few days.

Cryptopolitan Academy: Tired of market swings? Learn how DeFi can help you build steady passive income. Register Now

No comments yet