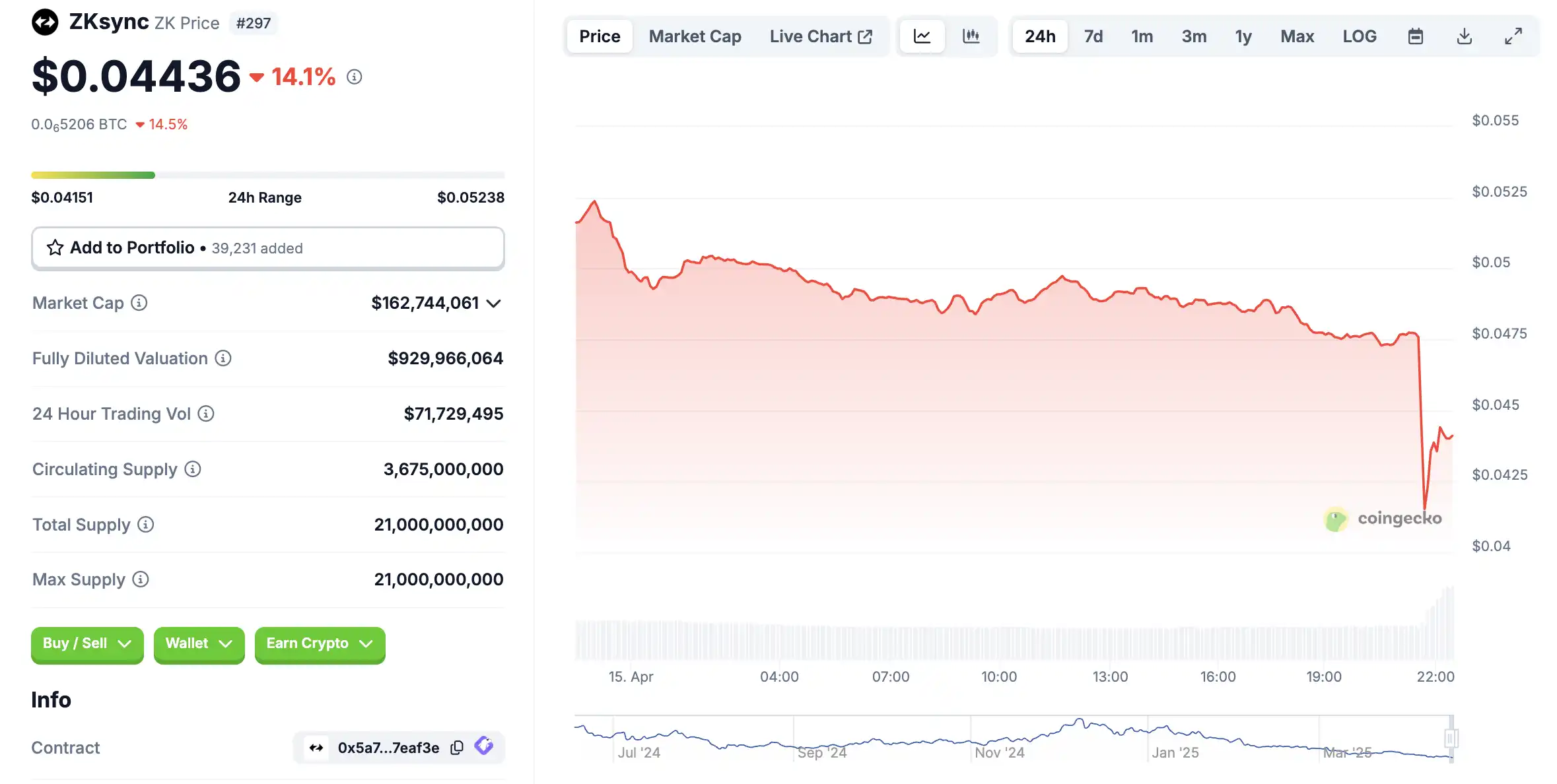

On April 15, the price of ZK tokens on the chain, one of the "Four Ethereum layers2", suddenly plunged. As of writing, the price of ZK tokens is temporarily reported at US$0.0444, with a drop of more than 14% in 24 hours, and the incident quickly attracted community attention.

The incident was over

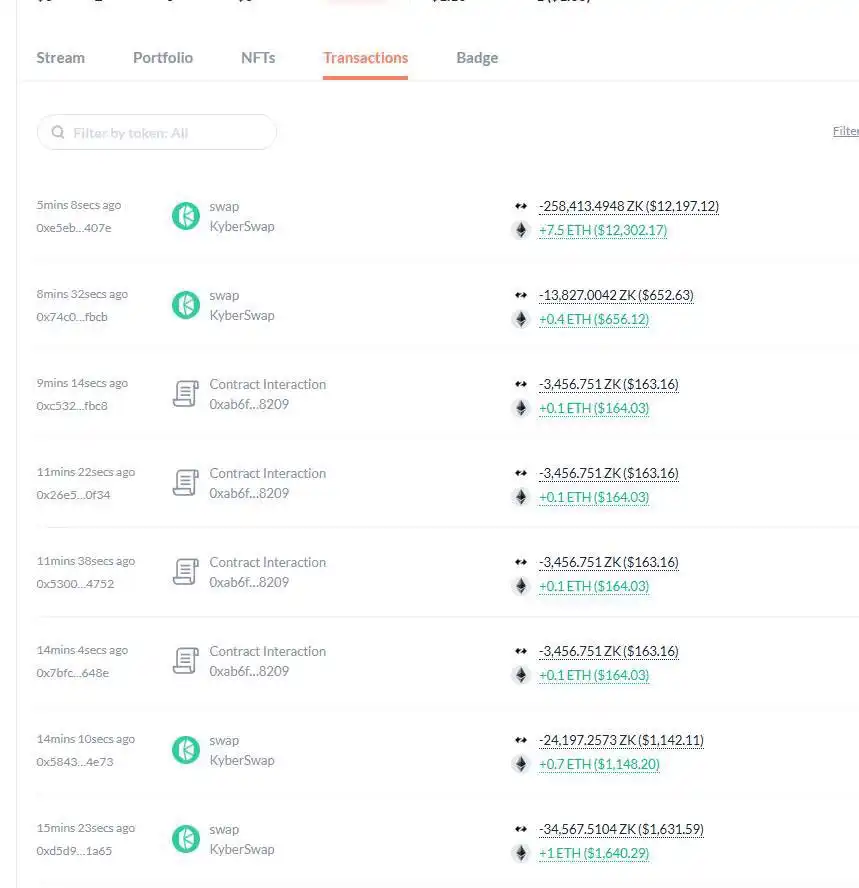

ZKsync officials responded quickly to the storm. At 9:49 pm on April 15, the team issued a statement saying their security team found a stolen administrator account at the heart of the incident. This account controls ZK tokens worth about $5 million, which did not appear out of thin air, but were derived from the remaining tokens that had not been collected in previous ZKsync airdrop activities.

The official emphasized that behind the abnormal additional issuance and sale is the isolated incident caused by the stolen keys, which is limited to the airdrop contract itself. At present, ZKsync is taking necessary security measures and clearly stated that all users’ funds are safe and never face risks; the ZKsync protocol and ZK token contracts have not been affected, and no more tokens are at risk of being stolen.

Although the official tried to calm market sentiment, it is an indisputable fact that the sharp fluctuations in the price of ZK tokens are now an indisputable fact, and more importantly, the community seems to be very unwilling to buy the official statement.

Many community members pointed out that this operation was planned for a long time, not an occasional theft incident as the official said. ZKsync first issued an additional $ZK on the chain, and then continued to smash and sell 66 million tokens, staged a drama of "guarding and stealing".

@yuyue_chris said that the ZKsync incident is another example of the recent "centralized trading routine". The abnormal issuance was regarded as a direct evil of "unethical morality", which destroyed the bottom line of trust of investors in VC projects, and the official response was "completely perfunctory".

In recent years, Layer 2 competition has become increasingly fierce. Previously, ZKsync's termination of liquidity plans due to the impact of the bear market has disappointed some investors. Now that the safety scandal has exploded again, it is undoubtedly a worse situation.

The former star of L2 is now a mess

ZKsync is Ethereum's Layer 2 expansion solution, which greatly reduces transaction fees and increases speed by transferring transaction processing from the Ethereum main chain to the side chain. ZKsync uses ZK Rollup technology, which was once considered the future direction of Layer 2 because it takes into account both efficiency and safety.

In the Layer 2 track, ZKsync was once known as the "Four Top Players" along with Arbitrum, Optimism (OP Rollup camp) and Starknet (both ZK Rollup), and was in the limelight.

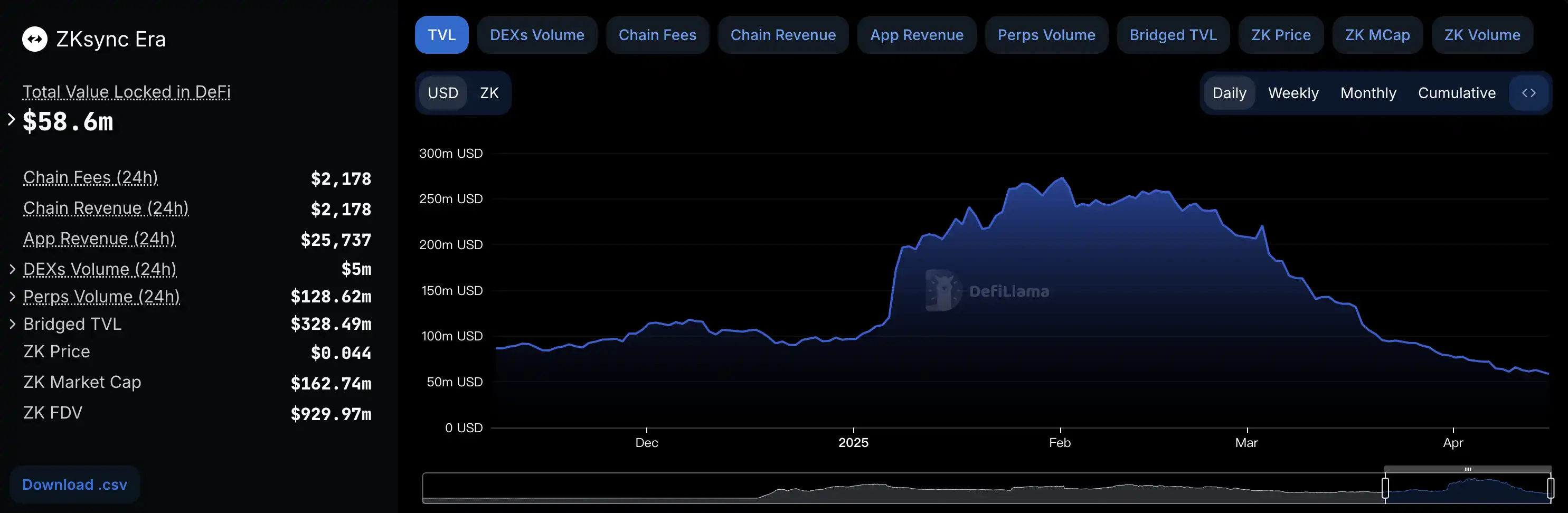

But to this day, ZKsync's performance is not satisfactory. After the airdrop in June last year, ecological activity declined sharply. Data shows that the number of active addresses in ZKsync fell by 83.5%, and the average daily trading volume plummeted by 86%. In the airdrop plan last June, 3.6 billion ZK tokens were allocated to 695,232 wallets, but Nansen data showed that more than 40% of recipients cleared their positions directly, 41.4% sold partly, and only 17.9% chose to hold them. This shows that airdrops have not effectively motivated long-term participation, but have instead intensified the selling pressure.

Moreover, ZKsync seems to have long had the "Rug chain" tag. In April 2023, SyncDex Finance was suspected to be Rug Pull, and funds with pledged over 100 ETH and 98,444.8 USDC evaporated and the official channels were closed; less than a month, the SHIBERA project drained the liquidity pool and ran away; in July of the same year, Kannagi Finance's TVL plummeted from US$2.13 million to US$24, and the official account was cancelled; the project xBank Finance, which was last May, was also suspected to be zeroed, and the official account was frozen.

Related readings:ZKsync issued coins, but the ecological project party first ran to the forefront?》

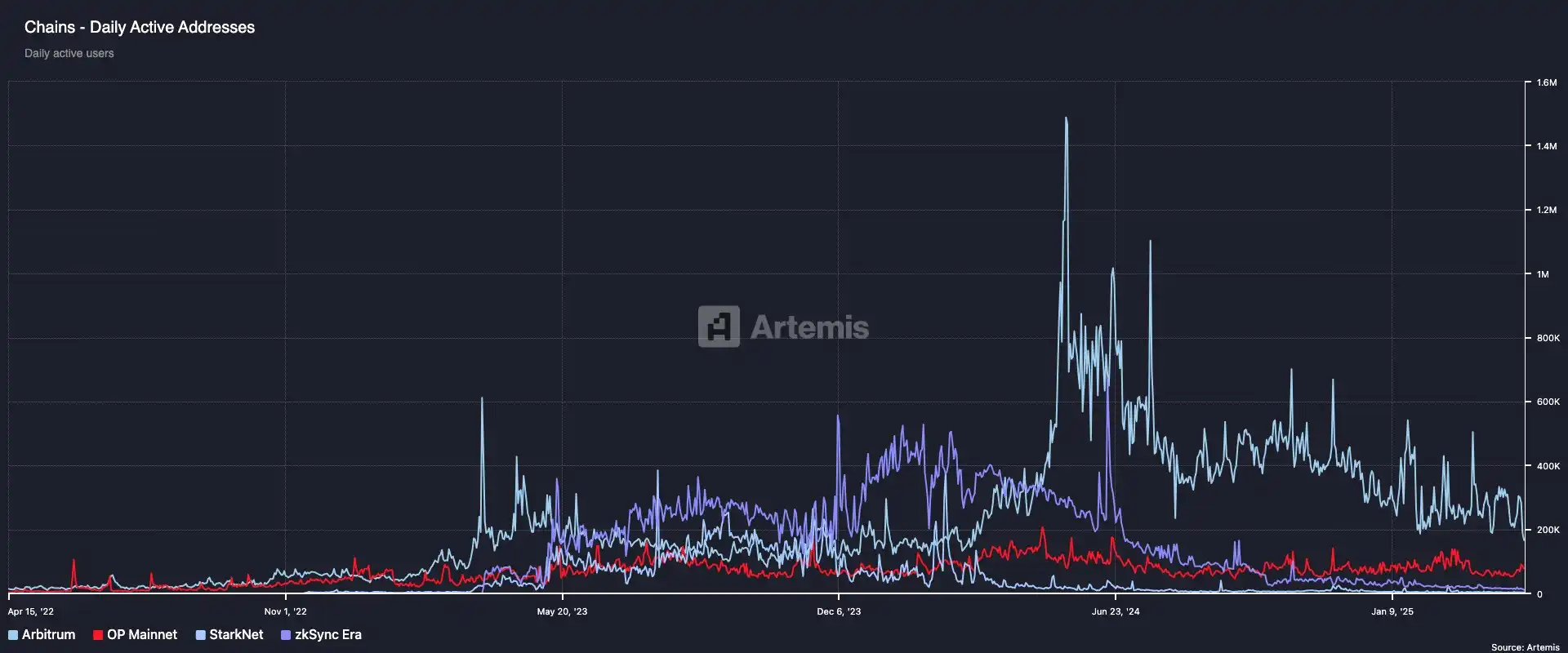

Not only ZKsync, but the "head players" of Ethereum Layer 2 are not having a good life. In March 2024, Ethereum completed its Cancun upgrade and will bring attention back to the Layer2 field. However, according to Artemis data, the number of daily active addresses of ZKsync, Arbitrum, Optimism and Starknet seems to be in a slump after reaching its peak in the second quarter of 2024. Among them, ZKsync had peaks in active address in April and June 2024, with a maximum of nearly 1.4 million, far exceeding other Layer 2 projects. However, after the airdrop on June 17, the number of active addresses dropped rapidly and had fallen to a low point by the end of July. Although there was a slight rebound in the future, it still hovered below 200,000 for a long time.

As competition on the Layer 2 track becomes fierce, ZK Rollup projects such as ZKsync have failed to maintain their early advantages. The rise of Base has attracted a large number of users with its low threshold of Coinbase smart wallet and 4 million transactions that are almost twice the average daily transaction volume of Arbitrum, and its market share has been diverted. In addition, Ethereum ecological applications, such as meme, DeFi, etc., were diverted by Layer 1 such as Solana, resulting in many L2s gradually becoming "no-used ghost chains".

Related readings:Layer2 Mid-Year Review: Base surpasses Optimism to become the second largest Layer2; zkSync and Satrknet face ecological dilemma》

No comments yet