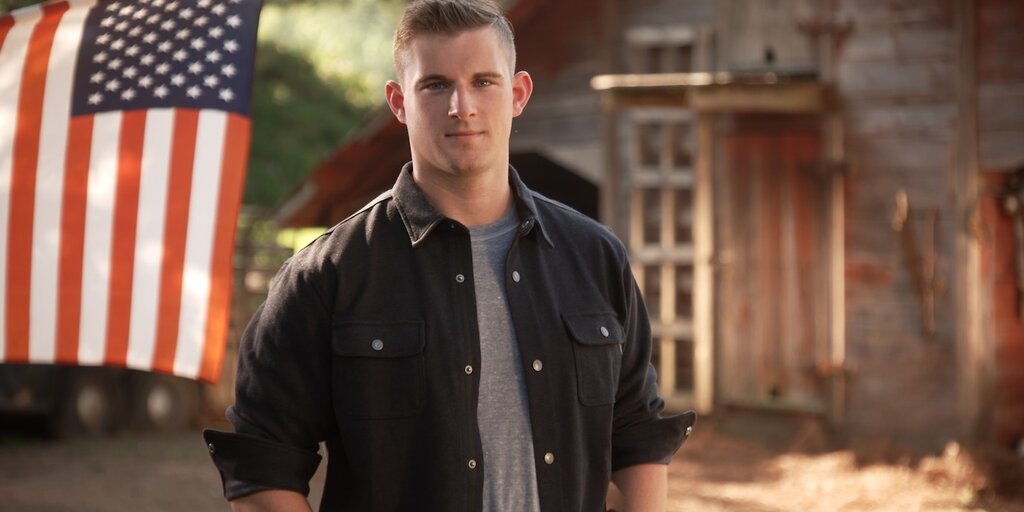

According to Bo Hines, Executive Director of the President’s Council of Advisers on Digital Assets, the Trump administration is exploring the creation of a U.S. Bitcoin Reserve funded through alternative government revenue streams.

Speaking in a recent White House interview with investor Anthony Pompliano, he revealed that officials are assessing the use of revenue from tariffs and the revaluation of existing gold reserves to fund Bitcoin purchases.

Alternative Funding Options

“We’re looking at many creative ways, whether it be from tariffs, whether it be from something else. I mean, there are literally countless ways in which you can do this,” Hines said in the interview.

He noted that future tariff revenue could offer the government an external, non-budgetary stream of funding that would allow it to accumulate Bitcoin without reallocating current assets. The official also disclosed that several federal agencies, including the Department of Commerce and the Treasury, are coordinating behind the scenes through a dedicated interagency working group.

One idea gaining momentum involves the Bitcoin Act of 2025, a legislative effort led by Senator Cynthia Lummis. The bill proposes revaluing gold certificates held by the U.S. Treasury, which are currently listed at a historical price far below today’s market rate.

According to Hines, the Treasury could revise the valuation of its gold certificates from $43 an ounce to roughly $3,200, the current market price, creating a paper surplus that could be redirected toward Bitcoin purchases without the need to sell any physical gold.

The executive director of the Crypto Council confirmed that the administration is open to all possibilities and intends to acquire as much Bitcoin as possible. However, he also acknowledged that most of the proposals are still subject to approval from Congress.

The Strategic Bitcoin Reserve will initially be funded using Bitcoin seized through criminal and civil forfeiture cases, an approach the administration says places no burden on taxpayers. Additionally, officials are exploring budget-neutral methods to expand the reserve, including internal portfolio rebalancing and generating new sources of external revenue.

Crypto Framework and Blockchain Solutions

Beyond the Reserve, the White House is also finalizing a national digital asset framework. According to Hines, the framework aims to clarify federal policy on key crypto issues, including tokenization, staking, and stablecoin development.

He noted that the administration is determined to make America the “crypto capital of the world,” delivering on one of President Trump’s campaign promises.

The 29-year-old also championed blockchain technology and digital assets as the key to modernizing how Americans interact with money. In his opinion, the traditional banking system is outdated due to delays, hidden fees, and a lack of transparency. He added that blockchain and digital assets offer a solution to such problems.

No comments yet