- A recent update spurred speculations around the approval of an XRP ETF

- While the short-term outlook might be positive, XRP remains susceptible to market risks

XRP’s weekly rebound from its sub-$0.95-levels was triggered by a high-impact FUD flush. However, it would appear to be a calculated re-accumulation play, rather than a random opportunistic trade.

In fact, the move coincided with broader sentiment rotation following key regulatory headlines. Specifically, the confirmation of Paul Atkins as Chair of the U.S. Securities and Exchange Commission (SEC) on 9 April. Needless to say, this has intensified market speculation about a potential shift in the Commission’s position, particularly with respect to the long-standing SEC vs. Ripple case.

That’s not all though, as it also raises hopes for a much-anticipated approval of an XRP Exchange-Traded Fund (ETF).

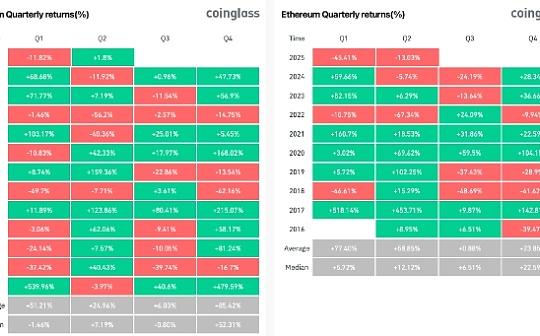

Key developments shaping XRP news in Q2

The XRP market remains buoyed by growing optimism surrounding regulatory clarity and the potential for an XRP-focused ETF.

On 9 April, the U.S. Senate confirmed President Trump’s nomination of Paul Atkins as SEC Chair. Atkins is widely perceived as crypto-friendly, increasing the likelihood of regulatory de-escalation.

Adding fuel to the narrative, the SEC and Ripple jointly filed to suspend the ongoing appeal, pushing Ripple’s ‘reply’ deadline beyond 16 April.

As a result, market analysts believe the SEC may be delaying action until Atkins is formally sworn in, potentially paving the way for a 3–1 vote in favor of withdrawing the appeal.

The market response was immediate. Following the XRP news, the altcoin surged a staggering 14.28% in a single day, pushing XRP above $2 after three consecutive days of downward pressure.

Despite trading more than 30% below its post-election peak of $3.30, these recent developments could significantly reshape the altcoin’s valuation outlook for Q2.

Market sentiment and ETF buzz

Following the XRP news-driven catalyst, Open Interest (OI) surged from $2.87 billion to $3.26 billion, signaling a sharp hike in leveraged participation.

On Binance, long positions made up nearly 70% of the XRP/USDT perpetual market, highlighting a strong directional bias towards further upside.

Meanwhile, short-term holders (STHs < 155 days) exited the prolonged capitulation phase they entered into following the drop to $1.60. This cohort appeared to have strategically offloaded positions to lock in profits from XRP’s January rally, which peaked near $3.30.

And, the good news? The number of addresses holding more than 10,000 XRP surged to an all-time high, nearing the historic 300k-mark.

This cohort now represents approximately 4.28% of all XRP addresses – Indicating a growing concentration of high-stake holders and possible institutional confidence building under the surface.

This is precisely where Exchange-Traded Funds (ETFs) enter the conversation.

XRP-related ETF speculation is heating up, especially in the wake of the pro-crypto shift at the SEC. Combined with XRP’s growing institutional footprint, the case for an ETF has never looked more credible.

Hence, short-term volatility, driven by weak-hand shakeouts, is to be expected.

However, these underlying metrics will be key. Firstly, for XRP to capitalize on the narrative shift and subsequently, to fuel a bullish Q2 trajectory.

No comments yet