When Hyperliquid was in dispute over the large-scale liquidation incident of JELLYJELLY, the traditional trading platform's move to launch the token perpetual contract exposes the decency of CEXs: CEX uses precise sniping of DEX's liquidity crisis, not only reaps short-term benefits, but also weakens the ecological foundation of its opponents. The competition for on-chain liquidity has entered a white-hot stage. In this war of on-chain liquidity without gunpowder, the CEXs also exposed their anxiety about Hyperliquid.

Today's trading platform battlefield has been transferred to the chain. The leading trading platforms are seizing new positions in different ways: Bybit has pushed the share of spot trading from 3.2% to 8.51% with the small currency craze; OKX quietly harvests traffic on the chain through Web3 wallet.

Those who win the chain win the world. In order to become the "HBO" of the new era, DEX and CEX have fallen into a "warlord melee period". The battlefield boundaries of traditional trading venues are melting, and the difference between the chain and the chain is no longer so important: "Black cats and white cats, if you can catch mice, you are a good cat."

With Hyperliquid's currency listing effect and TVL gradually falling and being surrounded by all parties, Perp DEX has become a beachhead coveted by various forces, but it also provides a breakthrough opportunity for new forces like Aster, which also happens to be in line with the strategic layout of Binance's competition for on-chain liquidity.

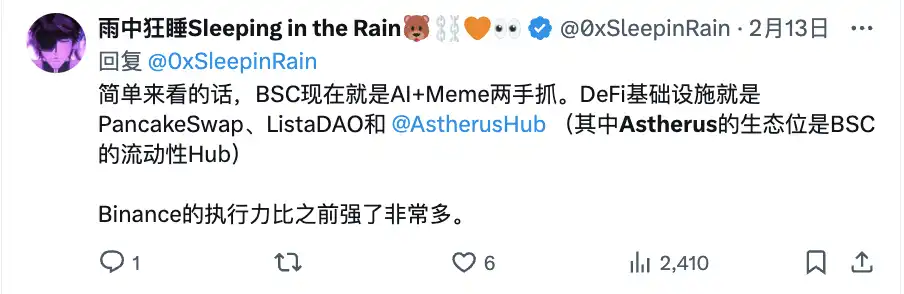

BNB Chain wants to revive again, where is the entry point? The analysis of encrypted KOL sleeping in the rain is very good: AI, MEME and DeFi.

Pancake and lista are still well-known YZi Labs. They have invested wholly and have already taken binance projects. Ordinary people continue to bet on the development of the Binance system. In comparison, Aster is an earlier opportunity to ambush.

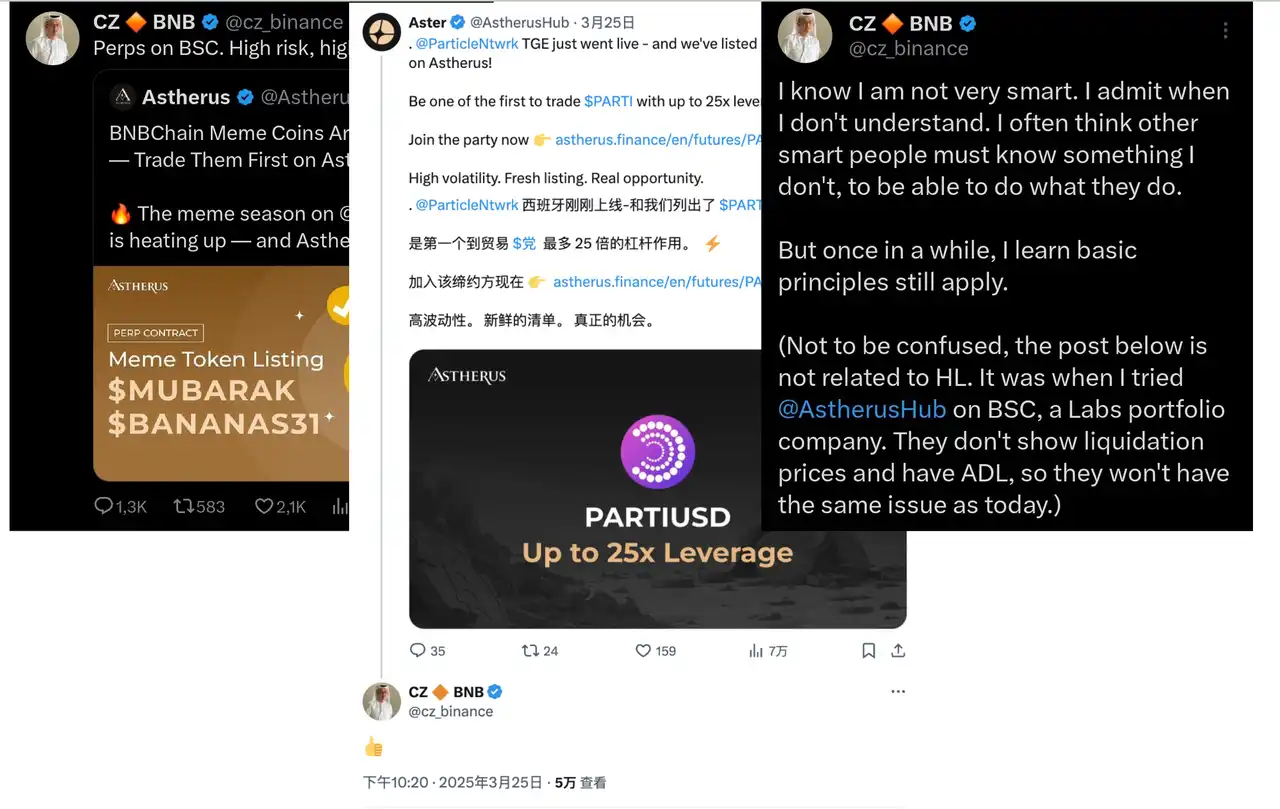

Because of CZ's multiple interactions with Aster, searching for Aster and Astherus (formerly known as) on Twitter, rows of keywords are binance's own son and CZ's own son. The community's expectations for Binance on it are full.

Beyond hyperliquid, Aster is going to be the top Perp DEX of BNB

On March 31, 2024, Astherus (formerly known as) completed strategic evolution. After merging and upgrading with APX to Aster, this agreement, which once focused on pledged asset liquidity, officially pointed its sword to the decentralized perpetual contract market.

At first, Aster's positioning was more like a pledged asset liquidity agreement. Based on this positioning, it launched two products, AstherusEx and AstherusEarn, which started from the perpetual contract decentralized trading platform and DEFI mining strategy, respectively, to support derivative trading of mainstream assets and allow users to pledge assets to obtain profits.

Product Reinvention: Aster's Perpetual Contract Revolution

In this strategic upgrade, the merger of Astherus and APX into Aster is not a simple brand iteration, but a comprehensive reconstruction from the underlying architecture to product logic. The new protocol anchors the goal of "Perp DEX ultimate form" and directly benchmarks hyperliquid.

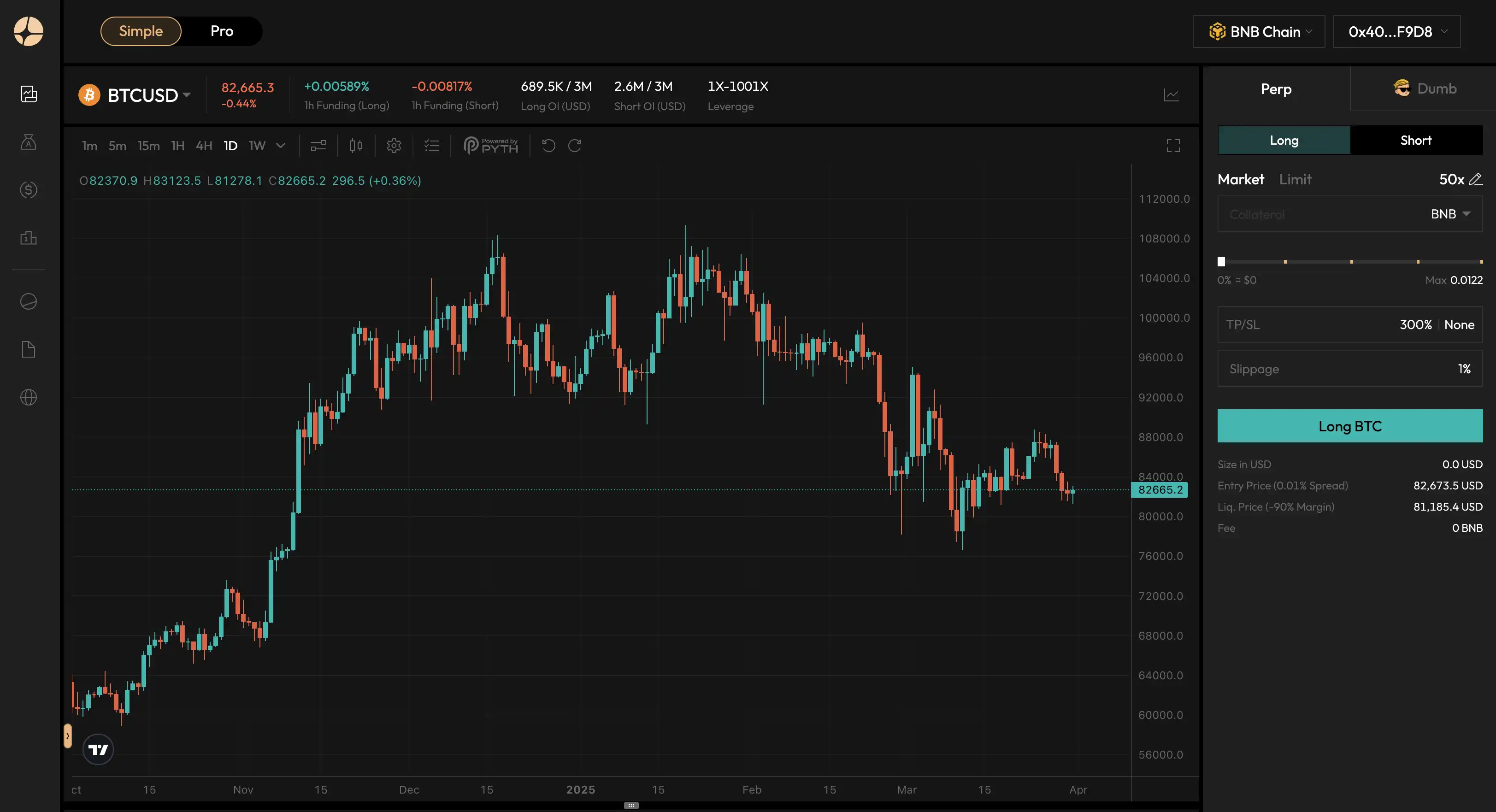

To meet the needs of different users, Aster has developed two trading modes: "Simple" and "Pro" and "Pro". The simple model provides the simplest trading experience in the form of a fully-on-chain perpetual contract, supporting up to 1001 times leverage BTCUSD trading pairs, covering a wealth of assets including cryptocurrencies, foreign exchange and popular Meme coins, and is compatible with the BNB Chain and Arbitrum networks. Users do not need complex charts, they can complete transactions with just one click, which greatly reduces the threshold for on-chain transactions.

It is worth mentioning that Aster has also innovatively launched the "Dumb" prediction model. Users can predict and participate in transactions based on minute-level asset price fluctuations. This novel feature has been launched on both BNB Chain and Arbitrum networks, further enriching the user's on-chain experience.

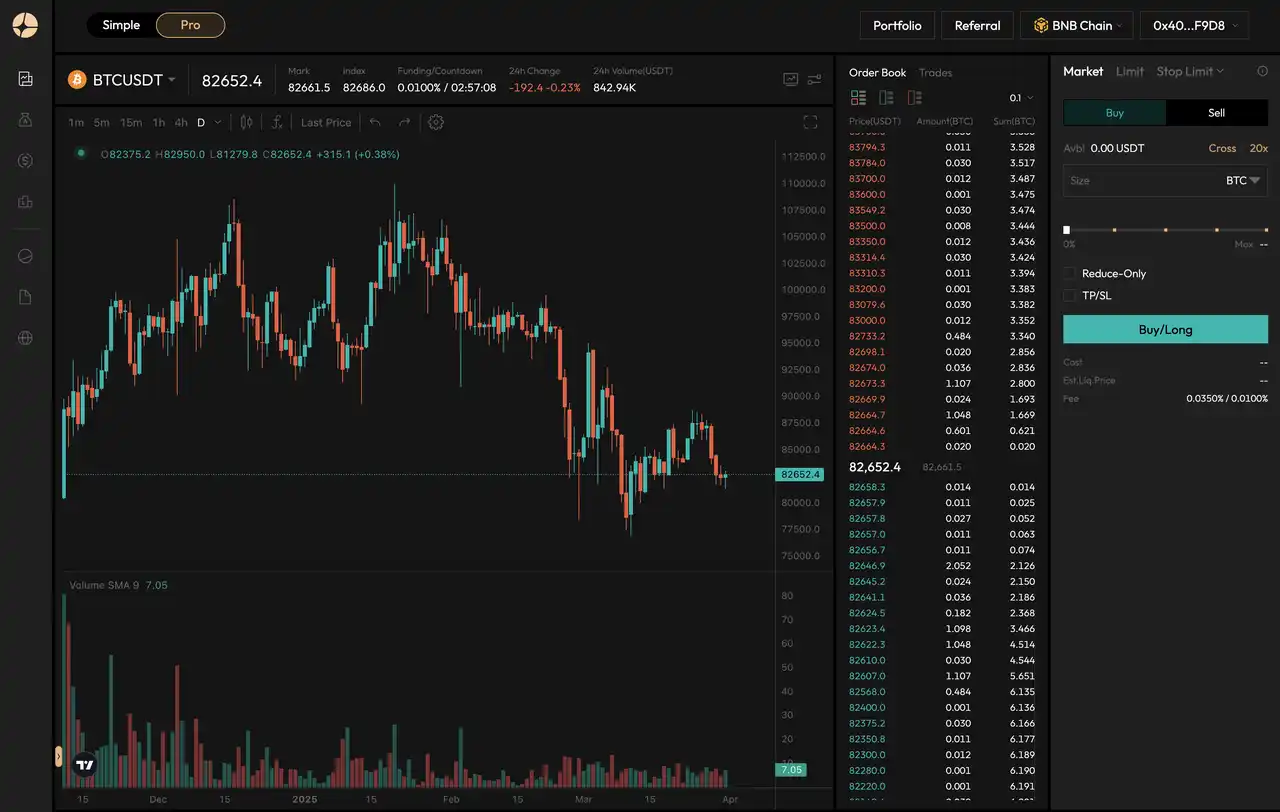

In contrast, the Pro model meets more professional and advanced trading needs. This model adopts an on-chain order book mechanism, with deep liquidity, real-time data and advanced trading tools.

Currently, the Pro model supports USDT perpetual contract trading pairs of 14 mainstream currencies including BTC, ETH, DOGE, SOL, XRP, SHIB, BNB, TRX, LINK, SUI, PEPE, LIATA, LO, and ZK, and supports BNB chain, Ethereum and Solana networks.

In terms of transaction fees, the Pro model has been optimized and upgraded, with the Maker fee reduced to 0.01% and the Taker fee adjusted to 0.035%, which significantly increases the attractiveness of high-frequency traders.

According to the coin Mubarak and BANANAS31 perpetual contracts on Aster's previous few times, it can be seen that Aster's listing strategy for a long time afterwards will also be mainly Binance Alpha's coins. In addition, Aster will also launch some popular meme coin, such as the latest Musk concept's solana meme coin RFC.

Two points system, how to use Aster airdrop?

After completing brand upgrades and product reshaping, Aster's series of actions have revealed the prelude of TGE (token generation event). With the continued fermentation of rumors that "Binance will be launched", Aster's airdrop points system has undoubtedly become the most noteworthy part.

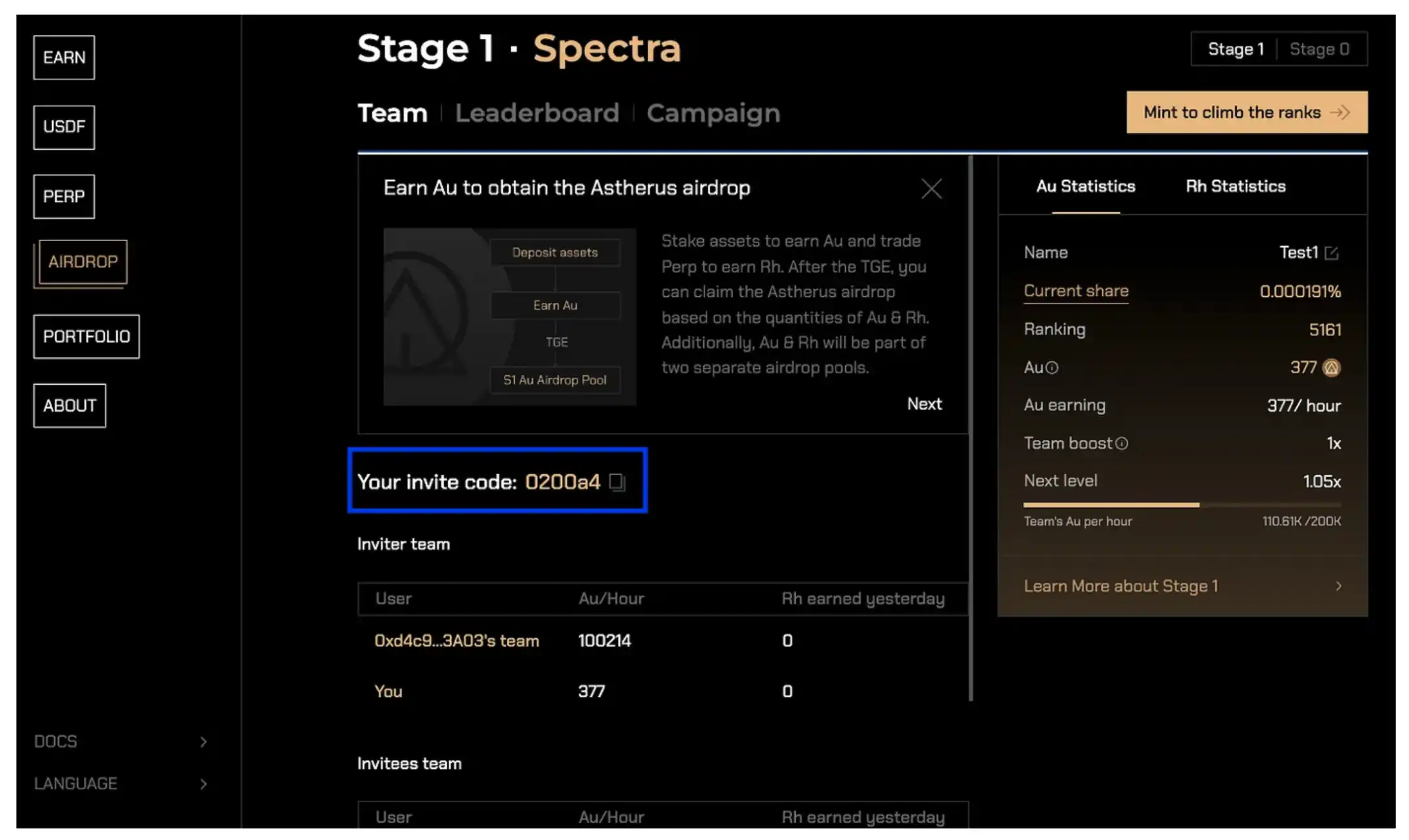

Currently, Aster has two points systems: Rh and AU. Simply put: Rh points are suitable for active players, the more transactions, the higher the profit; AU points are suitable for lazy players, and pledge assets to make airdrops.

As Aster's positioning shifts from liquid staking to Perp DEX, it means that the product logic shifts from "staking mining" to "transaction mining". Judging from the current rhythm and resource inclination, the proportion of Rh should be much higher than that of AU. Users who really want to get large airdrops should focus on obtaining Rh points, so we first focus on how to play the Rh points system.

1. Rh points (trading mining mode):

The Rh point gameplay is that the more transactions, the more points it earns, which is suitable for friends who like to operate frequently. However, it should be noted that in Aster's trading points system, Rh points can only be accumulated by using Aster Pro mode for perpetual contract trading (the transaction volume in Simple mode and "Dumb" mode is not included)

Rh points are subject to weekly settlement Epoch mechanism. Each natural week is a points cycle. At the end of the cycle, the system will clear and reset all users' Rh points, and start ranking again in the next week. However, weekly settlement zero does not mean a waste of previous efforts. The platform will record the user's points performance in each week, as one of the important basis for future airdrop allocation. There are three specific ways to obtain Rh points:

Professional model trading:Perpetual contract trading in Pro mode is the basic way to get Rh points. As long as the effective trading volume is generated, it will be converted into Rh points in a certain proportion. The larger the transaction scale, the more points you get.

Recommended code binding and teaming:Invite friends to form a team. The team's point bonus will allow you to get more points. The team's maximum bonus is 20%. You can search for some "full team" invitation codes on Twitter to join.

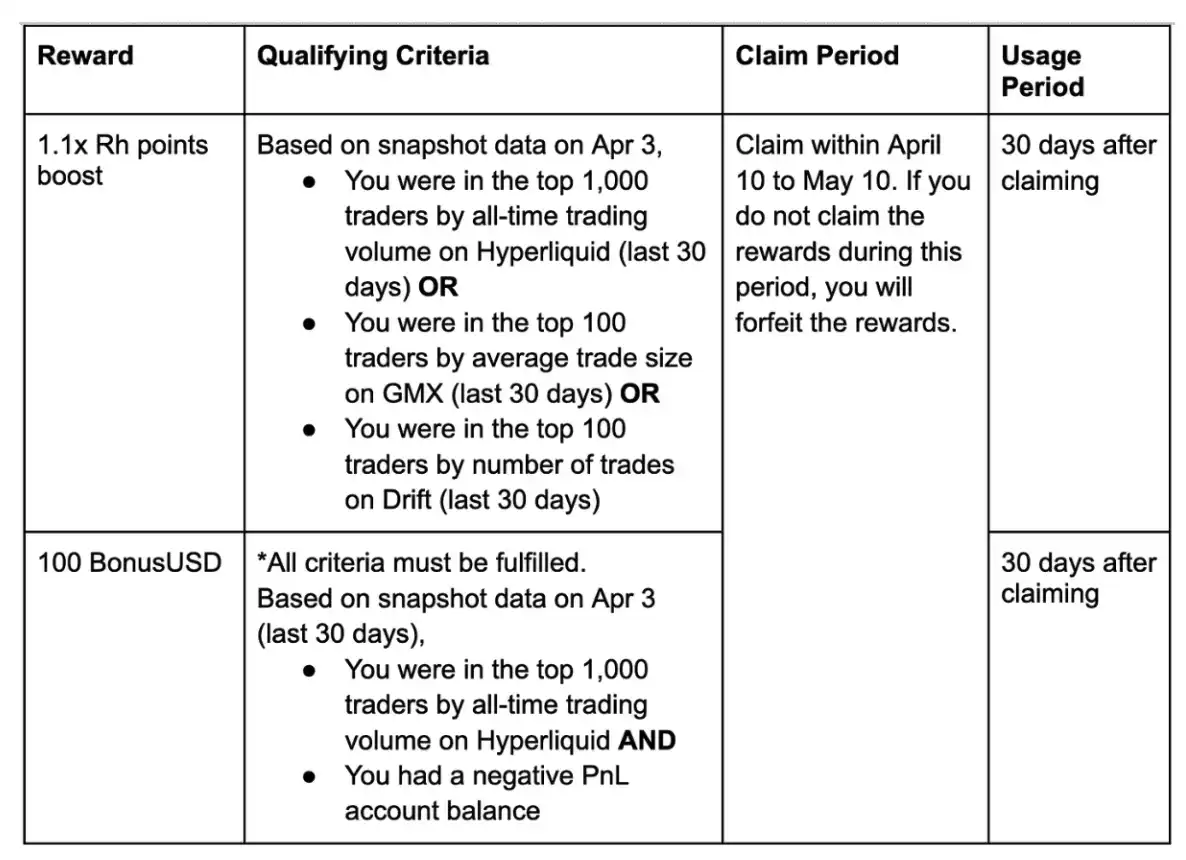

"Treasure Boost" Event:If you have recently had an active transaction history in Hyperliquid (top 1000), Drift (top 100) or GMX (top 100), as long as you trade with the same wallet address, the system will automatically identify it. Those who meet the criteria will receive an additional 1.1 times Rh points bonus, and you can also receive a BonusUSD contract experience bonus of US$100 (can be used for collateral transactions).

It should be noted that the Aster platform will refresh the user's transaction volume statistics and Rh points data every hour. Rh points do not automatically superimpose by time, but are entirely determined by your actual trading behavior and the bonus benefits you enjoy. In other words, if you have new transactions generated during this hour (and receive bonuses when the corresponding conditions are met), then your points will reflect these new results when the full point is refreshed; otherwise, if there is no transaction within a certain period of time, the points will not increase in vain.

2. AU points (living earning mode):

The way to play AU points is very simple, it is to earn points by pledging assets. You only need to mint and hold some assets in the Aster ecosystem to easily obtain AU points, which can participate in the platform's airdrop rewards in the future.

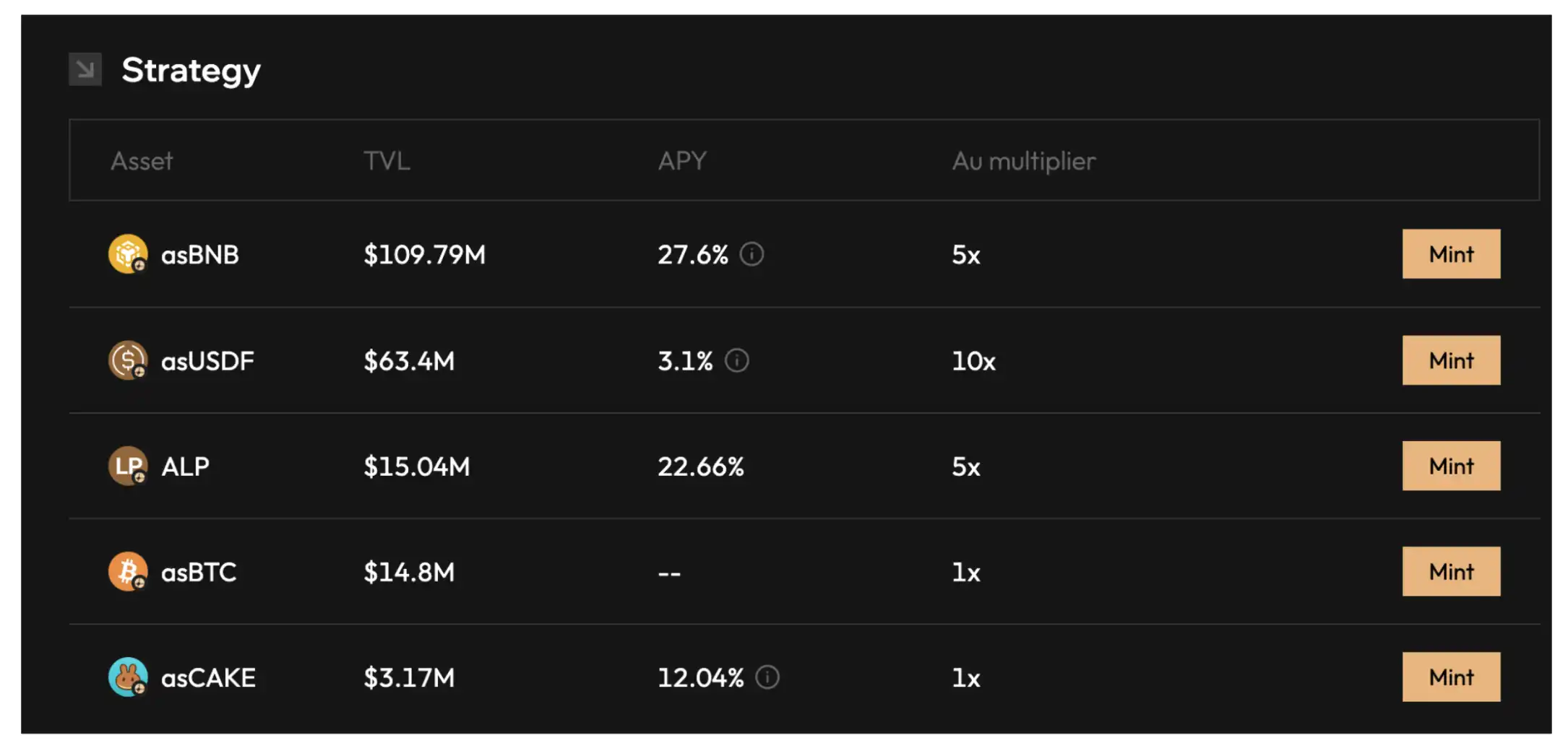

Holding as series assets (such as mainstream assets such as asBTC, asBNB, asUSDF, asCAKE, etc.):Enjoy up to 10 times the bonus points. Currently, the most multiples are asUSDF 10 times, ALP and asBNB 5 times, and the points are automatically accumulated every hour. The latest specific points multiples and introductions are as follows:

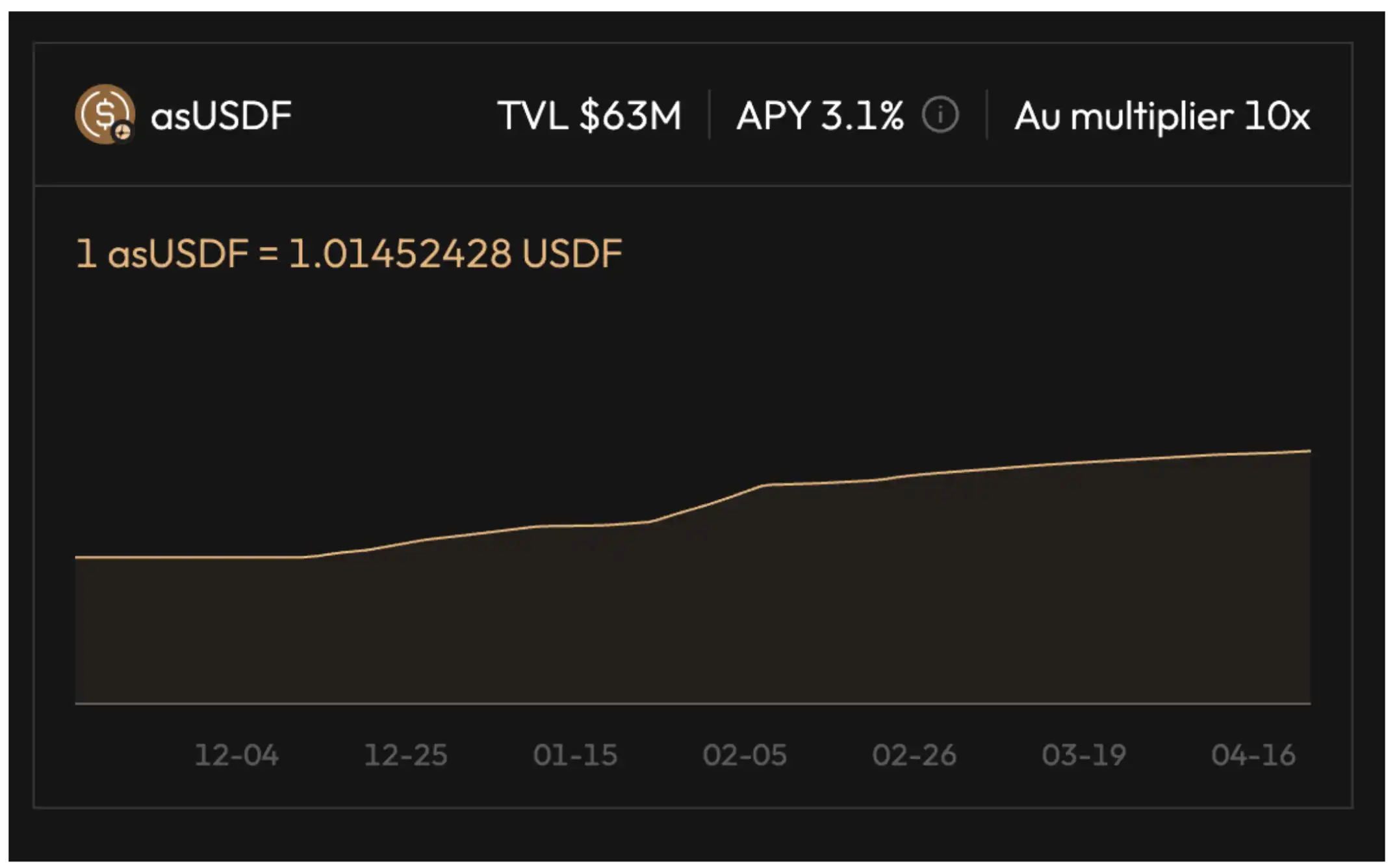

Hold USDF Stablecoins:You can get 10 times AU points bonus, which is also accumulated every hour. USDF is a revenue stablecoin issued by the platform. AsterEarn has reached in-depth cooperation with Binance asset management platform Ceffu to provide fund custody for CeDeFi asset products and strictly implement comprehensive audits. The annualized rate of return is currently 3.1%.

Holding ALP and asBNB tokens:5x AU points bonus. ALP is used to provide liquidity to AsterEX's simple model, earning points while enjoying the platform's trading income share.

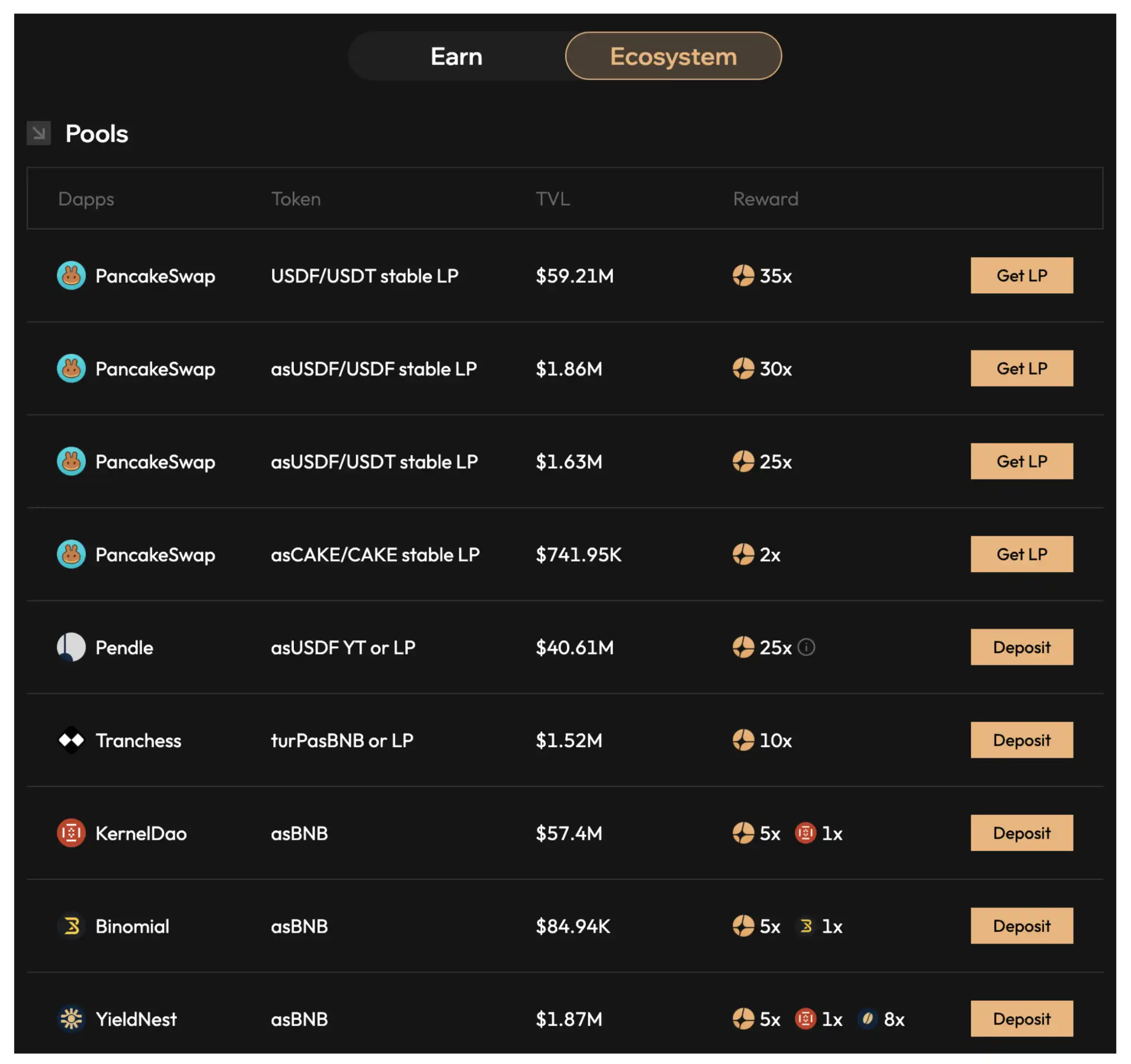

Provide liquidity (LP mining):In addition, the bonus multiples of some related ecological pools are also very large. LPs on PancakeSwap can get up to 35 times points, while Pendle platform has 25 times points, and the income is directly full.

The calculation method of AU points is based on the value of the pledged assets in the wallet every hour, multiplied by the corresponding points multiplication, and then added team bonuses and recommendation rewards, which is the number of points received every hour. For example: you hold 0.5 BNBs. At that time, the price of BNB was US$670, and the corresponding asBNB points ratio was 5 times, so you will get 0.5 × 670 × 5 = 1675 points per hour. If the price of BNB changes, the points will also change, which is very transparent.

Future product planning

1. Short-term plan:

VIP Plan: Launch a multi-level VIP system, with the larger the transaction volume, the lower the handling fee, providing active users with the lowest transaction fee rate on the market.

Recommendation plan: The current anti-commission ratio is 20%. On this basis, Aster will launch a hierarchical commission system. The more processing fees generated by recommending friends transactions, the higher your commission ratio will be, helping users fully utilize the network effect.

2. Long-term plan: from infrastructure to innovation

Aster Layer 1 Public Chain: Develop the Aster Layer 1 Public Chain specially used for on-chain derivative transactions, providing ultra-high-speed transaction confirmation, low fees and specially optimized transaction infrastructure to create a professional-level decentralized financial ecosystem.

Aster native blockchain browser: A native browser tool is launched in conjunction with Layer 1, allowing users to intuitively and real-time view on-chain transactions, points and capital flows, providing traders with a more transparent and friendly user experience.

What are the advantages of Aster when aiming at Hyperliquid?

In 2024-2025, when the on-chain perpetual contract trading platform is rapidly expanding, Hyperliquid is undoubtedly one of the fastest players. However, under the rapid growth, the $JELLYJELLY burst incident completely tear open the systematic shortcomings of such platforms in extreme market conditions. The liquidation mechanism is opaque, the insurance pool is almost hollowed out, and the lack of automatic risk release tools. Aster has given its own solution in advance on these possible problems.

A more complete risk control system and richer trading experience

The problem with Hyperliquid is that its liquidation system is almost opaque to users. In the JELLY incident, a large number of users triggered a breakdown without warning, and even could not know the calculation logic of the liquidation price. Although the platform documentation mentions that its price oracle is based on the weighted median of spot prices of multiple CEXs, this approach has extremely limited anti-manipulation capabilities in low-liquidity markets. At the node where the treasury was almost zeroed, the platform finally chose to artificially freeze the market and roll back the settlement price, which completely shattered the trust basis of its decentralized trading platform.

Aster solves these risk backlogs from an architectural level. The platform sets an independent leverage upper limit and initial/maintenance margin threshold for each trading pair to avoid systemic impact on the system due to high leverage. For example, highly volatile assets such as Meme coins force leverage, while blue chip trading pairs such as BTCUSD can provide up to 1001 times leverage within a safe range. In terms of price oracles, Aster integrates multi-source prophecy systems such as Python, Chainlink, Binance Oracle, etc., greatly improving the authenticity of prices and anti-manipulation capabilities.

More importantly, Aster has deployed a standardized automatic position reduction mechanism (ADL), which can automatically reduce positions in reverse accounts with excessive leverage and excessive profits in extreme market conditions to avoid the spread of risks to the entire system. At the same time, each asset pair adopts an independent position and insurance pool design. Once a burst occurs, it will only be handled within the market and will not "touch the whole body."

This means that Aster does not wait until the accident occurs before "repairing the problem", but set up a "firewall" at the bottom of the system to isolate and reduce all foreseeable risks as much as possible.

Let’s look at the trading experience. Hyperliquid's current trading product structure is relatively single, mainly based on the order book model, mainly serving professional traders, and the user group tends to be high-frequency quantization and senior speculators. But this also makes it seem unfriendly enough among novice users, Meme asset trading, or users who have a demand for cross-market trading.

Aster adopts a dual-mode trading design: Simple mode is suitable for one-click ordering, with a minimalist interface and a lightweight experience without charts.

The Pro model is equipped with professional tools such as complete order book, K-line chart, and depth chart to meet the refined transaction needs of advanced users. The platform has also innovatively launched the Dumb model, providing users with minute-level predicted trading gameplay, further expanding the trading possibilities.

It can also "provide blood" without relying on foreign aid

Although Hyperliquid has a liquid market-making mechanism, its treasury (i.e., the opponent's fund pool) is almost collapsed when it encounters large-scale forced normalcy. A single asset burst can put the entire platform at risk of systemic liquidation. This architecture naturally relies on continuous injection of external liquidity and is fragile and unsustainable.

At this time, the advantages of Aster's predecessor as a liquidity hub are reflected: it can "provide blood" without relying on foreign aid.

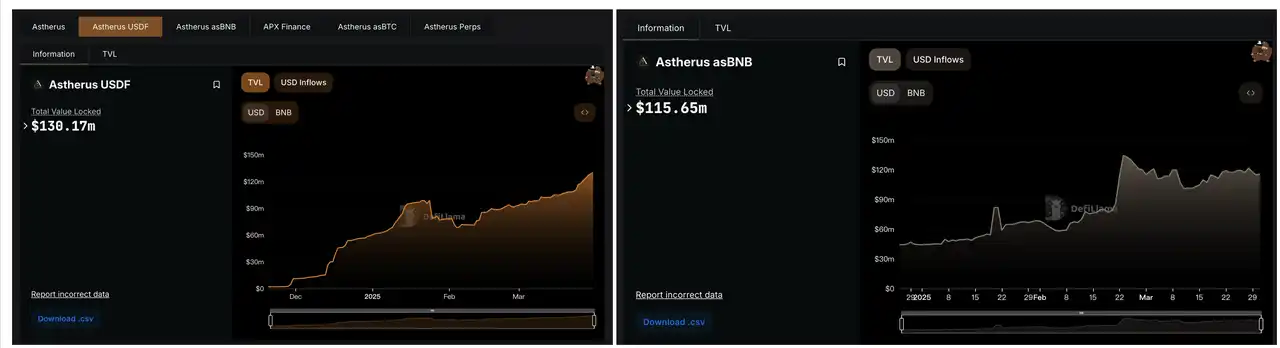

In the past year and over the past year, Aster launched the USDF stablecoin, which is currently at $130 million; it has in-depth cooperation with BNB Chain to launch asBNB TVL currently at $115 million.

Source: DefiLama

Hyperliquid's TVL has now fallen back to $177 million after he was attacked by rule arbitrage this month. This means that with TVL, which is USDF and asBNB alone, Aster's TVL scale has exceeded Hyperliquid's HLP treasury.

What's more, as of writing, the latest data displayed on Aster's official website is that Aster's current total TVL is US$300 million.

Aster's own TVL, combined with on-chain market making (MM strategy), not only strengthens the endogenous liquidity of the protocol, but also enhances the sense of security and stickiness of user participation. This liquidity strategy allows Aster to have stronger "seismic resistance" in market volatility.

The revival of the BNB chain

More importantly, Aster binds these products to the BNB ecosystem extremely closely, adapts to Binance Wallet, YZi Labs is wholly owned by investment, and CZ interactions frequently. Aster can be said to be able to enjoy the shade by relying on a big tree.

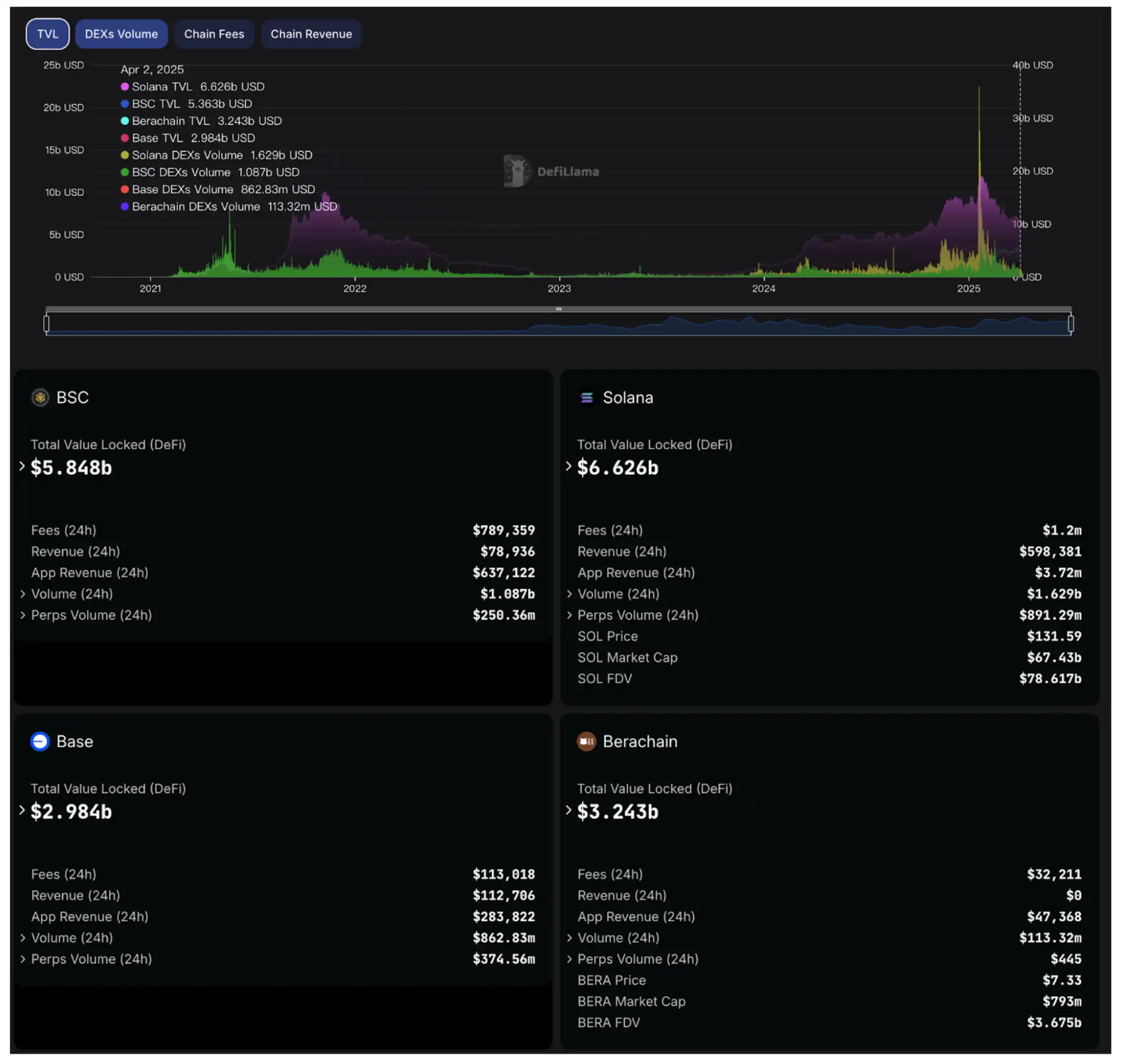

After all, the BNB chain itself is in a revival phase.

Many new friends may not know that when DeFi narrative dominated the market from 2020 to 2023, BNB Chain, which was also called BSC, was once the second largest public chain after Ethereum. With its efficient and low-cost architecture, BNB Chain has attracted a large number of users and developers and has become an indispensable force in the DeFi and NFT ecosystem.

Although BNB Chain has not made much move in the past two years, since CZ was released from prison in November this year, he often went to BNB Chain on Twitter. In addition to the various operations, the ecology has recovered significantly.

In terms of infrastructure, BNB Chain has an opBNB layer two expansion solution, which further optimizes transaction speed and cost, and greatly improves the scalability of the chain. At the same time, with Greenfield's data storage solution launched, BNB Chain's infrastructure capabilities have been further consolidated, providing more options for developers and users.

On-chain capital liquidity has rebounded, and the popularity of token concepts has increased. In addition, BNB itself has always been a public chain token with steady profits. All of this indicates that new opportunities are brewing, and "BNB Chain is reviving" has become a new trend.

From more direct data, BNB Chain is very trending to surpass solana, whether it is DEX trading volume or TVL.

No comments yet