原文标题:New State of the Network: Unpacking Circle IPO Filing and $USDC On-Chain Footprint

Original author: Tanay Ved, Coin Metrics

Original translation: Shan Oppa,

Key points:

· Circle generated $1.7 billion in revenue in 2024, with 99% of that coming from interest income from USDC reserves. Distribution costs paid to partners such as Coinbase and Binance totaled $1.01 billion, reflecting the key role of the trading platform in expanding USDC coverage.

· Total USDC supply has rebounded to $60 billion, with an average transfer of $40 billion in 30 days – indicating market confidence and a recovery in cross-chain adoption. However, USDC remains highly sensitive to interest rate changes, competitive pressures and regulatory developments.

· USDC's usage on major trading platforms continues to grow, currently accounting for 29% of Binance's spot trading volume, thanks to Circle's strategic partnership.

· Looking ahead, the next phase of Circle may depend on diversification from passive interest income to active revenue streams associated with tokenized assets, payment infrastructure and capital market integration.

introduction

Circle, the largest stablecoin issuer in the United States and the company behind the $60 billion USDC, recently submitted an IPO application, providing a window into the financial health and strategic prospects of the underlying company in the cryptocurrency space. As the only way to get direct access to the fastest-growing verticals in the open market, Circle’s application is at a critical moment. Although IPOs may still face delays due to market conditions, it coincides with the beginning of stablecoin legislation taking shape and competition between issuers and blockchains intensifies.

In this article, we dissect the key points of the Circle IPO application documents and combine them with USDC’s on-chain data to understand how Circle generates revenue, interest rates and other factors affect its business, and the role of platforms such as Coinbase and Binance in shaping USDC distribution. We also explore the on-chain footprint of USDC to evaluate Circle’s positioning in an increasingly competitive landscape.

Circle's financial overview

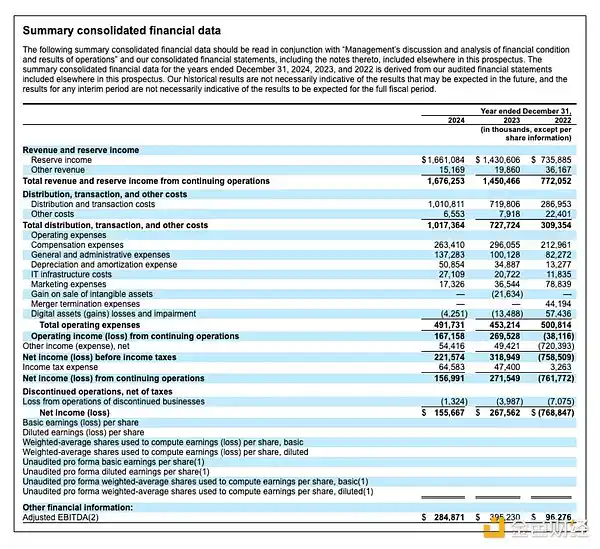

From its initial Bitcoin payments app to becoming a leading stablecoin issuer and crypto infrastructure provider, Circle has experienced a series of challenges over its 12-year journey. Growth slowed in 2023 after explosive revenue growth in 2021 (450%) and 2022 (808%), when USDC rose 88% by the bankruptcy of Silicon Valley. As of the end of 2024, Circle reported revenue of $1.7 billion, up 15% year-on-year, indicating it is turning to a more solid expansion.

Source: Circle S-1 Application Document

However, profitability declined, with net income and adjusted EBITDA down 42% and 28% to $157 million and $285 million, respectively. Notably, Circle's financial data shows that its revenue is highly concentrated on interest income from reserves, and distribution costs paid to partners such as Coinbase and Binance are as high as about $1.01 billion. However, both factors contributed to a rebound in USDC supply, up 80% for the full year to $44 billion.

On-chain growth of USDC

USDC is the core of Circle's business and was launched in 2018 through a joint venture with Coinbase. USDC is a tokenized representation of the US dollar, allowing end users to store value in digital form and trade on the blockchain network, enabling near-instant low-cost settlement. It follows a full reserve model and is backed by highly liquid assets such as short-term U.S. Treasuries, overnight repurchase agreements and cash held in regulated financial institutions at a 1:1 ratio.

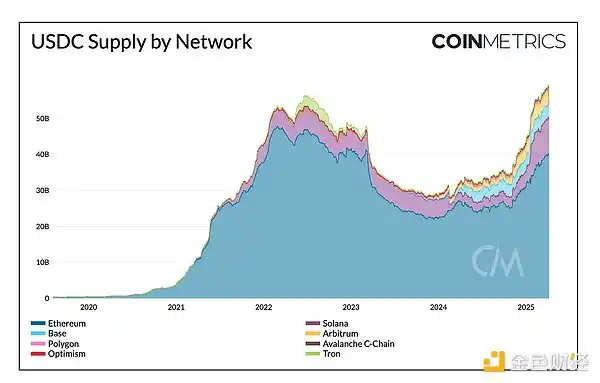

来源:Coin Metrics Network Data Pro & Coin Metrics Labs

The total supply of USDC has grown to about $60 billion, ranking second-largest stablecoin, behind Tether's USDT. Despite its market share being under pressure in 2023, it has since rebounded to 26%, reflecting a recovery in market confidence. Of these, about US$40 billion (65%) is issued on Ethereum, about US$9.5 billion is on Solana (15%), about US$3.75 billion is on Base Layer-2 (6%), and the rest is issued on blockchains such as Arbitrum, Optimism, Polygon, and Avalanche.

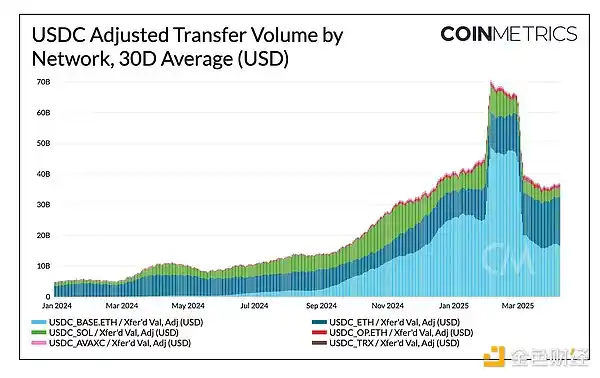

USDC also saw impressive growth in circulation speed and transfer volume, with a 30-day average of about $40 billion. In 2025, most USDC transfers occurred on Base and Ethereum, sometimes accounting for 90% of the total adjusted transfers.

Source: Coin Metrics Network Data Pro

These indicators show that USDC usage is growing as stablecoins become a substitute for dollar in emerging markets and the popularity of payments and fintech infrastructure. They also embody Circle's cross-chain strategy, with USDCs prevalent on major blockchains and supported by interoperability tools such as Cross-chain Transfer Protocol (CCTP).

Reserve composition and sensitivity to interest rates

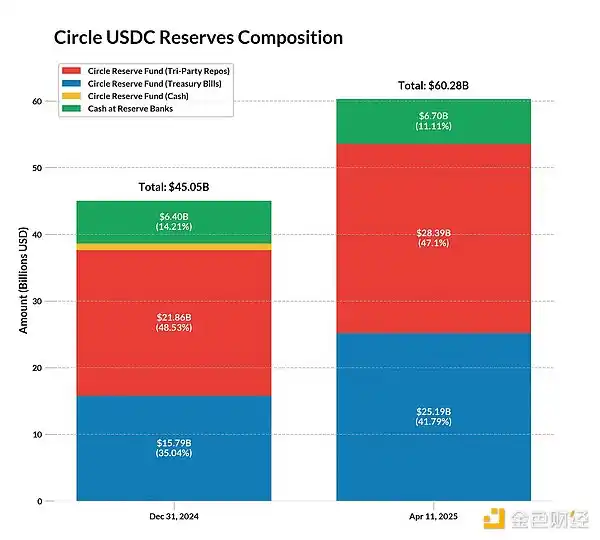

For every dollar of USDC issued, Circle will support reserves invested in a range of high-liquid, low-risk assets such as short-term U.S. Treasury bonds and cash deposits. This structure allows Circle to earn benefits from reserves while ensuring USDC holders liquidity and redemption stability. In its application documents, Circle revealed that it received $1.6 billion in reserve revenue in 2024. This accounts for 99% of its total revenue, indicating that its income structure is highly concentrated on interest rates.

Most of USDC's reserves are stored in the Circle Reserve Fund, a government money market fund managed by BlackRock that is registered with the U.S. Securities and Exchange Commission. Based on Circle's monthly certification, financial statements, and the BlackRock Circle Reserve Fund mentioned above, we found that as of April 11, US$53.5 billion (about 88%) of USDC reserves consisted of U.S. Treasury bonds and overnight buyback agreements with multiple financial institutions, all of which have less than 2 months maturity. Additionally, 11% of its reserves include cash deposited in regulated banks.

来源:Circle Transparency & BlackRock Circle Reserve Fund

Based on the $1.6 billion reserve revenue generated by Circle’s approximately $44 billion in 2024, the implied annualized rate of return is approximately 3.6%. If interest rates remain near current levels, assuming USDC supply remains unchanged or grows, Circle's reserve revenue may remain stable.

Our previous article focusing on the decline in USDC supply during rising interest rates reveals the high correlation between Circle's reserve income and universal interest rates, indicating its income model is highly sensitive to interest rate changes. While the effective federal funds rate in 2024 is between 4.58-5.33%, what does this mean for Circle in a context of falling interest rates? In the S-1 document, Circle estimates that a 1% drop in interest rates alone could result in a $441 million decrease in stablecoin reserve revenue, a key risk outlined in the document.

Given that Circle retains all earnings – unlike issuers like Ethena and Maker that distribute interest to holders, its business model remains highly sensitive to future interest rate changes, competitive pressures and regulatory evolution.

Distribution, distribution, distribution

The role of Coinbase and Binance

Circle’s IPO filing also reveals the importance of partners such as Coinbase and Binance in promoting USDC popularity. In 2024, their distribution costs reached US$1.01 billion, a significant increase of 40% from 2023 and 150% from 2022.

While Coinbase’s relationship with Circle is well known, the document reveals how closely the two are financially close. Coinbase earned $908 million in 2024 from USDC-related activities, accounting for about 13.8% of its total revenue. Under the revenue share agreement with Circle, Coinbase earns 100% of USDC interest held on its platform and 50% of USDC interest held elsewhere.

The USDC supply held on the Coinbase platform is currently 20%, up from 5% in 2022, and most of the economic benefits appear to be owned by Coinbase. The document also disclosed a one-time payment of $60.25 million to Binance, aiming to promote distribution in a similar way.

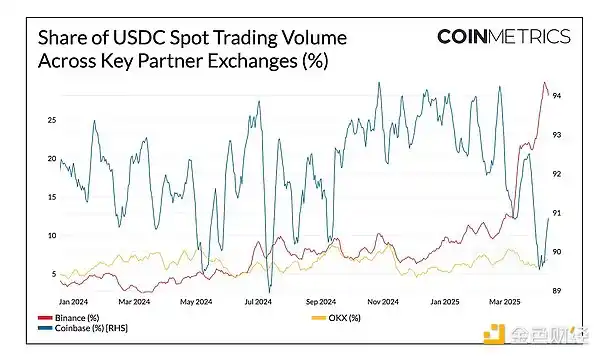

Source: Coin Metrics Market Data Feed

Judging from spot trading activities on major partner trading platforms, USDC currently accounts for more than 29% of Binance’s spot trading volume (about $6.2 billion), surpassing FDUSD after its recent dean. It is second only to USDT, which accounts for about 50% of Binance’s trading volume. On Coinbase, USDC drives approximately 90% of spot trading in the consolidated U.S. dollar and USDC market.

Despite the high cost, Circle’s distribution efforts have translated into significant trading platform-level adoption – driving USDC’s liquidity and the trading platform’s trusted spot trading volume of more than $10 billion.

Beyond trading platforms: empowering DeFi and business

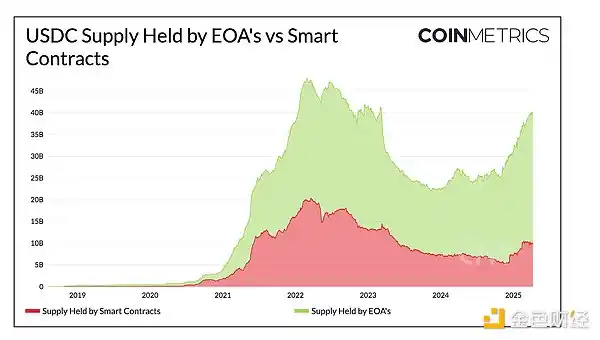

Separating the supply held in a smart contract from the supply in an externally owned account (EOA) can reveal the distribution of USDC in user wallets and applications on Ethereum. Currently, about $30 billion is held by EOA, up 66%, while about $10 billion is in smart contracts, up about 42% from a year ago. The growth in EOA balances may reflect the increase in trading platform custody and individual user holdings, while the growth in smart contracts suggests the utility of USDC as a source of liquidity for the DeFi lending market collateral and decentralized trading platform (DEX).

Source: Coin Metrics Network Data Pro

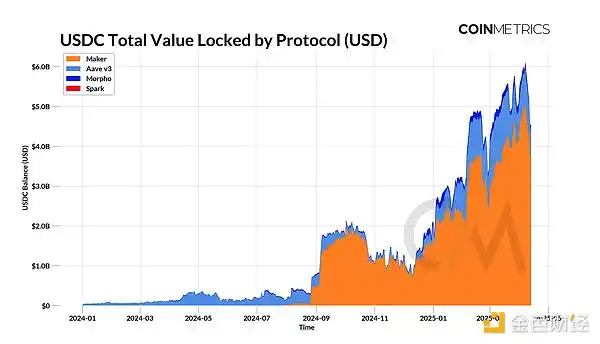

USDC continues to play a fundamental role in the DeFi lending market, with more than $5 billion locking in agreements such as Aave, Spark and Morpho (representing the portion of USDC that has been supplied but not lent). For collateral debt agreements like Maker (now Sky), about $4 billion USDC also supports the issuance of Dai/USDS through its price stabilization module.

Source: Coin Metrics ATLAS & Reference Rates

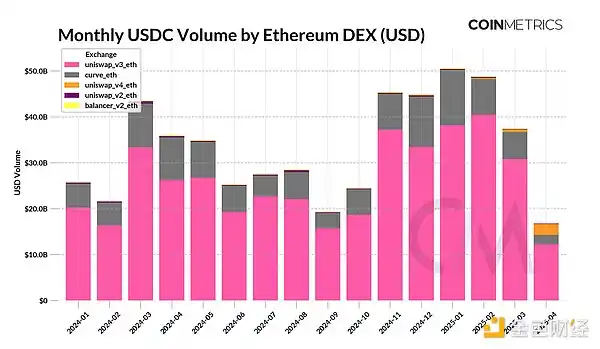

Similarly, USDC is a key source of liquidity for various DEX pools, facilitating the trading of stable value assets. It is also increasingly supporting the on-chain forex market, especially as other fiat-linked stablecoins such as Circle’s MiCA-regulated EURC are making progress.

Source: Coin Metrics DEX Data

in conclusion

USDC’s on-chain growth reflects a recovery in market confidence, but Circle’s application documents also highlight key challenges, especially high distribution costs and a heavy reliance on interest income. To maintain growth momentum in a low interest rate environment, Circle is committed to diversifying revenue through active product lines such as Circle Mint and expanding into the tokenized asset infrastructure sector through the acquisition of Hashnote, the largest issuer of tokenized money market funds.

Circle is in a good position as regulatory clarity increases, especially in the SEC's position that stablecoins are not securities. But it now faces growing competition from offshore publishers such as Tether and a new group of native American challengers looking to capitalize on policy shifting momentum. While Circle's valuation remains to be determined, its IPO will mark the first time that the open market can directly invest in stablecoin infrastructure growth.

No comments yet