April has been all about tariffs. The US government led by Donald Trump imposed broad new tariffs which primarily focused on imports. Several countries like China, India, Vietnam, and others were hit with tariffs of up to 46%. Trump did not stop at this; several investigations around pharmaceutical and electronics industries, as well as mineral imports, are underway. Amidst this, the US yet again hit China with a 245% retaliatory tariff. With this trade war taking place in full swing, several markets were being impacted. Bitcoin (BTC) has been often touted as a safe haven asset. But the king coin was seen slipping while gold stood strong.

Also Read: De-dollarization: Goldman Sachs Predicts Grim Future for U.S. Dollar

How Much Has Bitcoin Dropped Since The Tariff Announcement?

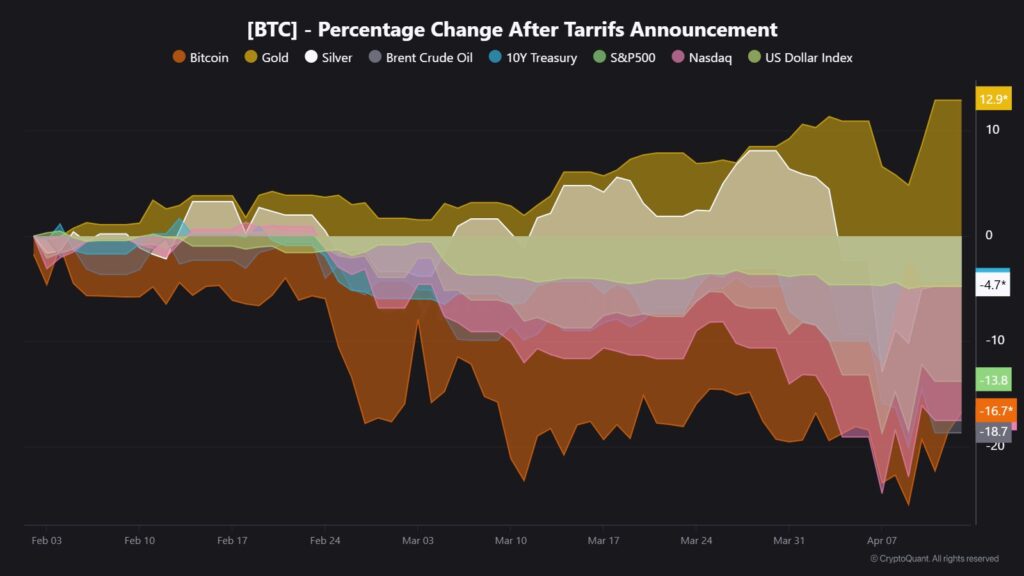

According to data curated by CryptoQuant, Bitcoin has reportedly dipped by 16.7% since the tariff announcement. The world’s largest cryptocurrency had a notable start to 2025 as it rose all the way to a peak of $109,114.88. The asset’s rise beyond $100,000 was lauded by the entire globe. Amidst this uptrend, the king coin was pushed down to a low of $74,436.68. At the time of writing, BTC encountered a dainty recovery and was trading at $83,743.99.

Also Read: Here’s How Much $2,000 in Solana at Its All-Time Low Is Worth Today

It looks like several other markets saw a much bigger drop. Even if Bitcoin is unstable, its decrease currently places it between the Nasdaq and oil. This further indicates a modest recovery but no indication of safe-haven behavior. But Bitcoin’s latest behavior had the community doubting its ability as a safe haven asset.

Meanwhile, gold was at the top of its game. Though the asset slipped from its all-time high, it managed to stay afloat. Ever since the tariff announcement, gold has increased by 12.9%. This is the only asset that saw an uptick. CryptoQuant revealed that silver and the US dollar index dipped by 4.8% each. Additionally, the S&P500 registered a 13.8% loss.

Also Read: Amazon Set to Accept $XRP Payments—Ripple Price Predicted to Reach $2.10 by April 2025

No comments yet