Author: Nianqing,

Recently, the U.S. Securities and Exchange Commission has launched a wave of "zero-cut" withdrawal of lawsuits against crypto companies, and lawsuits such as Kraken, Consensys, Cumberland, Ripple, Robinhood, Nova Labs, etc. have all been dismissed. Paul Atkins, the new SEC chairman, officially took office and stated that he would make the establishment of a digital asset regulatory framework the "priority" and completely change the closed and high-pressure regulatory style in the past. At the same time, the US Department of Justice has made it clear that encryption developers are not responsible for the use of code by criminals and are not responsible.

It is clear that clear and loosening of regulation is driving crypto companies into a rush era.

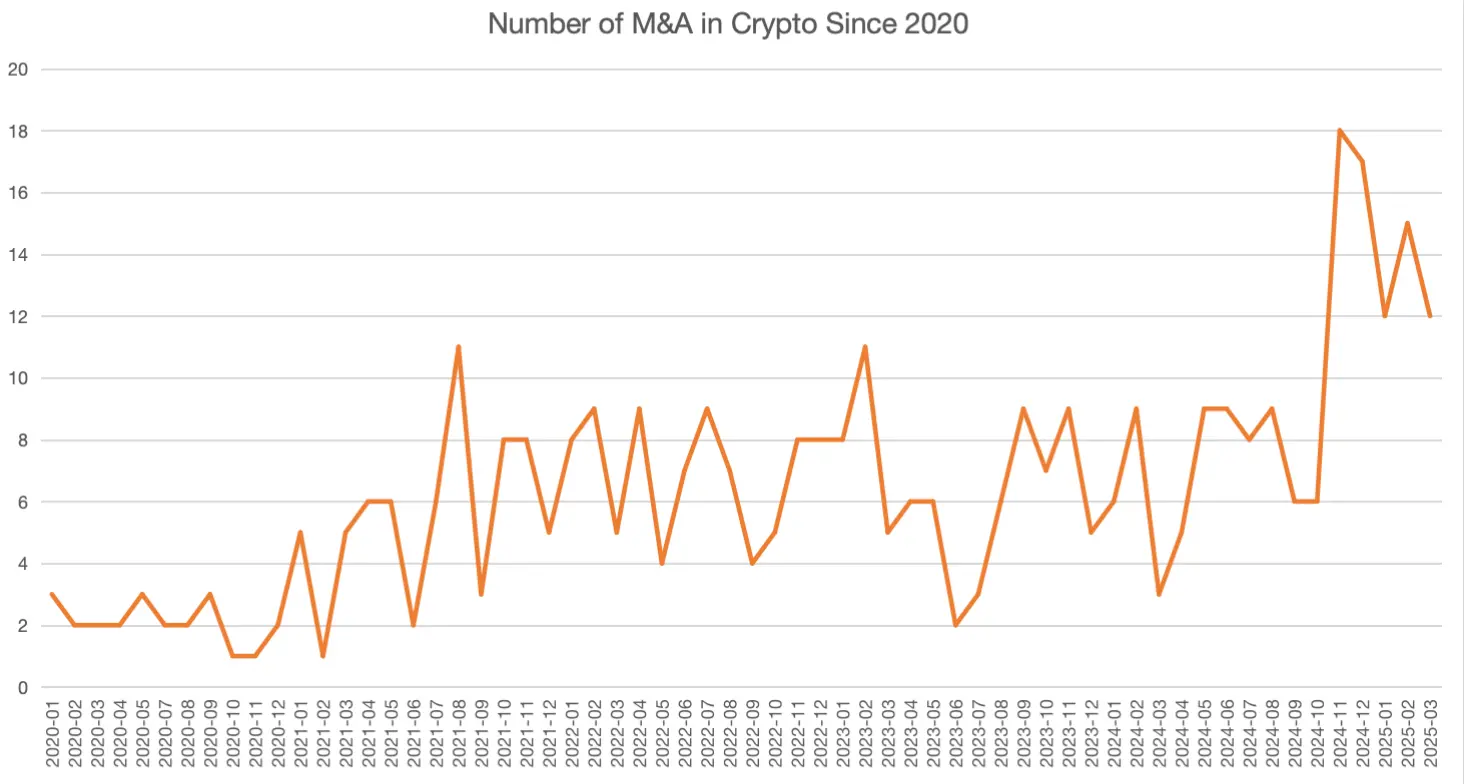

At present, American crypto companies are ushering in a wave of IPOs and mergers and acquisitions. More than a dozen American crypto companies are working hard to seize the window to promote listing. In addition, more and more projects have withdrawn by seeking mergers and acquisitions. Since November 2024, the number of mergers and acquisitions has exceeded 10 for five consecutive months. Moreover, large-scale mergers and acquisitions are frequent, and the amount of mergers and acquisitions continues to break through the historical highs of cryptocurrency. The crypto market has entered the stage of integration and institutionalization. One-stop, integrated platform-type crypto giants will continue to appear.

What are crypto giants planning? What impact will this have on the future crypto market?

IPO boom: Catch the window

2021 is a highlight of the crypto industry. Benefiting from the soaring Bitcoin price, low interest rate environment and SPAC boom, several crypto companies plan to raise funds and enhance their market influence through IPOs or SPACs. On April 14, 2021, Coinbase's successful listing on Nasdaq was regarded as a milestone in the mainstreaming of the crypto industry. But other crypto companies are not as lucky as Coinbase. Circle, Kraken, Ripple, BlockFi, and eToro all had plans to go public or SPAC in 2021, and eventually some plans were stranded due to regulatory uncertainty and market volatility.

In the second half of 2024, Trump was elected to open the IPO window for US crypto companies again. At present, several crypto companies have been listed in the United States. Japanese cryptocurrency exchange Coincheck completed its merger and listing on December 11, 2024; Fold Holdings successfully listed on Nasdaq on February 19 through SPAC; Amber PremiumAmber, a digital wealth management platform under Amber Group, completed its merger and listing in March.

Circle, eToro, Kraken and other crypto companies that had previously planned IPOs are also seizing the window period to promote IPO plans. At present, Circle, eToro, Bgin Blockchain, Chia Network, Gemini, lonic Digital, etc. have submitted S-1/F-1 documents, and the possibility of listing in Q2 2025 is relatively high; BitGo, Kraken, Bullish Global, Consensys, Figure, Chainalysis, Blockchain.com, etc. have stated that they have IPO plans or are in the consultant negotiation stage, and have great listing potential from 2025 to 2026.

The specific progress is shown in the figure below:

Related readings:AmberLog in to Nasdaq, super10Household queuingThe team will go public, and the first year of encryption "IPO" will begin

Mergers and acquisitions heat up, and the crypto market enters the stage of integration and institutionalization

Recently, mergers and acquisitions in the crypto market have heated up. As the primary investment market is generally declining, more and more projects are exiting through seeking mergers and acquisitions, and leading projects are more willing to optimize industrial layout and expand their influence through mergers and acquisitions within a reasonable valuation range.

According to data, there have been more than 40 mergers and acquisitions in the past three months, and most of the acquirers are American crypto companies. Since November 2024, the number of mergers and acquisitions has exceeded 10 for five consecutive months. Moreover, large-scale mergers and acquisitions are frequent, and the amount of mergers and acquisitions continues to break through the historical highs of cryptocurrency.

Encryption M&A Trends Since 2020, Data Source:

Among them, mergers and acquisitions of more than US$1 billion in the past six months have occurred in the United States:

- In December 2024, traditional payment giant Stripe acquired the stablecoin platform Bridge for US$1.1 billion

- In March 2025, Kraken acquires US futures trading platform NinjaTrader for US$1.5 billion

- In April 2025, Ripple acquires crypto-friendly broker Hidden Road for $1.25 billion

In addition, Coinbase is in deep negotiations on the acquisition of Deribit, which is valued at about $4 billion to $5 billion, and BitMEX, a crypto derivatives platform founded by Arthur Hayes, is seeking to sell. If Deribit and BitMEX complete the merger, the amount of the merger will inevitably break through a new high.

Bernstein analysts said that as the exchange and broker/dealer models begin to merge, the crypto industry is moving towards a more integrated "one-stop" multi-asset investment platform. For example, Kraken acquires NinjaTrader, while Robinhood integrates Bitstamp, and Coinbase is in-depth negotiations on the acquisition of Deribit. Among them, Deribit's BTC and ETH options market has a monthly trading volume of more than US$100 billion, accounting for about 70% of the market share, and the monthly trading volume of cryptocurrency futures is approximately US$45 billion. Coinbase's acquisition of Deribit will enable it to expand into the derivatives sector, especially the options sector, and will compete with Binance in the international crypto derivatives market.

In addition to options and derivatives, crypto exchanges’ “multi-assets” are even expanding like traditional assets. On April 14, Kraken launched stock and ETF trading in the U.S. market for the first time. On April 12, several members of the US SEC expressed their support for the establishment of a digital asset regulatory sandbox and allow crypto exchanges such as Coinbase to freely conduct experiments in new fields, including providing tokenized securities trading. In the future, crypto exchanges will provide spot cryptocurrencies, cryptocurrency derivatives and tokenized stocks, as well as stock and stock derivatives. Meanwhile, brokerage platforms like Robinhood will further expand their cryptocurrency and cryptocurrency futures businesses.

As traditional assets are tokenized, the boundaries between crypto tokens and stocks are becoming blurred, the role of digital asset securities, tokenization and intermediaries will become clearer, the overlap between cryptocurrency exchanges and brokers will continue to increase, and traditional financial companies and crypto companies will be further merged.American crypto companies will be more like Fintech than Crypto.

Transformation of crypto enterprises to institutional services

The Trump administration's crypto-friendly policies lower barriers to institutional entry. The US OCC approved blockchain native loan licenses (such as Figure Technologies) to encourage traditional banks to participate. Starting from 2024, institutional services including digital asset custody, tokenization, payment settlement, derivatives trading and compliance solutions have become the main profit growth points in the crypto industry.

At the same time, as the entire crypto market lacks new narratives to attract new users, crypto institutions including crypto exchanges have increased their customer acquisition costs on the C-side, and crypto companies that comply with US regulations and adhere to compliance have begun to lay out and make efforts toward institutional business.

In order to get rid of the dependence on retail transactions, Coinbase made an early layout in institutional services. The proportion of its transaction revenue, especially retail transaction revenue, is decreasing year by year, with retail transaction fee revenue accounting for 70%, 65% and 52.7% from 2022 to 2024 respectively. At the same time, Coinbase's subscription and service (institutional-oriented) revenue share has been increasing year by year, reaching 17.8%, 22.6% and 34.8% from 2022 to 2024, respectively.

As of 2024, Coinbase's custodial assets were US$220 billion, a year-on-year increase of 100%, and it mainly serves institutional customers (such as hedge funds and ETF issuers). Over the past year, Coinbase has become the main custodian of Bitcoin spot ETFs.

If Coinbase completes its acquisition of Deribit, it can not only expand the global crypto derivatives market, but also enhance its institutional service capabilities. In 2024, Deribit's trading volume has almost doubled, and the demand for complex financial instruments by institutional investors (such as hedge funds and asset management companies) has surged. Deribit's institutional client base and professional trading tools (such as options and futures) will enhance the attractiveness of Coinbase Prime. Recently, Coinbase Prime also provided US$200 million in credit support to CleanSpark, a listed mining company on Nasdaq. CleanSpark has officially launched an institutional-level Bitcoin fund management platform.

Crypto exchanges such as Kraken and Gemini have made the same choice. Kraken has invested heavily in acquiring NinjaTrader, a US retail futures trading platform, aiming to expand the competitiveness of the derivatives market and expand institutional service capabilities. In April, Kraken also announced that it would launch a hosting service in partnership with Beeks Exchange Cloud, which is planned to go live later this year; while Gemini recently expanded its institutional services business to regions such as Europe and Canada by providing US dollar payment support.

Ripple recently spent $1.25 billion to acquire cryptocurrency-friendly broker Hidden Road, with the core purpose of expanding its services to institutional investors. Hidden Road is a one-stop service provider that specializes in connecting large institutional investors (such as Jump Trading, market makers, hedge funds) to exchanges, move money, borrow money, and clear.

Ripple's main business is cross-border payments, but the ecosystem relies entirely on self-built networks and win-win alliances to maintain it, and the bottleneck of its payment business is obvious. In addition, in June last year, Ripple acquired Standard Custody & Trust Company, a New York crypto trust company. The acquisition allows Ripple to conduct cryptocurrency custody and settlement operations.

Layout tokenization

Behind the crypto companies' services to institutions is the rapid expansion of the tokenized market.

Recently, Ripple and Boston Consulting Corporation (BCG) released a report called "Approaching the Tokenization Tipping Point." This report makes an important prediction—Tokenization market will surge from $600 billion in 2025 to $18.9 trillion in 2033, the annual compound growth rate (CAGR) is as high as 53%.

Tokenization refers to the process of using blockchain tracks to record ownership and transfer assets such as securities, commodities and real estate. The main application scenarios of the tokenized market include trade finance, mortgage and liquidity management, investment-grade bonds, private equity credit and carbon markets, etc.

It is worth mentioning that unlike the Chinese region that divided stablecoins and RWA tracks separately, this report also included stablecoins as asset tokenization. This is basically also the must-fight place for American crypto companies - tokenization. Kraken co-CEO also recently stated that the size of tokenized stocks is expected to exceed that of stablecoins.

Figure, Fireblocks and Securities, the three crypto companies selected for the Forbes 2025 FinTech 50 this year, are all engaged in tokenization businesses, including real estate, bonds and equity tokenization.

Figure Technologies uses its self-developed Provenance blockchain to provide home equity loans (HELOCs), payment solutions and asset tokenization services. In addition, Figure also launched its own tokenized assets. On February 20, the SEC approved for the first time the application of Figure Markets (a subsidiary of Figure Technologies) to develop the "income stablecoin" YLDS. YLDS is 1:1 pegged to the US dollar and registered as a public security in the SEC, providing income and currently has an annualized rate of return of approximately 3.85%. YLDS is in the same financial category as stocks or bonds.

Fireblocks' core business revolves around the secure storage, transfer and issuance of digital assets, serving financial institutions, exchanges, payment platforms and Web3 companies. Last September, Fireblocks acquired tokenization company BlockFold for $13.6 million to enhance its ability to provide assets to large banks and financial institutions. Since 2024, Fireblocks has begun to rapidly deploy global markets and has already carried out business in European countries such as Germany and France, as well as Singapore, Japan and South Korea, Asia-Pacific regions such as Singapore.

Securities has entered the public eye by partnering with BlackRock to launch the tokenized asset BUIDL. Securities provides integrated services covering fund management, token issuance, brokerage services, transfer agency and alternative trading systems. On April 15, Securities announced the acquisition of MG Stover's fund management business, and its subsidiary Securities Fund Services (SFS) has become the world's largest digital asset fund management platform. The acquisition “consolidates Securities’ position as a comprehensive platform for institutional-level tokenization and fund management.”

In addition to planning IPOs, Circle is also targeting a larger tokenized market.

Circle's IPO S-1 documents show that 95% of its revenue comes from short-term U.S. Treasury yields, while its own businesses such as transaction fees, cross-chain bridges and wallets are insignificant. In addition to the hidden dangers of interest rate dependence, high compliance costs and distribution costs eat up most of its revenue.

Circle recently acquired Hashnote and its USYC tokenized money market fund. Hashnote is a regulated institutional-level investment management platform incubated by Cumberland Labs (DRW’s blockchain incubator). It mainly provides institutional investors with tokenized money market funds (USYC), customized investment strategies, on-chain asset management and custody services.

No comments yet