Original title: "From "Preacher" to "Reaper": Galaxy's "Pull Up Shipping" Art"

原文作者:Daii

In the world of cryptocurrencies, the distance between the "evangelist" and the "reaper" is often only separated by a thin line that is almost invisible.

This line is called "trust".

The evangelist we are going to talk about today is Mike Novogratz, a former Goldman Sachs partner, New York Fed adviser, and now the founder and CEO of Galaxy Digital. With unparalleled passion and firm belief, he spreads the vision of cryptocurrency to the world in a variety of ways, becoming a voice that cannot be ignored in the industry.

Galaxy Digital, known as "the institution on Wall Street that understands cryptocurrencies the most", not only manages billions of dollars in assets, but also enjoys a high reputation in the entire crypto industry. Countless investors have invested their funds without hesitation because of their trust in Novogratz and Galaxy, dreaming of seizing the opportunities of the times and becoming that lucky member.

However, sometimes "trust" becomes a fatal trap.

The story we are going to tell today should have been shared with you last week, but the sudden Sino-US tariff war forced us to temporarily intersperse a topic about the cracking of the dollar hegemony and the rise of decentralized stablecoins. Although those grand narratives are related to the global landscape, for ordinary investors, today's story may be more important.

If you have lost all your money in Luna’s investments, you don’t need to blame yourself too much. Because it’s not that you lack judgment, nor that Luna is destined to fail from the beginning, but that you don’t know that the person who encourages you to "stay faith" every day has quietly cleared his chips when you buy at a high level.

What you need to be more vigilant is that such a harvest scene has never ended, but it has changed the scene and the actors. Behind almost every "faith carnival", countless retail investors are paying for the shipment strategy accurately calculated by a small group of people.

Maybe you will be angry and even try to get justice. But the cruelty of the fact is that unless you can clearly prove the fraudulent intentions of these KOLs (Key Opinion Leader) or institutions, it is almost impossible to recover the losses you suffer.

Because the threshold for defining fraud is extremely high in law, you must provide sufficient evidence to prove that the other party not only knows that the project has huge risks or false information, but also holds clear malicious intentions and deliberately misleads you into the market to facilitate them to cash out at a high level.

However, reality is always more complex than theory. KOLs shrewdly avoid the red line of the law. What they say is always ambiguous "optimism", "giant potential", and "only represent personal opinions and does not constitute investment advice". As long as their language is vague enough and the shipment actions are concealed enough, it is almost impossible to convict.

This is the thickest fig leaf for KOL-style harvesting - the motivation is difficult to prove and subjectively unfounded.

But you must be curious: Since it is so difficult to discover, why did Galaxy CEO Mike Novogratz eventually "fall out"?

Speaking of this, we must mention a key figure – the New York State Attorney General, and a special bill – the Martin Act. It is precisely because of the existence of this law, to be precise, that the New York Attorney General can launch an investigation without proving a clear intention to defraud and uncover the delicate scams hidden behind "faith". Galaxy was the first to get caught, but it would never be the last one. We have had a very detailed introduction to the Martin Act. This bill that once fined the Trump Group $450 million has now begun to target the currency circle. English version

After reading this 44-page document from the New York State Attorney General's Office, I have to sigh: Without the constraints of the "the most ruthless securities bill in the United States", there would be no in-depth investigation by the New York State Attorney General. We may never know that behind Luna's $40 billion bubble burst, there is such a sophisticated and sophisticated institutional shipping script.

I hope that for you, this article today is not just a ups and downs of financial stories, but also a warning record for keeping a distance from KOLs and institutions.

Next, let’s first figure out how Galaxy and LUNA come together?

1. How does Galaxy "get connected" with Luna?

Before we start telling this thrilling "shipping story", we must first figure out what the protagonist, Galaxy, is.

1.1 Who is Galaxy?

Galaxy Digital, full name Galaxy Digital Holdings Ltd., is registered in the Cayman Islands and is headquartered in New York. It was founded by a big shot who has been working on Wall Street for decades: Mike Novogratz.

who is he? A former Goldman Sachs partner who served as a member of the investment advisory board of the New York Fed, began to get involved in Bitcoin as early as 2013 and was one of the first "institutional believers" to publicly support crypto assets. The "The Future of Bitcoin" you have read on CNBC, Bloomberg, and Financial Times is likely to be unable to avoid his name.

In 2018, he founded Galaxy, which manages more than $5 billion in assets and has 123 subsidiaries around the world, covering market making, venture capital, trading, custody, research... almost a "Morgan Stanley in the crypto industry".

In other words, if the industry needs a representative "most like Wall Street", it must be Galaxy. Obviously, Galaxy is Luna’s best partner, no one.

1.2 What is Luna?

Now let's learn about another protagonist in the story: Luna.

Luna is a cryptocurrency issued in 2018 by Terraform Labs. The project was founded by Korean Do Kwon and registered in Singapore. The core goal is to create a dual currency system of "algorithm stablecoin + main coin".

This ecosystem consists of several parts:

· Terra Blockchain: the underlying ledger where transactions occur;

Luna: The platform's native tokens are used to govern, pledge and regulate the supply and demand of stablecoins;

TerraUSD (UST) and TerraKRW: so-called "stable coins" claiming to anchor the US dollar and the Korean won;

· CHAI: A Korean payment app used to promote "real-world usage scenarios".

It sounds pretty cool, right? But the problem is: its "stability mechanism" relies entirely on market behavior, and once the UST is deaned, Luna will fall into a "death spiral." UST is essentially an algorithmic stablecoin, and there has been no successful case until now. The previous issue of "Tariffs Are Knifes, Currency Are Shields" has a more detailed analysis of stablecoins, you can learn about it.

You need to pay attention to the CHAI payment system mentioned above, which is somewhat similar to Alipay in China and PayPal in the United States. Do Kwon is the co-founder of CHAI. It is precisely because of the existence of this real-world connection point that Galaxy has important materials to raise Luna.

To put it bluntly: behind Luna is an innovative financial project, which has the possibility of success, but the possibility of failure is even greater. However, Do Kwon felt that the story was exciting enough, and he needed to find a "Western spokesperson" to help him tell the story to Americans.

1.3 "Getting Affinity": The Trading Stories endorsed by the West

As time comes to 2020, Do Kwon understands that if Luna becomes popular, it is far from enough to rely on Korean speculators and white papers. To gain popularity in the Western market, he needs a "credible" brand endorsement. So, they found Galaxy.

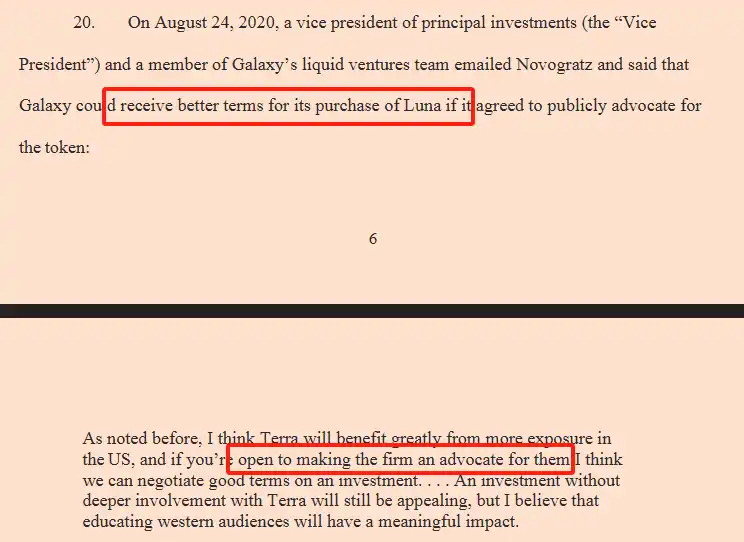

In August 2020, Terraform extended an olive branch to Galaxy and proposed a trading proposal: Terraform hopes that Galaxy can be their advocate, and as long as the CEO of Galaxy is willing to speak out to promote Luna, we can give you better investment terms.

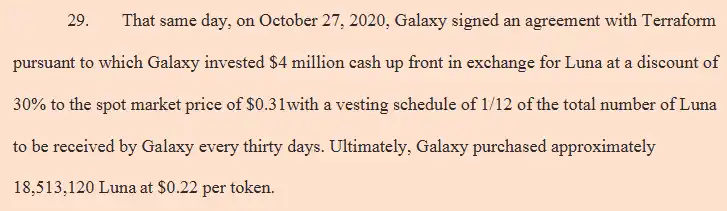

The Galaxy internal discussion begins immediately. They have long noticed Terraform's technology and realized that there is a huge capital need behind this project. On October 27, 2020, the two parties finally finalized the transaction, see the picture below:

Galaxy invests $4 million; buy 18.51 million Luna at a discount of $0.22 per coin; unlocks 1/12 per coin and can be sold as you like.

Note: The market price was US$0.31 at that time, and Galaxy received a 30% discount and was not forced to lock the position. This is not a "good price due to heaven", it is the trading rights they earn with endorsement, publicity and platform.

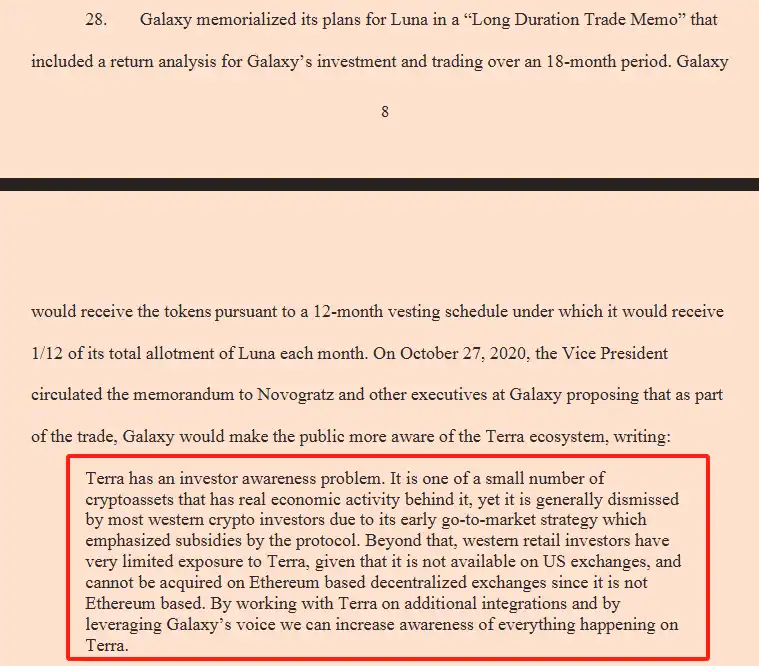

The hidden rule behind this is: as long as you are willing to "say something good", we will let you "unlock it quickly". Galaxy accepted all this and even wrote in an internal memo that Terraform has no popularity in the US market, and it is up to us to recommend it to believe that its economic activities are real. See the text in the red box below for details.

So, since November 2020, Galaxy began to "mentioned" Luna in podcasts, Twitter, and interviews in a planned manner, and the price began to rise and the transaction volume expanded rapidly. This rhythm lasted for a whole year.

1.4 Summary: "Money" is in a mess

Galaxy and Luna are not connected because of “conceptual compatibility” or “technology leadership”, but a complete “interest exchange”:

· Terraform offers discounts and unlock privileges;

· Galaxy provides traffic, trust and packaging;

· The two sides reached an implicit consensus: You are responsible for making the game, I am responsible for calling orders, and no one can say anything.

Judging from the results, this "cooperation" is very successful:

· Luna’s price rose from $0.31 to a maximum of $119;

· Galaxy makes more than hundreds of millions of dollars;

· Retail investors take over at a high level and then step into the "death spiral".

Essentially, this is a typical "structured shipping script", but it does not violate the traditional securities laws, which is why many KOL Galaxy calls for justice. But in front of the Martin Act, this is an absolute fraud, because you have different words and deeds, and you are pushing up and shipping the goods. This is market manipulation and illegal.

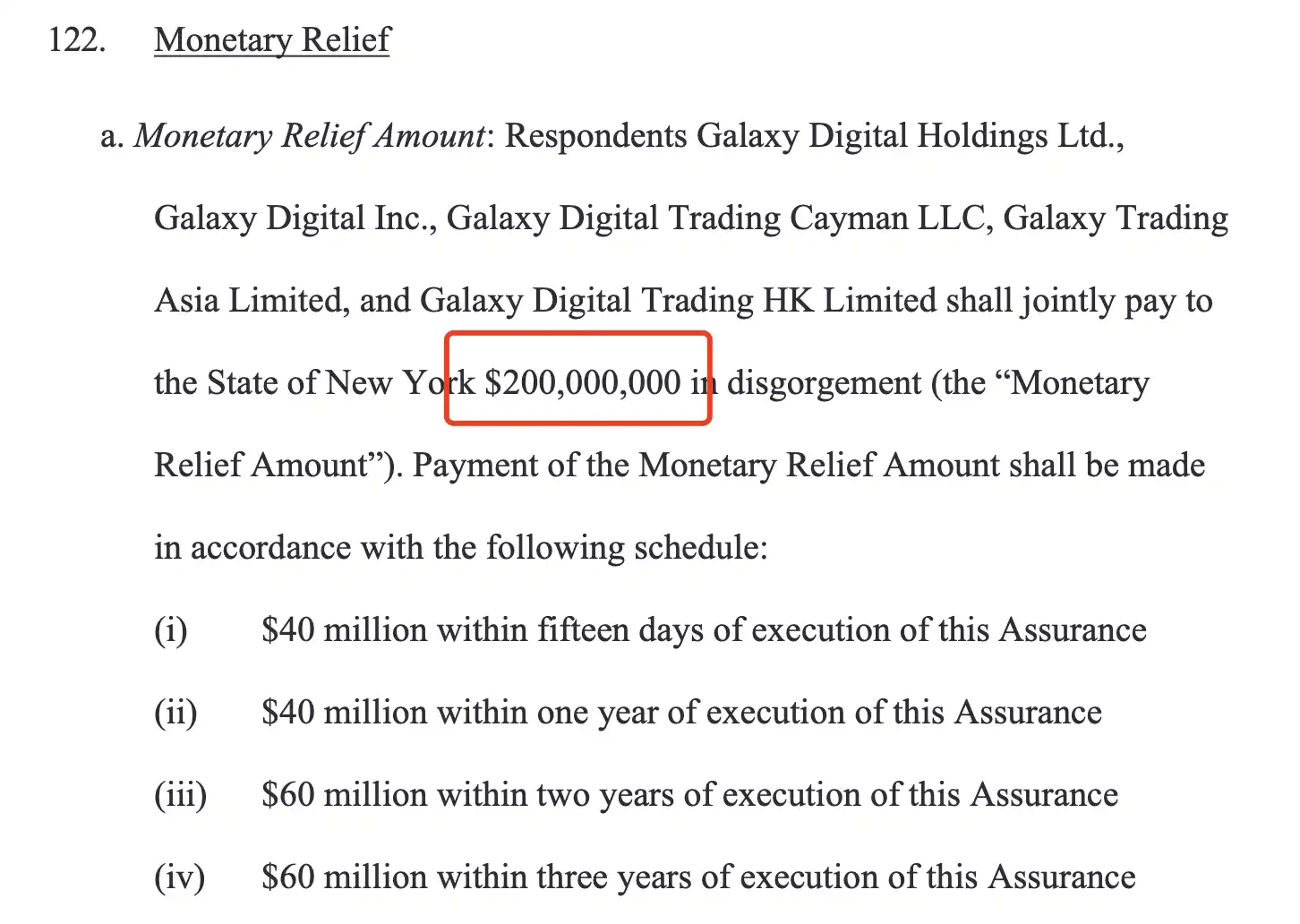

It is precisely for this reason that Galaxy is willing to pay 200 million settlement funds in exchange for the "suspended guarantee" of the New York Attorney General's investigation, see the picture below.

In order to analyze Galaxy's method of pulling up and shipping, I carefully read this 44-page document, which I will disassemble for you one by one.

2. How does Galaxy shipment increase?

Next, we will unveil the "shipping art" of how Galaxy shouts "faith" while accurately selling chips. Before we can break down this sad story, I must objectively say a few fair words for Galaxy and Mike Novogratz to avoid mistakenly thinking that Novogratz is just a "shameless person".

You may not know that, back in 2013, when Wall Street was still collectively mocking Bitcoin, Novogratz had already devoted himself to it with real money. Not only did he buy Bitcoin publicly, he also publicly expressed his optimism about crypto assets in mainstream financial media and supported this "financial revolution." Rather, he predicted that Bitcoin price would rise significantly in 2013, and in 2014, he invested in Ethereum, which is still in its infancy through crowdfunding. He once said that 20% of his net assets were invested in Bitcoin and Ethereum, which was shocking in the conservative and cautious Wall Street circle at that time.

As of 2024, Galaxy has invested as many as 72 projects, covering leading crypto projects such as Polygon, Bitfarms, and Celestia, with a cumulative investment of billions of dollars. Although Circle (USDC issuer) and Bitwise (crypto ETF issuer) have not directly disclosed Galaxy's investment records, Galaxy's active participation in ecological cooperation and consulting services has still contributed important strength to the overall ecological construction of the crypto industry.

In other words, you can buy coins on Coinbase today, transfer money with USDC stablecoins, and get approval of Ethereum ETFs. This is indeed inseparable from the power contributed by Galaxy in the early stages of uncertainty in the market. Galaxy is not the so-called "harvest foreign capital", but the "old-school player" who truly accompany the industry's growth for a long time.

This is also the reason why the "shipment incident" we are about to reveal today is sad. Because, with the long-term market reputation and resource advantages accumulated by Galaxy, they could have chosen to make profits in a more transparent and legal way, rather than fall into the now-criticized "gray shipment" quagmire.

Unfortunately, Galaxy did not resist the temptation in the end. They fell into the trap of their own design and chose such a clever but immoral way of making profits - to drive up shipments.

Next, I will explain in detail how Galaxy manipulates market sentiment step by step and completes shipment cash out with superb methods.

2.1 A try: the first attempt at "selling orders and shipping"

The story starts at the end of 2020.

The agreement signed by Galaxy can unlock 1/12 of Luna every month. As a veteran of Wall Street, Novogratz naturally understands that the most effective way to make quick money is to "sell while shouting."

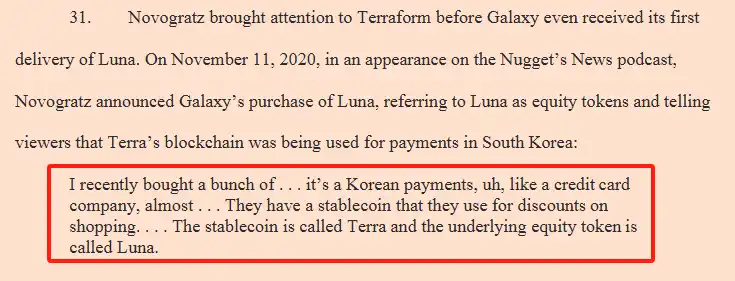

On November 11, 2020, just before Galaxy received its first Luna, Novogratz could not wait to start platforming for Luna. On the well-known podcast Nugget News , he told listeners that he recently bought a bunch of Luna, a Korean payment company that is a bit like a credit card company, where users can get discounts. See the picture below for details. In fact, this is not true at all, and Luna is not used in reality.

A few days later, on November 14, a netizen asked on Twitter: Brother, should I recommend a coin? Novogratz Reply immediately: $luna. See the picture below.

Entering December, Novogratz tweeted: South Korea's payment application Chai already has 80,000 active users every day, and $LUNA has great potential! As a result, Luna's daily trading volume instantly jumped from $27.5 million to $69 million that day, and the market heat suddenly ignited.

On the same day, Galaxy received the first batch of unlocked Lunas: more than 1.54 million. This "decent" Wall Street veteran told the internal team: Don't rush to sell, his rule is that it will not ship within 3 days after posting good news.

Two weeks later, on December 16 and 17, Galaxy sold all the Lunas at a price of US$0.50 to US$0.52 per piece, and the first "shouting order shipment" ended perfectly.

Let’s talk about the “throw it up and not shipped within 3 days” just now, it sounds very particular, right? However, even this custom rule has not been well implemented. In the face of the torrent of money, everything seems so vulnerable.

2.2 Return to the Bonus Battle: Bloomberg's God Assistance

Galaxy is obviously addicted to "shouting orders and shipping". But in order to quickly achieve profit-making and return to capital, they still need a bigger stage. This time, they chose the mainstream financial media - Bloomberg.

In January 2021, Galaxy took the initiative to contact Bloomberg to provide a press release containing fake data, claiming:

Terra now has the third highest number of transactions of all blockchains (after BTC and Ethereum) and is generating 13M USD in fees annually. Terra KRW today powers CHAI, one of the largest e-commerce wallets in Korea, which hosts over 2 million users and generates $1.2 billion in annualized transaction volume.

Translation: Terra has become the third largest blockchain in the world with transaction volume, second only to Bitcoin and Ethereum, generating $13 million in handling fee revenue each year. Terra's Korean won stablecoin (TerraKRW) supports CHAI, one of South Korea's largest e-commerce wallets, with 2 million users and an annual transaction volume of $1.2 billion.

The truth is that Chai’s transactions do not use the Terra blockchain at all, and all payments still use Korean won, which has nothing to do with Luna and TerraKRW. So, why do Galaxy and Terra have to be faked and use the Chai prop? Because without Chai as a backing, this story has no imagination.

On January 26, 2021, Bloomberg published a blockbuster report titled "Novogratz Invests in Crypto Startup Serving Millions in Korea" and Luna's price immediately soared from $0.89 to $1.23.

CoinTelegraph reported on the topic "LUNA doubles in price after $25 million investment by Galaxy Digital" (LUNA doubles in price after $25 million investment by Galaxy Digital), which triggered the market to chase high prices in a crazy way.

Just a few days after Bloomberg reported, the Galaxy shipped again, and on January 30, 2021, it sold more than 1.54 million Lunas, each priced at a whopping $1.47. At this point, Galaxy had successfully recovered the initial $4 million invested.

This battle was fought neatly and truly interpreted what the art of shipping is.

2.3 Intensify: A combination of tattoos and false data

After returning to the capital, Galaxy became even more unscrupulous. They began to use their big moves.

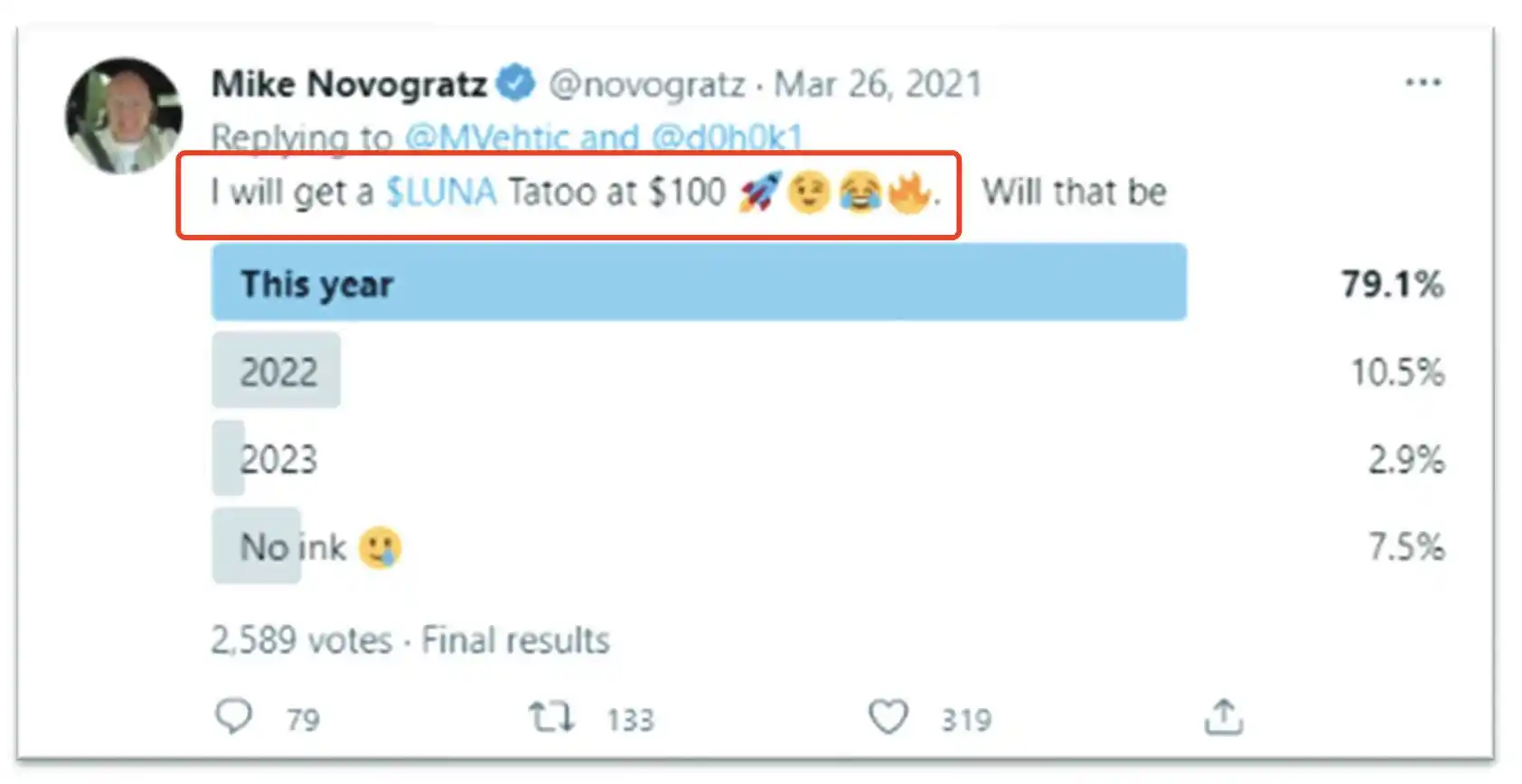

In March 2021, Novogratz tweeted: If Luna rises to $100, I'll go and have a Luna tattoo! This personal commitment that hits people's hearts quickly caused a sensation in the circle.

At the same time, Novogratz continues to confuse the relationship between Chai and Terra, making people mistakenly believe that the Terra blockchain has powerful real-life application scenarios. for example:

On April 26, 2021, Novogratz said in a podcast: 6% of payments in South Korea are already using Chai.

On May 21, he further exaggerated: 7%-8% of payments in South Korea have been made through blockchain Chai.

On June 22, he said: 8% of all payments in South Korea are paid in Chai.

On September 13, he said in a speech at the Barclays Global Finance Summit that 9% of payments are now done through the Luna blockchain.

However, Chai actually accounts for less than 1% of the total transaction volume in South Korea, and Chai is not supported by the Terra blockchain, and it has no relationship with Luna. These data are completely false, but the effect is immediate. Luna's price rose sharply after each speech, and Galaxy took the opportunity to sell its chips without hesitation every time:

In early May 2021, 1.3 million Lunas were sold at a price of up to $18.60 per piece;

On June 4, nearly 1.79 million were sold, each priced at about $6.91;

In early August, 1.61 million were sold again, with a price range of US$12.19-14.79.

By the eve of Christmas on December 24, 2021, Luna really rose to $100! Novogratz kept his promise and posted a picture of Luna’s tattoo on his arm, triggering a social media binge.

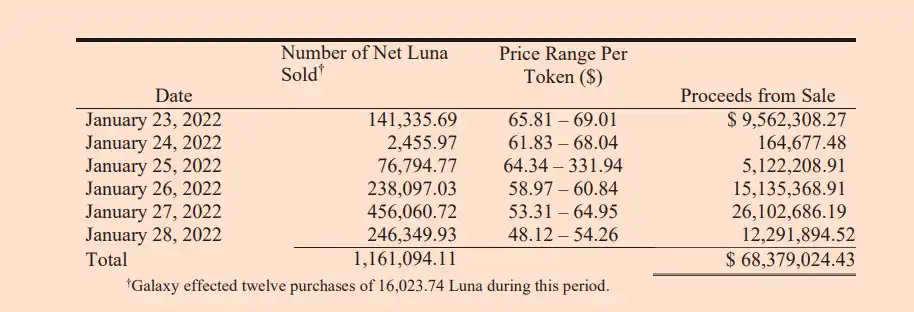

However, Galaxy, which was tattooed and shipped at the same time, had no intention of stopping. On Christmas day, they started selling Luna for $96.96. In early January 2022, Galaxy was sold in large quantities at a high of around $90, with a total cash out of tens of millions of dollars.

Can you imagine it? When Novogratz sent out that arm tattoo photo, the trader behind him was typing the keyboard quickly, throwing Luna chips frantically into the craziest market.

2.4 The last madness: Keep the faith while shipping on a large scale

At the beginning of the new year in 2022, Galaxy and Novogratz began to perform their final madness.

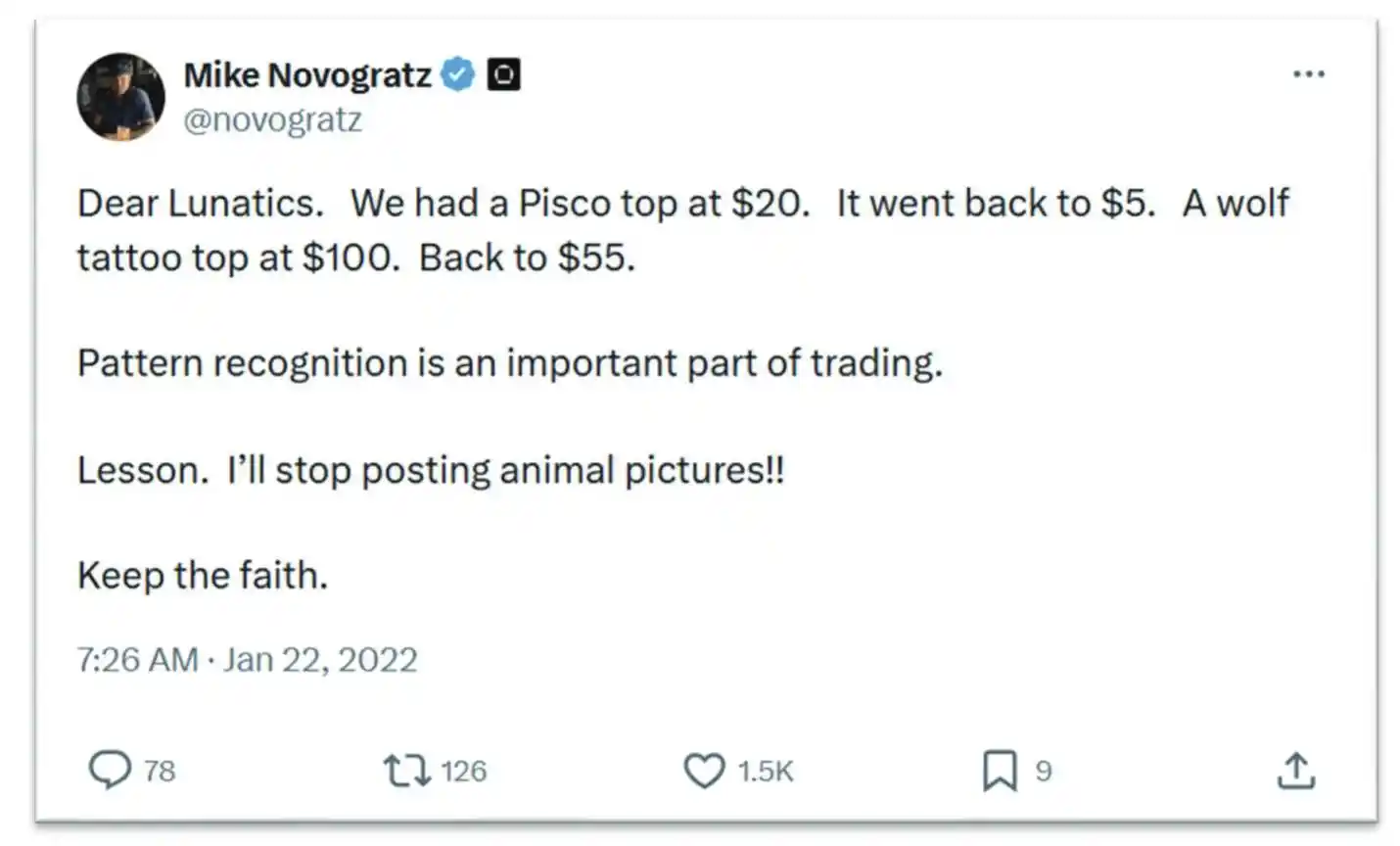

On January 5, when Luna slipped from the $100 high to around $80 and market sentiment began to shake, Novogratz made his debut again. He comforted anxious investors on Twitter: After the market surges, it will always be consolidated, and $100 is just a symbolic number. Be patient and Luna will definitely rise. Keep the faith!

This famous "Keep the faith" seems to be a shot of a heart-warming agent, and tens of thousands of Luna holders have rekindled hope. However, at the same time, the Galaxy's operating room was in a completely different situation:

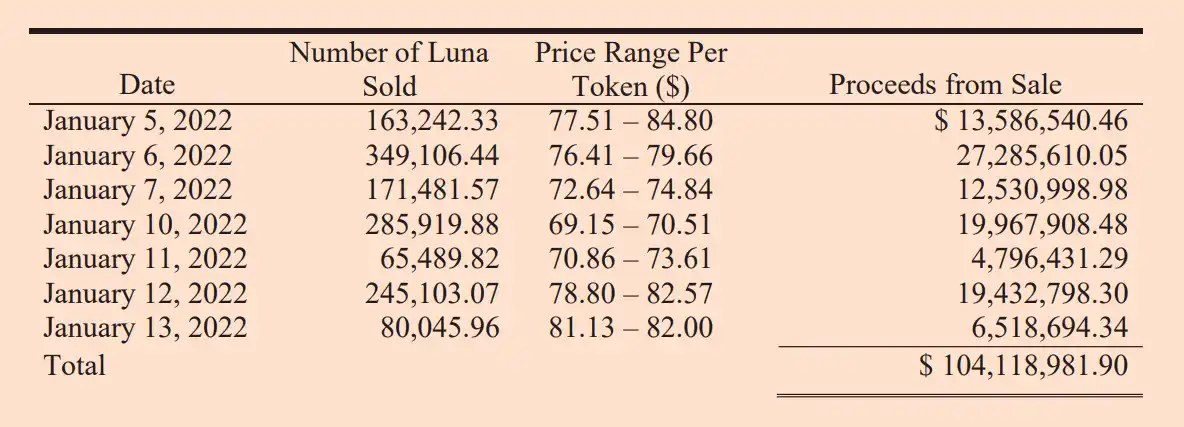

On January 5, Galaxy sold more than 160,000 Lunas in a massive spike, with a price range of between $7751-84.80, and cashed out about $13.58 million on the same day;

Then, in the two days from January 6 to January 7, Galaxy once again sold more than 520,000 Lunas without hesitation, with a total amount of nearly $40 million;

From January 10 to January 13, Galaxy shipped nearly 680,000 Lunas in just four days, cashing out more than $50 million again.

In the passionate "Keep the faith" sound of Novogratz, Galaxy has quietly sold more than 1.3 million Lunas in just one week, with a total cash out of up to $104 million! At the same time, they did not disclose any sales to the public and still maintained the character of "belief blessing".

A more absurd scene happened on January 15th. When Luna fell to around $87, Novogratz once again humorously retweeted the picture of "Viejo Lobo" (Spanish meaning Laolang) on Twitter, teasing: His positioning in the Luna community seemed to imply that he was an experienced Laolang and sat firmly on the Diaoyutai.

However, within just one and a half hours after posting the tweet, Galaxy quickly took 13,276 Lunas, accurately capturing the brief rebound and cashing out $1.15 million. In the following week, Galaxy sold more than 1.1 million Lunas almost frantically, and prices continued to fall, from $69 to $48.

Novogratz still shouts Keep the faith, encouraging followers to hold on as if it was just a normal market adjustment.

2.5 Summary: After the carnival, the ground is full of chickens

Galaxy and Novogratz’s final madness on Luna perfectly illustrate what the art of institutional shipment is. On the surface, they always act as loyal crypto preachers, inspiringly shouting "faith" and even stabbing Luna totem in their arms without hesitation. However, behind the spotlight, they carefully laid out and sold Luna on a large scale and continuously until their positions were almost cleared.

The end of this game is destined. On May 9, 2022, when TerraUSD (UST) completely collapsed, triggering Luna's death spiral, Luna's price plummeted from $65 to $0.004 in just three days, and its market value of $40 billion was wiped out. But at this time, the Galaxy had already left the market safely, with only 2,060 Lunas left on the book, worth less than $10.

Next, it’s our turn to reflect.

3. Can you escape this scam?

After watching the Galaxy's ups and downs, a critical question may have already arisen in your heart: If I were smarter and more cautious, could I avoid this scam?

To answer this question seriously, we must use an objective attitude and based on facts and data, gradually dismantle the clues hidden behind this scam, as well as what advantages and weaknesses ordinary investors have. Next, we conduct in-depth analysis from the two dimensions of why we can and why we cannot.

3.1 Why can it be?

In fact, if you can stay alert enough, have enough common sense and patience, it is entirely possible to avoid the Galaxy's carefully woven "pull up shipment" scam.

First, clues about exaggerated data

Careful investors can detect serious exaggeration or even falsehood of the data used by Galaxy and Novogratz in their publicity.

For example, Novogratz is strong again and again

In April 2021, 6% of payments in South Korea were already made through Chai.

On May 21, that number became 7%-8%.

By September, Novogratz was bolder to announce that 9% of South Korea's payments were all done using the Luna blockchain.

But what about the actual data? According to Chai's official data (can be queried through channels such as Chaiscan), Chai's payment transaction volume has always accounted for less than 1% of the Korean payment market. And Chai has never actually used Terra’s blockchain settlement transactions.

If you look at the Chaiscan data a little, you will find that these so-called powerful application scenarios are all castles in the air. In other words, if you pay a little attention, you can easily discover that there are huge data deviations and misleading elements in Galaxy's promotion.

Second, there are obvious signs of long-term cash out

Another important clue that can be used to identify scams is the market performance of Galaxy after every public order. Let’s take December 3, 2020 as an example. When Novogratz announced on Twitter that Chai had 80,000 daily active users, Luna’s transaction volume quickly surged from $27.5 million to $69 million that day. Just two weeks later, Galaxy quickly cleared the first batch of Lunas in its hands, with a price of around $0.50, achieving quick cash out.

For example, on January 30, 2021, just a few days after Bloomberg reported that Galaxy invested in Luna, Galaxy quickly cleared 1.54 million Luna again. This kind of shipment time is very close to the publicity benefits, and every time the price just rose, it is cashed out immediately. This regular shipment will occur repeatedly every month in the following period. As long as you pay a little attention to the on-chain data or Luna circulation, you can clearly see signs of such large investors' regular positions reductions, and thus infer that the traders behind them may have structured shipment intentions.

Third, an overly exaggerated personal endorsement

The third signal that can help you avoid the scam is Novogratz’s obvious exaggerated personal endorsement. Novogratz said: Luna hit $100, so he went to tattoo a Luna tattoo! Although this personal commitment can drive emotions, it is also too exaggerated and obvious, which instead exposes the traders' urgent desire to drive market sentiment.

Truly professional investors and institutional investors usually do not make such clear market commitments in public. When the market shows similar dramatic promises or excessively extreme order calls, cautious investors should be vigilant and avoid blindly following the trend.

3.2 Why not?

However, in addition to rational analysis, we must also admit that for the vast majority of ordinary investors, it is actually extremely difficult to avoid a high-level and structured scam like Galaxy, and it can even be said to be almost impossible.

First, the authority effect of the organization is too strong

Galaxy Digital CEO Mike Novogratz is a legend in the crypto market. He was a partner of Goldman Sachs and has long appeared in top financial media such as CNBC and Bloomberg. In addition, his early successful investment in Bitcoin and Ethereum has established extremely high authority and credibility.

For ordinary investors, seeing such an "industry expert" who once accurately predicted market trends and personally stood up to recommend a project, it would easily form a strong psychological anchoring effect, quickly relaxed his vigilance, rely entirely on the recommendations of experts to make decisions, and give up independent thinking.

It is precisely because Galaxy takes advantage of this authoritative effect to successfully manipulate market sentiment. For most investors, it is extremely difficult to see through the hidden motivation behind this authority.

Second, exquisite media operations and PR strategies

When promoting Luna, Galaxy has collaborated with many top media outlets (such as Bloomberg and CoinTelegraph) to successfully create a seemingly authentic and credible market impression of Luna. The Bloomberg report on January 26, 2021 clearly shows that Galaxy directly provides false data to Bloomberg, rendering the powerful ecological and realistic application scenarios of Terra and Luna, creating the illusion of explosive market rise.

This precise manipulation in the media makes it difficult for ordinary investors to have doubts. After all, when ordinary people see positive reports from mainstream media about a project, they naturally tend to think that this is objective and reliable information investigated by the media. It is extremely difficult to imagine that this is carefully designed to manipulate public opinion.

Third, keep the faith's emotional manipulation

From a psychological perspective, Novogratz’s Keep the faith slogan is extremely effective in manipulating investor emotions. When the market falls, what ordinary investors want to hear most is that someone encourages themselves to stick to their beliefs and not give up easily.

This emotional guidance is more penetrating than any rational analysis. Novogratz is good at using this emotion and firmly controls market sentiment with infectious words, making investors still unwilling to sell when they fall, and even continue to increase their positions at low levels, becoming the leek to take over.

In fact, it is almost impossible for ordinary investors to remain fully awake when Galaxy ships crazy from highs. Because when everyone shouts faith, the skeptic will be regarded as an alien and suffers tremendous psychological pressure.

3.3 Summary: The trade-off between ability and cannot

Going back to our original question: Can you escape this scam?

Objectively speaking, it depends on how much market knowledge, investment experience and independent thinking ability you have. If you are careful enough to be able to keenly detect the differences between data and reality, be able to discover the abnormal cash out rules after each order, and be vigilant about dramatic propaganda, you are completely likely to see through the scam in advance.

But if you are just an ordinary investor, confused by the halo of institutional authority, misled by the carefully packaged by the media, and infected by emotional slogans, then most people are almost unable to escape in the face of Galaxy's carefully designed scripts. There is always greed and deception in the market. The Galaxy story is not the first, nor will it be the last.

Conclusion

The line of trust between preaching and harvesting, once crossed, becomes the sharp edge of the sickle. Behind every scam is a game of human greed and fear.

In the story of Galaxy and Luna, we see how authority becomes the tool of harvest, how media becomes the megaphone of scams, and how emotions become the fuel of greed. But in the final analysis, there has never been free wealth in this world, nor has it become rich for no reason.

Faith is the most moving word in the world of investment, but when it is used by people with ulterior motives to manipulate the market, faith becomes a poison, and ultimately backfires against every blind follower.

However, we must also admit that Galaxy is not a mere predator. They bravely stood at the forefront of the crypto market when it was still wilderness and injected capital and confidence into the industry. Novogratz’s forward-looking vision and Galaxy’s contribution to industry standardization have indeed pushed the crypto world to the mainstream. They have accompanied the industry through ups and downs, witnessed and promoted the replacement of an era and the rise of industries. Unfortunately, when the temptation of capital collides with the bottom line of morality, Galaxy failed to keep its original aspirations and chose a not-so-glorious shortcut.

True investors must understand that investment does not rely on authoritative guidance, nor is it based on the hustle and bustle of the media, but on their own independent thinking and rational judgment.

Because: every time you blindly follow, you pay for the scam; and every time you question, you accumulate capital for freedom.

Starting today, remember:

Don’t be superstitious about authority, believe in data;

Don’t follow blindly, think independently;

Don’t be overwhelmed by emotions, but control it with rationality.

After all, the market is never kind, and only those who truly remain sober are worthy of real financial freedom.

Finally, we should thank the Martin Act, and hope that under the strong deterrence of the Martin Act, the KOLs' push-up shipments will no longer be so unscrupulous.

No comments yet