According to strategists, Japan's life insurers will face difficult choices when developing annual investment plans as they take into account the risks posed by the trade war and uncertain monetary policy outlook.

Companies such as Japan Life Insurance Co., Ltd., First Life Insurance Co., Ltd. and Japan Post Insurance Co., Ltd. will outline the strategies for the fiscal year in a series of briefings that will begin this week. These companies have388 trillion yen ($2.7 trillion)their decisions are closely watched because they have the potential to affect global markets.

These investment plans are in full swing as trade tensions escalate and the impact of tariffs blurs the Bank of Japan's monetary policy outlook.Dangerous moments. Japanese life insurance companies have always been known for their stability and are one of the most conservative and long-term bond buyers in the world. These giants have always been the "elephants" who are least willing to move, but this time they seem to have to move.

Yields on ultra-long-term Japanese government bonds, the cornerstone of insurance companies' portfolios, have soared in recent days, highlighting the challenges these companies face in seeking the biggest returns.

"Because there is a lot of uncertainty about the future of U.S. tariff policy and the Bank of Japan's monetary policy, life insurance companies are likely to not make any comments, thus deciding their investment stance," said Ataru Okumura, senior interest rate strategist at SMBC Nikkei Securities.

Japan's largest life insurance company, Japan Life Insurance Co., Ltd., recently said it will "further strengthen risk management" and continue to replace domestic bonds with unrealized losses to build a portfolio with higher returns. Fukoku Mutual Life Insurance Co. is increasing investment in alternative assets such as hedge funds and private credit.

All this happens as Washington's unpredictable trade policies fueled rapid changes in the investment landscape, which has caused traders to ponder the next move.

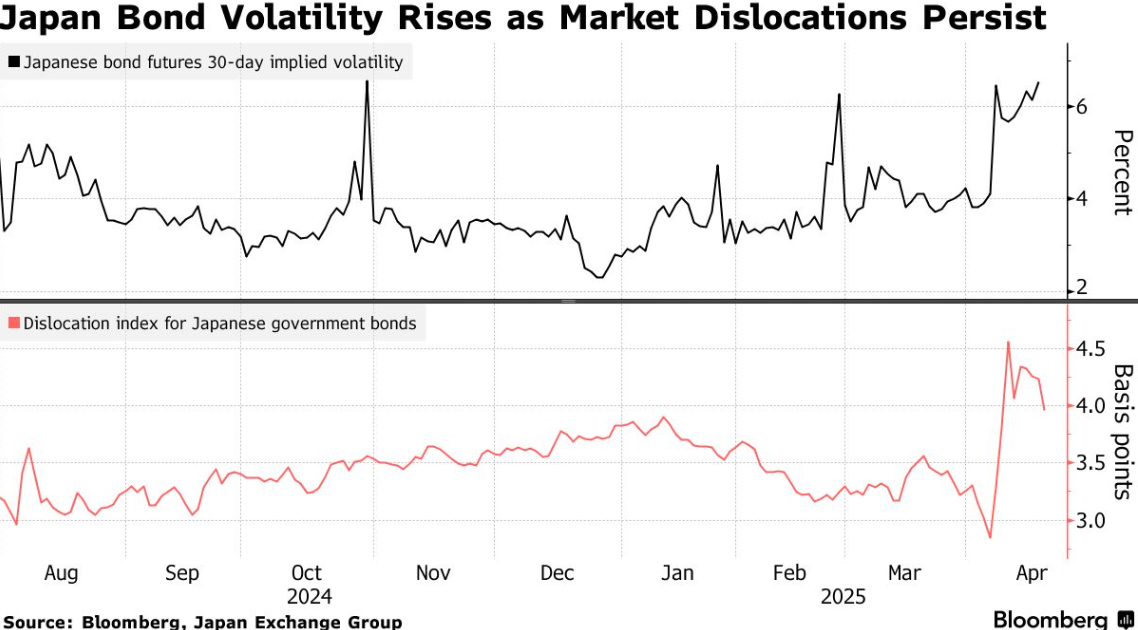

Used to measure 30-day Japanese 10-year Treasury bond futuresImplicit volatility index soars to its highest point in nearly six months. Traders are anxious about the worst losses of U.S. Treasury bonds in decades.Slashing futures bets, instead adopt a neutral stance.

"When the price changes so dramatically, there are no investors who can buy or sell them," said Tadashi Matsukawa, head of fixed income at PineBridge Investments Japan Co., Ltd.

How insurance companies deploy their trillions of dollars in funding will have an impact on everything from U.S. Treasury bonds to Japanese Treasury bonds and the dollar.

JPMorgan strategist Nikolaos Panigirtzoglou and others wrote in an April 16 report that long-term foreign investors are on theDollarOne way to make an impact is to change theirUS dollar hedging ratio. In Japan, the dollar hedging ratio has been lower since 2017 and reached an all-time low of less than 30% in 2024, they added.

Strategists write that Japanese pension funds and insurers may raise the dollar hedging ratio to 50% or above due to structural changes in perceptions of the U.S. economy.

Ultra-long-term bonds

Traders are also paying attention to how insurance companies deal with the recent sharp drop and rapid rebound in Japan's ultra-long-term government bonds. The sharp drop early this week brought the premium of 30-year bonds that investors demanded to hold to the highest since 2002.

Concerns about additional budgets have exacerbated market volatility, but investors are now awaiting the outcome of tariff negotiations between Washington and Tokyo. Japan's chief tariff negotiator Ryomasa Akazawa said that the two countries have begun discussions with the goal of reaching an agreement as soon as possible.

Matsukawa, Matsubashi Investment, said: "The Japanese government may be asked to increase in tariff negotiations with the United States.Defense expenditure, and becauseFinancial expansion, interest rate premiums may occur. ”

The Bank of Japan's policy path has also attracted attention, as the risk of U.S. taxation will hurt Japan's economic growth weakens more reasons for hikes.

The overnight index swap sets the Bank of Japan's 44% chance of hikes by the end of the year, and that was almost considered certain before the tariffs were announced.

Bank of Japan Governor Kazuo Ueda told Sankei Shimbun that Washington's tariff movement has caused a "bad situation" in the economy and that the Bank of Japan may be forced to take countermeasures. But he also reiterated the central bank's position that if the economic outlook is realized, the central bank will raise interest rates.

Overall, analysts expect insurers to exercise caution.

"Rate yields have risen to a level that meets the needs of life insurance companies, but there is no need to rush to buy. They may maintain a cautious buying stance," said Ryutaro Kimura, bond strategist at AXA Investment Managers.

No comments yet