For US stocks, another ugly day on Wednesday, with the S&P 500 closing down 2.24%.Trading volume is shrinking, but far from last week’s record, as everyone has serious headline phobia, and most people are too tired to (over) trade, with 15.7 billion shares trading on all U.S. stock exchanges, compared to 16.4 billion daily trading volume this year to date, compared to more than 30 billion shares last week.

Powell's comments on the day were quite hawkish, and he concluded: "At present, we are fully capable of waiting for clearer news before considering any adjustments to our policy position."

Will Marshall, a trader from Goldman Sachs, commented: "Given the tension between the two major tasks of the Federal Reserve, Powell's statement maintains a passive rather than an active approach, and the threshold for rate cuts is either a benign policy clarity or sufficient evidence of weak labor markets."

But financial blog Zero Hedge joked: "Think about Powell's amazing move to cut interest rates by 50 basis points (rather than 25 basis points) in September last year, when the 5Y5Y forward inflation swap was much higher and financial conditions were much more relaxed. It can be seen that the presidential election three months later was amazing to motivate a fair Fed chairman."

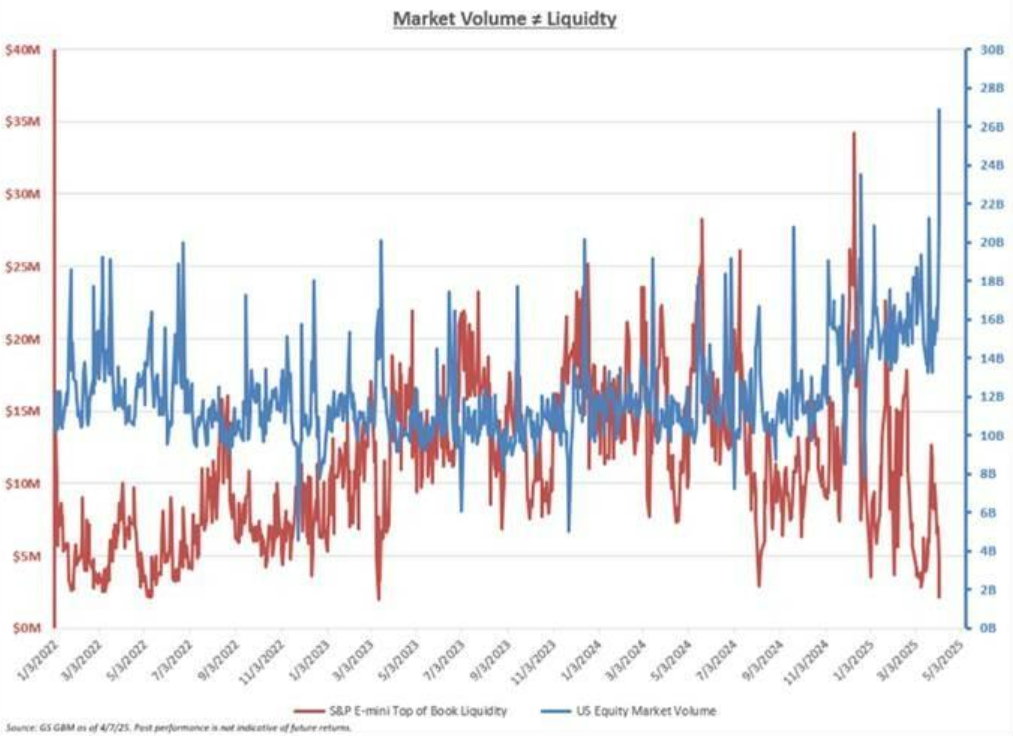

In any case, as Goldman Sachs’ Mike Washington wrote, despite these changes, market activity has not really recovered, and the S&P 500 trading volume tends to dry up in the mid-week shortened trading week (Friday is Good Friday, with markets closed in many places in Europe and the United States), with trading volume down 38% on Wednesday compared to the 10-day average.Liquidity is still terrible, the top book liquidity of the Standard 500 index (top book liquidity, reflects the ability to quickly transfer risks) is only $2.94 million.

Meanwhile, Goldman Sachs' total trading station traffic continuesCliff-like decline, indicating that investors are increasingly tired of the trade headlines that are trying to trade on the back and forth. The trends in various sectors remain defensive, with large companies continuing to perform poorly as increased concerns about cyclical issues seem to put pressure on Amazon and META in particular. Goldman Sachs further pointed out that during this decline, it did not observe any "defensive" behavior in these stocks, with ETF accounting for 33% (aligned with recent highs).

This tense calm could be further shaken Thursday when bad liquidity meets another huge option expiration date and Friday is another closing day.

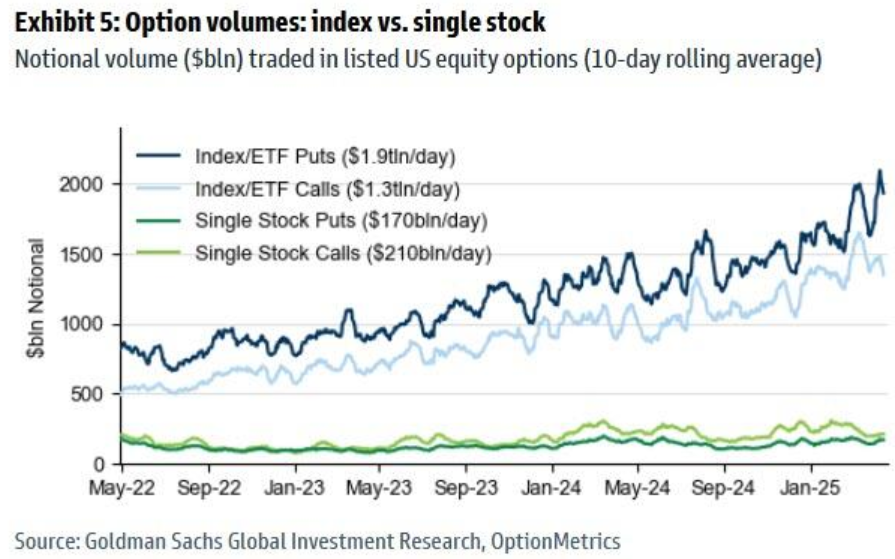

More than Thursday$2.6 trillionThe nominal option exposure will expire, including $1.2 trillion in SPX options and $480 billion in individual stock options. The nominal value of options expired Thursday is equivalent to 4.7% of the market capitalization of the Russell 3000. However, the relative scale of the options expired this time is lower than in April 2024.

Goldman Sachs noted that before the expiration date, the index/ETF'sPut options trading volume rises sharply。

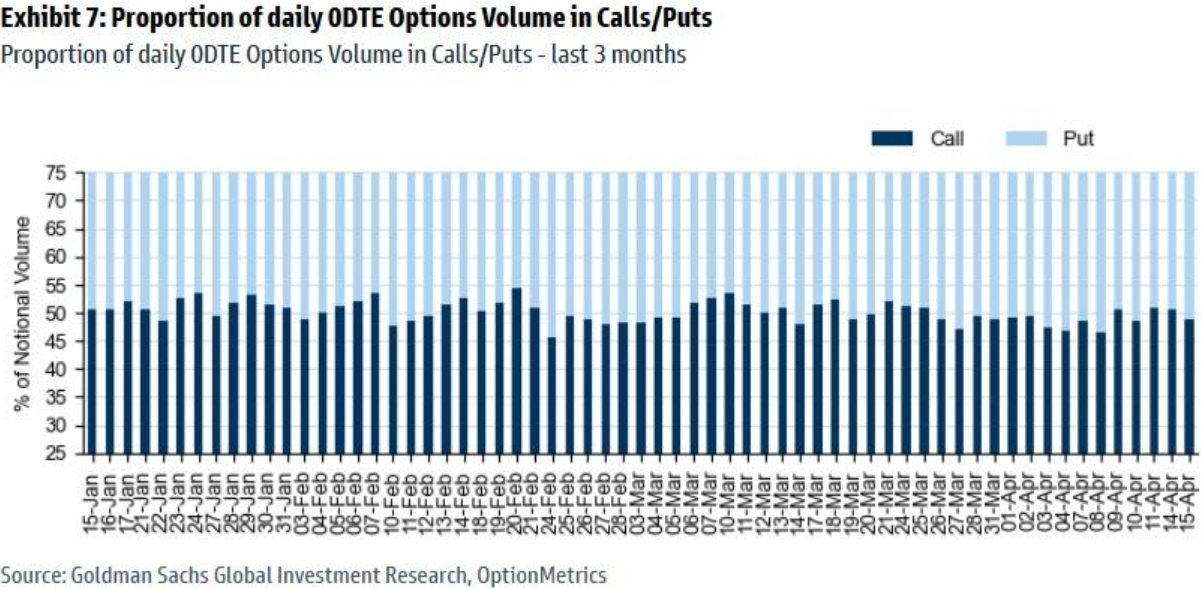

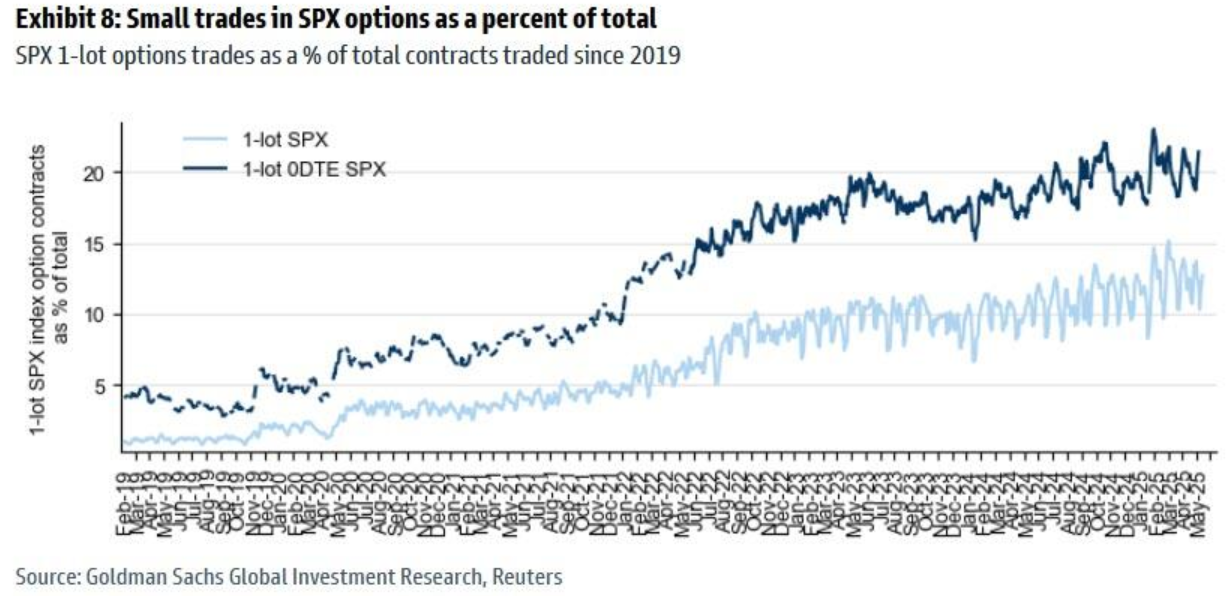

Nevertheless, the average daily trading volume of U.S. stock options continues to rise, with zero-date options (0DTE) trading volume still balanced between put and call options. Meanwhile, retail investors remain the main traders of margin: Despite the recent market volatility, SPX's first-hand zero-date options still account for a percentage of total trading volume near the highest level in history. The cross-option trading on the day currently means 1.70% volatility.

No comments yet