What Is MANTRA Chain?

MANTRA chain is a Layer 1 blockchain network that specializes in Real World Assets (RWA). MANTRA Chain is built using the Cosmos SDK and empowers developers with ready made solutions that are regulatory compliant. Developers can then easily tokenize RWAs without worrying about regulatory backlash, which is a major concern in many RWA projects.

Key Takeaways

-

MANTRA Chain a Cosmos SDK designed Layer 1 blockchain network specifically designed for Real World Assets (RWA).

-

The Mantra team designed modules to streamline regulatory compliance, allowing Web3 developers to tokenize RWA projects in a safe and easy manner.

-

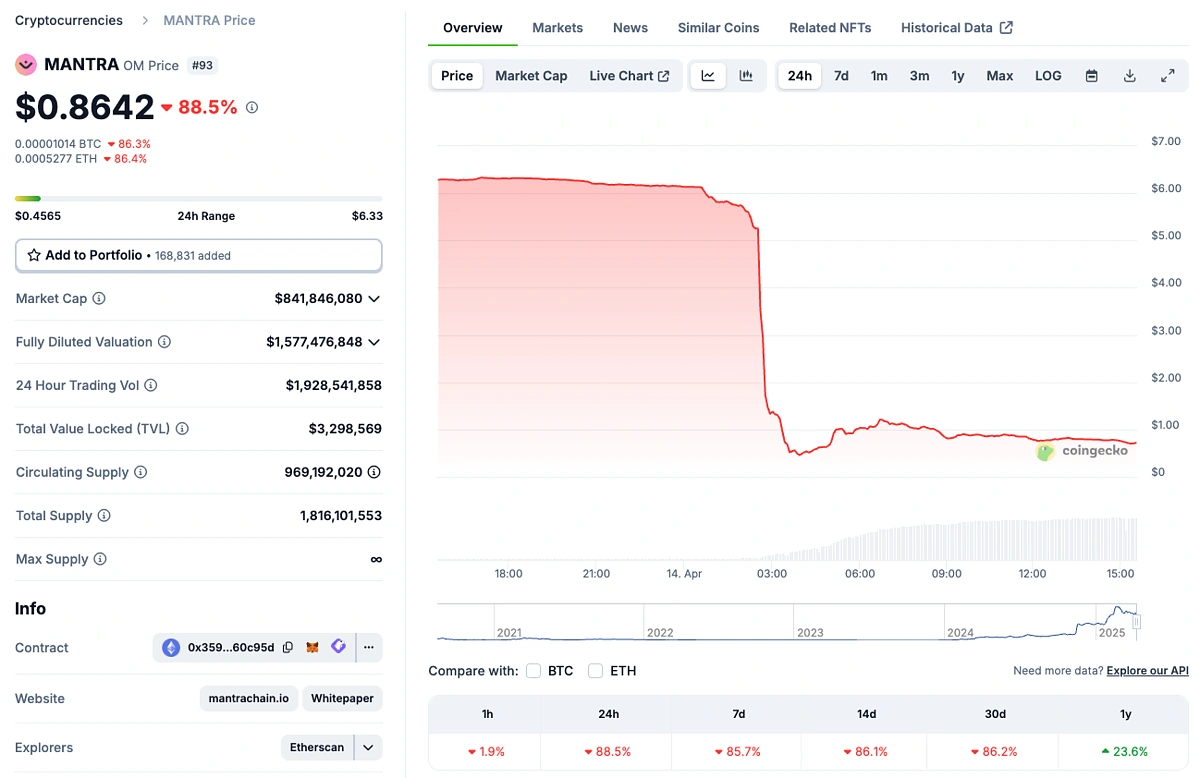

On 14 April 2025, MANTRA's OM token plunged by almost 90%, wiping out billions in market cap.

Why MANTRA Chain?

The rise of stablecoins and growing regulatory clarity has led to many institutions increasingly exploring the possibility of tokenizing real-world assets (RWAs). Despite the potential, RWA tokenization is met with many challenges including liquidity fragmentation, regulatory hurdles, security concerns and interoperability issues.

In response, MANTRA Chain designed proprietary blockchain modules to tackle these challenges specifically. Notably, the Mantra team sought to address the main concern of regulatory compliance. More on these blockchain modules will be explained below.

So far, Mantra’s unique blockchain solutions appear to have gained traction amongst traditional Web2 companies with partnerships including the likes of Google, UOB and DAMAC Group.

MANTRA Chain’s RWA Product Suite

There are currently 5 developer modules offered by the Mantra team, which are a key design feature of Cosmos SDK chains. It allows developers to design ready to use code in a compartmentalized manner to allow other developers to easily and quickly set up blockchains using pre-built components. For instance, Cosmos SDK provides commonly used modules such as “Governance” and “Staking”, which developers can leverage to set up blockchains easily without designing such features from scratch. In this case, the Mantra team has designed 5 modules that are specific for RWA use. Below is a summary of the 5 proprietary RWA modules.

MANTRA DID (Digital Identity)

This module revolves around tokenizing digital identities as soulbound NFTs (untradeable NFTs). There are also Know Your Customer (KYC) steps through a regulated entity in this process.

MANTRA Guard

Mantra Guard is a comprehensive set of tools and services provided to assist Web3 platforms in meeting regulatory requirements. This module would help streamline and automate many of the regulatory compliance processes such as the KYC process in Mantra DID.

MANTRA Token Service (MTS)

This is Mantra’s ready made solution to allow for Web3 businesses to create, distribute and manage digital assets. Besides regulatory compliance, this module also offers simple role-based access control mechanisms, including freeze, seize, destroy, and transfer functionalities.

MANTRA DEX (Decentralised Exchange)

This refers to Mantra Finance, the main DEX designed by the Mantra team to facilitate on-chain transactions.

MANTRA LEEP (Liquidity Efficient Emissions Protocol)

This is an upcoming work in progress module by the Mantra team. It is a liquidity management mechanism designed to solve the issue of scarce liquidity in less popular altcoins.

OM Crash on 14 April: What Happened?

Early on April 14 2025, MANTRA’s OM token plunged from around $6 to $0.45, wiping out billions in market cap. According to the project, this was caused by “forced closures initiated by the centralized exchanges on OM account holders.” The MANTRA team claims that “(this) was not caused by the team, the MANTRA Chain Association, its core advisors, or MANTRA’s investors selling tokens.” Based on updates from the team, the crash was attributed to the liquidation of large investors using OM as collateral.

However, Crypto Twitter is rife with rumors on the contrary. ZachXBT, a blockchain investigator, is skeptical.

MANTRA community - we want to assure you that MANTRA is fundamentally strong. Today’s activity was triggered by reckless liquidations, not anything to do with the project. One thing we want to be clear on: this was not our team. We are looking into it and will share more details…

— MANTRA | Tokenizing RWAs (@MANTRA_Chain) April 13, 2025

There are alleged reports that wallets linked to MANTRA were involved in dumping large amounts of OM, coupled with rumors about OTC deals.

On the CEX side, Binance states that their initial findings indicate that these drastic price movements are the result of cross-exchange liquidations.

Binance is aware that $OM, the native token of MANTRA, has experienced significant price volatilities. Our initial findings indicate that the developments over the past day are a result of cross-exchange liquidations.

— Binance Customer Support (@BinanceHelpDesk) April 14, 2025

Since October of last year, Binance has implemented various…

Meanwhile, Star Xu, founder of OKX, has released a statement on X that they will be releasing reports on the OM crash.

It’s a big scandal to the whole crypto industry. All of the onchain unlock and deposit data is public, all major exchanges’ collateral and liquidation data can be investigated. OKX will make all of the reports ready! https://t.co/YYnb1ByUGL

— Star (@star_okx) April 14, 2025

Ultimately, what happened with OM has led to discussions around transparency in the cryptocurrency space, and we’ll update when more information is available.

Mantra’s OM Token

OM is Mantra’s governance token launched in 2020 as an ERC20 token on Ethereum mainnet. Mantra was originally an Ethereum DeFi project before it pivoted into becoming its own L1 today. In February 2024, a community proposal was passed to make OM the official L1 staking token for MANTRA Chain. Mantra launched its mainnet successfully in October 2024. After the mainnet launch, legacy OM token holders are encouraged to voluntarily migrate their tokens to the newly launched L1.

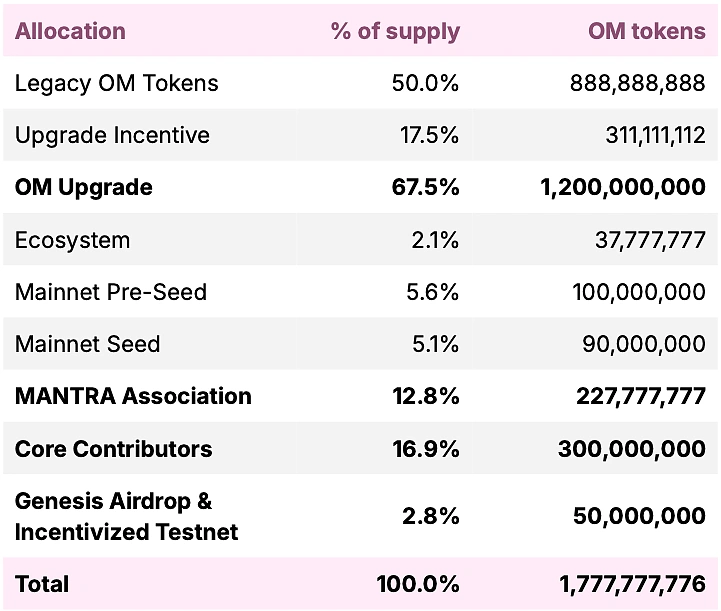

OM Tokenomics

The OM tokenomics was updated after the community proposal prior to their mainnet launch. Essentially, the maximum token supply of OM was doubled. Below is a summary of OM’s updated tokenomics.

Legacy OM Tokens

This refers to the old ERC20 tokens prior to their migration.

Upgrade Incentive

This refers to OM tokens used to incentivize legacy OM token holders to migrate their tokens.

Mantra Association

This refers to the token allocation for seed investors as well as a small ecosystem growth fund (2.1%).

Core Contributors

This refers to the team’s allocation of OM tokens. Team members are subject to a five year vesting schedule, with an initial 30 month cliff followed by another 30 months of linear vesting. Vesting began on mainnet launch (October 2024). In total, about 27% of the token supply is held by the team and its investors.

Genesis Airdrop and Incentivized Testnets

This is the all important allocation for community airdrops, of which 50 million OM tokens have been earmarked, allocation details will be discussed below.

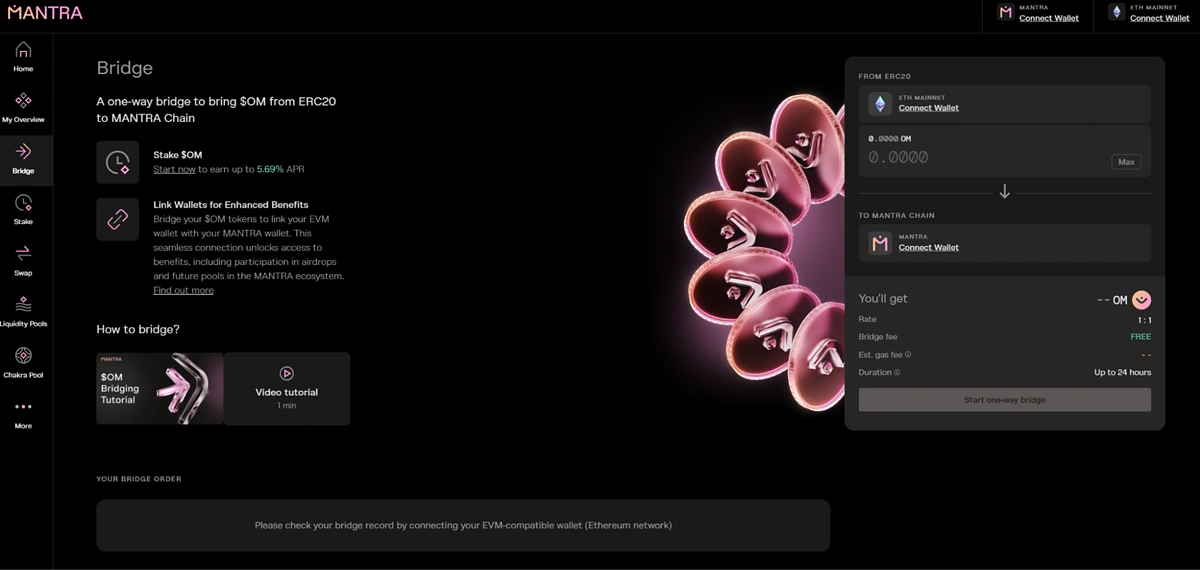

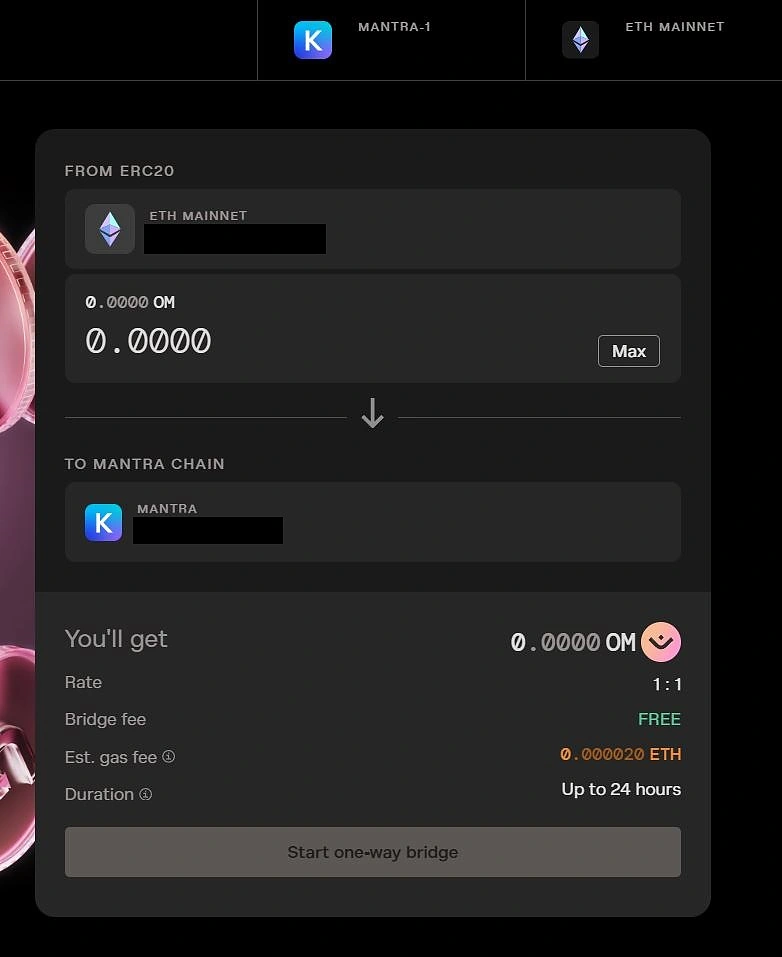

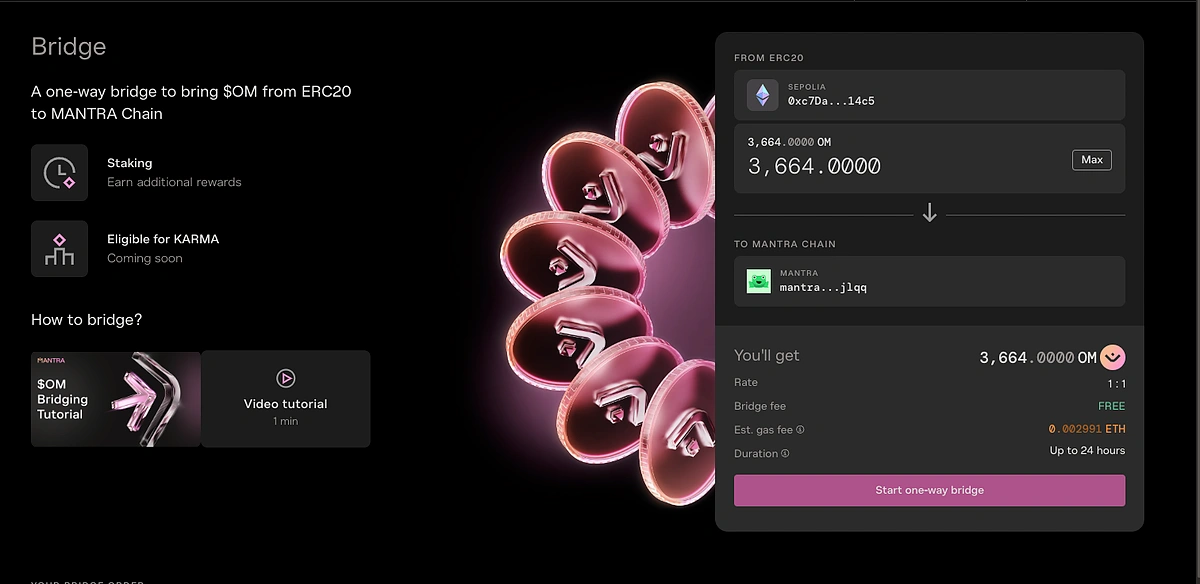

How to Bridge Legacy OM Tokens

In this section we will cover how users can bridge their legacy OM tokens should they have them. You should have an Ethereum wallet (MetaMask, Rabby, etc.) and a Cosmos wallet (Keplr, Leap, etc.) ready for this section.

Step 1: Go to Mantra.zone/bridge

Step 2: Connect Your Wallets

You will be bridging your legacy OM tokens from Ethereum to MANTRA Chain, which is a Cosmos chain, hence you will need to connect both wallets.

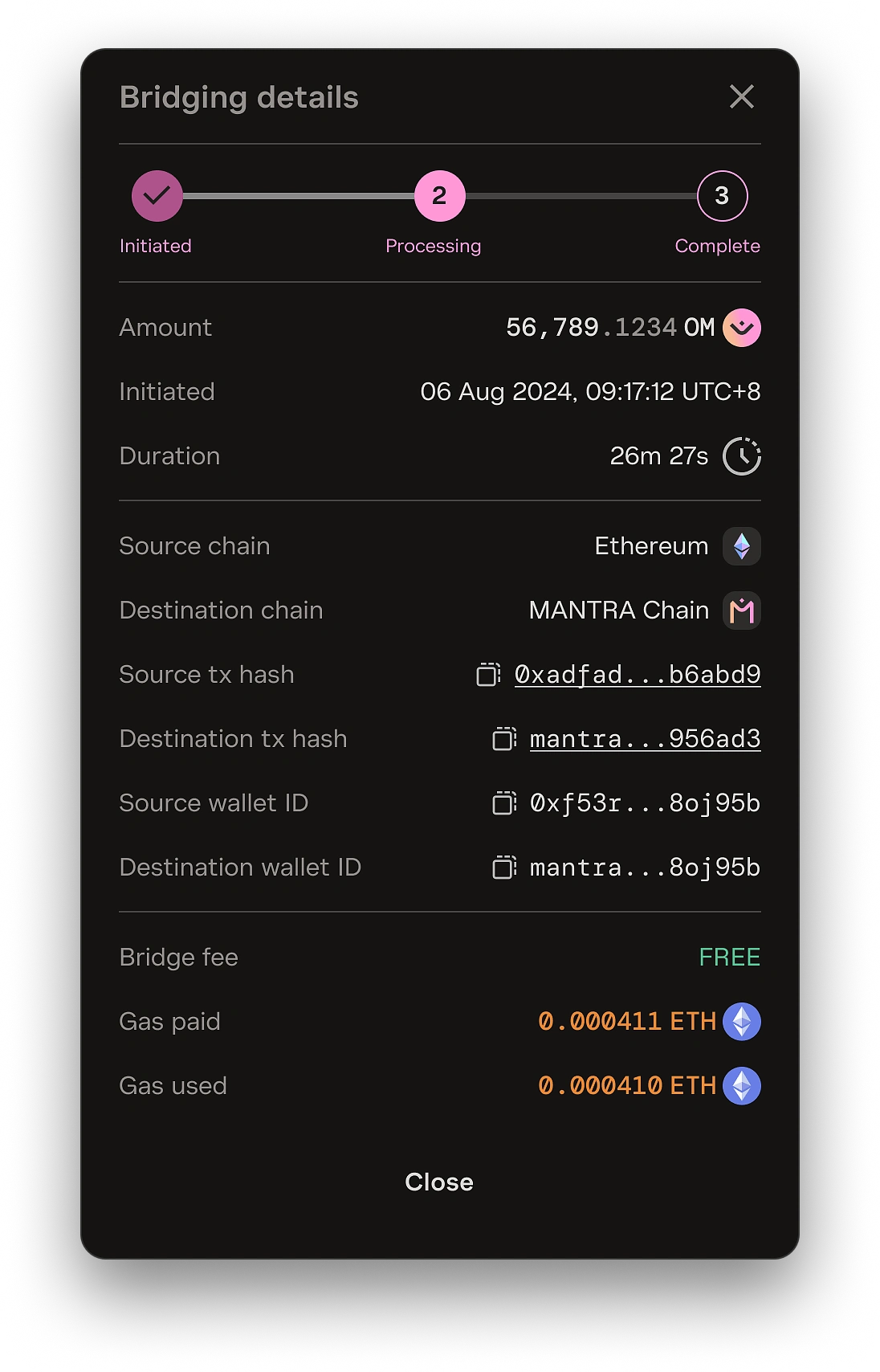

Step 3: Initiate Migration (Token Bridge)

Fill in the amount of OM tokens you would like to migrate and confirm the transaction.

Step 4: Receive Your Migrated OM Tokens

After confirming your transaction your ERC20 OM tokens will be burnt while you receive your migrated OM tokens. The migration transaction typically takes around 30 minutes to complete.

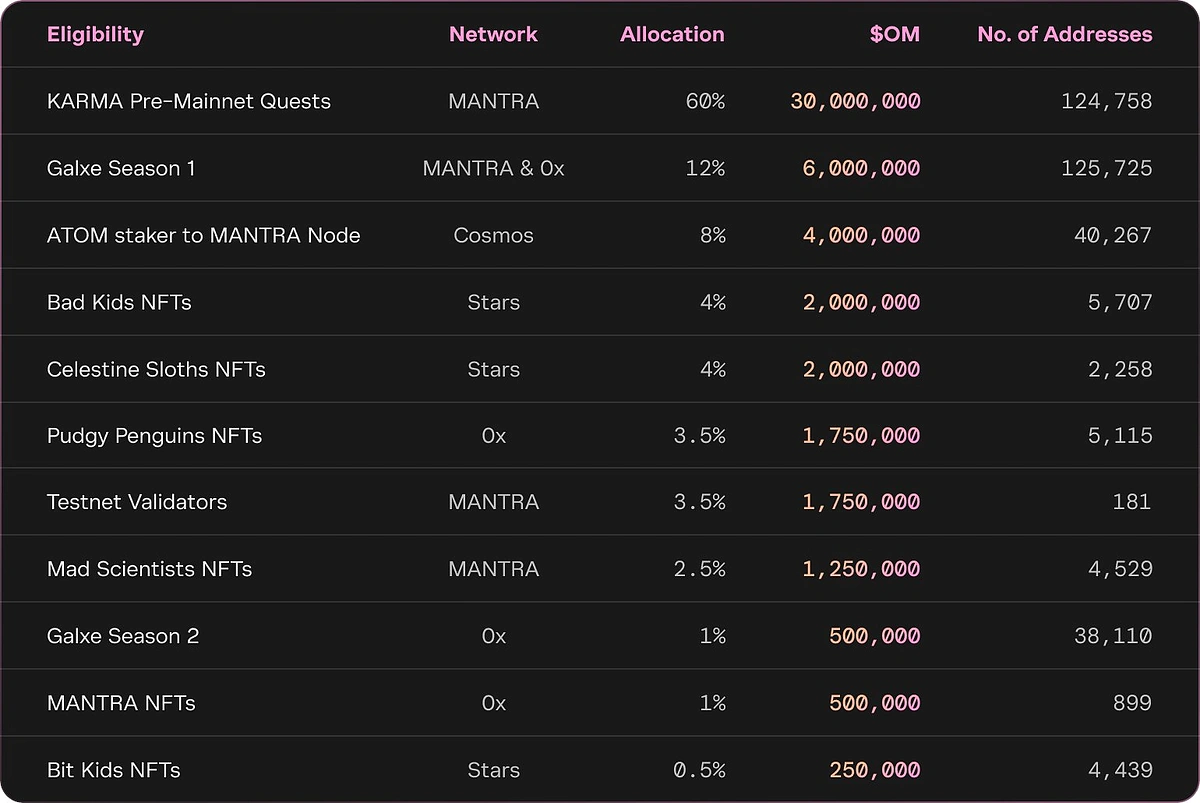

OM GenDrop

The airdrop eligibility and criteria was announced by the Mantra team on X back in August 2024. The post detailed the inclusion of several notable crypto communities including ATOM stakers on the MANTRA node, NFT holders and Mantra.zone participants. A total of 50 million OM tokens will be airdropped, but with vesting schedules. 10% of the airdrop amount will be available in March 2025, followed by a cliff of 6 months until September 2025, after which the remaining amount will be vested linearly till it fully unlocks in March 2027.

Eligibility checker: https://checker.mantra.zone/

Airdrop distribution details.

NFT holders of the popular Pudgy Penguins collections are slated to receive 210 OM per eligible NFT. This translates to a total airdrop amount of around $1470 at current market prices. Celestine Sloths seems to be the most valued NFT community in this airdrop allocation with each Sloth NFT receiving 810 OM tokens.

Conclusion

MANTRA Chain was the talk of town as the world turns its head away from memecoins and onto more quantifiable and sustainable projects such as DeFi and RWA, previously boasting positive price movements even as other assets fell. Mantra also originally caught the attention of many due to the positive price performance of OM. However, it remains to be seen if the project will be able to recover from the OM price crash.

Finally, note that this article is only for educational and informational purposes, and should not be taken as investment or financial advice. Always do your own research before investing any capital in cryptocurrencies.

No comments yet