Author: Ciaran Lyons, CoinTelegraph; Compiled by: Baishui,

Despite the significant progress made in the cryptocurrency industry recently, the market has just announced its weakest first-quarter performance in years — but a cryptocurrency analyst noted that some catalysts could make the outlook for the second quarter brighter.

"It's frustrating. It's definitely the best word to describe the past quarter," Bitwise chief investment officer Matt Hougan said in a recent market report, calling the first quarter "the best quarter in cryptocurrency history."

Bitcoin and Ethereum suffered an unusual blow in the first quarter

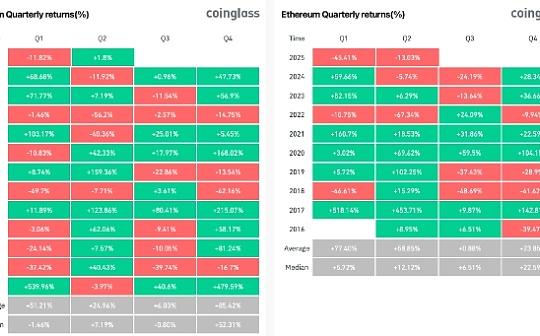

BTC and ETH are the two cryptocurrencies with the largest market cap, with prices down 11.82% and 45.41% respectively in the first quarter of 2025 – and both assets historically performed quite strongly in the first quarter. According to CoinGlass, the first quarter was the second strongest quarter for Bitcoin’s average performance since 2013 (51.2%) and the best quarter in Ethereum’s history (77.4%).

Historically, the first quarter of 2025 was the second best-performing quarter on average in Bitcoin, but it was the best-performing quarter for Ethereum. Source: CoinGlass

Hougan pointed out some key catalysts that could help cryptocurrencies bring more ups in the second quarter.

He pointed out that the global money supply has increased,"After years of austerity, central banks around the world are signaling a shift to monetary easing and M2 expansion."

“Historically, these conditions have been favoring risky assets, especially digital assets,” Hougan said. Pav Hundal, chief analyst at Australian cryptocurrency exchange Swyftx, expressed a similar view in an interview in February, “In normal times, global easing measures are a fairly reliable leading indicator of cryptocurrencies.”

Recently, on April 14, analyst Colin Talks Crypto said: "Global M2 has remained at a high for three consecutive days." Economist Lyn Alden wrote in a September research note that Bitcoin is consistent with the global M2 trend 83% of the time.

BTC/USD vs. global M2 supply. Source: Colin Talks Crypto

Hougan also said thatThe United States' "full relaxation of regulation" may be another positive factor in the cryptocurrency market.“It’s a long-tail effect of regulatory clarity, which no one has talked about yet, and that’s just beginning,” Hougan said.

The growth of stablecoin asset management scale may also be a positive signal, indicating that the cryptocurrency market will usher in more room for growth this year.Hougan said that in the first quarter, the scale of stablecoin asset management soared to "an all-time high of over $218 million."

“The popularity of stablecoins will benefit related industries, including DeFi and other cryptocurrency applications,”He said.

The company also said that the "geopolitical chaos" in the global economy in the first quarter of 2025 was mainly caused by the chaos through tariff measures after US President Donald Trump's inauguration, "is forcing global investors to reevaluate their portfolios."

Just a few days ago, Hougan recently reiterated his forecast that by the end of the year, the price of Bitcoin could surge about 138% from its current $84,080.

"Last December, Bitwise predicted that Bitcoin will reach $200,000 by the end of the year. I still think that prediction is feasible," Hougan said.

Meanwhile, cryptocurrency exchange Coinbase recently said: “It may happen very quickly when market sentiment finally recovers and we are optimistic about the outlook for the second half of 2025.”

No comments yet