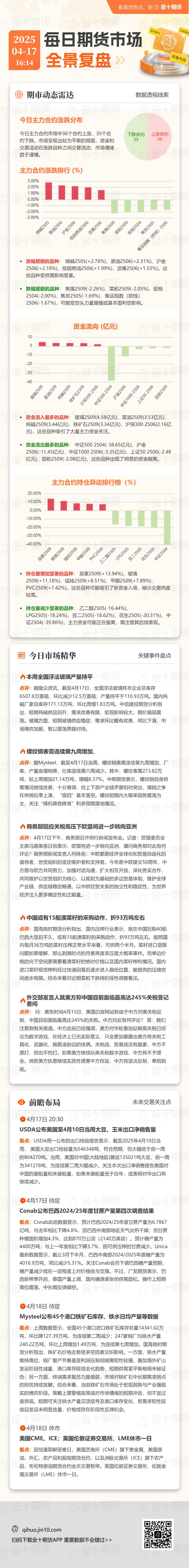

Popular varieties of institutions

1. Shanghai Gold Main Contract: The situation of short-term recession and rising inflation is further clarified, and gold will remain strong as a whole

Precious metals surged and fell on Thursday, with gold and silver showing differentiation. Shanghai gold rose by more than 3% in the morning, hitting 796.7 yuan/gram, Shanghai silver rose by nearly 1%, and then the gold and silver rose significantly. Shanghai silver was relatively weak. Shanghai gold rose by 2.18% to 789.22 yuan/gram, and Shanghai silver fell by 0.23% to 8,161 yuan/kilogram.

Shenyin Wanguo Futures believes thatLast night, Powell once again stated that he was not in a hurry to cut interest rates, and US stocks continued to fall. Trump launched an investigation into the necessity of tariffs on key minerals, which may consider imposing tariffs on key minerals, and tariffs may continue to escalate. Yesterday, India said it was considering importing gold and other high-value goods from the United States in response to Washington's concerns about the continued widening US-India trade deficit. As the trade war disturbances intensify, triggering a series of chain reactions, problems such as financial market turmoil, intensified recession risks, de-dollarization, and U.S. debt have become increasingly prominent. With policy and market uncertainty, gold has entered a state of "no peak". Faced with the upward pressure on future inflation, Powell has not relaxed in future interest rate cuts. However, the long-term U.S. bond prices continue to fall, and market expectations for the Federal Reserve to restart QE and early interest rate cuts have heated up. Considering that the contradiction between the continued US Treasury bonds and debt pressure has further polarized this year, the short-term recession and rising inflation have been further clarified, and gold will remain strong as a whole.

CICC Wealth Futures stated thatBank of America released a global fund manager survey report on the 15th, showing that 42% of investors believe that a global recession is imminent, and the expected probability of a "hard landing" has risen sharply to 49%. This method of reducing US stocks and increasing holdings of gold is quite different from previous markets, and the performance is relatively extreme. The best strategy for the market is still "not guessing the top, follow" and respecting the market trend.

2. Main contract for rebar: The terminal demand performance of steel is relatively weak, and the fundamental angle does not continue to improve.

The main contract of rebar fluctuated weakly, closing at 3,092 yuan/ton, down 0.45%.

Shenyin Wanguo Futures believes thatThe impact of tariffs on steel is exempted and the impact is not direct. The indirect export impact has not been actually fulfilled, but the short-term release of emotions will still be suppressed. The terminal demand performance is relatively weak, and the fundamental angle has not continued to improve. The continuous situation of real steel demand needs to be observed carefully. The current profits of steel mills have recovered and total output is showing a rebound. Whether the apparent consumption of rebar can continue to be stable remains to be seen. The key points that need to be paid attention to in the future - the speed of steel mills' resumption of production and the recovery of demand, and whether the demand of steel mills can be undertaken after the increase in production to prevent the emergence of negative feedback markets. The domestic macro-implementation, overseas disturbance elasticity has decreased, fundamental transactions continue to support it, the National Development and Reform Commission has made it clear that it will continue to reduce crude steel production, but specific details have not been issued yet. The staged macro-emotional atmosphere shows signs of warming up and domestic policy expectations have reappeared. It is viewed weakly after the short-term fluctuation strengthens.

Guosen Futures said,供给端,高炉端利润尚可,铁水持续回升,保持增产,电炉利润不佳,各品种钢材产量出现分化,板材产量回落,长材产量稳中保持增长,钢联口径螺纹周产量回升至232万吨,供应压力逐步增加。需求方面,周度表需数据环比增加,同比回落,市场或有累库压力。贸易摩擦背景下远月需求不确定性增加,短期依旧宏观主导盘面,螺纹低位震荡,建议短线操作。

3. Main contract of crude oil:The crude oil market has initially digested the impact of oversupply and accumulation of inventory, and international oil prices have returned to a neutral position that can be up or down.

On Thursday, the main contract of SC crude oil rose sharply by 2.31%, closing at 482.7 yuan per barrel.

Shenyin Wanguo Futures believes thatRelations between the United States and Iran are tense, OPEC lists compensation plans for overproduction, and oil prices rebound at night. The U.S. imposed new sanctions on Iran's oil exports on Wednesday, a move that comes as the U.S. restarts negotiations on its nuclear program with Iran this month. Trump is trying to increase pressure on the country and reduce its oil exports to zero. But Iranian Foreign Minister Abbas Alachi said on Wednesday before the next round of talks that Iran's uranium enrichment rights are not negotiable. On Wednesday, the OPEC website released an announcement saying that the OPEC secretariat received the latest compensation plans for previous overproduction from Saudi Arabia, Russia, Iraq, the United Arab Emirates, Kuwait, Kazakhstan and Oman. According to the plan, from April 2025 to June 2026, OPEC and its seven member states of the allied countries must compensate 4.572 million barrels of previous excess production, of which Russia is 691,000 barrels; Saudi Arabia is 15,000 barrels; Oman is 97,000 barrels; UAE is 386,000 barrels; Iraq is 1.934 million barrels; Kazakhstan is 1.299 million barrels; Kuwait is 15,000 barrels. The short term continues to bearish oil prices, but also pays attention to the low oil prices giving U.S. sanctions against Venezuela and Iran.

CICC Wealth Futures stated thatGlobal crude oil investors are re-adapting to the Trump 2.0 era. Under the pressure of radical tariff policies, expectations for growth in crude oil demand will slow down sharply in the future. The IEA believes that tariff policies will seriously drag down global economic performance, and as the risk of recession further intensifies, the outlook for crude oil demand is not optimistic. In its latest report, the IEA significantly lowered the growth rate of global crude oil demand in 2025 by 300,000 barrels per day to 730,000 barrels per day, which is far lower than the EIA's 900,000 barrels per day and OPEC's 1.3 million barrels per day, and is expected to further slow down to 690,000 barrels per day in 2026. However, the IEA also pointed out that the sharp drop in oil prices is putting the US shale oil industry in trouble. WTI benchmark crude oil needs to be stabilized at around $65 to make drilling of new oil wells profitable. If low oil prices continue or even continue to fall, it is likely to trigger a rebalancing mechanism on the supply side. At present, the crude oil market has initially digested the impact of oversupply and accumulation of inventory, and international oil prices have returned to a neutral position that can be up or down, but this temporary steady state is still very fragile and needs to be maintained on the premise that the US economy avoids a hard landing and the controllable increase in OPEC+ production.

No comments yet