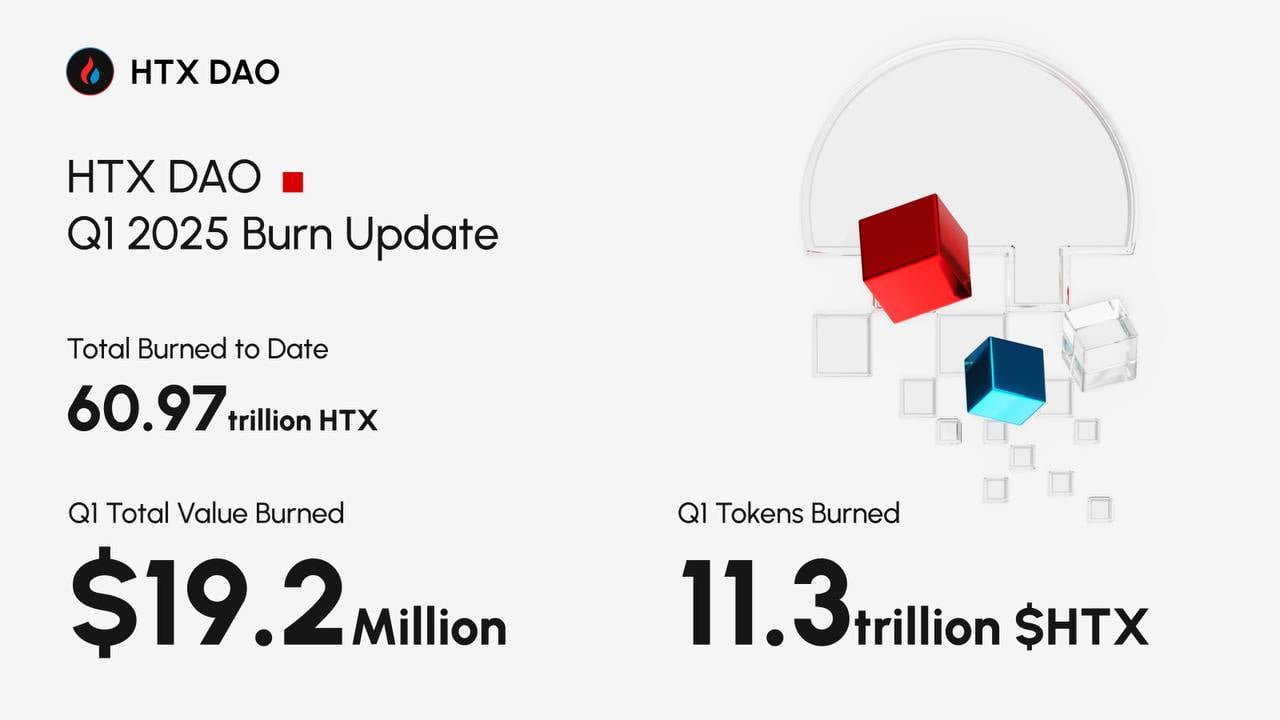

On April 15, HTX DAO released a token destruction announcement for the first quarter of 2025. According to the announcement, a total of approximately 11.3 trillion US dollars of HTX were destroyed this quarter, and based on the current price, it is worth approximately US$19.2 million. At the same time, since its operation, HTX DAO has destroyed more than 60.97 trillion US dollars of HTX, worth approximately US$114 million, showing strong deflation execution and high transparency. This destruction is based on the HTX DAO governance mechanism, and 50% of Huobi HTX's revenue in the first quarter of 2025 are withdrawn for token destruction. The destruction funds are mainly executed through the Sun.io channel, and open and transparent records are completed on-chain. Users can query specific destruction details through transaction hash.

It is worth noting that in the first quarter of 2025, Bitcoin fell from a maximum of nearly $110,000 to $70,000, with a pullback of more than 30%. According to Coingecko data, the average daily trading volume of cryptocurrencies across the network fell from US$200.7 billion to US$146 billion, a drop of 27%. In an overall decline, HTX DAO quarterly destruction fell by only 15%.

At the same time, the HTX DAO position voting tool has been launched recently, supporting users to participate in community governance, proposal voting, etc. through position $HTX. In the future, HTX DAO will continue to strengthen community consensus, help the ecological prosperity, and jointly build an autonomous financial ecosystem in the Web3 era with users.

Compared with many "paper DAO" and "empty call for destruction" projects in the crypto industry, HTX DAO's destruction action not only has verifiable authenticity on-chain, but also reflects its long-term strategy in deflation model and ecological construction. We disassembled this destruction incident from multiple dimensions to try to restore a more realistic and rational HTX DAO development picture.

1. Destruction is not a gimmick, but part of the DAO governance mechanism

The common "destruction" operations in the early stages of the crypto industry are often "market value management" behaviors carried out by project parties in order to stimulate prices in the short term without the consent of the community or a transparent mechanism. In contrast, the "verifiable revenue-automatic repurchase-on-chain destruction" model established by HTX DAO at the end of 2023 provides a strong institutional basis for destruction.

The destruction mechanism of HTX DAO includes:

Income linkage: Used to repurchase HTX based on a certain proportion of ecological income (such as handling fees, platform income, etc.);

On-chain transparency: all destroyed addresses and transaction records can be checked, and data is synchronized in real time;

Cycle clear: Destruction announcements and hash information are issued regularly every quarter and subject to community audits;

Governance constraints: The DAO governance mechanism supervises and adjusts the proportion and frequency of repurchase and destruction.

Therefore, the destruction of HTX DAO is not a short-term market behavior, but a deflation "cash" action under institutional design, with a long-term compound interest effect.

2. Destroy value fluctuations, behind which is the rational manifestation of the market mechanism

Compared with Q4 2024, the total value of destruction in Q1 2025 decreased slightly ($22 million in Q4 2024 and $19.2 million in Q1 2025), and some investors expressed concerns. But from the mechanism perspective, this decline reflects the rationality and non-manipulation of HTX DAO operation:

DAO revenue fluctuations are the norm and depend on the overall trading activity of the market;

Repurchase funds originate from real income, not virtual grants or pre-market capitalization;

The amount and rhythm of destruction follow the established model and do not temporarily adjust due to "market value anxiety".

This shows that HTX DAO's value growth path does not rely on "artificial beautification", but is on a verifiable and sustainable dual-driven path of "growth + deflation".

3. Circulation is reduced, scarcity is increasing, and value logic is being fulfilled

The current deflation trend of HTX DAO is already very obvious:

Cumulative destruction: more than 60.97 trillion HTX, and the proportion of the initial total volume has been continuously increased;

Total circulation decreases: HTX scarcity in long-term holders is constantly increasing;

Token model health: low inflation and high destruction make HTX a "rare net deflation asset" in the exchange ecosystem.

From Ethereum (ETH) EIP-1559 model to BNB's quarterly destruction, deflationary assets have been repeatedly verified by the market as one of the core logics of long-term value support. HTX DAO is constantly advancing along this mature logic, and the mechanisms such as pledge, governance, and nodes in its ecosystem also form positive feedback with the destruction system. The deflation logic of HTX DAO is not only designed by Tokenomics, but also a value consensus: the less circulation, the stronger the value of a single coin; the larger the ecology, the more destruction, and the higher the value.

4. Comparative analysis: Scarce execution power in DAO governance

There are many projects in the market under the banner of "DAO", but it is rare to truly implement governance proposals and cash out the benefits distribution of the mechanism. One of the biggest features of HTX DAO is that its execution and transparency are truly visible on the chain.

Compare with other DAO FAQs:

Therefore, from the perspective of mechanism reliability, HTX DAO can be said to be one of the top samples with the strongest execution efficiency, the clearest deflation logic, and the most transparent financial data in the current DAO ecosystem.

5. DAO is not a slogan, it is a value realization mechanism

Judging from the Q1 destruction data, HTX DAO is still continuing its steady growth route: it still maintains nearly US$20 million in repurchase and destruction under revenue fluctuations, transparent on-chain, high community acceptance, and continuous optimization of circulation structure. These factors come together to form a key judgment: HTX DAO is on a path that can truly enable DAO to "fulfill promises" and realize the long-term value of tokens.

With the recovery of the market, the expansion of the ecosystem and the increase in user activity, we have reason to believe that the destruction data in each quarter in the future will become a convincing "milestone" on the growth path of HTX DAO.

This is not only a verification of the mechanism, but also a realistic answer to "whether DAO can do it".

About HTX DAO

As a multi-chain deployment decentralized autonomous organization (DAO), HTX DAO demonstrates an innovative governance approach. Unlike traditional enterprise structures, it adopts a decentralized governance structure composed of diverse groups, working together to promote the success of this organization. Its unique ecosystem advocates the values of openness and encourages all ecological participants to propose suggestions that can promote the development of HTX DAO.

No comments yet