Original author: Weird thinking

Open a long post and record your thoughts: Why is #Bittensor a scam, and $TAO is heading for zeroing?

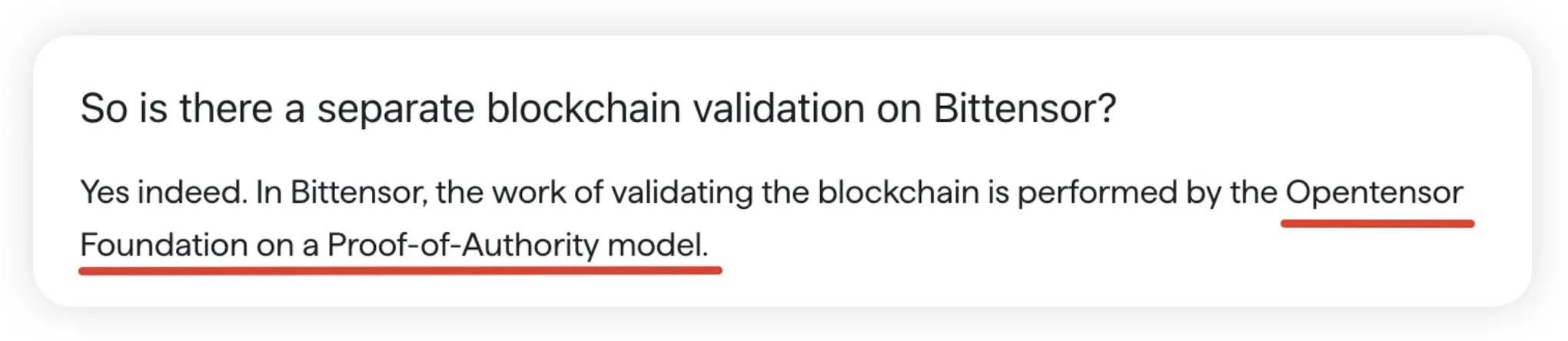

First of all, although Bittensor has always claimed that it is a "fair mining" project, in fact, the underlying Subtensor is neither a PoW public chain nor a PoS public chain; it is a stand-alone chain led by the Opentensor Foundation (Bittensor's foundation), and the mechanism is very black.

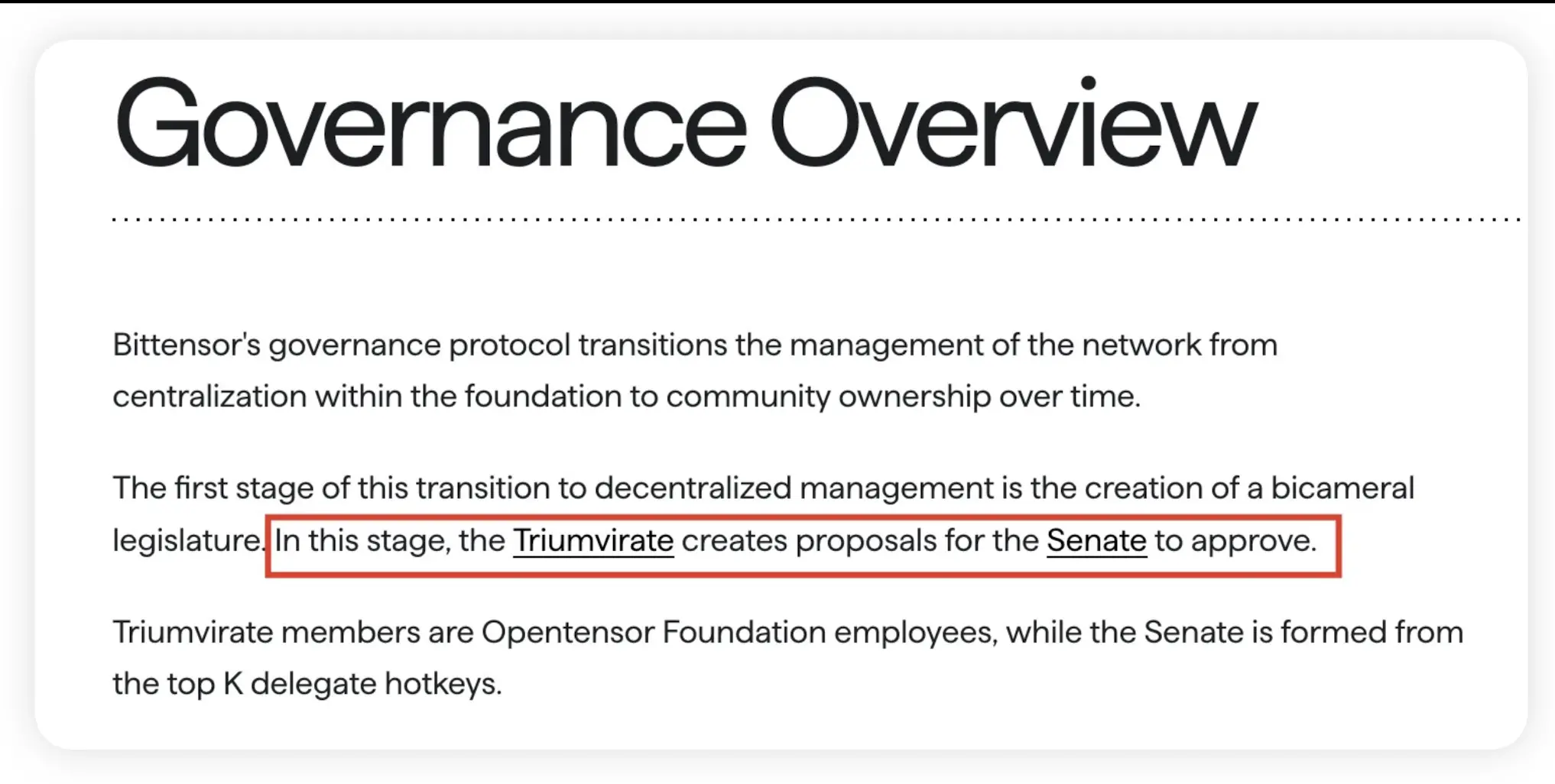

As for the so-called "Big Three + Senate" binary governance structure, the Big Three are three employees of Opentensor Foundation. The Senate is the top 12 verification nodes, all of which are their own people or stakeholders.

Second, the release of "Kusanagi" on January 3, 2021 marks the activation of the Bittensor network, allowing miners and validators to start receiving the first batch of TAO rewards. In the past 2 years and 9 months from the network activation to the launch of the subnet on October 2, 2023, Bittensor has dug up a total of 5.38 million TAOs. However, there is no documentation or information on what rules will the tokens generated during the online launch period from January 3, 2021 to October 2, 2023 and the final flow.

It can be reasonably speculated that this part of the token was divided up by internal members and interest groups, because Bittensor is unlike Bitcoin, which is incubated and invested by VCs.

If this part of the token is divided by the current issuance of 8.61 million, at least 62.5% of TAOs are in the hands of internal members and interest groups. In addition, Opentensor Foundation and some invested VCs also operate the verification node business on Bittensor, so they only have more chip ratios than the 62.5% figure.

Like the OMs that were avalanche a few days ago, all projects that you don’t know why the market value is so high, their deformed market value is often created by poor circulation.

Billions marketcap backed by poor liquidity.

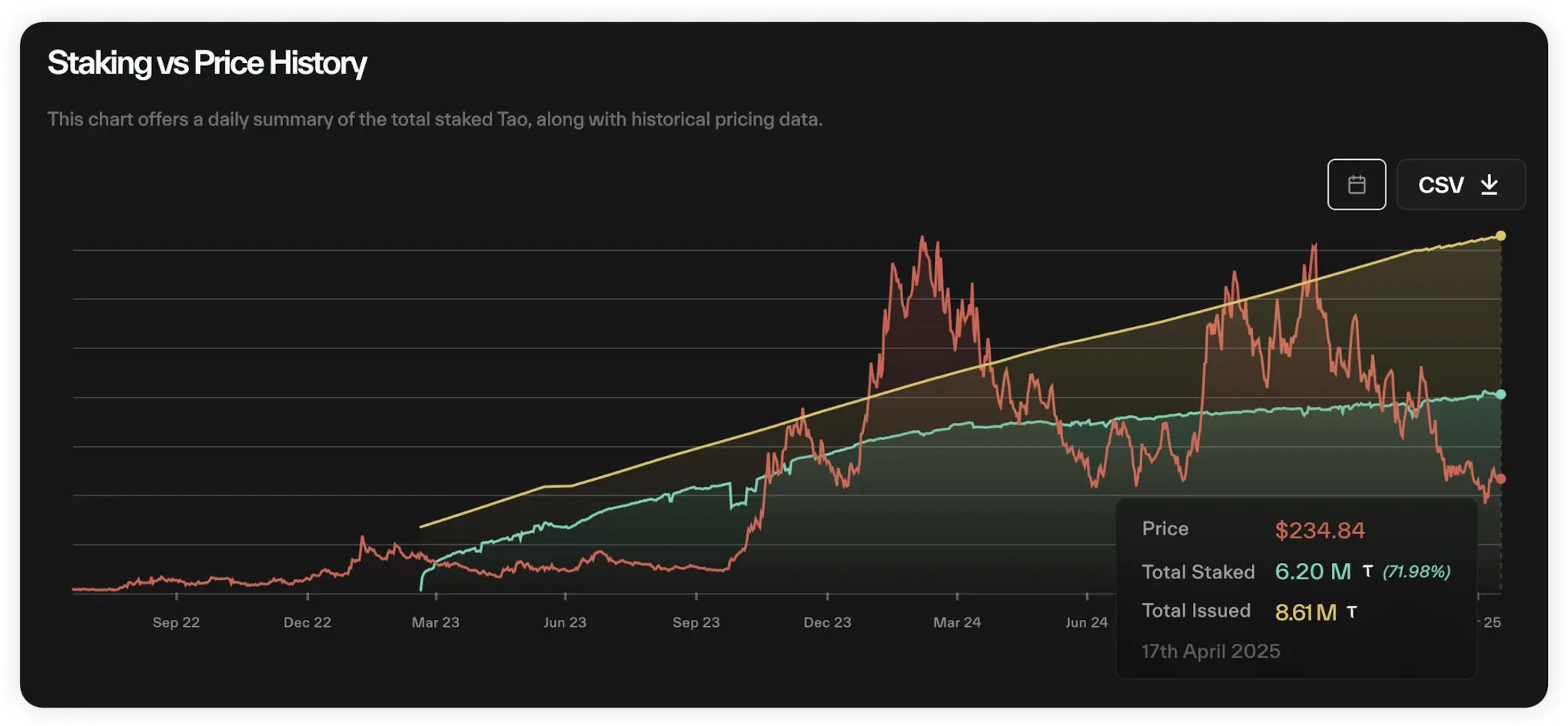

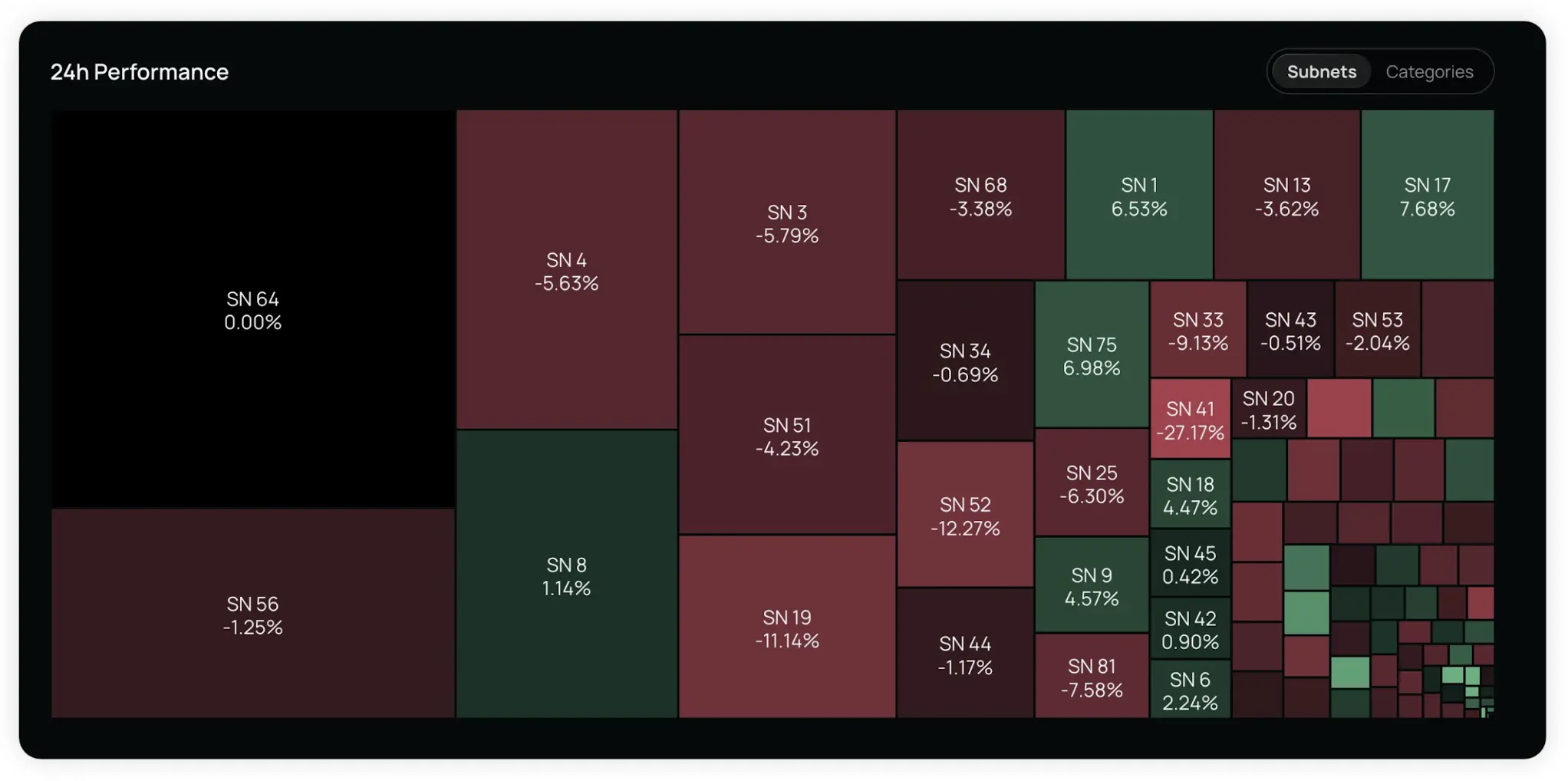

The picture below shows the historical pledge of TAO. Don’t be deceived by it, thinking that TAO’s pledge rate will gradually increase from low to high. The reason I painted this way is because TAO is in severe inflation.

In fact, TAO's staking rate has never been lower than 70%, and at its highest level it is close to 90%. Based on TAO's current market value of US$2 billion, that is to say, at least US$1.4 billion of TAO has never participated in circulation. TAO's actual market value is actually only US$600 million, while the corresponding FDV is as high as US$5 billion, a typical low circulation and high market value project.

The so-called AI project with the highest market value, how Bubble was blown up by the main dealer, please give me some careful consideration.

Finally, the so-called dTAO upgrade is actually more like providing OGs with opportunities to exit liquidity. Let you take over the TAO from the interest group in order to buy subnet tokens with high-speed increase.

According to the three-disk theory, Bittensor's dTAO upgrade in February this year was a situation where the "dividend trading" was unsustainable, and it had to introduce a new Ponzi scam model "split trading" and "mutual aid trading" to deleverage. The core purpose is to fabricate new narratives to attract new external liquidity to continue to squeeze out when the old narrative is weakened and external liquidity is about to be squeezed out.

The first is "split disk": by allowing all subnets to issue tokens, TAO has been successfully positioned as the base currency of all Bittensor subnet tokens, with its value supported by tokens from dozens (and more and more) subnets.

Due to the poor depth of the transaction pool, subnet tokens often have amazing increases. By doing so, Bittensor showed the outside world a mask that can provide high ROI opportunities. The exaggerated nominal ROI provided by subnet Alpha tokens artificially creates huge buying pressure for TAO and covers the sale of TAO for the root network verification node.

Unfortunately, Bittensor's closed ecosystem, coupled with the market environment from bull to bear, has caused the dTAO upgrade to not attract enough external liquidity, and even internal liquidity (those TAOs pledged on the root network) has not been mobilized and activated enough.

At the same time, the entry threshold for subnets has dropped and the number of no upper limit has been set, resulting in too many and too fast issuance of coins diluting the overall liquidity of the Bittensor ecosystem.

The second is the "mutual assistance plate". Unfortunately, Bittensor's subnet issuance of coins cannot establish a mutual aid disk model where funds can be highly circulated like Pump.fun on Solana, because Bittensor's network infrastructure is very poor, and even the tokens of different subnets cannot be exchanged, making it difficult for participants of subnet tokens to migrate liquidity between different subnets. This worsens the liquidity dilution problem caused by the high split rate, and cannot do so, so that funds can be kept on the market and continue to participate in speculation.

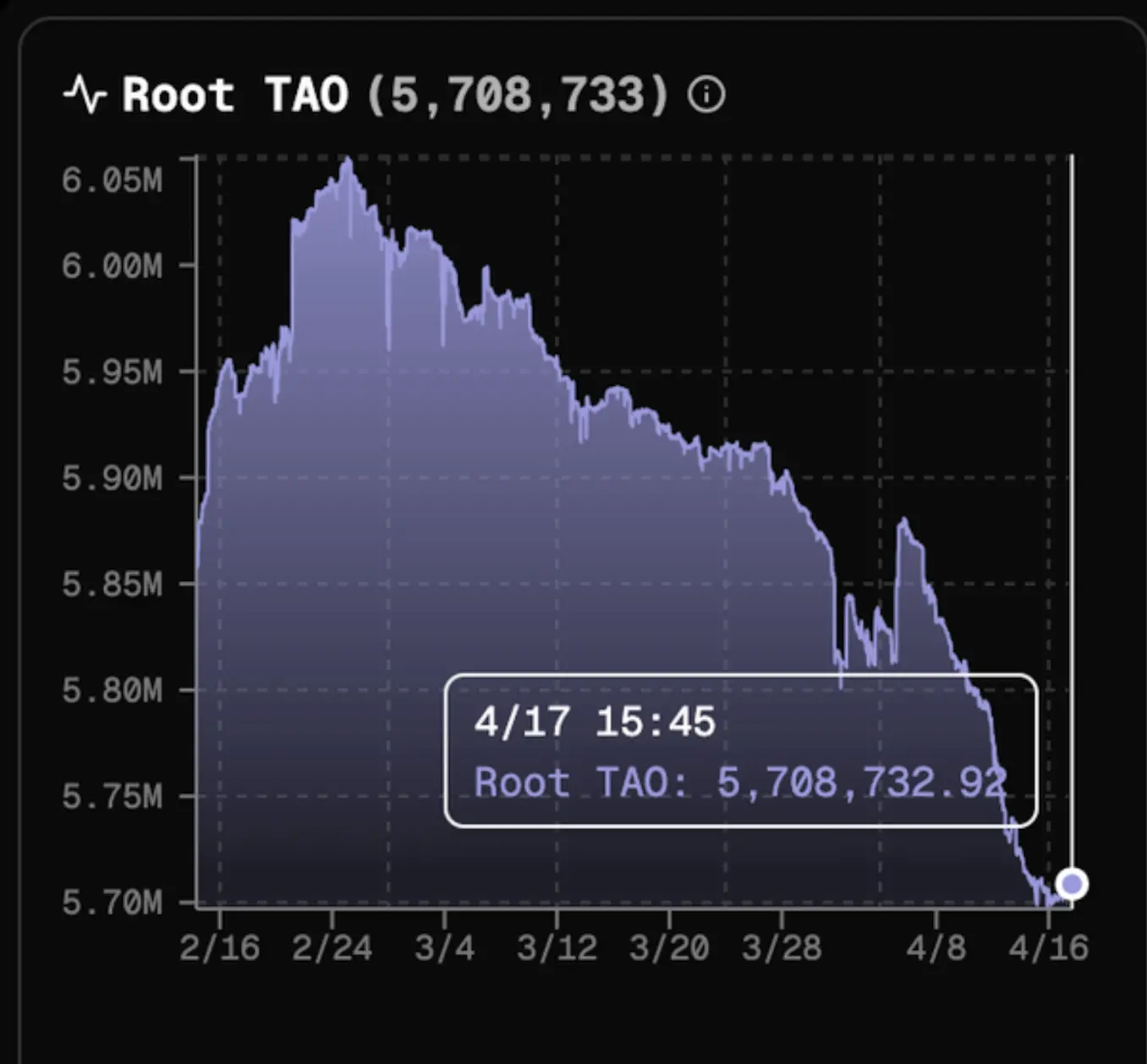

Once the large pledgee of the Gen Network begins to escape collectively, the liquidity on and off the market will quickly dry up.

The moment you sell, game over.

So are the big people running away? The answer is "They are running away"!

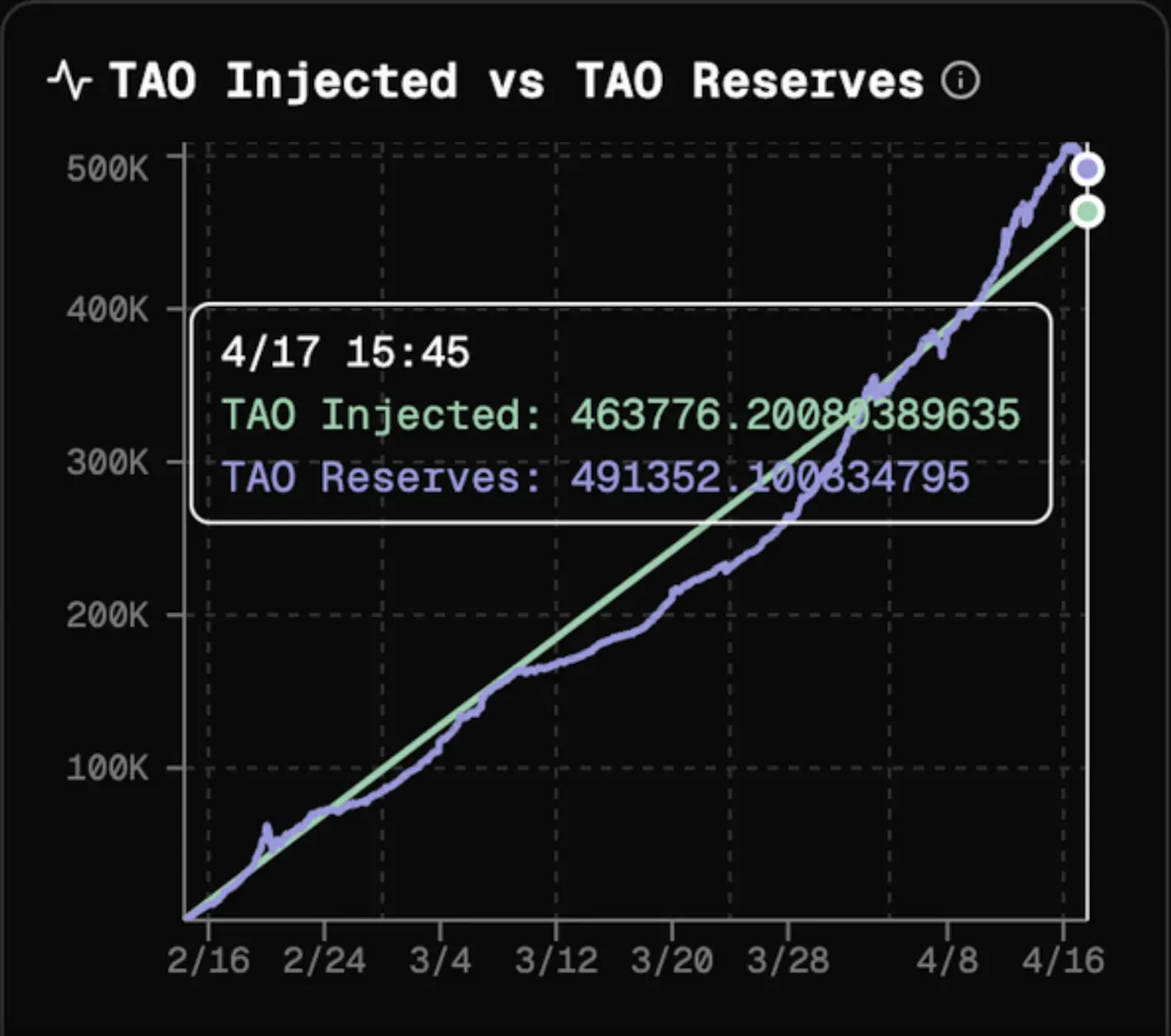

Since dTAO launched:

➤ Bittensor protocol injects 450,000 TAOs into the subnet pool

➤ 150,000 TAOs (33%) flow to the root network verification node through the "automatic sell" mechanism

➤ The amount of root network pledge (τ₀) decreased by 150,000 (5.86 million → 5.71 million)

This means:

300,000 TAOs (≈70 million USD) successfully escaped from the root network and may be liquidated in CEX.

Moreover, the basic disk of Bittensor was subnet and miners before. Bittensor's previous model was like VC, giving money to projects, so that they can focus on building valuable business models first, without having to worry about how to make money and ensure balance in income and expenditure. This is the core reason that attracts projects to be subnets on Bittensor.

The project has attracted miners who provide computing power (in Bittensor, it is "intelligent"). This "hello, I good, everyone" situation is the core reason why Bittensor can become the largest crypto AI project with a market value.

However, after the dTAO upgrade, the interests of the subnet project parties, miners and verification nodes are no longer consistent, and the original "Hello, I, Hello, everyone" no longer exists. The dTAO model has no benefit to the subnet project party, and the collapse of the economic model is Bittensor's biggest and most fundamental problem at present.

In Bittensor's dTAO model, the subnet Alpha token is a kind of "warrant" we obtain from staking TAO on the subnet, and it is not a token that can be circulated in the general sense. This makes it difficult for subnet project parties to invent effective Tokenomics for these tokens. These Alpha tokens are of no use to retail investors except for being able to generate more Alpha tokens. According to my observation, in order to pull the coin price, the most common method of subnet project parties now is to announce the use of project revenue to repurchase Alpha tokens, such as Chutes (SN64).

But if Subnet Owner can only empower Alpha tokens in this way, then the funny thing will come. The 18% Alpha tokens distributed to the subnet project party will always be able to be destroyed by the project party. After all, you have announced that you will use project income to repurchase, so why do you still have to sell your own tokens?

Selling and repurchasing are contradictory.

Therefore, not only can subnet owners not get any income from the dTAO model, they even have to subsidize it: create external income and inject it into their subnet Alpha tokens. This means that the subnet project parties and miners are essentially working for verification nodes. As the privileged class of the Bittensor network, verification nodes not only cannot do anything of value, but can continue to sell subnet Alpha tokens from the beginning of the dTAO upgrade, and TAO flowing to the root network accounts for up to 1/3 of the daily emissions.

The reason why Bittensor was able to absorb other projects to build subnets is essentially because the previous TAO emissions were a good subsidy mechanism for emerging projects without revenue, allowing these projects to only focus on the business model to be run.

If this subsidy mechanism not only disappears, but even reverses it, why should the subnet project still establish a subnet on Bittensor? Isn’t it good to just work alone and earn all your income?

Therefore, the dTAO model, as a means of interest groups' shipment, is hurting the basic foundation of Bittensor's development to this day. Although the business model of most subnets of Bittensor ecosystem is a piece of shit that cannot be seen, without them, Bittensor loses the last fig leaf.

No comments yet