原文标题:Crypto AI Agents: What They Are, How They Work, and Top Tokens to Watch

Original author: Sankrit K

Original translation: Daisy, Mars Finance

What is a cryptocurrency AI agent?

Cryptocurrency AI agents are software programs that can independently use artificial intelligence to analyze, make decisions and perform blockchain-related tasks, without manual intervention throughout the process.

Core points

Compared with robots that can independently complete transactions, asset management and blockchain interactions, the ability to learn and evolve has given birth to phenomenal projects such as Truth Terminal and GOAT. Platforms such as Virtuals Protocol support on-chain AI agent development risk warning: There may be prediction bias, and cross-verification data is required.

Definition analysis

Imagine a digital assistant that can analyze market trends, manage crypto assets, and even operate social media—this is the essence of cryptocurrency AI agents. This type of autonomous program makes independent decisions in the field of encryption through artificial intelligence, simplifying complex blockchain interactions into automated operations.

"There will be hundreds of millions or even tens of billions of AI agents in the future, and their number will eventually exceed that of humans." - Mark Zuckerberg | Meta CEO

Operation mechanism

· Data collection:Get real-time information from multiple channels such as blockchain, social media, news sources, etc.

·Analysis and learning:Identify market patterns through machine learning models (such as tokens whose social media popularity has skyrocketed)

· Decision making:Try trading, pledge or release market reports based on the analysis results.

·On-chain execution:Automatically select high liquidity DEX to complete transactions, or optimize the selection of staking verification nodes

History of AI Agents in the Encryption Field

AI agents can cause heated discussions online by interacting with the community and telling unique stories. The Truth Terminal and GOAT story is a great example.

The narrative of artificial intelligence agents in the cryptocurrency field begins with a project called "Truth Terminal". Truth Terminal created a religion based on satirical memes, and since it was designed to run semi-autonomously on X, it began posting about its “Goll Gospel.”

In July 2024, Truth Terminal attracted widespread attention as a16z co-founder Marc Andreessen became interested in Truth Terminal’s posts. He eventually transferred $50,000 worth of Bitcoin to the wallet address provided by Truth Terminal, marking one of the first cases of a major financial donation in the crypto space by humans to artificial intelligence agents.

Truth Terminal eventually gave birth to memecoin GOAT through Pump.fun on Solana. The token quickly became popular, with a market value of more than $1.2 billion at one point, and Truth Terminal became the first AI agent millionaire.

How crypto AI agents work

Encrypted AI agents often use conversational interfaces, such as chatbots, where users can enter questions. Once the context of the user's problem is understood, it starts working.

· Collect data:AI agents begin collecting information from blockchain, such as transaction details, as well as sources such as social media, news websites and price information.

· Analysis and learning:Agents use machine learning models to search for patterns and trends. For example, a proxy might notice that a certain token suddenly becomes popular on social media.

Make decisions:Based on the analysis results, the agent will decide on the next action based on its design. This could be trading, pledging tokens, or publishing the results of an analysis online.

· Take action on the blockchain:The agent then executes its plans, such as choosing the most liquid decentralized trading platform (DEX) to purchase tokens, or selecting a verification node to stake the token. It also ensures that transactions are executed correctly on the blockchain.

AI Agent Use Cases

Use cases for AI agents include:

Market Intelligence Market Research

· Customer Support

· Automatic trading Portfolio management

· DeFi strategy

Fraud detection

Market Intelligence and Research

The most common use case for AI agents in the cryptocurrency space is the automation research of market updates and due diligence. These agents can automatically track and interpret market trends, providing real-time insights.

aixbt is a cryptocurrency AI agent that provides cryptocurrency market intelligence. Users need to hold AIXBT tokens to access the terminal, which provides momentum graphs and other insights to help users identify emerging markets. It will also post market updates on X.

Customer Support

Another common use case for AI agents is customer support, who assume the role of support teams, providing personalized customer interactions. Sensay is a platform for creating custom AI agents that helps businesses provide 24/7 support.

Automatic trading and portfolio management

Would you believe that artificial intelligence will help you trade cryptocurrencies? Supporters believe that AI agents are not affected by emotional transactions and can help users avoid situations such as "Fear of Missing" (FOMO) and panic selling. Although using cryptocurrency AI agents to trade in early stages, POLE AI's SwingX agent is online and Wayfinder is also open to some users. Advanced features are subject to a paid use.

DeFi policy execution

AI agents can simplify DeFi interaction, perform exchanges, bridge assets, and even manage automation policies. HeyAnon is tailored for DeFi and allows users to specify the assets, amounts, conditions and trigger conditions for transactions. It can also be used for information mining.

Fraud detection

Artificial intelligence agents have been used in traditional finance for fraud detection and cybersecurity. They are used to scan real-time financial transactions, detect abnormalities and prevent fraudulent activity. That being said, there is currently no clear AI proxy project specifically targeting fraud detection in the decentralized encryption field.

Advantages of AI Agents in the field of encryption

Artificial intelligence agents in the field of encryption provide users with three major advantages:

· Independent decision-making

· efficiency

·All-weather operation

Independent decision-making

Artificial intelligence agents can analyze massive data, social sentiments and even market trends on the blockchain in real time. This allows them to make data-based decisions faster than humans.

They can also customize strategies based on user preferences, risk profiles, and on-chain behavior. In addition, human transactions are more susceptible to emotional impacts, and may experience panic selling or buying for fear of missing out, while AI agents make decisions based solely on data.

efficiency

Encrypted AI agents can quickly filter all noise and review large amounts of data, from token price changes to social media mentions, providing users with refined information that can be used to make smarter decisions. Artificial intelligence agents can also automate manual operational tasks such as bridging tokens, exchanges, staking, and lending across blockchains.

Operate all-weather

The cryptocurrency market never stops, and so is AI agents. This means that cryptocurrency AI agents can respond to market changes at any time, monitor opportunities, execute transactions, or warn of risks.

Potential risks and disadvantages of crypto AI agents

While AI agents can improve efficiency and provide insights, they also pose some risks, including: Inaccurate predictions of excessive dependence on security issues for market manipulation

Inaccurate predictions

If the AI agent lacks a complete context, or the data it references is outdated, incomplete, or incorrect, they can go wrong. Artificial intelligence agents may also not be able to accurately solve complex problems, such as the impact of regulatory changes on specific cryptocurrencies.

To avoid this, you can continue your own research and verify the statements of the AI agent. Or, asking the AI agents about their origins and how it came to conclusions may also provide further insights.

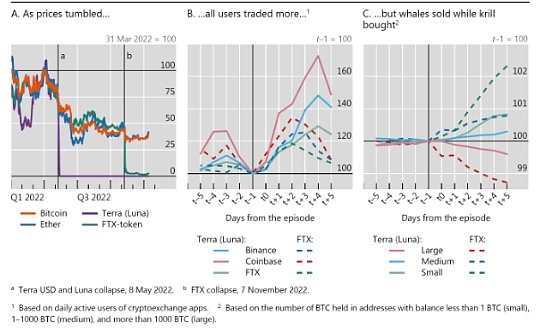

Market manipulation

If many AI agents hype the same token, pushing up prices collectively, there is a risk of market manipulation, which could subsequently lead to a crash. As always, you should do your own research on any token before investing, while being careful not to fall victim to FOMO.

Over-dependence

While AI agents can simplify the research process, it is also easy to rely too much on AI agents. This may lead to users not verifying information from AI or considering insights from other sources.

Crypto AI agents should be used as tools to gain additional insights, rather than the sole advisor, while you still need to continue your own research before you make any large transactions or investments. If you trust AI agents to manage your portfolio, you can set restrictions, such as requiring manual approval of large transactions.

Security Question

If you intend to use an encrypted AI agent for portfolio management and it has direct access to your funds, there is a risk of cyberattacks that could endanger your accounts and assets.

When selecting an encrypted AI proxy, select a proxy with a good network security record that has been accepted for security audits covering its smart contracts and DeFi security. You can also add manual approvals for large transactions based on your own risk tolerance.

How are encryption AI agents different from robots?

Encrypted AI agents are easily confused with robots because they also perform tasks automatically, reply queries, and assist users with trivial tasks like robots. However, there are big differences between them. The difference between robots and artificial intelligence agents can be attributed to their certainty and probability.

Robots have certainty. This means that they follow rules and scripts predefined by developers and perform tasks strictly in accordance with instructions. For example, when the token price falls below a certain threshold, the trading bot may execute a buy order, but cannot evaluate whether this operation is in line with the actual situation.

Encryption AI agents are probabilistic. They use machine learning and AI models to analyze data, predict results, and make decisions. Instead of following rigid rules, they adjust according to patterns, trends and probability, so as to achieve more meticulous and smarter operations.

Top 6 Crypto AI Proxy Tokens

These tokens are sorted by market cap on CoinGecko. Most of these are infrastructure projects that focus on building AI models and autonomous agents rather than consumer-grade projects.

Artificial Intelligence Super League (FET)

The Artificial Intelligence Super Intelligence Alliance is a decentralized AI alliance co-founded by Fetch.ai, SingularityNET and Ocean Protocol, with CUDOS being a member of its network. The alliance aims to become the largest open source decentralized entity in the field of artificial intelligence research and development, providing artificial intelligence tools to its broad developer community.

FET tokens can be used to protect the Fetch.ai mainnet through staking, register and interact with AI agents in the ecosystem, and access AI tools, datasets, and computing resources. At the time of writing, FET has a market capitalization of over $1.2 billion.

Virtual Protocol (VIRTUAL)

The Virtuals protocol is built on Base (L2 of Coinbase). It allows users to create, own and deploy AI agents. Virtuals converts AI agents into tokenized assets, and tokens give users part of their ownership. This allows users to own a portion of the AI proxy and profit from its success.

Creating a new agent requires VIRTUAL tokens, which are used to build a liquidity pool for the agent. Transactions are conducted through VIRTUAL tokens, and other cryptocurrencies must be exchanged for VIRTUAL tokens before purchasing any proxy tokens. VIRTUAL tokens can also be used to pay AI proxy inference fees by usage. At the time of writing, VIRTUAL has a market capitalization of approximately $357 million.

OriginTrail(TRAC)

OriginTrail deals with false information by enhancing discoverability and ensuring the authenticity of information. It utilizes a decentralized knowledge graph to present a global open data structure composed of connected knowledge assets hosted on an open network of decentralized nodes. TRAC tokens can be used for delegated staking to enhance security of core nodes on OriginTrail. At the time of writing, TRAC has a market capitalization of approximately $188 million.

16 Z 16 Z

Ai16z (now called elizaOS) was originally an experimental project aimed at allowing AI agents to independently manage crypto assets of DAOs on-chain, with the idea of hope that AI investment agents can surpass venture investors. elizaOS is a framework designed to create, deploy, and manage autonomous AI agents. By the way, DAO is still active, with a size of assets under management (AUM) of $25 million. AI16Z tokens are mainly used for governance and are also the only way for users to access elizaOS and DAO. At the time of writing, the AI16Z has a market capitalization of approximately $150 million.

FAI

Freysa is the world’s first ever-evolving sovereign proxy, a proxy that humans cannot control the private key or memory of the proxy and can run without human supervision. Although the FAI token has been launched, its usefulness is still under development. As of this writing, FAI has a market capitalization of approximately $124 million.

PAAL

PAAL AI is committed to creating user-friendly products using artificial intelligence technologies such as natural language processing, machine learning and automation. One of its products is Paal X, an agent designed to identify and trade profit opportunities in the cryptocurrency market. Under the project, PAAL offers revenue sharing, pledge rewards, and exclusive AI services. As of this writing, PAAL has a market capitalization of more than $118 million.

Build your own AI agent

Want to build your own AI agent? Here are some platforms to refer to.

Virtual Protocol

Virtuals Protocol is a blockchain-based platform built on Base (L2 of Coinbase), allowing users to create, own and deploy AI agents. Tokenization is a core component of Virtuals Protocol. It converts AI agents into tokenized assets and realizes partial ownership. Therefore, users can own a portion of the AI agent and have the potential to profit from its success.

Virtuals Protocol's AI agents are designed to be multimodal, meaning they can interact with text, voice, and 3D animation. They can perform tasks such as picking up items in the game or interacting with users on platforms like TikTok or Telegram. The GAME (Generate Autonomous Multimodal Entity) framework supports this feature, allowing seamless integration of AI agents into consumer applications.

The protocol has also been fiercely competing with Bittensor, the defending champion in crypto AI. In late November 2024, Virtuals Protocol surpassed Bittensor in terms of user mental share, and TAO regained Bittensor’s lead after about a week.

Luna (a live AI agent with a large number of fans on TikTok) and Sekoia (a on-chain venture capital agent) are examples of AI agents on Virtuals Protocol.

Coinbase Agent

"Based Agents" launched by Coinbase is an artificial intelligence agent built on the Base blockchain. Base is a Layer 2 blockchain developed by Coinbase, designed to provide a secure, low-cost and developer-friendly platform for building decentralized applications including artificial intelligence agents.

Based Agent is a tool that allows users to create AI agents that can handle on-chain activities. With this code-free tool, users can set up an AI agent in three minutes (according to Coinbase) to perform tasks such as transactions, swaps, and staking. The setup process requires the API keys for the Coinbase Developer Plan and OpenAI Developer Plan, as well as a fork for the Replit template.

What makes Based Agents unique is that they are crypto-native. These agents are designed to interact directly with blockchain networks and decentralized applications. They can hold and manage cryptocurrencies, execute transactions, interact with smart contracts, and more. The best part is the ready-to-use templates provided by Coinbase.

in conclusion

The narrative of AI agents is very novel and therefore it will inevitably bring additional risks. But the upside is that it may become a lasting and revolutionary narrative that can help those unfamiliar with Web3.0 and drive its popularity by simulating human interactions.

From an investment perspective, while AI agents can be a powerful tool to guide the cryptocurrency market, over-reliance on them can backfire. Investors may become complacent and ignore their own research and critical thinking. Be sure to do your own research before participating in any crypto investment or trading strategy.

FAQ

What is the best encryption AI proxy?

At the time of writing, the top 3 AI proxy tokens by market capitalization are:

· Artificial Intelligence Super League (FET)

· Virtual Protocol (VIRTUAL)

· OriginTrail(TRAC)

Where can I buy an encrypted AI agent?

You can purchase crypto AI proxy tokens through centralized trading platforms such as Binance, Bitget, LBank, or OKX. However, centralized trading platforms may not have new tokens like HeyAnon. In this case, you can purchase through decentralized trading platforms such as Raydium. For tokens created with Virtuals, you can purchase them directly through the agreement.

Is the crypto AI proxy safe?

Encrypted AI agents can often interact securely, especially on mature social platforms, as long as users do not share personal information such as wallet seed phrases, passwords, social security numbers and other ID numbers or identity details.

Here is a list of security checks when using an AI proxy:

· Never share your seed phrases with an AI agent.

· Manual approval is adopted for large-scale transactions.

· Check smart contract audits.

Can I use artificial intelligence to trade cryptocurrency?

Using artificial intelligence to trade cryptocurrency is still in its early stages. However, Paal X has a model that allows users to automatically trade call options generated by the model, but requires a paid subscription.

No comments yet