Original title: "A surge of 10 times a week and a 80% drop in a day. What happened to AERGO? 》

Original author: Oliver, Mars Finance

In mid-April 2025, $AERGO set off a storm in the crypto market. Within a week, its price soared from $0.05 to $0.5, up 10 times; but just one day later, the price plummeted 80%, falling to around $0.1. This roller coaster market has turned investors' emotions from fanaticism to anger, and Binance's data issues have pushed the storm to a climax. What exactly drives the crazy rise of $AERGO, and what leads to the collapse and strong rebound in the community? Let us uncover the truth of this storm.

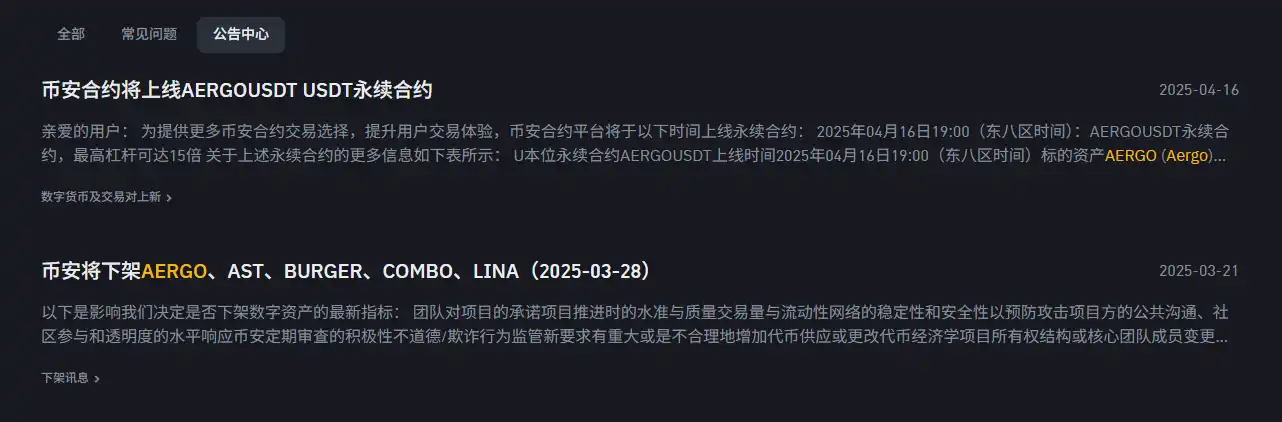

Binance's "Operational Fog": From the Shelves to the Futures Hot

The story of $AERGO begins with Binance’s dramatic decision making. Aergo is a hybrid blockchain project developed by South Korean company Blocko, which has long received no widespread attention for its low profile. On March 28, 2025, Binance announced the removal of $AERGO's spot trading pair on the grounds of "insufficient liquidity". The decision disappointed the community, with prices falling to a low of $0.04, and investors generally looked down on the outlook.

However, the plot took a sharp turn on April 16: Binance suddenly announced the launch of the $AERGO/USDT perpetual contract, supporting up to 15x leverage. As soon as the news came out, speculative funds quickly poured in, and the price of $AERGO soared from $0.2 to $0.4995 in a few hours, a record high.

This rise has been helped by many parties. On April 15, the DigiFinex trading platform launched the $AERGO/USDT trading pair, which improved token liquidity. The Aergo team also announced on the same day that it will hold an AMA on Telegram on April 16 to discuss decentralized AI and potential new projects, igniting the enthusiasm of the community. Market sentiment was pushed to its peak, and technical indicators showed that the RSI (relative strength index) was as high as 93, indicating that the market was seriously overbought and the speculation boom reached its peak.

The fuse of the crash: leverage trap and data deviation

Just as investors cheered for the 10-fold increase, the launch of Binance futures on the afternoon of April 16 became the starting point of the disaster. The $AERGO price fell sharply from $0.5 to $0.1 in 12 hours, down as much as 80%. Community anger spread rapidly, pointing to Binance’s data transparency issue. Investors found that Binance showed that $AERGO's circulating market capitalization was $30 million, while at 477 million of circulation, there was a serious deviation in the market capitalization data. For example, at the price of $0.40 USD, the market value corresponding to the 477 million circulation should be 0.4 × 477 million = 190.8 million; even if the price falls to $0.22419 (data on April 17), the market value should be 0.22419 × 477 million ≈ 107 million, but Binance still shows 30.0869 million. This deviation makes investors question: Did Binance deliberately underreport market value, causing retail investors to mistakenly think that the token is "undervalued" and take over at a high level?

Funding rate data exacerbates market chaos. During the surge, $AERGO's capital rate was about 0.1%, attracting a large number of leveraged longs. However, after the price collapsed, Bybit data showed that the capital fee rate fell to -3.000%, shorts dominated the market, and long positions were forced to close. On-chain data further showed that the number of open contracts in Bybit, Gate.io and MEXC fell by 53%, 50% and 71%, respectively, reflecting the panic withdrawal of traders. High concentration has also become a hidden danger: about 50% of the tokens are held by teams and early investors and are vulnerable to large-scale sell-offs.

Community anger: data fraud or low-level mistakes?

Binance’s market value bias has become the focus of community controversy. Investors calculated and found that Binance's market value data was much lower than the actual value. Some people sarcastically said: "Binance doesn't even calculate the primary school students? 477 million circulating volume, 0.4 US dollars unit price, how could the market value be 30 million?" What is even more confusing is that the market value data of trading platforms such as OKX, Bybit and BG are consistent with the actual circulation, but Binance's data is abnormal, which triggers speculation of "data fraud". An investor in the community complained: "I thought the market value was only 30 million yuan, so I bought it a little, but it fell. After a closer look, the market value was not right at all!" Another investor said that because he misunderstood that Binance bought at a high level, the price was cut in half and the losses were heavy.

The consequences of this data bias are catastrophic. Investors generally believe that Binance's underreporting market value may mislead retail investors to believe that $AERGO is "undervalued", thus taking over long positions, while large investors take the opportunity to sell and make profits. The community began to call for rights protection, and some people proposed: "The price of the currency has been cut in half twice. Can those who lose money long to find Binance to protect their rights? It is obvious that their data mislead retail investors!" The Aergo team issued a statement on April 17, acknowledging the abnormal price fluctuations, but emphasized that Binance's futures launch plan was not known in advance, and called for the resumption of spot trading to stabilize the market. However, the official website has further weakened community confidence due to the surge in traffic and DDoS attacks.

The surge in $AERGO reflects the complexity of the crypto market. Community sentiment swings between optimism and anger: Supporters are expecting a new direction for the project on April 26th community vote; critics warn that high concentration and opaque operations on trading platforms may lead to more volatility. Technical analysis shows that $AERGO stabilizes in the range of USD 0.1-0.2, and Bollinger Bands shows that volatility is narrowing and may enter the consolidation stage in the short term. However, the continued negative capital rates and sluggish open contract volume reflect that market sentiment is still pessimistic, and investors need to be wary of further downward risks.

Conclusion: Market lessons in the fog of data

The $AERGO roller coaster market surged 10 times a week and slumped 80% in a day. The $AERGO roller coaster market is a microcosm of speculative fanaticism and market risks. Binance's dramatic operation from removing spot stocks to launching futures has not only ignited the speculative craze, but also triggered a trust crisis due to data deviations. The serious errors in market value display not only caused heavy losses to retail investors, but also exposed the transparency of trading platforms. For investors, the $AERGO story reminds us that between the craze and traps of the crypto market, the authenticity of data may be the key to determining profit and loss.

No comments yet