As we delve into 2025, have you noticed how the atmosphere in the crypto sphere has become increasingly tense and complex? Not long ago, being a cryptocurrency investor seemed like a foolproof path to quick riches. However, as the market matures and regulatory environments tighten, more and more investors are realizing that making money is no longer straightforward. Coupled with market volatility and the proliferation of scams, many find they're almost picking up cash yet never actually grabbing it. Today, let's explore why making money in the crypto space has become challenging in 2025 and discuss the avenues still available for ordinary investors.

1. High Volatility and Market Saturation

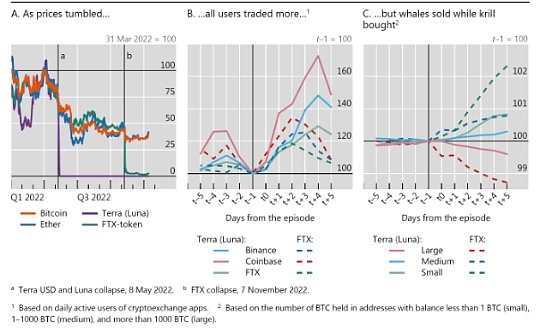

First and foremost, the high volatility of the crypto market leaves many investors unsure of where to start. The price fluctuations of major coins like Bitcoin and Ethereum remain significant, but compared to the frenzy of previous years, this volatility has begun to wane. While price predictions and market trends were somewhat straightforward in 2021 and 2022, by 2025, the market dynamics have grown more complex with a multitude of influencing factors.

Market Maturity: By 2025, the crypto market has reached a relatively mature stage. An influx of capital has accelerated competition among emerging projects, leading to a faster market shakeout. In this environment, ordinary investors face an increasing asymmetry of information, making it significantly harder to gain insights and achieve profitable outcomes.

2. Changes in Regulatory Environments

Next, let’s discuss regulation. The cryptocurrency market has attracted increasing attention from governments around the world over the past few years, particularly concerning anti-money laundering and investor protection. Regulations are tightening, resulting in heightened risks for market participants.

The Importance of Compliant Investment: In this landscape, ordinary investors who blindly follow trends may easily fall into traps set by laws and regulations. Therefore, understanding your local legal framework and investing only in legitimate, compliant projects has become a prerequisite for profitability in crypto for everyday investors.

3. Challenges in Identifying Quality Projects

Given the market's complexity, investors must learn to discern quality projects from the noise. In 2025, numerous projects continue to surface, many of which are promoted with great fanfare but lack substance. How can you determine the reliability of a project? This requires a degree of research capability and risk assessment skills.

Research the Team: Check the experience and reputation of the project team. The more reliable the people behind the project, the higher the credibility of the initiative.

Technical White Papers: Most quality blockchain projects publish white papers. Reading these documents carefully can help you understand the project's goals, technical highlights, and the real-world problems it aims to solve.

Community Engagement: Observe the project's social media presence and community feedback. An active community typically indicates higher project attractiveness and potential for success.

4. Where Are the Money-Making Opportunities for Ordinary People in Crypto?

Although finding profitable avenues has become more challenging, opportunities still exist for ordinary investors. Here are some suggestions to help you uncover suitable money-making strategies:

Long-Term Investment: Rather than frequent trading, consider investing in projects with potential for the long haul. While Bitcoin and Ethereum may show volatility in the short term, their value tends to grow over time.

Participating in Staking and Liquidity Mining: Many emerging projects offer staking and liquidity mining opportunities where investors can earn returns by locking up assets, which suits those with lower risk tolerance.

Continuous Learning and Knowledge Building: Staying updated on market dynamics and mastering investment techniques can help you remain calm and make rational decisions amid volatility. Joining relevant investment communities, engaging in discussions, and networking with professionals are effective ways to enhance your skills.

Small-Scale Investments to Diversify Risk: Avoid concentrating all your funds in one project; diversifying your investments can effectively reduce risk.

Conclusion: Opportunities Amidst Challenges in the Crypto Market

In summary, while the crypto landscape has become more complex in 2025, it does not mean that all opportunities have vanished. Ordinary people can still find avenues for success through rational analysis, long-term investing, and constant learning. I hope this piece provides some valuable insights for your investment journey in the crypto space. No matter how market conditions evolve, maintaining a calm mindset and a passion for learning is the key to winning in this volatile environment.

No comments yet