Solana apps still dominate the decentralized market, gaining 46% of fees for all major chains. The share of Solana still reflects the slower meme market since the January peak.

Solana apps make 46% of all app revenues for March, still far ahead of Ethereum and other L1 chains. The results for the previous month reflect a slower meme token market, but also signal that the Solana app ecosystem is key for crypto activity.

Solana apps achieved $146M in monthly revenues, surpassing the Ethereum ecosystem. Despite the relatively high performance, Solana fee share is down since January.

📊 REPORT: @Solana dApps generated 46% of total revenue across all chains in March, dominating the ecosystem and maintaining strong user activity even as the memecoin frenzy cools down.

– Revenue: $146 million pic.twitter.com/eAKKE0xdBq

— SolanaFloor (@SolanaFloor) April 18, 2025

Solana app revenues still need to offset the expenses for running the network. Currently, Solana subsidizes its validators. Solana has up to $4.5B in expenses for running the network, still surpassing the revenues from on-chain economic activity.

The peak month for meme token activity expanded Solana app revenues to 73.3% of all on-chain app revenues. January was a high watermark for the Solana ecosystem, which was later displaced by new narratives and apps. However, the token casino continues to have its appeal, especially after the renewed trading frenzy around FARTCOIN.

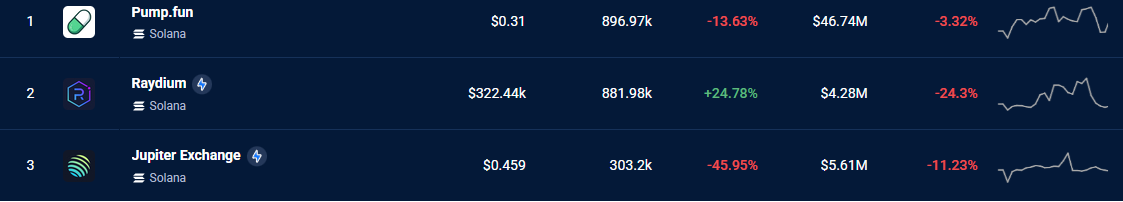

Pump.fun is also back in the top 5 apps in terms of daily fees, with up to $2.78M daily.

Solana apps still surpass BNB Smart Chain

The Solana app performance in the past month is slightly higher compared to BNB Smart Chain, which is catching up with its own brand of meme activity. The app fees are independent of the main chain revenues, which go toward validators.

Solana app revenues mostly go to the teams, with some platforms also offering a form of earnings distribution. In March, Solana top apps included aggregator Jupiter and the Raydium DEX, as well as the Pump.fun platform, which regained higher activity levels. Solana daily revenues are also fluctuating, with days when the share rises back to over 70% in the short term.

Solana apps continue to achieve up to $6.36M in revenues in 24 hours, in the form of SOL tokens. The apps continue their activity recovery, as crypto traders still demand the most active chains for fast returns. Jupiter, Raydium and Kamino Lend increased their revenues by about 15% in the past week, reflecting the renewed inflows into the Solana ecosystem.

Solana apps lead to SOL recovery

SOL recovered to $134.44, after a recent dip under $100. The performance of apps, despite the SOL price levels, shows the Solana ecosystem remains robust. SOL is close to its usual range of $150, despite the need for apps to sell SOL.

SOL open interest also increased, from $1.86B after a series of liquidations up to $2.6B. SOL now awaits a breakout to $142, against the general headwinds of the crypto market.

The SOL market manages to absorb the regular unlocks, especially the outsized allocations in April. For the rest of 2025, the Solana ecosystem is expecting a smaller supply pressure. SOL is also locked in DeFi protocols, turning whales into holders.

Cryptopolitan Academy: Want to grow your money in 2025? Learn how to do it with DeFi in our upcoming webclass. Save Your Spot

No comments yet