Peter Schiff pointed out sharply about the fragile nature of the U.S. economy in a recent podcast:"We rely on printing money to consume goods from other countries, and the world bears our inflation, and we think we have taken advantage of it.", but this model is actually an overdraft future - foreign capital is using US dollar bills to acquire U.S. stocks, bonds and real estate, "we squander the present, but we have mortgaged the wealth of our descendants."

Structural imbalances have no way out. Schiff stressed that if we want to truly rebuild the economy, the United States must cut medical insurance, social security and defense spending."But politicians have no courage to implement reforms". The current system is built on three major bubbles:The dollar's high valuation, trade deficit and artificially depressed interest rates, and all this is about to collapse. What's more serious is thatReciprocal tariff policies will force inflation from financial markets to the real economy, accelerated recession:“We are already in stagflation and the future will only be worse – soaring inflation coexist with weak economics.”

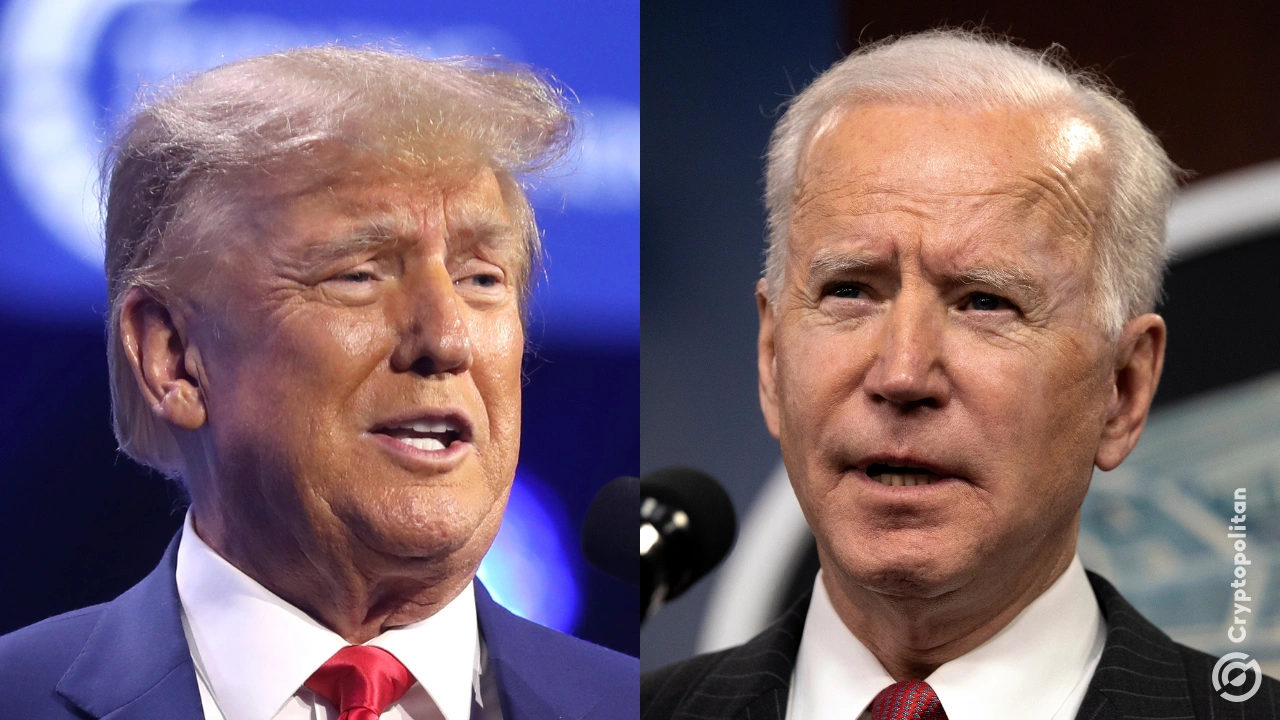

Capital flow confirms the crisis. Schiff discovered,European, Asian and South American stocks rose 3%-6% in a single day, while the United States has experienced capital outflows,"This is completely contrary to Trump's expectations, capital is fleeing rather than pouring into the United States"。

Given this reality, Peter provides investors with practical advice to encourage them to move from overpriced U.S. assets to more robust fundamental investment opportunities overseas, especially precious metals.

He advised investors to turn to gold and mining stocks:"The gold price will continue to rise after breaking through $3,000, and the trend of central banks in various countries increasing their holdings of gold and reducing their holdings of US bonds is irreversible."But this is no different from bad news for the US government—"Who will take over the huge deficit? Only the Federal Reserve prints money and buys bonds, further pushing up inflation"。

By contrast, other economies around the world only need"Transfer existing production capacity to domestic demand"You can get out of trouble and decouple yourself from the constantly collapsed dollar."The world just needs to let factories produce for themselves, not for Americans", while the United States faces hell-level challenges:“We have to rebuild everything on a zero factory basis – that’s the real path to despair.”

No comments yet