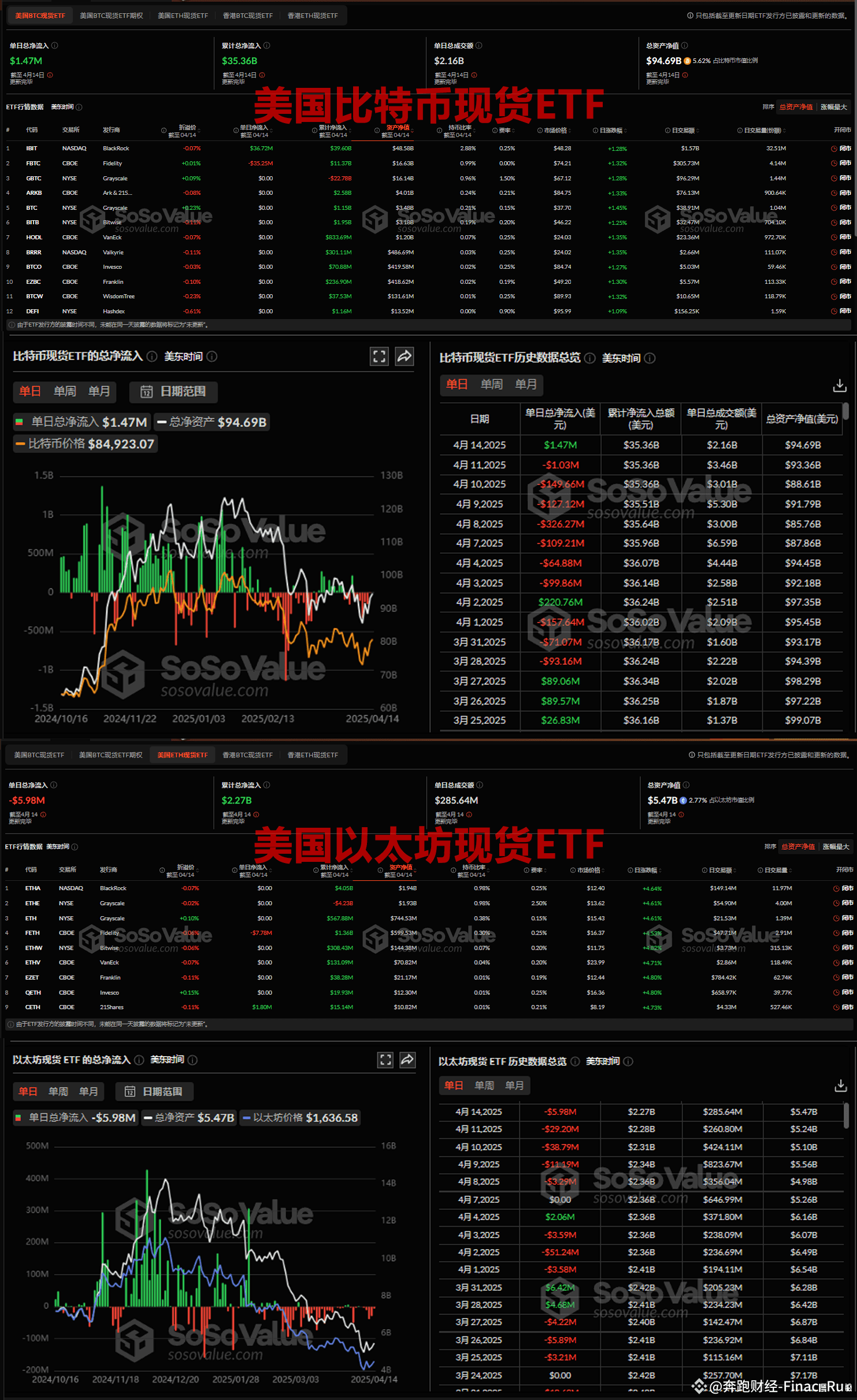

Bitcoin Spot ETF Net inflows of US$1.47 million yesterday, Ethereum ETF Net outflows for 5 consecutive days

On April 15, according to SoSoValue data, the total net inflow of Bitcoin spot ETF yesterday was US$1.47 million, a net inflow of funds on the first day after seven consecutive days of net outflows.

Among them, BlackRock's Bitcoin ETF IBIT has a single-day net inflow of US$36.72 million, and the current cumulative net inflow of IBIT has reached US$39.6 billion.

Fidelity's Bitcoin ETF FBTC showed a single-day net outflow of US$35.25 million yesterday, and the current cumulative net inflow of FBTC has reached US$11.37 billion. It is worth noting that the other 10 Bitcoin ETFs did not see capital flow on that day.

As of now, the total net asset value of Bitcoin spot ETFs is US$94.69 billion, accounting for 5.62% of the total market value of Bitcoin, and the cumulative total net inflow has reached US$35.36 billion.

On the same day, the total net outflow of Ethereum spot ETFs was US$5.98 million, recording a net outflow of funds for five consecutive days.

Among them, Fidelity's Ethereum spot ETF FETH has a net outflow of US$7.78 million in a single day, and the current cumulative net inflow of US$1.36 billion.

CETH, 21Shares' Ethereum ETF, recorded a net inflow of US$1.8 million in a single day. Currently, the total net inflow of CETH in history has reached US$15.14 million.

As of now, the total net asset value of Ethereum spot ETFs is US$5.47 billion, accounting for 2.77% of Ethereum's total market value, and the cumulative total net inflow has reached US$2.27 billion.

Conclusion:

In summary, Bitcoin ETFs ushered in the first day of capital return after experiencing continuous net outflows, while Ethereum ETFs continue to face pressure on continuous capital outflows. This differentiation may reflect the market's different expectations for the future trend of Bitcoin and Ethereum.

However, while investors' confidence in Bitcoin appears to have rebounded and cautious about Ethereum remains uncertain.

#Bitcoin ETF #Ethereum ETF #Fund flow